Multi-Technical Indicator Trend Following Strategy with RSI Momentum Filter

Author: ChaoZhang, Date: 2024-12-20 14:10:43Tags: EMARSIATRSMAMACD

Overview

This is a trend-following strategy that combines multiple technical indicators, primarily using Exponential Moving Average (EMA) crossovers, Supertrend indicator, and Relative Strength Index (RSI) to identify trading opportunities. The strategy achieves a complete trading system by organically integrating indicators, adding momentum filtering to trend following, and utilizing ATR for dynamic stop-loss and take-profit positioning.

Strategy Principles

The strategy employs a triple-filtering mechanism to determine trading signals: 1. EMA crossover system captures short-term trend changes, generating long signals when fast EMA crosses above slow EMA and short signals when crossing below. 2. Supertrend indicator calculates dynamic support/resistance lines based on ATR to confirm overall trend direction. Long positions are only allowed when price is above the Supertrend line, and shorts when below. 3. RSI indicator filters overbought or oversold market conditions. Long entries are permitted only when RSI is below overbought levels, and shorts when above oversold levels.

The strategy includes an ATR-based dynamic stop-loss and take-profit system that automatically adjusts risk management parameters based on market volatility. A time filter also restricts trading to specific time periods to avoid low liquidity periods.

Strategy Advantages

- The combination of multiple technical indicators provides more reliable trading signals, avoiding false signals that might come from single indicators.

- Dynamic stop-loss and take-profit settings adapt to different market volatility conditions, allowing more breathing room in highly volatile markets.

- RSI filtering mechanism effectively reduces the risk of entering during extreme market conditions.

- Time filtering functionality allows traders to focus on specific trading sessions, avoiding inefficient periods.

Strategy Risks

- Multiple filtering conditions may cause missed trading opportunities.

- Stop-loss levels might be easily triggered in rapidly volatile markets.

- Excessive parameter optimization may lead to overfitting issues.

- High-frequency trading may result in significant transaction costs.

Strategy Optimization Directions

- Consider adding volume indicators as additional confirmation.

- Introduce adaptive parameter adjustment mechanisms for better adaptation to different market environments.

- Implement trend strength filters to avoid overtrading in weak trend markets.

- Develop more intelligent position sizing systems that dynamically adjust position sizes based on market conditions.

Summary

This strategy constructs a relatively complete trading system by combining multiple technical indicators and filtering conditions. Its core advantages lie in multiple confirmation mechanisms and dynamic risk management, while attention must be paid to parameter optimization and transaction costs. Through continuous optimization and improvement, the strategy has the potential to maintain stable performance across different market environments.

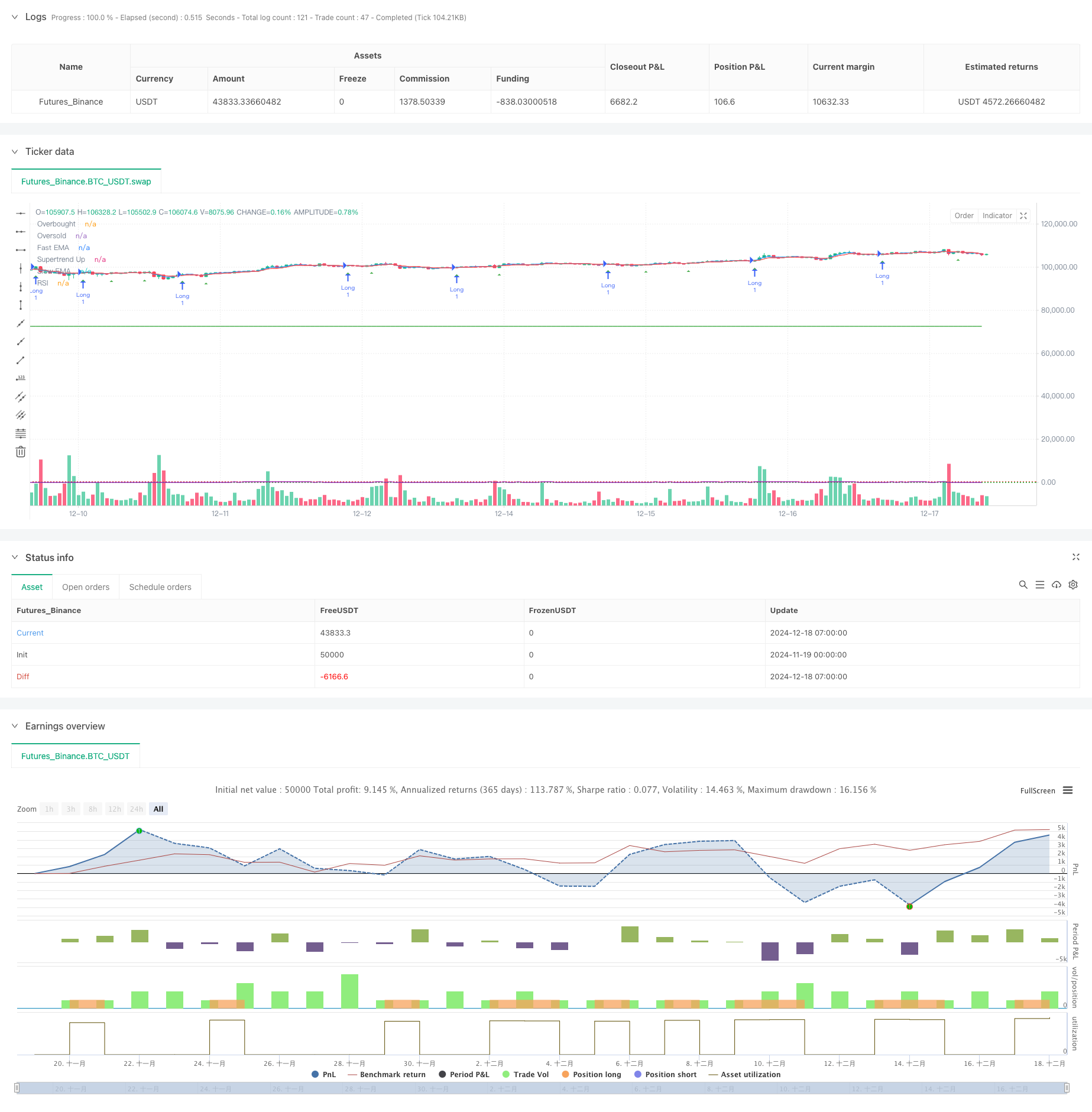

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="Supertrend + EMA Crossover with RSI Filter", shorttitle="ST_EMA_RSI", overlay=true)

// Input parameters for EMA

fastEMA = input.int(3, title="Fast EMA Period", minval=1)

slowEMA = input.int(6, title="Slow EMA Period", minval=1)

atrLength = input.int(3, title="ATR Length", minval=1)

// Using a fixed multiplier for Supertrend calculation

stMultiplier = 1

// Stop loss and take profit multipliers

stopLossATR = input.float(2.5, title="Stop Loss ATR Multiplier", minval=0.1, step=0.1)

takeProfitATR = input.float(4, title="Take Profit ATR Multiplier", minval=0.1, step=0.1)

// RSI inputs

rsiLength = input.int(10, title="RSI Length", minval=1)

rsiOverbought = input.float(65, title="RSI Overbought Level", minval=50.0, maxval=100.0)

rsiOversold = input.float(30.0, title="RSI Oversold Level", minval=0.0, maxval=50.0)

// Declare the RSI plot toggle input as a global variable

bool rsiPlotEnabled = input.bool(true, title="Show RSI in separate panel")

// Time filter inputs

i_startTime = input(title="Start Filter", defval=timestamp("01 Jan 2023 13:30 +0000"), group="Time Filter", tooltip="Start date & time to begin searching for setups")

i_endTime = input(title="End Filter", defval=timestamp("28 Apr 2099 19:30 +0000"), group="Time Filter", tooltip="End date & time to stop searching for setups")

// Date/time filtering logic

inDateRange = true

// Calculate EMAs

fastEMALine = ta.ema(close, fastEMA)

slowEMALine = ta.ema(close, slowEMA)

// Calculate ATR

atr = ta.atr(atrLength)

// Calculate Supertrend using fixed multiplier

up = high - (stMultiplier * atr)

dn = low + (stMultiplier * atr)

var float trendUp = na

var float trendDown = na

var int trend = na

trendUp := na(trendUp[1]) ? up : (close[1] > trendUp[1] ? math.min(up, trendUp[1]) : up)

trendDown := na(trendDown[1]) ? dn : (close[1] < trendDown[1] ? math.max(dn, trendDown[1]) : dn)

trend := close > nz(trendUp[1]) ? 1 : close < nz(trendDown[1]) ? -1 : nz(trend[1], 1)

supertrend = trend == 1 ? trendUp : trendDown

// Calculate RSI

myRSI = ta.rsi(close, rsiLength)

// Entry conditions with RSI filter

longEntryCondition = ta.crossover(fastEMALine, slowEMALine) and (trend == 1) and (myRSI < rsiOverbought)

shortEntryCondition = ta.crossunder(fastEMALine, slowEMALine) and (trend == -1) and (myRSI > rsiOversold)

// Strategy entries

if inDateRange and longEntryCondition and strategy.position_size <= 0

strategy.entry("Long", strategy.long)

if inDateRange and shortEntryCondition and strategy.position_size >= 0

strategy.entry("Short", strategy.short)

// Stops and targets

if strategy.position_size > 0

longStopLoss = strategy.position_avg_price - stopLossATR * atr

longTakeProfit = strategy.position_avg_price + takeProfitATR * atr

strategy.exit("Long SL/TP", "Long", stop=longStopLoss, limit=longTakeProfit)

if strategy.position_size < 0

shortStopLoss = strategy.position_avg_price + stopLossATR * atr

shortTakeProfit = strategy.position_avg_price - takeProfitATR * atr

strategy.exit("Short SL/TP", "Short", stop=shortStopLoss, limit=shortTakeProfit)

// Plot EMAs and Supertrend

plot(fastEMALine, title="Fast EMA", color=color.new(color.blue, 0))

plot(slowEMALine, title="Slow EMA", color=color.new(color.red, 0))

plot(trend == 1 ? supertrend : na, title="Supertrend Up", color=color.green, style=plot.style_linebr)

plot(trend == -1 ? supertrend : na, title="Supertrend Down", color=color.red, style=plot.style_linebr)

// Plot RSI and hlines

plot(rsiPlotEnabled ? myRSI : na, title="RSI", color=color.new(color.purple, 0))

hline(rsiOverbought, "Overbought", color=color.red, linestyle=hline.style_dotted)

hline(rsiOversold, "Oversold", color=color.green, linestyle=hline.style_dotted)

// Plot entry signals

plotshape(longEntryCondition, title="Long Entry Signal", style=shape.triangleup, location=location.belowbar, size=size.tiny, color=color.new(color.green, 0))

plotshape(shortEntryCondition, title="Short Entry Signal", style=shape.triangledown, location=location.abovebar, size=size.tiny, color=color.new(color.red, 0))

- Multi-EMA Trend Following Strategy with Dynamic ATR Targets

- Short-term Short Selling Strategy for High-liquidity Currency Pairs

- Multi-Period Exponential Moving Average Crossover Strategy with Options Trading Suggestion System

- Golden Momentum Capture Strategy: Multi-Timeframe Exponential Moving Average Crossover System

- Dual EMA Indicator Smart Crossing Trading System with Dynamic Stop-Loss and Take-Profit Strategy

- Multi-Period Trend Following Trading System Based on EMA Volatility Bands

- No Upper Wick Bullish Candle Breakout Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Indicator Trend Momentum Trading Strategy: An Optimized Quantitative Trading System Based on Bollinger Bands, Fibonacci and ATR

- Volume-based Dynamic DCA Strategy

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Multi-Indicator Volatility Trading RSI-EMA-ATR Strategy

- Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

- Dual Moving Average Trend Following Strategy with Risk Management

- Triple Supertrend and Bollinger Bands Multi-Indicator Trend Following Strategy

- Multi-Trendline Breakout Momentum Quantitative Strategy

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Timeframe Liquidity Pivot Heatmap Strategy

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- Advanced Trend Following Strategy with Adaptive Trailing Stop

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Dual Exponential Moving Average and Relative Strength Index Crossover Strategy

- Dual Momentum Oscillator Smart Timing Trading Strategy

- Advanced Quantitative Trend Capture Strategy with Dynamic Range Filter

- TradingView signal execution policy (built-in HTTP service version)

- Advanced Five-Day Cross-Analysis Strategy Based on RSI and MACD Integration

- Adaptive Range Trading System Based on Dual RSI Indicators

- Dynamic Dual Supertrend Volume-Price Strategy

- Black Swan Volatility and Moving Average Crossover Momentum Tracking Strategy

- Intelligent Volatility Range Trading Strategy Combining Bollinger Bands and SuperTrend