Large Volatility Breakout Dual-Direction Trading Strategy: Point-Based Threshold Entry System

Author: ChaoZhang, Date: 2024-11-18 16:11:21Tags: ATRSLTP

Overview

This strategy is a dual-direction trading system based on 30-minute candles, seeking trading opportunities through price volatility monitoring. The core mechanism involves identifying significant price movements using point thresholds and executing trades upon breakout confirmation. The strategy incorporates strict time management, stop-loss/take-profit mechanisms, and trade management protocols for controlled automated trading.

Strategy Principle

The strategy employs multiple filtering mechanisms to identify valid trading signals. It calculates the volatility range of each 30-minute candle at close, marking potential trading opportunities when the range exceeds preset thresholds. To ensure signal validity, the strategy implements additional buffer points, triggering actual trade signals only when prices break through this buffer zone. The system enables both long and short positions, entering longs on upward breakouts and shorts on downward breakouts, with corresponding profit targets and stop-loss levels.

Strategy Advantages

- Comprehensive time management: Limited trading windows avoid false signals during inactive periods

- Dual-direction trading: Captures opportunities in both market directions, improving capital efficiency

- Robust risk control: Fixed-point stop-loss and take-profit levels facilitate risk assessment and management

- High automation: Fully automated from signal identification to trade execution, minimizing human intervention

- Flexible parameter settings: Adjustable key parameters adapt to different market conditions

Strategy Risks

- False breakout risk: Large volatility may lead to false breakouts resulting in stop-loss exits

- Parameter sensitivity: Improper threshold settings may cause missed opportunities or overtrading

- Market environment dependency: May trigger frequent stop-losses in ranging markets

- Slippage impact: Actual execution prices may significantly deviate from signal prices during high volatility

- Capital management risk: Lack of position sizing mechanisms may lead to excessive risk exposure

Strategy Optimization Directions

- Add trend filtering: Incorporate longer-term trend indicators to improve signal quality

- Dynamic parameter optimization: Automatically adjust thresholds and stop-loss parameters based on market volatility

- Volume confirmation: Add volume filtering conditions to enhance breakout reliability

- Optimize stop-loss/take-profit: Implement dynamic exits adapting to different market conditions

- Incorporate position sizing: Dynamically adjust position sizes based on signal strength and market volatility

Conclusion

This is a comprehensively designed automated trading strategy with clear logic. Through strict condition filtering and risk control, the strategy demonstrates practical applicability. However, thorough testing and optimization in live trading are necessary, particularly in parameter settings and risk control aspects which need adjustment based on actual market conditions. Successful strategy implementation requires stable market conditions and appropriate parameter configuration, with recommended extensive backtesting before live deployment.

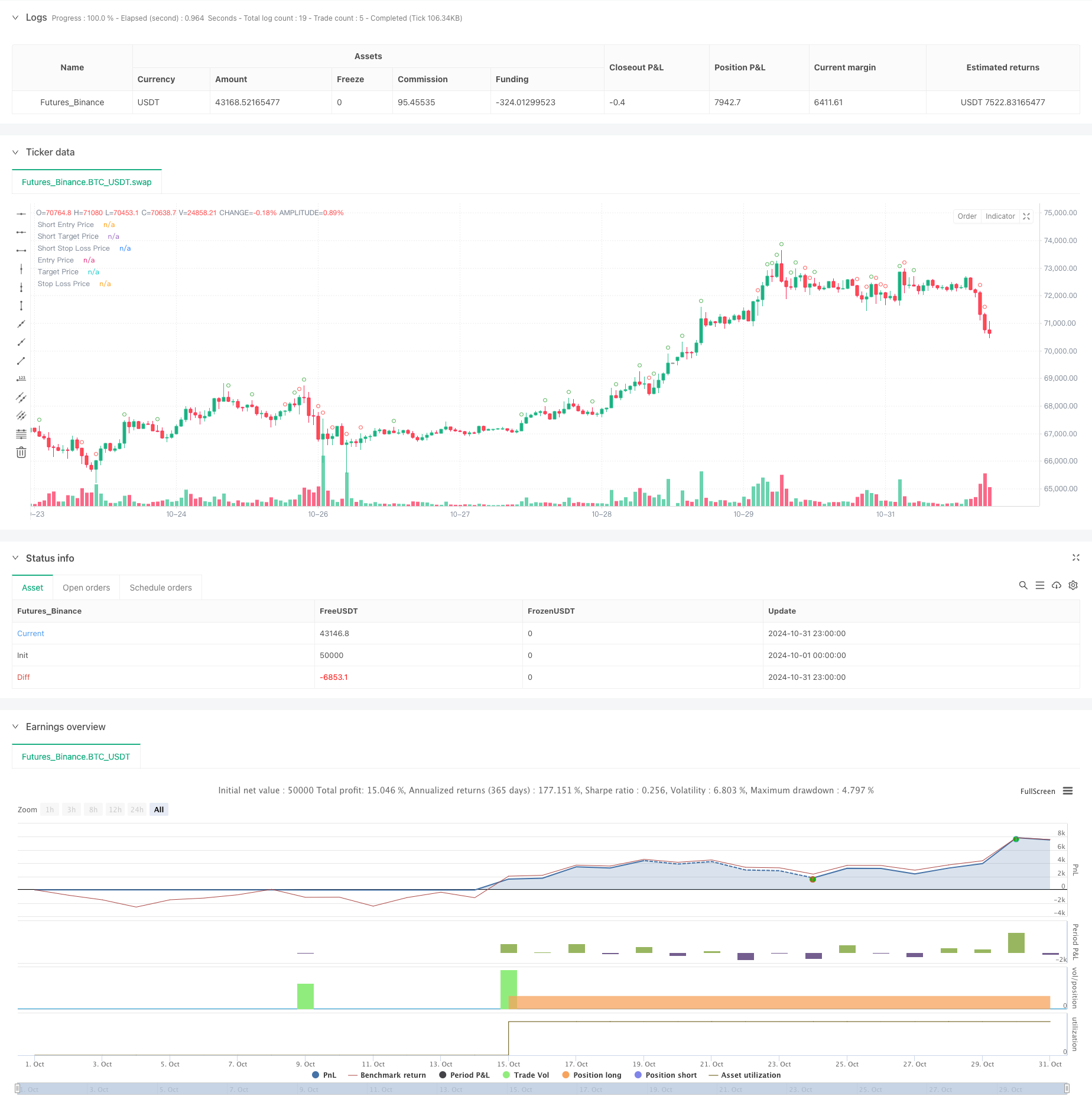

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Big Candle Breakout Strategy Both Side", overlay=true)

// Input for the point move threshold

point_move_in = input.int(100, title="Point Move Threshold")

point_target = input.int(100, title="Point Target")

point_stoploss = input.int(100, title="Point Stop Loss")

point_buffer = input.int(5, title="Point Buffer")

point_move = point_buffer + point_move_in

// Define the start and end times for trading

start_hour = 9

start_minute = 15

end_hour = 14

end_minute = 30

// Function to check if the current time is within the allowed trading window

in_time_range = (hour(time('30')) > start_hour or (hour(time('30')) == start_hour and minute(time('30')) >= start_minute)) and (hour(time('30')) < end_hour or (hour(time('30')) == end_hour and minute(time('30')) <= end_minute))

// Retrieve the open, high, low, and close prices of 30-minute candles

open_30m = request.security(syminfo.tickerid, "30", open)

high_30m = request.security(syminfo.tickerid, "30", high)

low_30m = request.security(syminfo.tickerid, "30", low)

close_30m = request.security(syminfo.tickerid, "30", close)

// Calculate the range of the candle

candle_range_long = (close_30m - open_30m)

candle_range_short = (open_30m - close_30m)

// Determine if the candle meets the criteria to be marked

big_candle_long = candle_range_long >= point_move_in

big_candle_short = candle_range_short >= point_move_in

// Variables to store the state of the trade

var float long_entry_price = na

var float long_target_price = na

var float long_stop_loss_price = na

var float short_entry_price = na

var float short_target_price = na

var float short_stop_loss_price = na

// Check if there are no active trades

no_active_trades = (strategy.opentrades == 0)

// Long entry condition

if (big_candle_long and na(long_entry_price) and in_time_range and no_active_trades)

long_entry_price := high_30m+point_buffer

long_target_price := long_entry_price + point_target

long_stop_loss_price := long_entry_price - point_stoploss

strategy.entry("Buy", strategy.long, stop=long_entry_price, limit=long_target_price)

plot(long_entry_price, style=plot.style_linebr, color=color.blue, linewidth=2, title="Entry Price")

plot(long_target_price, style=plot.style_linebr, color=color.green, linewidth=2, title="Target Price")

plot(long_stop_loss_price, style=plot.style_linebr, color=color.red, linewidth=2, title="Stop Loss Price")

// Short entry condition

if (big_candle_short and na(short_entry_price) and in_time_range and no_active_trades)

short_entry_price := low_30m - point_buffer

short_target_price := short_entry_price - point_target

short_stop_loss_price := short_entry_price + point_stoploss

strategy.entry("Sell", strategy.short, stop=short_entry_price, limit=short_target_price)

plot(short_entry_price, style=plot.style_linebr, color=color.blue, linewidth=2, title="Short Entry Price")

plot(short_target_price, style=plot.style_linebr, color=color.green, linewidth=2, title="Short Target Price")

plot(short_stop_loss_price, style=plot.style_linebr, color=color.red, linewidth=2, title="Short Stop Loss Price")

// Long exit conditions

if (not na(long_entry_price))

strategy.exit("Long Exit", from_entry="Buy", limit=long_target_price, stop=long_stop_loss_price)

// Short exit conditions

if (not na(short_entry_price))

strategy.exit("Short Exit", from_entry="Sell", limit=short_target_price, stop=short_stop_loss_price)

// Reset trade status

if (strategy.position_size == 0)

long_entry_price := na

long_target_price := na

long_stop_loss_price := na

short_entry_price := na

short_target_price := na

short_stop_loss_price := na

// Plot the big candle and entry/exit levels

plotshape(series=big_candle_long, location=location.abovebar, style=shape.circle, color=color.green)

plotshape(series=big_candle_short, location=location.abovebar, style=shape.circle, color=color.red)

//plot(long_entry_price, style=plot.style_stepline, color=color.blue, linewidth=2, title="Entry Price")

//plot(long_target_price, style=plot.style_stepline, color=color.green, linewidth=2, title="Target Price")

//plot(long_stop_loss_price, style=plot.style_stepline, color=color.red, linewidth=2, title="Stop Loss Price")

- Multi-Equilibrium Price Trend Following and Reversal Trading Strategy

- Dynamic Optimized Supertrend Trading Strategy

- Precision Trading Strategy and Risk Management System Based on SuperTrend Indicator

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Dual EMA Pullback Trading System with ATR-Based Dynamic Stop-Loss Optimization

- RSI and Supertrend Trend-Following Adaptive Volatility Strategy

- Dual EMA Momentum Trend Trading Strategy with Full Body Candle Signal System

- Dual Timeframe Supertrend with RSI Optimization System

- Dual Moving Average Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit System

- Multi-Timeframe Trend Following Trading System with ATR and MACD Integration

- Dual Timeframe Supertrend RSI Intelligent Trading Strategy

- Dual MACD Price Action Breakout Trailing Strategy

- Multi-EMA Trend Momentum Recognition and Stop-Loss Trading System

- Dual EMA Volume Trend Confirmation Strategy for Quantitative Trading

- Dual EMA-RSI Crossover Strategy with Dynamic Take-Profit/Stop-Loss

- Enhanced Multi-Period Dynamic Adaptive Trend Following Trading System

- Enhanced Bollinger Mean Reversion Quantitative Strategy

- Dynamic Darvas Box Breakout with Moving Average Trend Confirmation Trading System

- Dynamic Take-Profit Stop-Loss EMA Crossover Quantitative Trading Strategy

- Multi-EMA Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit Optimization

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- The two platforms hedge balancing strategy

- Dual Moving Average Crossover with Dynamic Risk Management Strategy

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System