Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

Author: ChaoZhang, Date: 2024-12-20 14:55:02Tags: RSIMACD

Overview

This strategy is an advanced trend following trading system that integrates G-Channel, RSI, and MACD indicators. It identifies high-probability trading opportunities by dynamically calculating support and resistance zones while combining momentum indicators. The core lies in utilizing a custom G-Channel indicator to determine market trends while using RSI and MACD to confirm momentum changes for more accurate signal generation.

Strategy Principle

The strategy employs a triple-filtering mechanism to ensure signal reliability. First, the G-Channel dynamically constructs support and resistance zones by calculating maximum and minimum prices over a specified period. When prices break through the channel, the system identifies potential trend reversal points. Second, the RSI indicator confirms whether the market is in overbought or oversold conditions, helping to filter out more valuable trading opportunities. Finally, the MACD indicator confirms momentum direction and strength through histogram values. Trading signals are only generated when all three conditions are met.

Strategy Advantages

- Multi-dimensional signal confirmation mechanism significantly improves trading accuracy

- Dynamic stop-loss and take-profit settings effectively control risk

- G-Channel’s adaptive nature allows the strategy to adapt to different market environments

- Comprehensive risk management system including position and money management

- Visual labeling system intuitively displays trading signals for analysis and optimization

Strategy Risks

- May generate false signals in choppy markets, requiring market environment identification

- Parameter optimization may lead to overfitting risk

- Multiple indicators may produce lag effects during high volatility periods

- Improper stop-loss placement may result in excessive drawdowns

Strategy Optimization Directions

- Introduce market environment identification module to use different parameter settings in different market states

- Develop adaptive stop-loss mechanism to dynamically adjust stop-loss levels based on market volatility

- Add volume analysis indicators to improve signal reliability

- Optimize G-Channel calculation method to reduce lag effects

Summary

This strategy builds a complete trading system through the comprehensive use of multiple technical indicators. Its core advantages lie in the multi-dimensional signal confirmation mechanism and comprehensive risk management system. Through continuous optimization and improvement, the strategy shows promise in maintaining stable performance across different market environments. Traders are advised to thoroughly test different parameter combinations and make appropriate adjustments based on specific market characteristics before live trading.

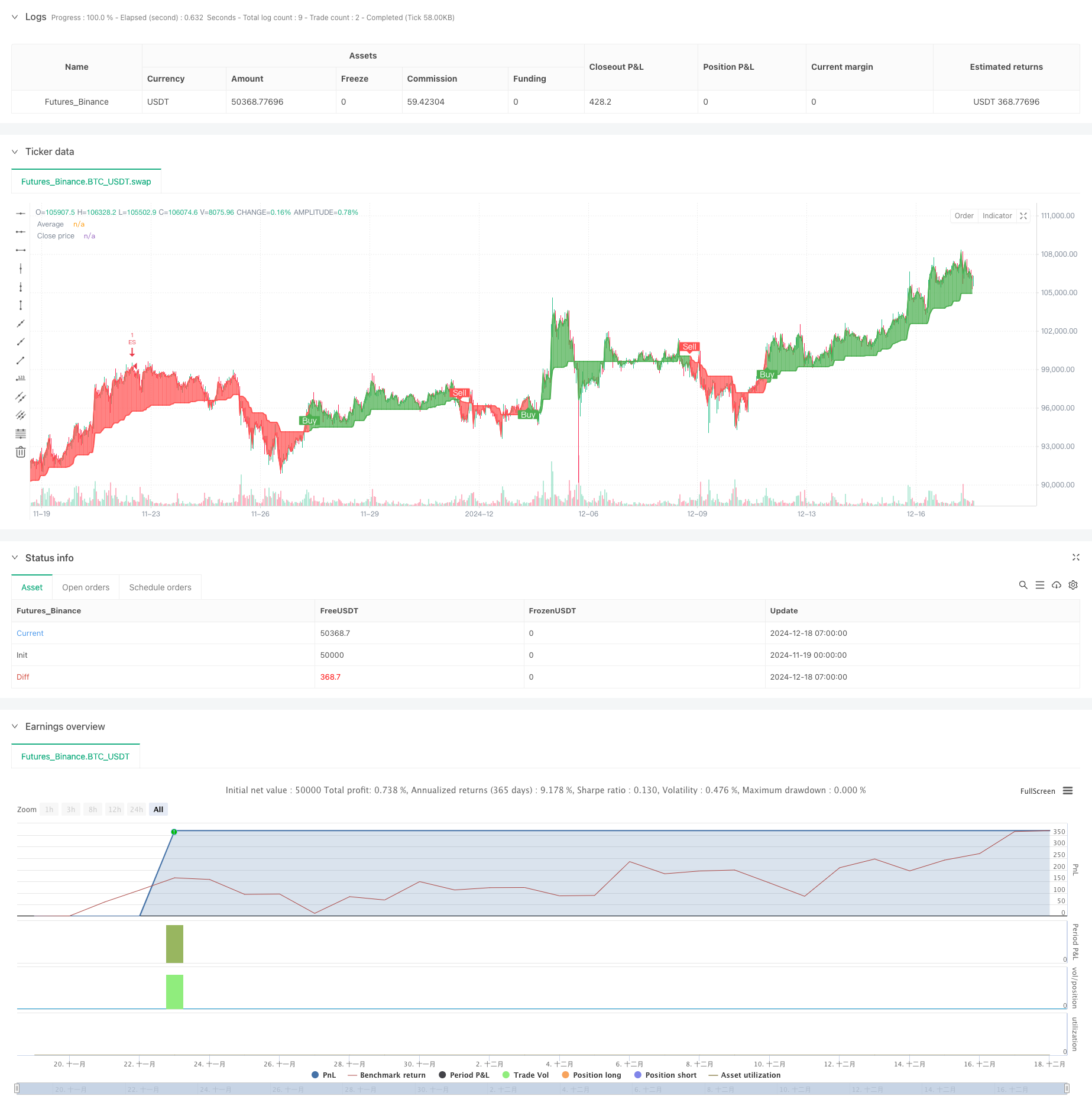

/*backtest

start: 2024-11-19 00:00:00

end: 2024-12-18 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=6

strategy("VinSpace Optimized Strategy", shorttitle="VinSpace Magic", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Input Parameters

length = input.int(100, title="Length")

src = input(close, title="Source")

stop_loss_pct = input.float(1, title="Stop Loss (%)") / 100

take_profit_pct = input.float(3, title="Take Profit (%)") / 100

rsi_length = input.int(14, title="RSI Length")

rsi_overbought = input.int(70, title="RSI Overbought")

rsi_oversold = input.int(30, title="RSI Oversold")

macd_short = input.int(12, title="MACD Short Length")

macd_long = input.int(26, title="MACD Long Length")

macd_signal = input.int(9, title="MACD Signal Length")

// ---- G-Channel Calculations ----

var float a = na

var float b = na

a := math.max(src, na(a[1]) ? src : a[1]) - (na(a[1]) ? 0 : (a[1] - b[1]) / length)

b := math.min(src, na(b[1]) ? src : b[1]) + (na(a[1]) ? 0 : (a[1] - b[1]) / length)

avg = (a + b) / 2

// ---- RSI Calculation ----

rsi = ta.rsi(src, rsi_length)

// ---- MACD Calculation ----

[macdLine, signalLine, _] = ta.macd(src, macd_short, macd_long, macd_signal)

macd_hist = macdLine - signalLine

// ---- Trend Detection Logic ----

crossup = b[1] < close[1] and b > close

crossdn = a[1] < close[1] and a > close

bullish = ta.barssince(crossdn) <= ta.barssince(crossup)

c = bullish ? color.new(color.green, 0) : color.new(color.red, 0)

// Plotting the Average

p1 = plot(avg, "Average", color=c, linewidth=2)

p2 = plot(close, "Close price", color=c, linewidth=1)

// Adjusted fill with transparency

fill(p1, p2, color=color.new(c, 90))

// ---- Buy and Sell Signals ----

showcross = input(true, title="Show Buy/Sell Labels")

plotshape(showcross and bullish and not bullish[1], location=location.belowbar, style=shape.labelup, color=color.green, size=size.small, text="Buy", textcolor=color.white, offset=-1)

plotshape(showcross and not bullish and bullish[1], location=location.abovebar, style=shape.labeldown, color=color.red, size=size.small, text="Sell", textcolor=color.white, offset=-1)

// ---- Entry and Exit Conditions ----

enterLong = bullish and rsi < rsi_oversold and macd_hist > 0

enterShort = not bullish and rsi > rsi_overbought and macd_hist < 0

// Exit Conditions

exitLong = ta.crossunder(close, avg) or rsi > rsi_overbought

exitShort = ta.crossover(close, avg) or rsi < rsi_oversold

// Position Size (example: 10% of equity)

posSize = 1

// Submit Entry Orders

if enterLong

strategy.entry("EL", strategy.long, qty=posSize)

if enterShort

strategy.entry("ES", strategy.short, qty=posSize)

// Submit Exit Orders

if exitLong

strategy.close("EL")

if exitShort

strategy.close("ES")

// Set Stop Loss and Take Profit for the trades

strategy.exit("Take Profit/Stop Loss Long", from_entry="EL", loss=stop_loss_pct * close, profit=take_profit_pct * close)

strategy.exit("Take Profit/Stop Loss Short", from_entry="ES", loss=stop_loss_pct * close, profit=take_profit_pct * close)

- Trend-Following Cloud Momentum Divergence Strategy

- Advanced Five-Day Cross-Analysis Strategy Based on RSI and MACD Integration

- RSI-MACD Multi-Signal Trading System with Dynamic Stop Management

- Price Divergence Strategy v1.0

- Multi-Indicator Divergence Trading Strategy with Adaptive Take Profit and Stop Loss

- MACD and RSI Combined Long-term Trading Strategy

- RSI and MACD Combined Long-Short Strategy

- Darvas Box Breakout and Risk Management Strategy

- Multi-Indicator Intelligent Pyramiding Strategy

- Low-Risk Stable Cryptocurrency High-Frequency Trading Strategy Based on RSI and MACD

- Adaptive EMA Dynamic Position Break-out Trading Strategy

- Multi-Indicator Dynamic Trading Optimization Strategy

- Multi-SMA Zone Breakout with Dynamic Profit Lock Quantitative Trading Strategy

- Dynamic Wave-Trend Tracking Strategy

- Break of Structure with Volume Confirmation Multi-Condition Intelligent Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Multi-Moving Average Trend Following Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Dynamic EMA Breakthrough and Reversal Strategy

- Multi-level ATH Dynamic Tracking Triple-Entry Strategy

- Adaptive VWAP Bands with Garman-Klass Volatility Dynamic Tracking Strategy

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Multi-Indicator Volatility Trading RSI-EMA-ATR Strategy

- Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

- Dual Moving Average Trend Following Strategy with Risk Management

- Triple Supertrend and Bollinger Bands Multi-Indicator Trend Following Strategy

- Multi-Trendline Breakout Momentum Quantitative Strategy

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Timeframe Liquidity Pivot Heatmap Strategy