La media móvil cruzada + la estrategia de impulso de la línea lenta del MACD

El autor:¿ Qué pasa?, Fecha: 2024-04-12 17:16:06Las etiquetas:La SMAEl EMAEl MACD

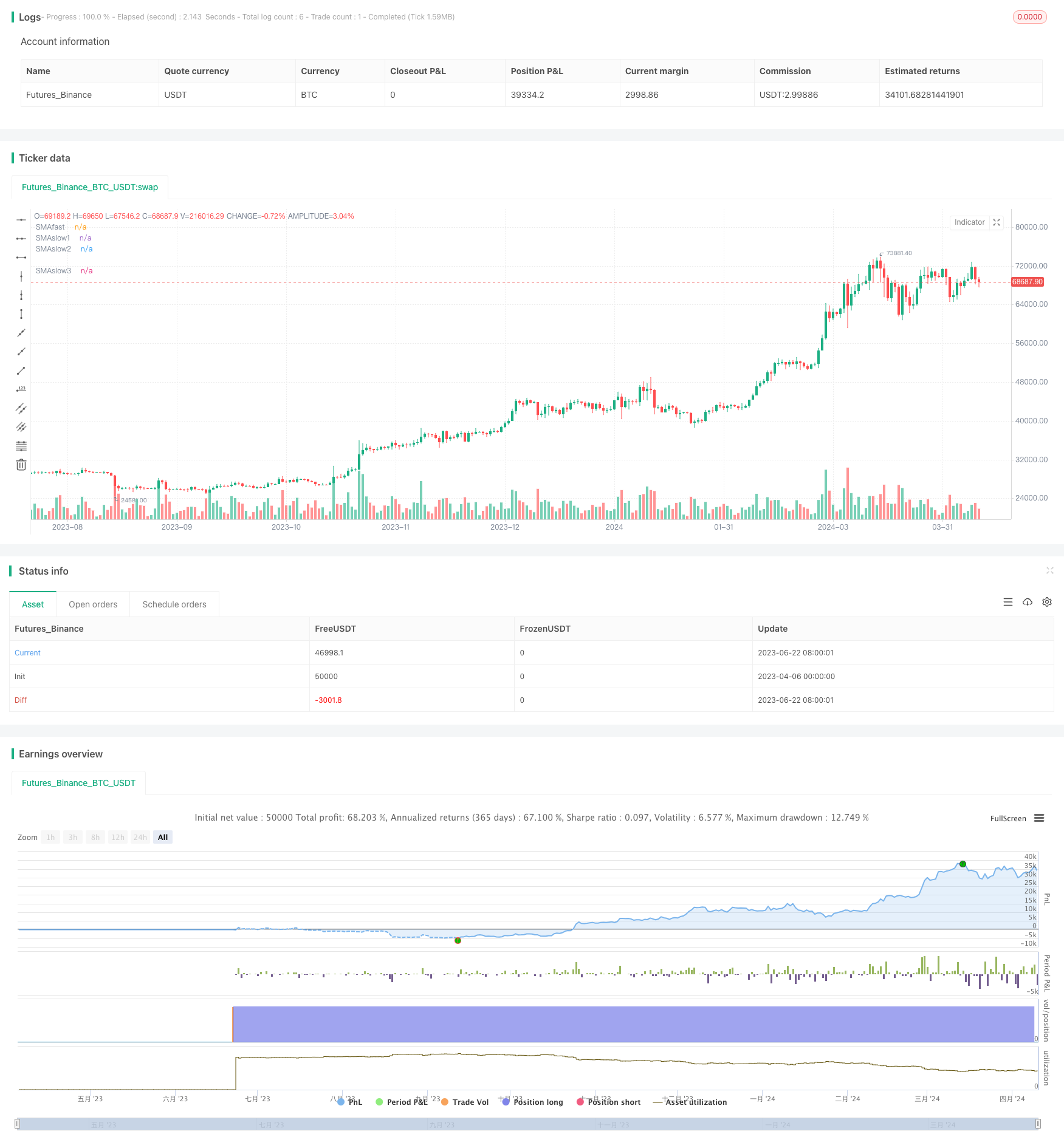

Resumen general

Esta estrategia combina el cruce de la media móvil y el indicador MACD como las señales comerciales principales. Utiliza el cruce de una media móvil rápida con múltiples medias móviles lentas como la señal de entrada, y el valor positivo/negativo del histograma de la línea lenta del MACD como la confirmación de la tendencia. La estrategia establece múltiples niveles de toma de ganancias y stop-loss al entrar, y ajusta continuamente el nivel de stop-loss a medida que aumenta el tiempo de retención para bloquear las ganancias.

Principio de la estrategia

- Cuando el MA rápido cruza por encima del MA lento 1, el precio de cierre está por encima del MA lento 2 y el histograma MACD es mayor que 0, vaya largo;

- Cuando el MA rápido se cruza por debajo del MA lento 1, el precio de cierre está por debajo del MA lento 2 y el histograma MACD es inferior a 0, se realiza una operación corta;

- Establecer múltiples niveles de take-profit y stop-loss al momento de ingresar. Los niveles de take-profit se basan en la preferencia de riesgo, mientras que los niveles de stop-loss se ajustan continuamente a medida que aumenta el tiempo de retención para bloquear gradualmente las ganancias;

- Los períodos de medias móviles, los parámetros MACD, los niveles de take-profit y stop-loss, etc., pueden ajustarse de forma flexible para adaptarse a las diferentes condiciones del mercado.

Esta estrategia utiliza el cruce MA para capturar tendencias y el MACD para confirmar la dirección, mejorando la confiabilidad del juicio de tendencia.

Ventajas estratégicas

- El cruce MA es un método clásico de seguimiento de tendencias que puede capturar la formación de tendencias de forma oportuna;

- El uso de múltiples indicadores de mercado permite evaluar de manera más exhaustiva la intensidad y la persistencia de las tendencias;

- El indicador MACD puede identificar eficazmente las tendencias y juzgar el impulso, sirviendo como un complemento sólido para el cruce de MA;

- El diseño de ventajas múltiples y el diseño dinámico de pérdidas de parada pueden controlar los riesgos y permitir que las ganancias se ejecuten, mejorando la robustez del sistema;

- Los parámetros son ajustables y adaptables, y pueden fijarse de forma flexible de acuerdo con diferentes instrumentos y plazos.

Riesgos estratégicos

- El cruce de MA tiene el riesgo de retraso de la señal, que puede pasar por alto las tendencias iniciales o perseguir las altas;

- La configuración incorrecta de los parámetros puede dar lugar a un exceso de negociación o a períodos de retención demasiado largos, lo que aumenta los costes y los riesgos;

- Los niveles de stop-loss demasiado agresivos pueden dar lugar a stop-outs prematuros, mientras que los niveles de take-profit demasiado conservadores pueden afectar a los rendimientos;

- Los cambios bruscos de tendencia o las anomalías del mercado pueden hacer que la estrategia fracase.

Estos riesgos pueden controlarse optimizando los parámetros, ajustando las posiciones, estableciendo condiciones adicionales, etc. Sin embargo, ninguna estrategia puede evitar completamente los riesgos y los inversores deben tratarla con precaución.

Direcciones para la optimización de la estrategia

- Considere la posibilidad de introducir más indicadores, como el RSI, las bandas de Bollinger, etc., para confirmar aún más las tendencias y las señales;

- llevar a cabo una optimización más refinada en el establecimiento de los niveles de toma de ganancias y stop-loss, como la consideración de los niveles ATR o basados en porcentajes;

- Ajustar dinámicamente los parámetros en función de la volatilidad del mercado para mejorar la adaptabilidad;

- Introducir un módulo de dimensionamiento de posiciones para ajustar los tamaños de las posiciones en función de las condiciones de riesgo;

- Reunir la estrategia para establecer una cartera de estrategias para diversificar los riesgos.

A través de la optimización y mejora continuas, la estrategia puede volverse más robusta y confiable, adaptándose mejor al entorno cambiante del mercado.

Resumen de las actividades

Esta estrategia combina los indicadores MA y MACD para construir un sistema comercial relativamente completo. El diseño de múltiples MA y múltiples operaciones mejora las capacidades de captura de tendencias y control de riesgos del sistema. La lógica de la estrategia es clara y fácil de entender e implementar, adecuada para una mayor optimización y mejora.

/*backtest

start: 2023-04-06 00:00:00

end: 2024-04-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxmirus

//@version=5

strategy("My strategy_Cross_SMA(EMA)+Macd,slow3",overlay=true)

// ver 4

// Date Inputs

startDate = input(timestamp('2019-01-01T00:00:00+0300'), '' , inline='time1',

tooltip=' Время первого бара расчета стратегии. Первый ордер может быть выставлен на следующем баре после стартового.')

finishDate = input(timestamp('2044-01-01T00:00:00+0300'), '' , inline='time2',

tooltip=' Время после которого больше не будут размещаться ордера входа в позицию.')

// Calculate start/end date and time condition

time_cond = true

//SMA(EMA) Inputs

fast=input.int(12, title="Fastlength",group="MA")

slow1=input.int(54,title="Slowlength1",group="MA")

slow2=input.int(100, title="Slowlength2",group="MA")

slow3=input.int(365, title="Slowlength3",group="MA")

fastma=input.string(title="Fastlength", defval="EMA",options=["SMA","EMA"],group="MA")

slowma1=input.string(title="Slowlength1", defval="EMA",options=["SMA","EMA"],group="MA")

slowma2=input.string(title="Slowlength2", defval="EMA",options=["SMA","EMA"],group="MA")

slowma3=input.string(title="Slowlength3", defval="EMA",options=["SMA","EMA"],group="MA")

fastlength = fastma == "EMA" ? ta.ema(close, fast) : ta.sma(close, fast)

slowlength1 = slowma1 == "EMA" ? ta.ema(close, slow1) : ta.sma(close, slow1)

slowlength2 = slowma2 == "EMA" ? ta.ema(close, slow2) : ta.sma(close, slow2)

slowlength3 = slowma3 == "EMA" ? ta.ema(close, slow3) : ta.sma(close, slow3)

//Macd Inputs

macdfastline = input.int(12, title="FastMacd",group="MACD")

macdslowline = input.int(26,title="SlowMacd",group="MACD")

macdhistline = input.int(9,title="HistMacd",group="MACD")

src=input(defval=close,title="Source",group="MACD")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

fast_ma = sma_source == "SMA" ? ta.sma(src, macdfastline) : ta.ema(src, macdfastline)

slow_ma = sma_source == "SMA" ? ta.sma(src, macdslowline) : ta.ema(src, macdslowline)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, macdhistline) : ta.ema(macd, macdhistline)

hist = macd - signal

//fastMACD = ta.ema(close, macdline) - ta.ema(close, signalline)

//signalMACD = ta.ema(MACD, histline)

//histMACD = MACD - aMACD

//EMA Plot

plot(fastlength,title="SMAfast",color=color.blue)

plot(slowlength1,title="SMAslow1",color=color.orange)

plot(slowlength2,title="SMAslow2",color=color.red)

plot(slowlength3,title="SMAslow3",color=color.black)

//Macd plot

//col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

//col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

//col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

//col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

//col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

//col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)))

//plot(macd, title="MACD", color=col_macd)

//plot(signal, title="Signal", color=col_signal)

//Take profit

tp1=input.float(5.1,title="Take Profit1_%",step=0.1)/100

tp2=input.float(10.1,title="Take Profit2_%",step=0.1)/100

//Stop loss

sl1=input.float(5.1,title="Stop loss1_%",step=0.1)/100

sl2=input.float(0.1,title="Stop loss2_%",step=0.1)/100

sl3=input.float(-5.5,title="Stop loss3_%", step=0.1)/100

//Qty closing position

Qty1 = input.float(0.5, title="QtyClosingPosition1",step=0.01)

Qty2 = input.float(0.25, title="QtyClosingPosition2",step=0.01)

//Take profit Long and Short

LongTake1=strategy.position_avg_price*(1+tp1)

LongTake2=strategy.position_avg_price*(1+tp2)

ShortTake1=strategy.position_avg_price*(1-tp1)

ShortTake2=strategy.position_avg_price*(1-tp2)

//Plot Levels Take

plot(strategy.position_size > 0 ? LongTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongTake2 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake2 : na,color=color.green,style=plot.style_linebr)

//Stop loss long and short

LongStop1=strategy.position_avg_price*(1-sl1)

LongStop2=strategy.position_avg_price*(1-sl2)

LongStop3=strategy.position_avg_price*(1-sl3)

ShortStop1=strategy.position_avg_price*(1+sl1)

ShortStop2=strategy.position_avg_price*(1+sl2)

ShortStop3=strategy.position_avg_price*(1+sl3)

//Stop=strategy.position_avg_price

//Plot Levels Stop

plot(strategy.position_size > 0 ? LongStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop3 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop3 : na,color=color.red,style=plot.style_linebr)

//Entry condition

LongCondition1 = ta.crossover(fastlength, slowlength1)

LongCondition2 = close>slowlength2

LongCondition3 = time_cond

LongCondition4=close>slowlength3

//LongCondition5=slowlength100>slowlength3

LongCondition6 = hist > 0

buy=(LongCondition1 and LongCondition2 and LongCondition3 and LongCondition4 and LongCondition6 ) and strategy.position_size<=0

//longCondition3 = nz(strategy.position_size) == 0//если отсутствует открытая позиция

ShortCondition1 = ta.crossunder(fastlength, slowlength1)

ShortCondition2 = close<slowlength2

ShortCondition3 = time_cond

ShortCondition4=close<slowlength3

//ShortCondition5=slowlength100<slowlength3

ShortCondition6=hist < 0

sell=(ShortCondition1 and ShortCondition2 and ShortCondition3 and ShortCondition4 and ShortCondition6 ) and strategy.position_size>=0

//Strategy entry

strategy.cancel_all(not strategy.position_size)

if(buy)

strategy.cancel_all()

strategy.entry("Buy",strategy.long)

if(sell)

strategy.cancel_all()

strategy.entry("Sell",strategy.short)

//Strategy Long exit

var int exitCounter=0

exitCounter := not strategy.position_size or strategy.position_size > 0 and strategy.position_size[1] < 0 or strategy.position_size < 0 and strategy.position_size[1] > 0 ? 0:

strategy.position_size > 0 and strategy.position_size[1]>strategy.position_size? exitCounter[1] + 1:

strategy.position_size < 0 and strategy.position_size[1]<strategy.position_size? exitCounter[1] - 1:

exitCounter[1]

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long1",strategy.short, qty=math.abs(strategy.position_size*Qty1), limit=LongTake1, oca_name='Long1', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long2",strategy.short, qty=math.abs(strategy.position_size*Qty2), limit=LongTake2, oca_name='Long2', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Stop Long1",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop1,oca_name='Long1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==1

strategy.order("Stop Long2",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop2,oca_name='Long2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==2

strategy.order("Stop Long3",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop3)

// Strategy Short exit

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short1", strategy.long, qty=math.abs(strategy.position_size*Qty1), limit=ShortTake1, oca_name='Short1', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short2", strategy.long, qty=math.abs(strategy.position_size*Qty2), limit=ShortTake2, oca_name='Short2', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Stop Short1",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop1,oca_name='Short1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-1

strategy.order("Stop Short2",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop2,oca_name='Short2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-2

strategy.order("Stop Short3",strategy.long,qty=math.abs(strategy.position_size),stop=ShortStop3)

- Indicador de inversión de K I

- Indicador personalizado CM MACD - Marco de tiempo múltiple - V2

- Sistema de negociación de confirmación de tendencia MACD doble

- Estrategia corta y larga del MACD ZeroLag

- La estrategia de negociación de doble cruce MACD de Lag Cero - Negociación de alta frecuencia basada en la captura de tendencias a corto plazo

- Sistema de negociación dinámico de stop-loss y take-profit de intervalo múltiple MACD

- Estrategia de combinación MACD y Martingale para una operación larga optimizada

- Estrategia de negociación cuantitativa ajustable para el cruce de fechas de la media móvil MACD doble

- Estrategia de ruptura del MACD BB

- Estrategia de predicción cruzada de la oscilación dinámica del MACD

- Estrategia de negociación de redes de rebote de gran amplitud

- Estrategia de cruce del MACD

- Estrategia de seguimiento de tendencias del MACD optimizada con gestión del riesgo basada en el ATR

- Estrategia corta y larga del MACD ZeroLag

- BBSR Estrategia extrema

- Estrategia de negociación de reversión de alta frecuencia basada en el indicador RSI de impulso

- Estrategia del índice de fortaleza relativa del RSI

- Estrategia de ruptura de bandas de Bollinger

- Donchian Channel y Larry Williams Estrategia de índice de comercio grande

- SPARK Dimensión dinámica de las posiciones y estrategia de negociación de dos indicadores

- Estrategia dinámica de DCA basada en el volumen

- Estrategia del detector de valle MACD

- N Bars estrategia de ruptura

- Estrategia de negociación de alta frecuencia de criptomonedas estable y de bajo riesgo basada en el RSI y el MACD

- Las bandas de Bollinger Estocástico RSI Estrategia de señal extrema

- Estrategia de negociación de dos caras del RSI

- KRK ADA 1H Estrategia estocástica lenta con más entradas y IA

- Estrategia de negociación de pérdidas y ganancias dinámicas basadas en el volumen de operaciones de mercado

- Estrategia de cruce de las TEMA del MACD

- El RSI y las bandas de Bollinger tienen una doble estrategia