Stratégie de négociation AlphaTradingBot

Auteur:ChaoZhang est là., Date: 2024-04-28 13:48:51 Je vous en prie.Les étiquettes:- Je vous en prie.Le taux d'intérêtATRIndice de résistance

Résumé

AlphaTradingBot est une stratégie de day trading basée sur l'indicateur Zigzag et la séquence de Fibonacci. La stratégie identifie les points hauts (HH) et les points bas (LL) du marché pour déterminer la tendance, et utilise les rétracements et les expansions de Fibonacci pour définir les points d'entrée, les bénéfices et les stop-loss.

Principe de stratégie

- Utilisez l'indicateur Zigzag pour identifier les hauts (HH), les bas (LL), les bas (HL) et les bas (LH) du marché.

- L'apparition d'un HH est considérée comme le début d'une tendance haussière et la stratégie commence à chercher des opportunités longues; l'apparition d'un LL est considérée comme le début d'une tendance baissière et la stratégie commence à chercher des opportunités courtes.

- Dans une tendance à la hausse, si une HL apparaît, la plage formée par la HL et la LL précédente est utilisée comme plage de retracement de Fibonacci pour les longs. Si le prix dépasse le sommet précédent, un ordre long est placé dans la zone de retracement de 23,6% à 38,2% (ajustable), le stop-loss étant fixé au niveau de retracement de 61,8% et le take-profit calculé sur la base de la valeur RR (ajustable).

- Dans une tendance à la baisse, si une LH apparaît, la plage formée par la LH et la HH précédente est utilisée comme plage de retracement de Fibonacci pour les shorts. Si le prix franchit le plus bas précédent, un ordre court est placé dans la zone de retracement de 61,8% à 76,4% (ajustable), le stop-loss étant fixé au niveau de retracement de 38,2% et le profit obtenu est calculé sur la base de la valeur RR (ajustable).

- Gestion des ordres: une seule commande est passée par signal jusqu'à la clôture de cet ordre.

Analyse des avantages

- Une forte capacité de suivi des tendances. Identifie efficacement les tendances par Zigzag et peut entrer au stade précoce d'une tendance.

- Logique de retracement claire. Utilise les retracements de Fibonacci pour définir les zones d'entrée et entre pendant les retracements de tendance, ce qui donne un taux de gain relativement élevé.

- Risque contrôlable: contrôle le risque de chaque transaction en fixant un pourcentage de perte maximum pour une seule transaction, tandis qu'un système strict de stop-loss assure également un contrôle global du risque.

- Optimiser le rapport risque/rendement: la valeur RR peut être ajustée en fonction des caractéristiques du marché et des préférences personnelles pour optimiser le rapport risque/rendement de la stratégie.

Analyse des risques

- Commerce fréquent. En raison de la grande sensibilité du Zigzag, il peut générer des signaux fréquemment, conduisant à un sur-trading.

- Les tendances déterminées par Zigzag peuvent encore présenter des écarts, ce qui entraîne un moment d'entrée moins que idéal.

- La stratégie peut générer plus de pertes sur les marchés latéraux.

- La stratégie ne fonctionne que dans une plage de dates spécifiée et peut manquer certains mouvements du marché.

Direction de l'optimisation

- Mettre en place davantage d'indicateurs techniques, tels que l'AM et le MACD, pour améliorer la précision de l'identification des tendances.

- Optimiser la gestion des positions, par exemple en ajustant dynamiquement la taille des positions en fonction d'indicateurs tels que l'ATR.

- Optimiser la logique de prise de profit et de stop-loss, par exemple en ajustant dynamiquement les niveaux de stop-loss en fonction de la volatilité du marché.

- Mettre en place des indicateurs du sentiment du marché pour éviter de s'engager dans une période d'extrême optimisme ou de pessimisme.

- Réduire la restriction de date pour accroître la polyvalence de la stratégie.

Résumé

AlphaTradingBot est une stratégie intraday de suivi des tendances basée sur l'indicateur Zigzag et les retraces de Fibonacci. Elle détermine les tendances à travers des points hauts et bas et entre pendant les retraces de tendance, dans le but de poursuivre un taux de gain et un ratio risque-rendement plus élevés.

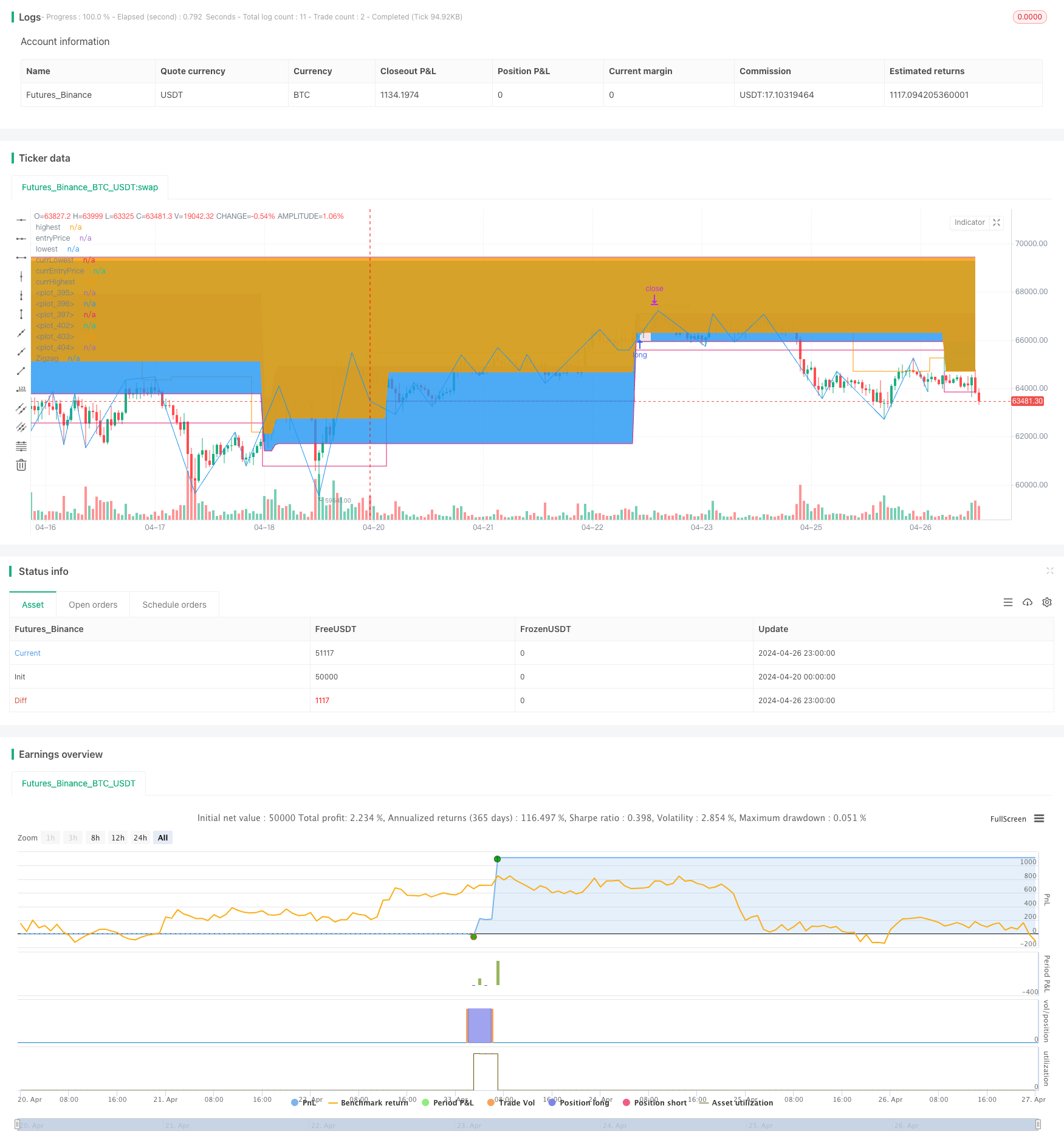

/*backtest

start: 2024-04-20 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © javierfish

//@version=5

strategy(title = 'Augusto Bot v1.2', shorttitle='🤑 🤖 v1.2', overlay = true, pyramiding=0, initial_capital=100000, default_qty_value=1)

lb = input.int(5, title='Pivot Bars Count', minval=1)

rb = lb

var color supcol = color.lime

var color rescol = color.red

// srlinestyle = line.style_dotted

srlinewidth = 1

changebarcol = true

bcolup = color.blue

bcoldn = color.black

intDesde = input(timestamp('2023-01-01T00:00:00'), 'Desde', group='Rango de fechas')

intHasta = input(timestamp('2023-12-31T23:59:59'), 'Hasta', group='Rango de fechas')

blnFechas = true

blnShorts = input.bool(false, " Shorts", group="Trading", tooltip = 'Checked = Shorts. No Checked = Longs')

blnLongs = not blnShorts

pctRisk = input.float(1, 'Riesgo %', 0.1, 100,step = .1, group='Trading', tooltip = 'Porcentaje del total de su cuenta que está dispuesto a arriesgar en cada trade')

RR = input.float(2, 'Ratio de Ganancia X', 1, 10, .5, tooltip = 'Proporción de Take Profit contra Stop Loss', group='Trading')

retro = input.float(40, 'Retroceso %', 1, 100, 10, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar un retroceso', group='Fibonacci')

fibSL = input.float(72, 'Stop Loss %', 1, 100, 5, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar perdido un trade', group='Fibonacci')

blnDebug = input.bool(false, 'Debug', tooltip = 'Mostrar información de depuración como estatus y línea de tendencia')

showsupres = blnDebug

blnEnLong = strategy.position_size > 0

blnEnShort = strategy.position_size < 0

blnEnTrade = blnEnLong or blnEnShort

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

float loc1 = na

float loc2 = na

float loc3 = na

float loc4 = na

if not na(hl)

ehl = hl == 1 ? -1 : 1

loc1 := 0.0

loc2 := 0.0

loc3 := 0.0

loc4 := 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

[loc1, loc2, loc3, loc4] = findprevious()

a = fixnan(zz)

b = loc1

c = loc2

d = loc3

e = loc4

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(blnDebug and _hl, text='HL', title='Higher Low', style=shape.labelup, color=color.lime, textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _hh, text='HH', title='Higher High', style=shape.labeldown, color=color.lime, textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(blnDebug and _ll, text='LL', title='Lower Low', style=shape.labelup, color=color.red, textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _lh, text='LH', title='Lower High', style=shape.labeldown, color=color.red, textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol and blnDebug ? iff_4 : na)

usdCalcRisk = strategy.equity * pctRisk / 100

usdRisk = usdCalcRisk > 0 ? usdCalcRisk : 0

blnOrder = strategy.opentrades > 0

var entryPrice = close

var hhVal = high

var lhVal = high

var hlVal = low

var llVal = low

var longTP = high

var longSL = low

var shortTP = low

var shortSL = high

var lowest = low

var highest = high

var status = 0

var closedTrades = strategy.closedtrades

var currSignal = ''

var prevSignal = currSignal

if _hh

hhVal := a

prevSignal := currSignal

currSignal := 'HH'

else if _lh

lhVal := a

prevSignal := currSignal

currSignal := 'LH'

else if _hl

hlVal := a

prevSignal := currSignal

currSignal := 'HL'

else if _ll

llVal := a

prevSignal := currSignal

currSignal := 'LL'

fibo(fibTop, fibLow) =>

diff = fibTop - fibLow

fib50 = 0.0

if status % 2 == 1 // Estatus pares son longs

fib50 := fibLow + (diff * (1 - (retro / 100))) // Longs

else

fib50 := fibLow + (diff * (retro / 100))

fib70UP = fibLow + (diff * (1 - (fibSL / 100))) // Fibo 61.8% up

fib70DW = fibLow + (diff * (fibSL / 100)) // Fibo 61.8% down

[fib50, fib70UP, fib70DW]

currLowest = ta.lowest(low, lb + 1) // El menor low de las últimas n barras

currHighest = ta.highest(high, lb + 1) // El mayor high de las últimas n barras

// status 0. En espera de un LL para longs o un HH para shorts

if status == 0 and blnFechas

closedTrades := strategy.closedtrades

if _ll and blnLongs

status := 1

else if _hh and blnShorts

status := 2

// -------- LONGS --------

// status 1. Longs. En espera de un nuevo nivel superior (HH o LH)

else if status == 1

closedTrades := strategy.closedtrades

if _hh or _lh

highest := currHighest

else if _hl

lowest := currLowest

if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice and close <= open // Si la vela roja que rebasó el reciente nivel superior también cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if entryPrice > longSL

strategy.entry('🚀 1', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 1', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

else

status := 3

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if low < llVal

status := 0

// status 3. Longs. En espera de que aparezca un HL

else if status == 3

if _hl

lowest := currLowest

if _lh or _ll or low < hlVal

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL

strategy.cancel_all()

strategy.entry('🚀 3', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 3', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 5. Longs. Crecimiento del fibo en espera de que se rebase el nivel superior y se toque el entry price para entrar a un trade

else if status == 5

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnLong

status := 7

else if _lh or _ll or low < llVal // Caso invalidación por nuevo bajo nivel

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest // Caso de rebase de niveles superiores

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL // Orden limit de long con su TP y SL

strategy.cancel_all()

strategy.entry('🚀 5', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 5', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 7. Longs. En espera que finalice el trade

else if status == 7

blnOrder := false

if not blnEnLong

strategy.cancel_all()

if currSignal == 'HH' and blnShorts // Si se finaliza un trade e inmediatamente se presenta un HH debe comenzarse la formación de un setup bajista

status := 2

else

status := 0

// -------- SHORTS --------

// status 2. Shorts. En espera de un nuevo nivel inferior (LL o HL)

else if status == 2

closedTrades := strategy.closedtrades

if _ll or _hl

lowest := currLowest

else if _lh

highest := currHighest

if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice and close > open // Si la vela verde que rebasó el reciente nivel inferior tambien cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.entry('🐻 2', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 2', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

else

status := 4

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if high > hhVal

status := 0

// status 4. Shorts. En espera de que aparezca un LH

else if status == 4

if _lh

highest := currHighest

if _hl or _hh or high > lhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if not blnEnShort and entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 4', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 4', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 6. Shorts. Crecimiento del fibo en espera de que se rebase el nivel inferior y se toque el entry price para entrar a un trade

else if status == 6

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnShort

status := 8

else if _hl or _hh or high > hhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest // Caso de rebase de niveles inferiores

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 6', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 6', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 8. Shorts. En espera que finalice el trade

else if status == 8

blnOrder := false

if not blnEnShort

strategy.cancel_all()

if currSignal == 'LL' and blnLongs // Si inmediatamente después de finalizar un trade existe un LL debe comenzarse un setup alcista

status := 1

else

status := 0

plotchar(blnDebug and status == 0 and blnFechas, '0', '0', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 1 and blnFechas, '1', '1', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 2 and blnFechas, '2', '2', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 3 and blnFechas, '3', '3', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 4 and blnFechas, '4', '4', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 5 and blnFechas, '5', '5', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 6 and blnFechas, '6', '6', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 7 and blnFechas, '7', '7', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 8 and blnFechas, '8', '8', location.abovebar, color.yellow, size = size.tiny)

plot(highest, 'highest', (status == 5 or status[1] == 5) and blnLongs ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'entryPrice', (status == 5 or status[1] == 5) and blnLongs ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(lowest, 'lowest', (status == 3 or status == 5 or status[1] == 5) and blnLongs ? color.new(color.yellow, 50) : na, 1, plot.style_stepline)

plot(lowest, 'currLowest', (status == 6 or status[1] == 6) and blnShorts ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'currEntryPrice', (status == 6 or status[1] == 6) and blnShorts ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(highest, 'currHighest', (status == 4 or status == 6 or status[1] == 6) and blnShorts ?color.new(color.yellow, 50) : na, 1, plot.style_stepline)

exitLong = barstate.isconfirmed and blnEnLong and time >= intHasta

exitShort = barstate.isconfirmed and blnEnShort and time >= intHasta

if exitLong

strategy.cancel_all()

strategy.close_all(comment = close > strategy.position_avg_price ? '✅' : '💥')

status := 0

if exitShort

strategy.cancel_all()

strategy.close_all(comment = close < strategy.position_avg_price ? '❎' : '☠️')

status := 0

plot(zz, 'Zigzag', blnDebug ? color.white : na, offset = lb * -1)

rayaTradeLong = strategy.position_size == strategy.position_size[1] and (strategy.position_size > 0) and blnLongs

tpPlLong = plot(longTP, color = rayaTradeLong ? color.teal : na)

epPlLong = plot(entryPrice, color= rayaTradeLong ? color.white : na)

slPlLong = plot(longSL, color = rayaTradeLong ? color.maroon : na)

fill(tpPlLong, epPlLong, color= rayaTradeLong ? color.new(color.teal, 85) : na)

fill(epPlLong, slPlLong, color= rayaTradeLong ? color.new(color.maroon, 85) : na)

rayaTradeShort = strategy.position_size == strategy.position_size[1] and strategy.position_size < 0 and blnShorts

tpPlShort = plot(shortTP, color = rayaTradeShort ? color.teal : na)

epPlShort = plot(entryPrice, color=rayaTradeShort ? color.white : na)

slPlShort = plot(shortSL, color=rayaTradeShort ? color.maroon : na)

fill(tpPlShort, epPlShort, color=rayaTradeShort ? color.new(color.teal, 85) : na)

fill(epPlShort, slPlShort, color=rayaTradeShort ? color.new(color.maroon, 85) : na)

Relationnée

- Stratégie de négociation à double dynamique de tendance EMA

- Aucune stratégie de rupture de bougie haussière

- Tendance composite à plusieurs indicateurs suivant une stratégie

- Système d'analyse stratégique de l'anomalie du vendredi d'or multidimensionnel

- Théorie des ondes d'Elliott 4-9 Détection automatique des ondes d'impulsion Stratégie de trading

- RSI-ATR Momentum Volatilité Stratégie de négociation combinée

- Stratégie de redressement du mardi (filtre du week-end)

- Stratégie de négociation d'action sur les prix du canal magique

- Tendance dynamique à la suite de la stratégie de négociation à plusieurs périodes d'ATR

- Stratégie de dynamisme du RSI à moyenne mobile double basée sur l'EMA et les écarts de tendance

Plus de

- RSI2 Stratégie Réversion intradienne Taux de victoire Test de retour

- Les lignes futures de la stratégie de démarcation

- Tendance à la suite d'une stratégie basée sur les signaux croisés OBV et MA

- Stratégie confirmée de GBS TOP Bottom

- Tendance multi-indicateurs à la suite de la stratégie

- Transformateur de test arrière v2.0

- Stratégie de renversement de tendance de Fibonacci

- Stratégie de parcours en zigzag du HTF

- La stratégie de WaveTrend Cross LazyBear

- La stratégie à court terme hybride CCI, DMI et MACD

- La stratégie améliorée de Vegas SuperTrend

- Stratégie de négociation quantitative basée sur la moyenne mobile modifiée de la coque et Ichimoku Kinko Hyo

- Stratégie d'inversion de la tendance de l'indicateur de risque

- Stratégie de négociation de l'indicateur stochastique croisé

- RSI et stratégie quantitative du signal croisé double EMA

- Théorie des ondes d'Elliott 4-9 Détection automatique des ondes d'impulsion Stratégie de trading

- Stratégie de croisement d'oscillateur stochastique et de moyenne mobile avec stop loss et filtre stochastique

- Stratégie de négociation de volatilité scalable au cours de la journée

- KRK aDa Stratégie de réversion moyenne lente stochastique avec améliorations de l'IA

- Opérations en ligne de tendance en temps réel basées sur les points pivots et les pentes