Estrategia de negociación cuantitativa de tendencia dinámica MACD avanzada

El autor:¿ Qué pasa?, Fecha: 2024-11-12 16:27:01Las etiquetas:El MACD- ¿Qué es?El EMAIndicador de riesgo

Resumen general

Esta estrategia es un sistema de negociación cuantitativo avanzado basado en el indicador de Divergencia de Convergencia de la Media Móvil (MACD, por sus siglas en inglés), que mejora las decisiones comerciales a través de una pantalla de fondo dinámica y múltiples combinaciones de parámetros preestablecidos.

Principio de la estrategia

La estrategia emplea diez parámetros MACD diferentes preestablecidos, incluidos Standard (12,26,9), Short-term (5,35,5), Long-term (19,39,9), etc., para adaptarse a diferentes entornos de mercado y estilos de negociación. El sistema genera señales de compra cuando la línea MACD cruza por encima de la línea de señal (cruz dorada) y señales de venta cuando cruza por debajo (cruz de muerte).

Ventajas estratégicas

- Flexibilidad de parámetros: ofrece diez combinaciones de parámetros preestablecidas para diferentes entornos de mercado

- Retroalimentación visual clara: los cambios dinámicos de color de fondo proporcionan una visualización intuitiva de la tendencia del mercado

- Las señales claras: generan señales explícitas de compra/venta basadas en cruces MACD.

- Alta adaptabilidad: aplicable a operaciones con diferentes plazos

- Estructura de código clara: utiliza una estructura de interruptor para cambiar parámetros, fácil de mantener y extender

Riesgos estratégicos

- Riesgo de retraso: el MACD como indicador de retraso puede generar señales retrasadas en mercados volátiles

- Riesgo de ruptura falsa: puede generar falsas señales cruzadas en mercados variados

- Dependencia de parámetros: las diferentes combinaciones de parámetros tienen un rendimiento diferente en diferentes condiciones de mercado.

- Limitaciones de las condiciones de mercado: Puede tener un rendimiento inferior en entornos de mercado altamente volátiles o poco líquidos

Direcciones para la optimización de la estrategia

- Implementar filtros de volatilidad para filtrar las señales comerciales durante los períodos de alta volatilidad

- Añadir indicadores de confirmación de tendencia como RSI o ATR para mejorar la fiabilidad de la señal

- Implementar la optimización de parámetros adaptativos basada en las condiciones del mercado

- Añadir funciones de stop-loss y take-profit para mejorar la gestión del riesgo

- Incluir análisis de volumen para mejorar la fiabilidad de la señal

Resumen de las actividades

Esta es una versión avanzada bien estructurada y lógicamente sólida de la estrategia MACD. A través de múltiples ajustes previos de parámetros y retroalimentación visual dinámica, mejora significativamente la practicidad y operabilidad de la estrategia. Aunque existen riesgos inherentes, la estrategia tiene el potencial de convertirse en un sistema de negociación robusto con las optimizaciones sugeridas. Se aconseja a los operadores que realicen pruebas de retroceso completas antes de la implementación en vivo y elijan la configuración de parámetros apropiada basada en condiciones específicas del mercado.

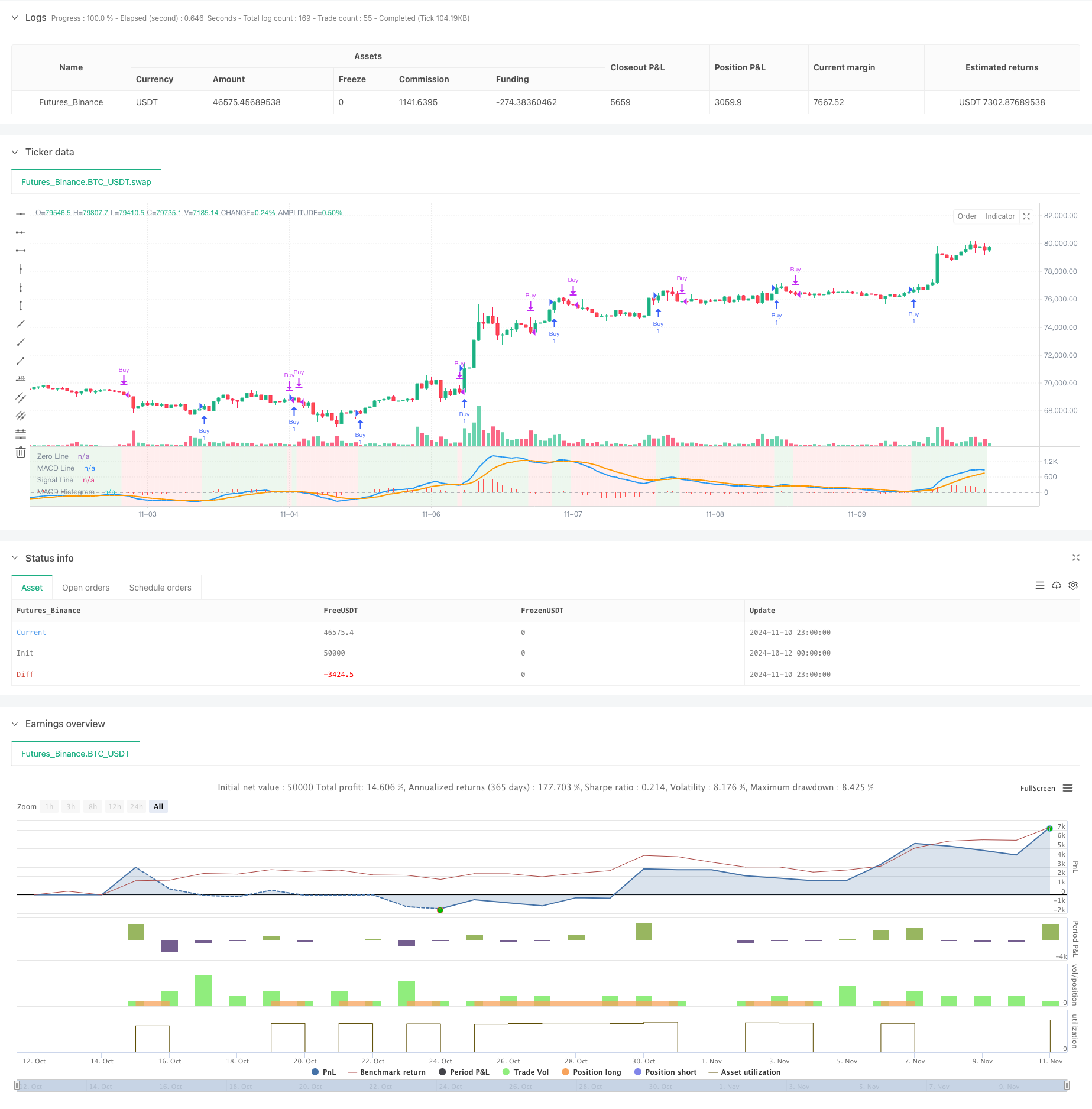

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Hanzo - Top 10 MACD Strategy", overlay=false) // MACD in a separate pane

// Define dropdown options for MACD settings

macdOption = input.string(title="Select MACD Setting",

defval="Standard (12, 26, 9)",

options=["Standard (12, 26, 9)",

"Short-Term (5, 35, 5)",

"Long-Term (19, 39, 9)",

"Scalping (3, 10, 16)",

"Cryptocurrency (20, 50, 9)",

"Forex (8, 17, 9)",

"Conservative (24, 52, 18)",

"Trend-Following (7, 28, 7)",

"Swing Trading (5, 15, 5)",

"Contrarian (15, 35, 5)"])

// MACD setting based on user selection

var int fastLength = 12

var int slowLength = 26

var int signalLength = 9

switch macdOption

"Standard (12, 26, 9)" =>

fastLength := 12

slowLength := 26

signalLength := 9

"Short-Term (5, 35, 5)" =>

fastLength := 5

slowLength := 35

signalLength := 5

"Long-Term (19, 39, 9)" =>

fastLength := 19

slowLength := 39

signalLength := 9

"Scalping (3, 10, 16)" =>

fastLength := 3

slowLength := 10

signalLength := 16

"Cryptocurrency (20, 50, 9)" =>

fastLength := 20

slowLength := 50

signalLength := 9

"Forex (8, 17, 9)" =>

fastLength := 8

slowLength := 17

signalLength := 9

"Conservative (24, 52, 18)" =>

fastLength := 24

slowLength := 52

signalLength := 18

"Trend-Following (7, 28, 7)" =>

fastLength := 7

slowLength := 28

signalLength := 7

"Swing Trading (5, 15, 5)" =>

fastLength := 5

slowLength := 15

signalLength := 5

"Contrarian (15, 35, 5)" =>

fastLength := 15

slowLength := 35

signalLength := 5

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

macdHist = macdLine - signalLine

// Buy and Sell conditions based on MACD crossovers

enterLong = ta.crossover(macdLine, signalLine)

exitLong = ta.crossunder(macdLine, signalLine)

// Execute buy and sell orders with price labels in the comments

if (enterLong)

strategy.entry("Buy", strategy.long, comment="Buy at " + str.tostring(close, "#.##"))

if (exitLong)

strategy.close("Buy", comment="Sell at " + str.tostring(close, "#.##"))

// Plot the signal price using plotchar for buy/sell prices

//plotchar(enterLong ? close : na, location=location.belowbar, color=color.green, size=size.small, title="Buy Price", offset=0)

//plotchar(exitLong ? close : na, location=location.abovebar, color=color.red, size=size.small, title="Sell Price", offset=0)

// Background highlighting based on bullish or bearish MACD

isBullish = macdLine > signalLine

isBearish = macdLine < signalLine

// Change background to green for bullish periods and red for bearish periods

bgcolor(isBullish ? color.new(color.green, 90) : na, title="Bullish Background")

bgcolor(isBearish ? color.new(color.red, 90) : na, title="Bearish Background")

// Plot the MACD and Signal line in a separate pane

plot(macdLine, title="MACD Line", color=color.blue, linewidth=2)

plot(signalLine, title="Signal Line", color=color.orange, linewidth=2)

hline(0, "Zero Line", color=color.gray)

plot(macdHist, title="MACD Histogram", style=plot.style_histogram, color=color.red)

- Sistema de negociación cuantitativa de cruce dinámico de varios períodos MACD-EMA

- Sistema de negociación de análisis técnico multiestratégico

- Estrategia de negociación cuantitativa de media móvil doble dinámica

- Estrategia cuantitativa de transición a corto y largo plazo basada en el canal G y la EMA

- Estrategia de negociación con doble tendencia de la EMA

- Tendencia de alta tasa de ganancia de la EMA a través de marcos de tiempo múltiples siguiendo la estrategia (avanzada)

- No hay estrategia de ruptura de vela alcista de parche superior

- Estrategia de negociación natural combinada del MACD y del RSI

- Sistema de análisis de estrategias de anomalías del viernes de oro multidimensional

- Teoría de las ondas de Elliott 4-9 Detección automática de ondas de impulso Estrategia de negociación

- Estrategia de negociación cuantitativa cruzada de la EMA para obtener beneficios dinámicos y evitar pérdidas

- Tendencia de cruce multi-EMA siguiendo una estrategia con optimización dinámica de stop-loss y take-profit

- Estrategia doble de cruce de medias móviles con gestión dinámica del riesgo

- Las estrategias de contraposición de las dos plataformas

- Se trata de la suma de las pérdidas de los activos de la entidad que no son objeto de una recapitalización.

- Captura de la fortaleza de la tendencia multi-MA con una estrategia de obtención de beneficios de impulso

- Sistema de negociación de tendencia adaptativa de múltiples estrategias y de ruptura

- Sistema de negociación de media móvil de varios niveles con reconocimiento de patrones de velas

- Estrategia de negociación de tendencia de impulso de la EMA en varios marcos de tiempo

- Estrategia de negociación equilibrada de rotación larga y corta basada en el tiempo

- Sistema de negociación de ruptura de tendencia con media móvil (Estrategia TBMA)

- Estrategia de seguimiento de tendencias múltiples basada en ATR con sistema de optimización de beneficios y pérdidas

- RSI Sistema de negociación inteligente adaptativo basado en el impulso con gestión de riesgos de varios niveles

- Estrategia de negociación dinámica del oscilador RSI adaptativo con optimización de umbral

- Tendencia sinérgica de RSI y AO a raíz de una estrategia de negociación cuantitativa

- Estrategia RSI de tendencia adaptativa con sistema de filtro de media móvil

- Estrategia de impulso del RSI con doble media móvil cruzada con sistema de optimización de riesgo-recompensa

- Sistema de estrategia dinámica cruzada de múltiples indicadores: un modelo de negociación cuantitativo basado en EMA, RVI y señales de negociación

- Estrategia cuantitativa de reversión de rango dinámico del RSI con modelo de optimización de volatilidad

- Tendencia de impulso de las bandas de Bollinger siguiendo una estrategia cuantitativa