Stratégie de dynamique lente de la ligne uniforme croisée + MACD

Auteur:ChaoZhang est là., Date: 2024-04-12 17h16:06Les étiquettes:SMALe taux d'intérêtLe MACD

Résumé

La stratégie utilise le croisement des moyennes et l'indicateur MACD comme principaux signaux de trading. La stratégie utilise le croisement des moyennes rapides et de plusieurs moyennes lentes comme signal d'ouverture, tout en combinant les négatifs du diagramme des colonnes de la MACD comme base de jugement de la tendance. La stratégie met en place plusieurs niveaux d'arrêt et de perte en même temps que l'ouverture et modifie continuellement les positions de stop-loss pour bloquer les bénéfices avec l'augmentation du temps de possession.

Les principes stratégiques

- La moyenne rapide et la moyenne lente 1 se croisent vers le haut, tandis que le prix de clôture est au-dessus de la moyenne lente 2, le diagramme MACD est plus grand que 0, et plus;

- La moyenne rapide et la moyenne lente 1 se croisent à la baisse, tandis que le prix de clôture est inférieur à la moyenne lente 2, le diagramme MACD est inférieur à 0.

- L'ouverture de la position est réglée sur plusieurs niveaux de stop-loss et de stop-loss en même temps, le stop-loss est réglé en fonction des préférences de risque, et le stop-loss est ajusté en fonction de la durée de la position, pour verrouiller progressivement les bénéfices;

- Les cycles homogènes, les paramètres MACD, les niveaux d'arrêt-déperdition peuvent être ajustés de manière flexible pour s'adapter aux différents environnements du marché.

Cette stratégie utilise la capture de tendances transversales homogènes, tout en confirmant la direction avec l'indicateur MACD, ce qui améliore la fiabilité des jugements de tendance.

Les avantages stratégiques

- Le croisement homogène est une méthode classique de suivi des tendances qui permet de capturer la formation des tendances en temps opportun.

- L'utilisation de lignes homogènes à plusieurs niveaux permet de déterminer plus complètement l'intensité et la durabilité des tendances.

- L'indicateur MACD peut identifier efficacement les tendances et déterminer la dynamique, en tant que complément puissant au croisement de l'équilibre;

- Les paramètres de freinage à plusieurs niveaux et de freinage dynamique permettent à la fois de contrôler les risques et de faire courir les bénéfices, ce qui renforce la stabilité du système.

- Les paramètres sont réglables, adaptatifs et peuvent être ajustés de manière flexible en fonction de différentes variétés et cycles.

Risque stratégique

- Le risque de retard de signal est présent lors de l'intersection d'une ligne uniforme, qui peut manquer une tendance précoce ou rattraper une hausse.

- Les paramètres mal réglés peuvent entraîner une sur-transaction ou une durée de détention trop longue, ce qui augmente les coûts et les risques;

- Un niveau de stop-loss trop radical peut entraîner un stop-loss prématuré et un niveau de stop-loss trop conservateur peut affecter les gains;

- Les mutations de tendance ou les fluctuations du marché peuvent entraîner un échec de la stratégie.

Ces risques peuvent être maîtrisés par l'optimisation des paramètres, l'ajustement des positions, la mise en place de conditions supplémentaires, etc. Mais aucune stratégie ne peut éviter complètement le risque et nécessite une prudence des investisseurs.

Optimisation stratégique

- L'introduction d'autres indicateurs, tels que le RSI, le Brainstorm, etc., pourrait être envisagée pour confirmer davantage les tendances et les signaux.

- Une optimisation plus fine des paramètres de l'emplacement de l'arrêt de perte peut être effectuée, par exemple en tenant compte de l'ATR ou du pourcentage d'arrêt de perte;

- Les paramètres peuvent être ajustés en fonction de la dynamique de la volatilité du marché pour améliorer l'adaptabilité;

- Un module de gestion des positions peut être introduit et la taille des positions peut être ajustée en fonction de la situation de risque.

- Les stratégies peuvent être regroupées et des combinaisons de stratégies peuvent être créées pour disperser les risques.

L'optimisation et l'amélioration continue peuvent rendre les stratégies plus solides et plus fiables, mieux adaptées à l'environnement changeant du marché.

Résumé

La stratégie est combinée avec le croisement de l'avenant et l'indicateur MACD pour construire un système de trading relativement complet. La conception de l'avenant à plusieurs niveaux et de l'opération multi-tête améliore la capacité de capture des tendances et de contrôle des risques du système. La stratégie est logiquement claire, facile à comprendre et à mettre en œuvre, adaptée à l'optimisation et à l'amélioration ultérieures.

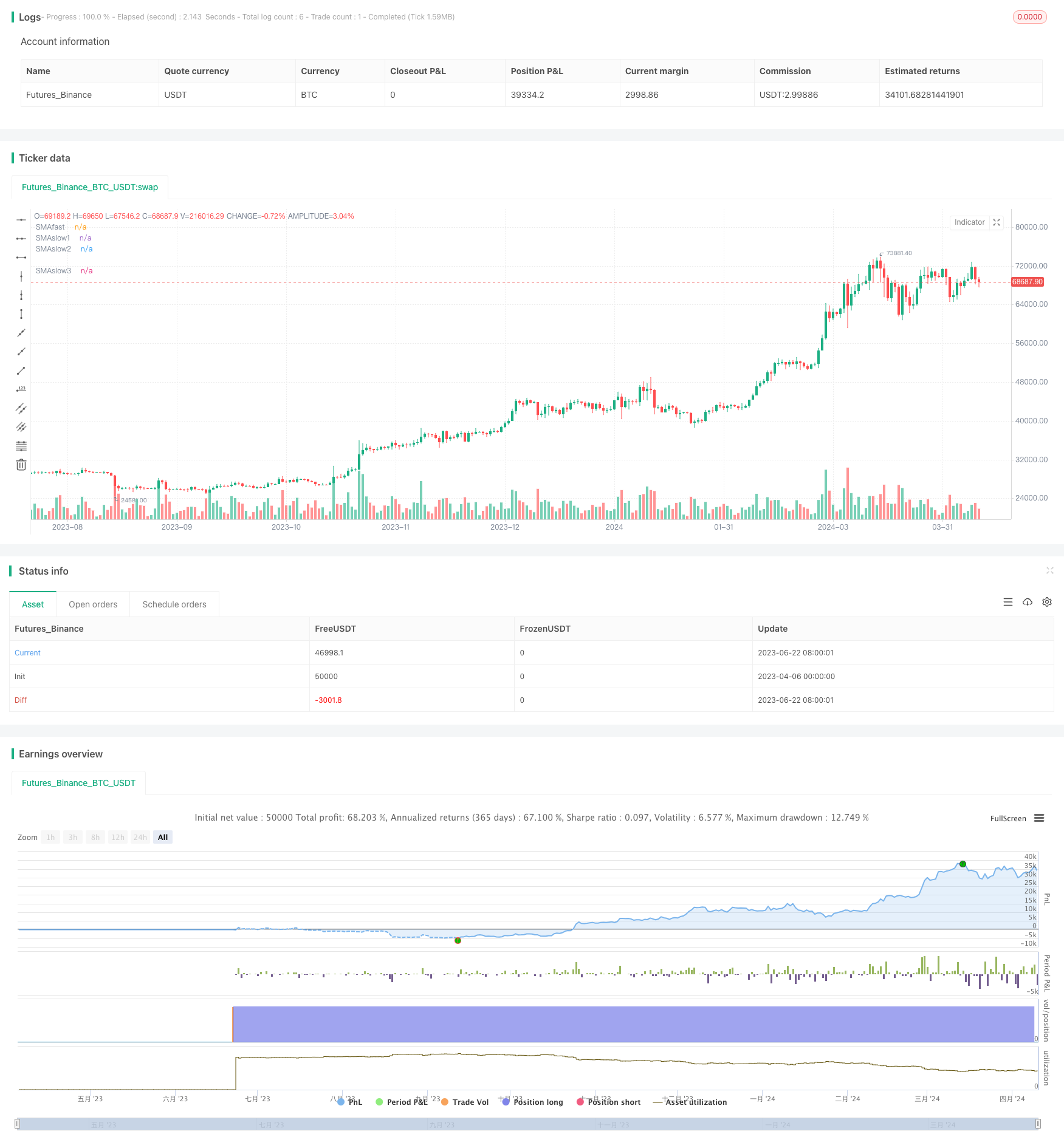

/*backtest

start: 2023-04-06 00:00:00

end: 2024-04-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxmirus

//@version=5

strategy("My strategy_Cross_SMA(EMA)+Macd,slow3",overlay=true)

// ver 4

// Date Inputs

startDate = input(timestamp('2019-01-01T00:00:00+0300'), '' , inline='time1',

tooltip=' Время первого бара расчета стратегии. Первый ордер может быть выставлен на следующем баре после стартового.')

finishDate = input(timestamp('2044-01-01T00:00:00+0300'), '' , inline='time2',

tooltip=' Время после которого больше не будут размещаться ордера входа в позицию.')

// Calculate start/end date and time condition

time_cond = true

//SMA(EMA) Inputs

fast=input.int(12, title="Fastlength",group="MA")

slow1=input.int(54,title="Slowlength1",group="MA")

slow2=input.int(100, title="Slowlength2",group="MA")

slow3=input.int(365, title="Slowlength3",group="MA")

fastma=input.string(title="Fastlength", defval="EMA",options=["SMA","EMA"],group="MA")

slowma1=input.string(title="Slowlength1", defval="EMA",options=["SMA","EMA"],group="MA")

slowma2=input.string(title="Slowlength2", defval="EMA",options=["SMA","EMA"],group="MA")

slowma3=input.string(title="Slowlength3", defval="EMA",options=["SMA","EMA"],group="MA")

fastlength = fastma == "EMA" ? ta.ema(close, fast) : ta.sma(close, fast)

slowlength1 = slowma1 == "EMA" ? ta.ema(close, slow1) : ta.sma(close, slow1)

slowlength2 = slowma2 == "EMA" ? ta.ema(close, slow2) : ta.sma(close, slow2)

slowlength3 = slowma3 == "EMA" ? ta.ema(close, slow3) : ta.sma(close, slow3)

//Macd Inputs

macdfastline = input.int(12, title="FastMacd",group="MACD")

macdslowline = input.int(26,title="SlowMacd",group="MACD")

macdhistline = input.int(9,title="HistMacd",group="MACD")

src=input(defval=close,title="Source",group="MACD")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

fast_ma = sma_source == "SMA" ? ta.sma(src, macdfastline) : ta.ema(src, macdfastline)

slow_ma = sma_source == "SMA" ? ta.sma(src, macdslowline) : ta.ema(src, macdslowline)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, macdhistline) : ta.ema(macd, macdhistline)

hist = macd - signal

//fastMACD = ta.ema(close, macdline) - ta.ema(close, signalline)

//signalMACD = ta.ema(MACD, histline)

//histMACD = MACD - aMACD

//EMA Plot

plot(fastlength,title="SMAfast",color=color.blue)

plot(slowlength1,title="SMAslow1",color=color.orange)

plot(slowlength2,title="SMAslow2",color=color.red)

plot(slowlength3,title="SMAslow3",color=color.black)

//Macd plot

//col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

//col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

//col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

//col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

//col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

//col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)))

//plot(macd, title="MACD", color=col_macd)

//plot(signal, title="Signal", color=col_signal)

//Take profit

tp1=input.float(5.1,title="Take Profit1_%",step=0.1)/100

tp2=input.float(10.1,title="Take Profit2_%",step=0.1)/100

//Stop loss

sl1=input.float(5.1,title="Stop loss1_%",step=0.1)/100

sl2=input.float(0.1,title="Stop loss2_%",step=0.1)/100

sl3=input.float(-5.5,title="Stop loss3_%", step=0.1)/100

//Qty closing position

Qty1 = input.float(0.5, title="QtyClosingPosition1",step=0.01)

Qty2 = input.float(0.25, title="QtyClosingPosition2",step=0.01)

//Take profit Long and Short

LongTake1=strategy.position_avg_price*(1+tp1)

LongTake2=strategy.position_avg_price*(1+tp2)

ShortTake1=strategy.position_avg_price*(1-tp1)

ShortTake2=strategy.position_avg_price*(1-tp2)

//Plot Levels Take

plot(strategy.position_size > 0 ? LongTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongTake2 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake2 : na,color=color.green,style=plot.style_linebr)

//Stop loss long and short

LongStop1=strategy.position_avg_price*(1-sl1)

LongStop2=strategy.position_avg_price*(1-sl2)

LongStop3=strategy.position_avg_price*(1-sl3)

ShortStop1=strategy.position_avg_price*(1+sl1)

ShortStop2=strategy.position_avg_price*(1+sl2)

ShortStop3=strategy.position_avg_price*(1+sl3)

//Stop=strategy.position_avg_price

//Plot Levels Stop

plot(strategy.position_size > 0 ? LongStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop3 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop3 : na,color=color.red,style=plot.style_linebr)

//Entry condition

LongCondition1 = ta.crossover(fastlength, slowlength1)

LongCondition2 = close>slowlength2

LongCondition3 = time_cond

LongCondition4=close>slowlength3

//LongCondition5=slowlength100>slowlength3

LongCondition6 = hist > 0

buy=(LongCondition1 and LongCondition2 and LongCondition3 and LongCondition4 and LongCondition6 ) and strategy.position_size<=0

//longCondition3 = nz(strategy.position_size) == 0//если отсутствует открытая позиция

ShortCondition1 = ta.crossunder(fastlength, slowlength1)

ShortCondition2 = close<slowlength2

ShortCondition3 = time_cond

ShortCondition4=close<slowlength3

//ShortCondition5=slowlength100<slowlength3

ShortCondition6=hist < 0

sell=(ShortCondition1 and ShortCondition2 and ShortCondition3 and ShortCondition4 and ShortCondition6 ) and strategy.position_size>=0

//Strategy entry

strategy.cancel_all(not strategy.position_size)

if(buy)

strategy.cancel_all()

strategy.entry("Buy",strategy.long)

if(sell)

strategy.cancel_all()

strategy.entry("Sell",strategy.short)

//Strategy Long exit

var int exitCounter=0

exitCounter := not strategy.position_size or strategy.position_size > 0 and strategy.position_size[1] < 0 or strategy.position_size < 0 and strategy.position_size[1] > 0 ? 0:

strategy.position_size > 0 and strategy.position_size[1]>strategy.position_size? exitCounter[1] + 1:

strategy.position_size < 0 and strategy.position_size[1]<strategy.position_size? exitCounter[1] - 1:

exitCounter[1]

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long1",strategy.short, qty=math.abs(strategy.position_size*Qty1), limit=LongTake1, oca_name='Long1', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long2",strategy.short, qty=math.abs(strategy.position_size*Qty2), limit=LongTake2, oca_name='Long2', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Stop Long1",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop1,oca_name='Long1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==1

strategy.order("Stop Long2",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop2,oca_name='Long2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==2

strategy.order("Stop Long3",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop3)

// Strategy Short exit

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short1", strategy.long, qty=math.abs(strategy.position_size*Qty1), limit=ShortTake1, oca_name='Short1', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short2", strategy.long, qty=math.abs(strategy.position_size*Qty2), limit=ShortTake2, oca_name='Short2', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Stop Short1",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop1,oca_name='Short1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-1

strategy.order("Stop Short2",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop2,oca_name='Short2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-2

strategy.order("Stop Short3",strategy.long,qty=math.abs(strategy.position_size),stop=ShortStop3)

- Stratégie de négociation à double conversion MACD sans décalage - négociation à haute fréquence basée sur la capture de tendances à court terme

- Indicateur MACD personnalisé CM - Cadre temporel multiple - V2

- Indicateur d'inversion de K I

- La stratégie de stockage de masse du MACD ZeroLag

- Système de négociation de confirmation de tendance double MACD

- La stratégie de rupture de la bande MACD BB

- Stratégie de négociation optimisée multi-tête combinée à la stratégie de Martin

- La stratégie de négociation quantitative peut être ajustée à la date de croisement MACD à double équilibre

- Système de négociation dynamique de stop-loss sur plusieurs bandes MACD

- Stratégie de prévision croisée des fluctuations dynamiques du MACD

- Wavetrend: une stratégie de trading de grille de rebond pour dépasser les indices à forte baisse

- La stratégie de croisement du MACD

- Stratégie de suivi des tendances optimisée basée sur l'intersection des lignes de signaux MACD avec la gestion des risques ATR

- La stratégie de stockage de masse du MACD ZeroLag

- La valeur de l'indice de change est la valeur de l'indice de change de l'indice de change.

- Stratégie de trading inverse à haute fréquence basée sur l'indicateur RSI dynamique

- RSI est une stratégie pour les indices relativement forts et faibles.

- La ligne de ligne a été déjouée.

- Donchian Channel et Larry Williams sur la stratégie de l'indice mondial des transactions

- SPARK stratégie de négociation de positions dynamiques et de doubles indices

- Taux de transactions dynamiques ajustés à la stratégie DCA

- La stratégie du détecteur de vallée MACD

- Les N Bars dépassent les limites

- Stratégie de trading à haute fréquence de crypto-monnaie à faible risque et solide basée sur RSI et MACD

- Stratégie de signaux RSI au seuil aléatoire

- RSI stratégie de négociation bilatérale

- Stratégie de trading basée sur des indicateurs aléatoires à vitesse lente

- Stratégie de négociation de stop-loss dynamique basée sur une ligne moyenne de transaction adaptative pyramidale

- La stratégie de croisement du MACD TEMA

- RSI et Brin ont une double stratégie