मल्टी-एमए ट्रेंड तीव्रता ट्रेडिंग रणनीति - एमए विचलन पर आधारित एक लचीली स्मार्ट ट्रेडिंग प्रणाली

लेखक:चाओझांग, दिनांकः 2024-12-11 17:46:33टैगःएमएएटीआरएचटीएफआर आरटीपीSL

अवलोकन

यह रणनीति कई चलती औसत और प्रवृत्ति तीव्रता पर आधारित एक बुद्धिमान ट्रेडिंग प्रणाली है। यह स्थिति प्रबंधन और जोखिम नियंत्रण के लिए एटीआर अस्थिरता संकेतक के साथ संयुक्त विभिन्न अवधियों की कीमत और चलती औसत के बीच विचलन का विश्लेषण करके बाजार की प्रवृत्ति की ताकत को मापता है। यह रणनीति उच्च अनुकूलन क्षमता प्रदान करती है और विभिन्न बाजार वातावरण और ट्रेडिंग आवश्यकताओं के अनुसार मापदंडों को लचीले ढंग से समायोजित कर सकती है।

रणनीतिक सिद्धांत

रणनीति का मूल तर्क निम्नलिखित पहलुओं पर आधारित हैः 1. प्रवृत्ति दिशा और क्रॉसिंग संकेतों की पहचान करने के लिए विभिन्न अवधियों के दो चलती औसत (तेज और धीमी) का उपयोग करता है 2. मूल्य और चलती औसत के बीच विचलन की गणना करके प्रवृत्ति की ताकत को मापता है (बिंदुओं में) 3. पुष्टिकरण संकेतों के रूप में कैंडलस्टिक पैटर्न (ग्लॉविंग, हथौड़ा, शूटिंग स्टार, डोजी) शामिल करता है 4. गतिशील रूप से स्टॉप लॉस और लाभ लक्ष्यों की गणना करने के लिए एटीआर संकेतक का उपयोग करता है 5. अर्डर प्रबंधन के लिए आंशिक लाभ और ट्रैलिंग स्टॉप का उपयोग करता है

रणनीतिक लाभ

- प्रणाली में विभिन्न बाजार वातावरण के लिए पैरामीटर समायोजन के माध्यम से मजबूत अनुकूलन क्षमता है

- कमजोर रुझानों में बार-बार व्यापार करने से बचने के लिए विचलन माप के माध्यम से प्रवृत्ति शक्ति को मात्रात्मक करता है

- बेहतर संकेत विश्वसनीयता के लिए कई तकनीकी संकेतकों और पैटर्न को जोड़ती है

- उचित जोखिम नियंत्रण के लिए एटीआर आधारित गतिशील स्टॉप लॉस का उपयोग करता है

- मिश्रित और निश्चित स्थिति आकार दोनों विधियों का समर्थन करता है

- लाभ को प्रभावी ढंग से संरक्षित करने के लिए आंशिक लाभ लेने और ट्रैलिंग स्टॉप की विशेषताएं

रणनीतिक जोखिम

- रेंजिंग बाजारों में झूठे संकेत उत्पन्न कर सकते हैं, ऑसिलेटर फ़िल्टर जोड़ने पर विचार करें

- कई संकेतक संयोजन कुछ व्यापारिक अवसरों को खो सकते हैं

- मापदंडों का अति-अनुकूलन अति-फिटिंग जोखिम का कारण बन सकता है

- कम तरल बाजारों में बड़े लेनदेन में फिसलने का जोखिम हो सकता है

- अत्यधिक एकल नुकसान से बचने के लिए उचित स्टॉप लॉस सेटिंग्स की आवश्यकता होती है

रणनीति अनुकूलन

- परिमाण संकेतकों को पूरक प्रवृत्ति पुष्टि के रूप में जोड़ सकता है

- व्यापारिक आवृत्ति को गतिशील रूप से समायोजित करने के लिए अस्थिरता संकेतकों को लागू करने पर विचार करें

- विभिन्न समय सीमाओं में प्रवृत्ति स्थिरता के आधार पर संकेत फ़िल्टर करें

- अधिक स्टॉप लॉस विकल्प जोड़ें, जैसे समय आधारित स्टॉप

- रणनीति अनुकूलन क्षमता में सुधार के लिए अनुकूलनशील पैरामीटर अनुकूलन तंत्र विकसित करना

सारांश

यह रणनीति मूविंग एवरेज, ट्रेंड स्ट्रेंथ क्वांटिफिकेशन, कैंडलस्टिक पैटर्न और डायनेमिक रिस्क मैनेजमेंट को मिलाकर एक व्यापक ट्रेडिंग सिस्टम का निर्माण करती है। यह कई पुष्टिकरण तंत्रों के माध्यम से ट्रेडिंग विश्वसनीयता को बढ़ाते हुए रणनीतिक सादगी बनाए रखती है। रणनीति की उच्च अनुकूलन क्षमता इसे विभिन्न ट्रेडिंग शैलियों और बाजार वातावरण के अनुकूल करने की अनुमति देती है, लेकिन कार्यान्वयन के दौरान पैरामीटर अनुकूलन और जोखिम नियंत्रण पर ध्यान दिया जाना चाहिए।

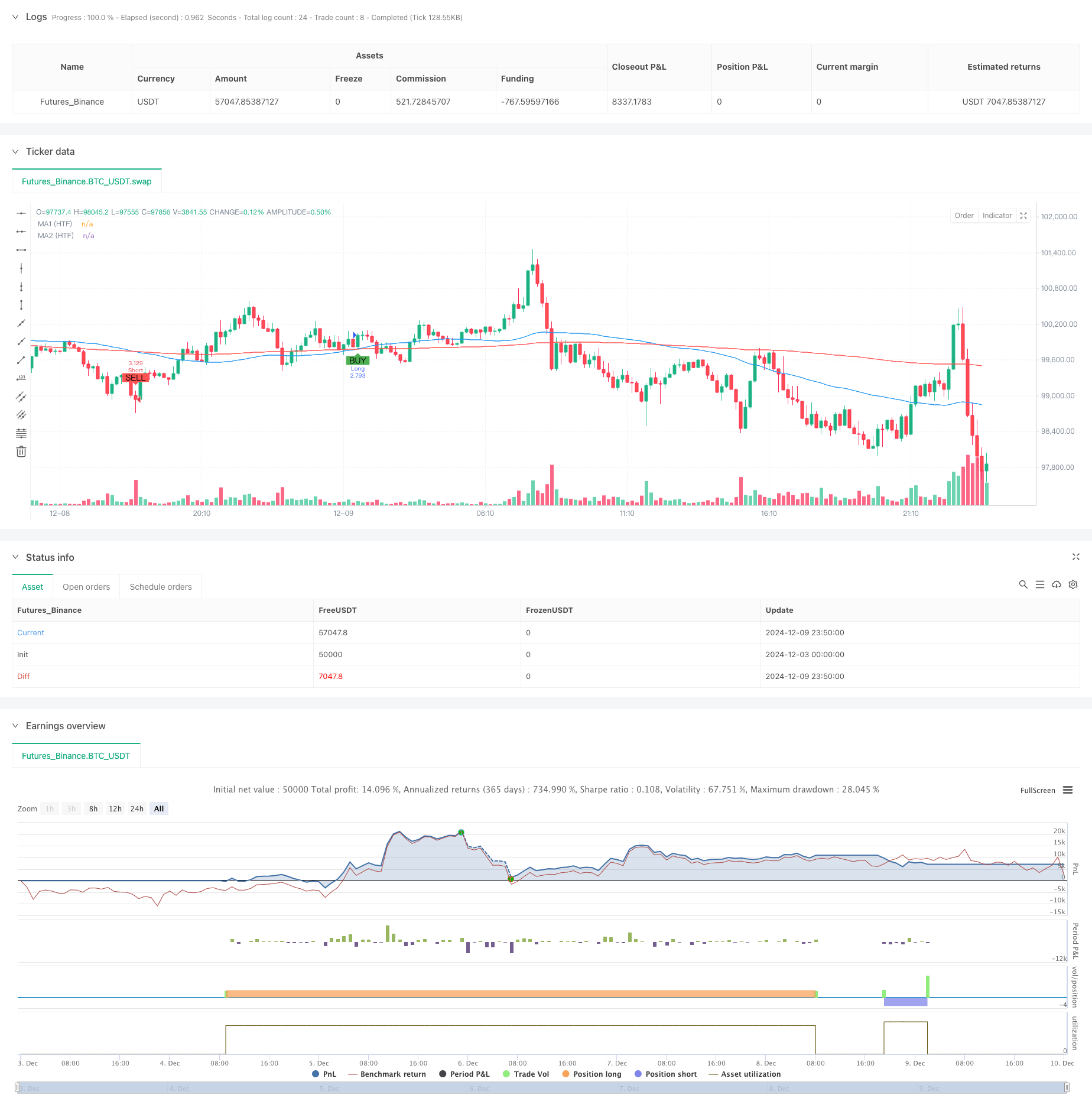

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Customizable Strategy with Signal Intensity Based on Pips Above/Below MAs", overlay=true)

// Customizable Inputs

// Account and Risk Management

account_size = input.int(100000, title="Account Size (USD)", minval=1)

compounded_results = input.bool(true, title="Compounded Results")

risk_per_trade = input.float(1.0, title="Risk per Trade (%)", minval=0.1, maxval=100) / 100

// Moving Averages Settings

ma1_length = input.int(50, title="Moving Average 1 Length", minval=1)

ma2_length = input.int(200, title="Moving Average 2 Length", minval=1)

// Higher Time Frame for Moving Averages

ma_htf = input.timeframe("D", title="Higher Time Frame for MA Delay")

// Signal Intensity Range based on pips

signal_intensity_min = input.int(0, title="Signal Intensity Start (Pips)", minval=0, maxval=1000)

signal_intensity_max = input.int(1000, title="Signal Intensity End (Pips)", minval=0, maxval=1000)

// ATR-Based Stop Loss and Take Profit

atr_length = input.int(14, title="ATR Length", minval=1)

atr_multiplier_stop = input.float(1.5, title="Stop Loss Size (ATR Multiplier)", minval=0.1)

atr_multiplier_take_profit = input.float(2.5, title="Take Profit Size (ATR Multiplier)", minval=0.1)

// Trailing Stop and Partial Profit

trailing_stop_rr = input.float(2.0, title="Trailing Stop (R:R)", minval=0)

partial_profit_percentage = input.float(50, title="Take Partial Profit (%)", minval=0, maxval=100)

// Trend Filter Settings

trend_filter_enabled = input.bool(true, title="Trend Filter Enabled")

trend_filter_sensitivity = input.float(50, title="Trend Filter Sensitivity", minval=0, maxval=100)

// Candle Pattern Type for Entry

entry_candle_type = input.string("Any", title="Entry Candle Type", options=["Any", "Engulfing", "Hammer", "Shooting Star", "Doji"])

// Moving Average Entry Conditions

ma_entry_condition = input.string("Both", title="MA Entry", options=["Fast Above Slow", "Fast Below Slow", "Both"])

// Trade Direction (Long, Short, or Both)

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"])

// ATR Calculation

atr_value = ta.atr(atr_length)

// Moving Average Calculations (using Higher Time Frame)

ma1_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma1_length)

ma2_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma2_length)

// Candle Pattern Conditions

is_engulfing = close[1] < open[1] and close > open and high > high[1] and low < low[1]

is_hammer = (high - low) > 3 * (close - open) and (close > open) and (low == ta.lowest(low, 5))

is_shooting_star = (high - low) > 3 * (open - close) and (open > close) and (high == ta.highest(high, 5))

is_doji = (close - open) <= ((high - low) * 0.1)

// Apply the selected candle pattern

candle_condition = false

if entry_candle_type == "Any"

candle_condition := true

if entry_candle_type == "Engulfing"

candle_condition := is_engulfing

if entry_candle_type == "Hammer"

candle_condition := is_hammer

if entry_candle_type == "Shooting Star"

candle_condition := is_shooting_star

if entry_candle_type == "Doji"

candle_condition := is_doji

// Moving Average Entry Conditions

ma_cross_above = ta.crossover(ma1_htf, ma2_htf)

ma_cross_below = ta.crossunder(ma1_htf, ma2_htf)

// Calculate pips distance to MAs and normalize it for signal intensity

pip_size = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

// Calculate distances in pips between price and MAs

distance_to_ma1_pips = math.abs(close - ma1_htf) / pip_size

distance_to_ma2_pips = math.abs(close - ma2_htf) / pip_size

// Calculate signal intensity based on the pips distance

// Normalize the signal intensity between the user-specified min and max

signal_intensity = math.min(math.max((distance_to_ma1_pips + distance_to_ma2_pips), signal_intensity_min), signal_intensity_max)

// Trend Filter Condition (Optional)

trend_condition = false

if trend_filter_enabled

trend_condition := ta.sma(close, ma2_length) > ta.sma(close, ma2_length + int(trend_filter_sensitivity))

// Entry Conditions Based on MA, Candle Patterns, and Trade Direction

long_condition = (trade_direction == "Long" or trade_direction == "Both") and (ma_entry_condition == "Fast Above Slow" or ma_entry_condition == "Both") and ma_cross_above and candle_condition and (not trend_filter_enabled or trend_condition) and signal_intensity > signal_intensity_min

short_condition = (trade_direction == "Short" or trade_direction == "Both") and (ma_entry_condition == "Fast Below Slow" or ma_entry_condition == "Both") and ma_cross_below and candle_condition and (not trend_filter_enabled or not trend_condition) and signal_intensity > signal_intensity_min

// Position Sizing Based on Risk Per Trade and ATR for Stop Loss

risk_amount = account_size * risk_per_trade

stop_loss_atr = atr_multiplier_stop * atr_value

// Calculate the position size based on the risk amount and ATR stop loss

position_size = risk_amount / stop_loss_atr

// If compounded results are not enabled, adjust position size for non-compounded returns

if not compounded_results

position_size := position_size / account_size * 100000 // Adjust for non-compounded results

// Convert take profit and stop loss from ATR to USD

pip_value = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

take_profit_atr = atr_multiplier_take_profit * atr_value

take_profit_usd = (take_profit_atr * pip_value) * position_size

stop_loss_usd = (stop_loss_atr * pip_value) * position_size

// Trailing Stop

trail_stop_level = trailing_stop_rr * stop_loss_atr

// Initialize long_box_id and short_box_id as boxes (not ints)

var box long_box_id = na

var box short_box_id = na

// Track Monthly Profit

var float monthly_profit = 0.0

if (month(timenow) != month(timenow[1])) // New month

monthly_profit := 0

// Long Trade Management

if long_condition

strategy.entry("Long", strategy.long, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Long", limit=strategy.position_avg_price + stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Long", from_entry="Long", limit=strategy.position_avg_price + take_profit_atr, stop=strategy.position_avg_price - stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

if not na(long_box_id)

box.delete(long_box_id)

// Plot Take Profit and Stop Loss for Long Positions

// long_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + take_profit_atr, right=bar_index, bottom=strategy.position_avg_price - stop_loss_atr, bgcolor=color.new(color.green, 90), border_width=1, border_color=color.new(color.green, 0))

// Short Trade Management

if short_condition

strategy.entry("Short", strategy.short, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Short", limit=strategy.position_avg_price - stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Short", from_entry="Short", limit=strategy.position_avg_price - take_profit_atr, stop=strategy.position_avg_price + stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

// if not na(short_box_id)

// box.delete(short_box_id)

// Plot Take Profit and Stop Loss for Short Positions

// short_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + stop_loss_atr, right=bar_index, bottom=strategy.position_avg_price - take_profit_atr, bgcolor=color.new(color.red, 90), border_width=1, border_color=color.new(color.red, 0))

// Plot MAs and Signals

plot(ma1_htf, color=color.blue, title="MA1 (HTF)")

plot(ma2_htf, color=color.red, title="MA2 (HTF)")

plotshape(series=long_condition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=short_condition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

- गतिशील समर्थन और प्रतिरोध व्यापार प्रणाली के साथ अनुकूलनशील चैनल ब्रेकआउट रणनीति

- फिबोनाची रिट्रेसमेंट स्तरों के आधार पर मात्रात्मक ट्रेडिंग रणनीति के बाद बहु-शर्त प्रवृत्ति

- चलती औसत क्रॉसओवर के आधार पर जोखिम-लाभ अनुपात अनुकूलित रणनीति

- गतिशील जोखिम प्रबंधन के साथ दोहरी चलती औसत क्रॉसओवर रणनीति

- एटीआर-आधारित गतिशील स्टॉप-लॉस अनुकूलन के साथ दोहरी ईएमए पुलबैक ट्रेडिंग प्रणाली

- गतिशील जोखिम-प्रबंधित घातीय चलती औसत क्रॉसओवर रणनीति

- एटीआर-आधारित जोखिम प्रबंधन प्रणाली के साथ रणनीति के बाद दोहरी चलती औसत प्रवृत्ति

- दोहरी पिवोट पॉइंट रिवर्सल ट्रेडिंग रणनीति

- स्थिर स्टॉप-लॉस अनुकूलन मॉडल के साथ गतिशील चलती औसत और बोलिंगर बैंड क्रॉस रणनीति

- दोहरे आरएसआई संकेतकों पर आधारित अनुकूलनशील रेंज ट्रेडिंग प्रणाली

- गतिशील आरएसआई स्मार्ट टाइमिंग स्विंग ट्रेडिंग रणनीति

- कैंडलस्टिक अवशोषण पैटर्न विश्लेषण पर आधारित द्विदिशात्मक ट्रेडिंग रणनीति

- औसत प्रतिगमन के साथ बोलिंगर ब्रेकआउट 4H मात्रात्मक ट्रेडिंग रणनीति

- गतिशील ग्रिड स्थिति आकार रणनीति के बाद की प्रवृत्ति

- दोहरी बीबीआई (बुल और बियर सूचकांक) क्रॉसओवर रणनीति

- गतिशील औसत क्रॉसओवर सिग्नल प्रणाली के साथ गतिशील लंबी/लघु स्विंग ट्रेडिंग रणनीति

- ट्रेडिंग रणनीति के बाद बहु-तकनीकी संकेतक की प्रवृत्ति

- उन्नत अस्थिरता औसत प्रतिगमन ट्रेडिंग रणनीति: VIX और चलती औसत पर आधारित बहुआयामी मात्रात्मक ट्रेडिंग प्रणाली

- सोने की रुझान चैनल रिवर्स मोमेंटम रणनीति

- उन्नत ईएमए गतिशीलता ट्रेडिंग रणनीति

- वॉल्यूम-वेटेड डबल ट्रेंड डिटेक्शन सिस्टम

- बहु-कारक विरोधी प्रवृत्ति व्यापार रणनीति

- संवर्धित गतिशीलता थरथरानवाला और स्टोकैस्टिक विचलन मात्रात्मक व्यापारिक रणनीति

- ट्रेंड ब्रेकआउट ट्रेडिंग रणनीति के साथ मल्टी-टाइमफ्रेम फाइबोनैचि रिट्रेसमेंट

- लाभ अनुकूलन के साथ बहु-निर्देशक प्रवृत्ति रणनीति का पालन करना

- लाभ अनुकूलन के साथ फ्रैक्टल ब्रेकआउट गति व्यापार रणनीति

- चैंडे मोमेंटम ऑसिलेटर पर आधारित अनुकूलनशील औसत-वापसी ट्रेडिंग रणनीति

- ट्रेडिंग रणनीति के बाद एमएसीडी-सुपरट्रेंड डबल कन्फर्मेशन ट्रेंड

- बहु-अवधि सुपरट्रेंड गतिशील ट्रेडिंग रणनीति

- फिबोनाची रिट्रेसमेंट और पिवोट पॉइंट ट्रेडिंग रणनीति के साथ मल्टी टाइमफ्रेम ईएमए