AlphaTradingBotの取引戦略

作者: リン・ハーンチャオチャン開催日:2024年4月28日 13:48:51タグ:マルチエイマATRRSI

概要

AlphaTradingBotは,ジグザグ指標とフィボナッチ配列をベースとした日取引戦略である.この戦略は,トレンドを決定するために市場のハイポイント (HH) とローポイント (LL) を特定し,フィボナッチリトレースと拡張を使用してエントリーポイント,テイク・プロフィート,ストップ・ロスを設定する.この戦略は,指定された日付範囲内でのみ実行され,トレンドを把握し,リスク・リターン比率を制御するいくつかの能力を持って,ロングとショートの両方に行うことができます.

戦略原則

- シグザグ指標を使用して,市場の高点 (HH),低点 (LL),高低点 (HL),低低点 (LH) を識別します.

- HH が出現すると,上向きの傾向の始まりとされ,戦略は長い機会を探し始めます.LL が出現すると,下向きの傾向の始まりとされ,戦略は短い機会を探し始めます.

- 上向きトレンドでは,HLと前のLLによって形成された範囲がロングのフィボナッチリトラセイメント範囲として使用されます.価格が前の最高値を突破した場合,23.6%~38.2% (調整可能) のリトラセイメントゾーンでロングオーダーを設定し,ストップロスは61.8%のリトラセイメントレベルに設定され,RR値 (調整可能) に基づいて計算されるテイク・プロフィートは使用されます.

- ダウントレンドでは,LHが現れると,LHと前のHHによって形成された範囲がショート用のフィボナッチリトレースメント範囲として使用されます.価格が前の低値を突破した場合,61.8%~76.4% (調整可能) のリトレースメントゾーンにショートオーダーを入れ,ストップロスは38.2%のリトレースメントレベルに設定され,RR値 (調整可能) に基づいて計算されるテイク・プロフィートです.

- オーダー管理:そのオーダーが終了するまで,信号ごとに1つのオーダーのみが配置されます.単一の取引の損失が総アカウント残高のX% (調整可能) に達すると,戦略は実行を停止します.

利点分析

- 強いトレンドフォロー能力.ジグザックを通じてトレンドを効果的に識別し,トレンドの初期段階に入ることができます.

- 明確なリトラセーション論理. エントリーゾーンを設定するためにフィボナッチリトラセーションを使用し,トレンドリトラセーション中にエントリーし,比較的高い勝利率をもたらします.

- 制御可能なリスク. 単一の取引の最大損失パーセントを設定することによって各取引のリスクを制御し,厳格なストップ・ロストシステムも全体的なリスク管理を保証します.

- リスク・リターン比を最適化できる.RR値は,戦略のリスク・リターン比を最適化するために,市場特性と個人の好みに合わせて調整できます.

リスク分析

- 頻繁に取引する.ジグザグの高い敏感性により,頻繁に信号を生成し,過剰な取引につながる可能性があります.

- 不正確なトレンド識別.ジグザックによって決定されたトレンドには,依然として偏差があり,理想的なエントリータイムが少ない結果になる可能性があります.

- 範囲内市場での業績が悪い.横向市場では,この戦略により多くの取引が失敗する可能性があります.

- 限られた実行期間. 戦略は指定された日付範囲内でのみ実行され,いくつかの市場の動きを見逃す可能性があります.

最適化方向

- トレンド識別の精度を向上させるために,MAやMACDなどのより多くの技術指標を導入する.

- ポジション管理を最適化します.例えば,ATRのような指標に基づいてポジションサイズを動的に調整します.

- 市場変動に基づいてストップロスのレベルを動的に調整するなど,利益とストップロスのロジックを最適化する.

- 市場情勢指標を導入して 極端な楽観主義や悲観主義を避ける

- 戦略の多様性を高めるため,日付制限を緩和します.

概要

AlphaTradingBotは,ジグザグ指標とフィボナッチリトレースをベースとしたトレンドフォローするイントラデイ戦略である.高低点を通じてトレンドを決定し,トレンドリトレース中にエントリーし,より高い勝利率とリスク・リターン比率を追求することを目指している.この戦略の利点は,強いトレンド把握能力,明確なリトレースロジック,測定可能なリスクにあるが,過剰取引,トレンド誤判,レンジバインド市場での不良パフォーマンスなどのリスクにも直面している.将来,戦略は技術指標,ポジション管理,テイク・プロフィート,ストップ・ロスト,市場情緒の観点から最適化され,その強度と収益性を向上させる.

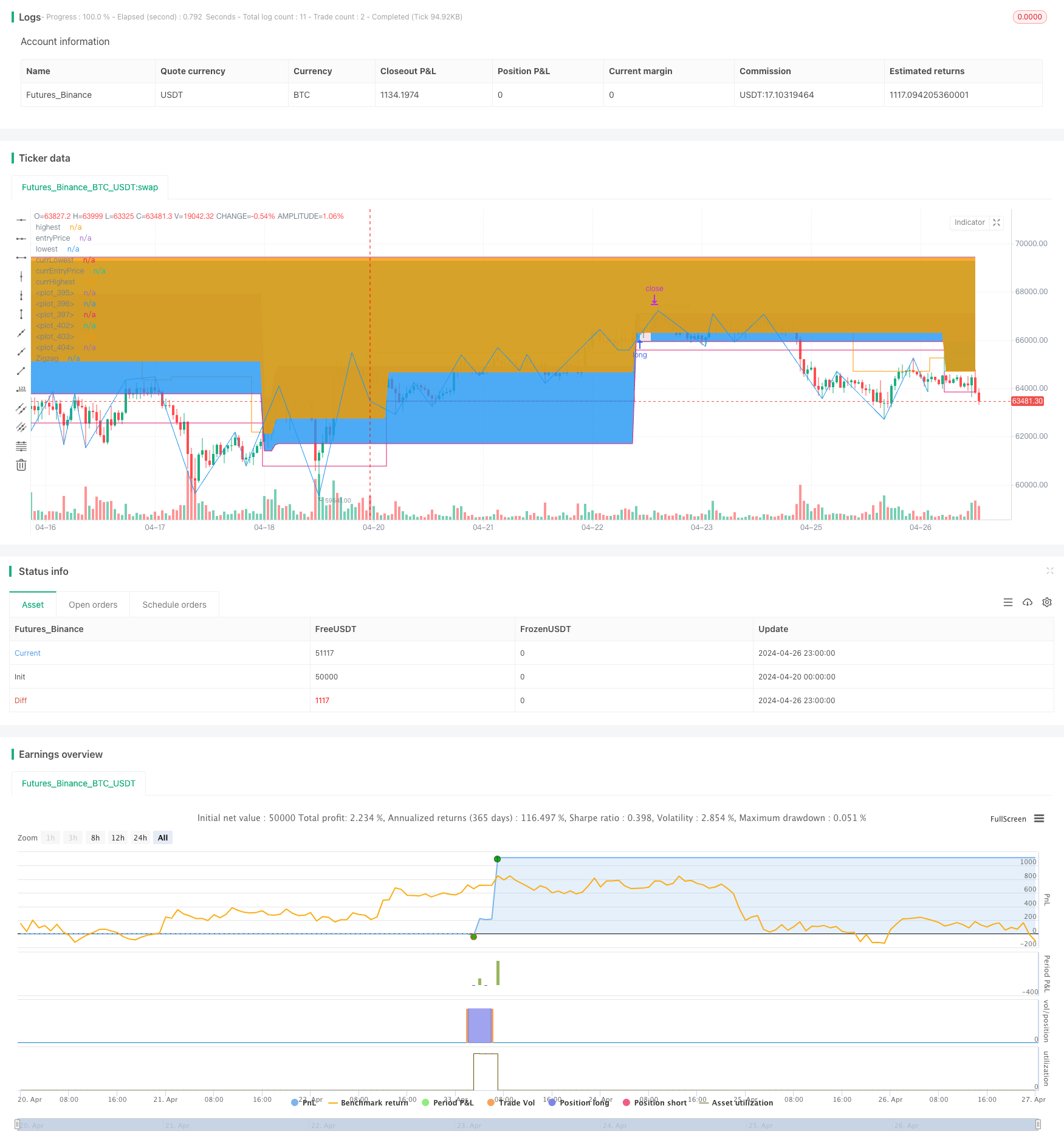

/*backtest

start: 2024-04-20 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © javierfish

//@version=5

strategy(title = 'Augusto Bot v1.2', shorttitle='🤑 🤖 v1.2', overlay = true, pyramiding=0, initial_capital=100000, default_qty_value=1)

lb = input.int(5, title='Pivot Bars Count', minval=1)

rb = lb

var color supcol = color.lime

var color rescol = color.red

// srlinestyle = line.style_dotted

srlinewidth = 1

changebarcol = true

bcolup = color.blue

bcoldn = color.black

intDesde = input(timestamp('2023-01-01T00:00:00'), 'Desde', group='Rango de fechas')

intHasta = input(timestamp('2023-12-31T23:59:59'), 'Hasta', group='Rango de fechas')

blnFechas = true

blnShorts = input.bool(false, " Shorts", group="Trading", tooltip = 'Checked = Shorts. No Checked = Longs')

blnLongs = not blnShorts

pctRisk = input.float(1, 'Riesgo %', 0.1, 100,step = .1, group='Trading', tooltip = 'Porcentaje del total de su cuenta que está dispuesto a arriesgar en cada trade')

RR = input.float(2, 'Ratio de Ganancia X', 1, 10, .5, tooltip = 'Proporción de Take Profit contra Stop Loss', group='Trading')

retro = input.float(40, 'Retroceso %', 1, 100, 10, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar un retroceso', group='Fibonacci')

fibSL = input.float(72, 'Stop Loss %', 1, 100, 5, tooltip = 'Porcentaje de Fibonacci que debe alcanzar el precio para considerar perdido un trade', group='Fibonacci')

blnDebug = input.bool(false, 'Debug', tooltip = 'Mostrar información de depuración como estatus y línea de tendencia')

showsupres = blnDebug

blnEnLong = strategy.position_size > 0

blnEnShort = strategy.position_size < 0

blnEnTrade = blnEnLong or blnEnShort

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

float loc1 = na

float loc2 = na

float loc3 = na

float loc4 = na

if not na(hl)

ehl = hl == 1 ? -1 : 1

loc1 := 0.0

loc2 := 0.0

loc3 := 0.0

loc4 := 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

[loc1, loc2, loc3, loc4] = findprevious()

a = fixnan(zz)

b = loc1

c = loc2

d = loc3

e = loc4

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(blnDebug and _hl, text='HL', title='Higher Low', style=shape.labelup, color=color.lime, textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _hh, text='HH', title='Higher High', style=shape.labeldown, color=color.lime, textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(blnDebug and _ll, text='LL', title='Lower Low', style=shape.labelup, color=color.red, textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(blnDebug and _lh, text='LH', title='Lower High', style=shape.labeldown, color=color.red, textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol and blnDebug ? iff_4 : na)

usdCalcRisk = strategy.equity * pctRisk / 100

usdRisk = usdCalcRisk > 0 ? usdCalcRisk : 0

blnOrder = strategy.opentrades > 0

var entryPrice = close

var hhVal = high

var lhVal = high

var hlVal = low

var llVal = low

var longTP = high

var longSL = low

var shortTP = low

var shortSL = high

var lowest = low

var highest = high

var status = 0

var closedTrades = strategy.closedtrades

var currSignal = ''

var prevSignal = currSignal

if _hh

hhVal := a

prevSignal := currSignal

currSignal := 'HH'

else if _lh

lhVal := a

prevSignal := currSignal

currSignal := 'LH'

else if _hl

hlVal := a

prevSignal := currSignal

currSignal := 'HL'

else if _ll

llVal := a

prevSignal := currSignal

currSignal := 'LL'

fibo(fibTop, fibLow) =>

diff = fibTop - fibLow

fib50 = 0.0

if status % 2 == 1 // Estatus pares son longs

fib50 := fibLow + (diff * (1 - (retro / 100))) // Longs

else

fib50 := fibLow + (diff * (retro / 100))

fib70UP = fibLow + (diff * (1 - (fibSL / 100))) // Fibo 61.8% up

fib70DW = fibLow + (diff * (fibSL / 100)) // Fibo 61.8% down

[fib50, fib70UP, fib70DW]

currLowest = ta.lowest(low, lb + 1) // El menor low de las últimas n barras

currHighest = ta.highest(high, lb + 1) // El mayor high de las últimas n barras

// status 0. En espera de un LL para longs o un HH para shorts

if status == 0 and blnFechas

closedTrades := strategy.closedtrades

if _ll and blnLongs

status := 1

else if _hh and blnShorts

status := 2

// -------- LONGS --------

// status 1. Longs. En espera de un nuevo nivel superior (HH o LH)

else if status == 1

closedTrades := strategy.closedtrades

if _hh or _lh

highest := currHighest

else if _hl

lowest := currLowest

if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice and close <= open // Si la vela roja que rebasó el reciente nivel superior también cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if entryPrice > longSL

strategy.entry('🚀 1', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 1', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

else

status := 3

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if low < llVal

status := 0

// status 3. Longs. En espera de que aparezca un HL

else if status == 3

if _hl

lowest := currLowest

if _lh or _ll or low < hlVal

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest

status := 5

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if low <= entryPrice

entryPrice := close

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL

strategy.cancel_all()

strategy.entry('🚀 3', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 3', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 5. Longs. Crecimiento del fibo en espera de que se rebase el nivel superior y se toque el entry price para entrar a un trade

else if status == 5

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnLong

status := 7

else if _lh or _ll or low < llVal // Caso invalidación por nuevo bajo nivel

strategy.cancel_all()

status := _ll ? 1 : 0 // Si fue un nuevo LL comienza a formarse un nuevo setup alcista

else if high > highest // Caso de rebase de niveles superiores

highest := high

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

longSL := fibUP // Reajuste de SL para long

diff = entryPrice - longSL

longTP := entryPrice + diff * RR // Reajuste de TP para long

lotSize = usdRisk / diff

if not blnEnLong and entryPrice > longSL // Orden limit de long con su TP y SL

strategy.cancel_all()

strategy.entry('🚀 5', strategy.long, limit = entryPrice, qty = lotSize, alert_message = 'long ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(longTP) + ' sl=' + str.tostring(longSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('lx', '🚀 5', limit = longTP, stop = longSL, comment_loss = '💥', comment_profit = '✅', alert_message = 'bal')

// status 7. Longs. En espera que finalice el trade

else if status == 7

blnOrder := false

if not blnEnLong

strategy.cancel_all()

if currSignal == 'HH' and blnShorts // Si se finaliza un trade e inmediatamente se presenta un HH debe comenzarse la formación de un setup bajista

status := 2

else

status := 0

// -------- SHORTS --------

// status 2. Shorts. En espera de un nuevo nivel inferior (LL o HL)

else if status == 2

closedTrades := strategy.closedtrades

if _ll or _hl

lowest := currLowest

else if _lh

highest := currHighest

if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice and close > open // Si la vela verde que rebasó el reciente nivel inferior tambien cruzó el precio de entrada se ingresa a un trade inmediatamente

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.entry('🐻 2', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 2', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

else

status := 4

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

else if high > hhVal

status := 0

// status 4. Shorts. En espera de que aparezca un LH

else if status == 4

if _lh

highest := currHighest

if _hl or _hh or high > lhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest

status := 6

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

if high >= entryPrice

entryPrice := close

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if not blnEnShort and entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 4', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 4', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 6. Shorts. Crecimiento del fibo en espera de que se rebase el nivel inferior y se toque el entry price para entrar a un trade

else if status == 6

if strategy.closedtrades > closedTrades // Caso trade abre y cierra en una misma vela

status := 0

else if blnEnShort

status := 8

else if _hl or _hh or high > hhVal

strategy.cancel_all()

status := _hh ? 2 : 0 // Si fue un nuevo HH comienza a formarse un nuevo setup bajista

else if low < lowest // Caso de rebase de niveles inferiores

lowest := low

[fib50, fibUP, fibDW] = fibo(highest, lowest)

entryPrice := fib50

shortSL := fibDW

diff = shortSL - entryPrice

shortTP := entryPrice - diff * RR

lotSize = usdRisk / diff

if entryPrice < shortSL

strategy.cancel_all()

strategy.entry('🐻 6', strategy.short, limit = entryPrice, qty = lotSize, alert_message = 'short ' + ' ' + syminfo.ticker + ' p=' + str.tostring(entryPrice) + ' tp=' + str.tostring(shortTP) + ' sl=' + str.tostring(shortSL) + ' q=' + str.tostring(pctRisk) + '%')

strategy.exit('sx', '🐻 6', limit = shortTP, stop = shortSL, comment_loss = '☠️', comment_profit = '❎', alert_message = 'bal')

// status 8. Shorts. En espera que finalice el trade

else if status == 8

blnOrder := false

if not blnEnShort

strategy.cancel_all()

if currSignal == 'LL' and blnLongs // Si inmediatamente después de finalizar un trade existe un LL debe comenzarse un setup alcista

status := 1

else

status := 0

plotchar(blnDebug and status == 0 and blnFechas, '0', '0', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 1 and blnFechas, '1', '1', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 2 and blnFechas, '2', '2', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 3 and blnFechas, '3', '3', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 4 and blnFechas, '4', '4', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 5 and blnFechas, '5', '5', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 6 and blnFechas, '6', '6', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 7 and blnFechas, '7', '7', location.abovebar, color.yellow, size = size.tiny)

plotchar(blnDebug and status == 8 and blnFechas, '8', '8', location.abovebar, color.yellow, size = size.tiny)

plot(highest, 'highest', (status == 5 or status[1] == 5) and blnLongs ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'entryPrice', (status == 5 or status[1] == 5) and blnLongs ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(lowest, 'lowest', (status == 3 or status == 5 or status[1] == 5) and blnLongs ? color.new(color.yellow, 50) : na, 1, plot.style_stepline)

plot(lowest, 'currLowest', (status == 6 or status[1] == 6) and blnShorts ? color.new(color.orange, 50) : na, 1, plot.style_stepline)

plot(entryPrice, 'currEntryPrice', (status == 6 or status[1] == 6) and blnShorts ?color.new(color.white, 50) : na, 1, plot.style_stepline)

plot(highest, 'currHighest', (status == 4 or status == 6 or status[1] == 6) and blnShorts ?color.new(color.yellow, 50) : na, 1, plot.style_stepline)

exitLong = barstate.isconfirmed and blnEnLong and time >= intHasta

exitShort = barstate.isconfirmed and blnEnShort and time >= intHasta

if exitLong

strategy.cancel_all()

strategy.close_all(comment = close > strategy.position_avg_price ? '✅' : '💥')

status := 0

if exitShort

strategy.cancel_all()

strategy.close_all(comment = close < strategy.position_avg_price ? '❎' : '☠️')

status := 0

plot(zz, 'Zigzag', blnDebug ? color.white : na, offset = lb * -1)

rayaTradeLong = strategy.position_size == strategy.position_size[1] and (strategy.position_size > 0) and blnLongs

tpPlLong = plot(longTP, color = rayaTradeLong ? color.teal : na)

epPlLong = plot(entryPrice, color= rayaTradeLong ? color.white : na)

slPlLong = plot(longSL, color = rayaTradeLong ? color.maroon : na)

fill(tpPlLong, epPlLong, color= rayaTradeLong ? color.new(color.teal, 85) : na)

fill(epPlLong, slPlLong, color= rayaTradeLong ? color.new(color.maroon, 85) : na)

rayaTradeShort = strategy.position_size == strategy.position_size[1] and strategy.position_size < 0 and blnShorts

tpPlShort = plot(shortTP, color = rayaTradeShort ? color.teal : na)

epPlShort = plot(entryPrice, color=rayaTradeShort ? color.white : na)

slPlShort = plot(shortSL, color=rayaTradeShort ? color.maroon : na)

fill(tpPlShort, epPlShort, color=rayaTradeShort ? color.new(color.teal, 85) : na)

fill(epPlShort, slPlShort, color=rayaTradeShort ? color.new(color.maroon, 85) : na)

関連性

- 双 EMA トレンド モメンタム 取引戦略

- 上方ウィック・ブイッシュ・キャンドル・ブレークアウト戦略なし

- 戦略をフォローする多指標複合動向

- 多次元ゴールド金曜日の異常戦略分析システム

- エリオット波理論 4-9 インパルス波自動検出 取引戦略

- 2つの移動平均RSIモメントストラテジー EMAとトレンドラインブレイクに基づいて

- 多レベルダイナミックトレンドフォローシステム

- RSI-ATR モメント・ボラティリティ コンビネード・トレーディング・ストラテジー

- ATR波動性フィルターシステムによる高度な二重EMA戦略

- ターンオーバー火曜日の戦略 (週末フィルター)

もっと

- RSI2 ストラテジー 日中の逆転 勝利率 バックテスト

- ハースト 境界線戦略の未来

- OBVとMAのクロスオーバー信号に基づいた戦略をフォローする傾向

- GBS TOP Bottom 確認された戦略

- 戦略をフォローする多指標の傾向

- 圧縮バックテスト トランスフォーマー v2.0

- フィボナッチトレンド逆転戦略

- HTF ジグザグパス戦略

- WaveTrend クロス LazyBear 戦略

- CCI,DMI,MACD ハイブリッド・ロング・ショート戦略

- ベガス スーパートレンド 強化戦略

- 量的な取引戦略 変更されたハルム移動平均値とイチモク・キンコ・ヒョーに基づいた

- RSIのトレンド逆転戦略

- ストカスティッククロスオーバー指標のモメンタム取引戦略

- RSIと二重EMAのクロスオーバー・シグナル量的な戦略

- エリオット波理論 4-9 インパルス波自動検出 取引戦略

- ストーカスティック・オシレーターとストップ・ロストとストーカスティック・フィルター付きの移動平均クロスオーバー戦略

- 日中の可拡大波動性取引戦略

- KRK aDa ストーカスティック AI 強化の遅い平均逆転戦略

- Pivot Point と Slope をベースにしたリアルタイムトレンドライン取引