先進的なMACD動的トレンド量的な取引戦略

作者: リン・ハーンチャオチャン,日付: 2024-11-12 16:27:01タグ:マックドマルチエイマRSI

概要

この戦略は,動向平均収束差異 (MACD) 指標に基づいた高度な定量取引システムで,ダイナミックな背景表示と複数の事前設定パラメータ組み合わせを通じて取引決定を強化する.この戦略の核心は,MACDクロスオーバー信号を通じて市場トレンド移行点を捕捉し,市場状況を視覚的に表示することにある.

戦略原則

この戦略は,標準 (12,26,9),短期 (5,35,5),長期 (19,39,9),など10つの異なるMACDパラメータプリセットを使用し,異なる市場環境と取引スタイルに適応する.このシステムは,MACD線が信号線 (黄金十字) の上を横切ると購入信号を生成し,下を横切ると販売信号を生成する.この戦略は,ダイナミックな背景色の変化 (上昇,赤,下落) により視覚認識を強化し,トレーダーが市場のトレンドをよりよく把握するのに役立ちます.

戦略 の 利点

- パラメータの柔軟性: 異なる市場環境のために10つの事前に設定されたパラメータの組み合わせを提供しています.

- 明確な視覚フィードバック: ダイナミックな背景色の変更は,直感的な市場トレンド表示を提供します

- クリア・シグナル:MACDクロスオーバーに基づいて明示的な買い/売るシグナルを生成する.

- 高い適応性: 異なるタイムフレーム取引に適用可能

- 明確なコード構造:パラメータの切り替えのためにスイッチ構造を使用し,維持および拡張が簡単です

戦略リスク

- 遅延リスク:遅延指標であるMACDは,不安定な市場で遅延信号を生む可能性があります.

- 偽のブレイクリスク: 異なる市場で偽のクロスオーバー信号を生む可能性があります.

- パラメータ依存性: 異なるパラメータの組み合わせは,さまざまな市場条件で異なるパフォーマンスを発揮する.

- 市場状況の制限: 市場環境が非常に不安定または不流動である場合,業績が低下する可能性があります.

戦略の最適化方向

- 波動性の高い期間の取引信号をフィルタリングするために波動性フィルターを実装する

- 信号の信頼性を向上させるために,RSIやATRのような傾向確認指標を追加します.

- 市場状況に基づいて適応性パラメータ最適化を実施する

- リスク管理の強化のためにストップ・ロストとテイク・プロフィートの機能を追加

- 信号の信頼性を向上させるため,ボリューム分析を含める

概要

これはMACD戦略の構造がよく,論理的に健全な高度バージョンである.複数のパラメータプレセットとダイナミックな視覚フィードバックを通じて,戦略の実用性と操作性を大幅に向上させる.固有のリスクが存在しているにもかかわらず,戦略は提案された最適化により堅牢な取引システムになる可能性がある.トレーダーはライブ実装の前に徹底的なバックテストを行い,特定の市場状況に基づいて適切なパラメータ設定を選択することをお勧めする.

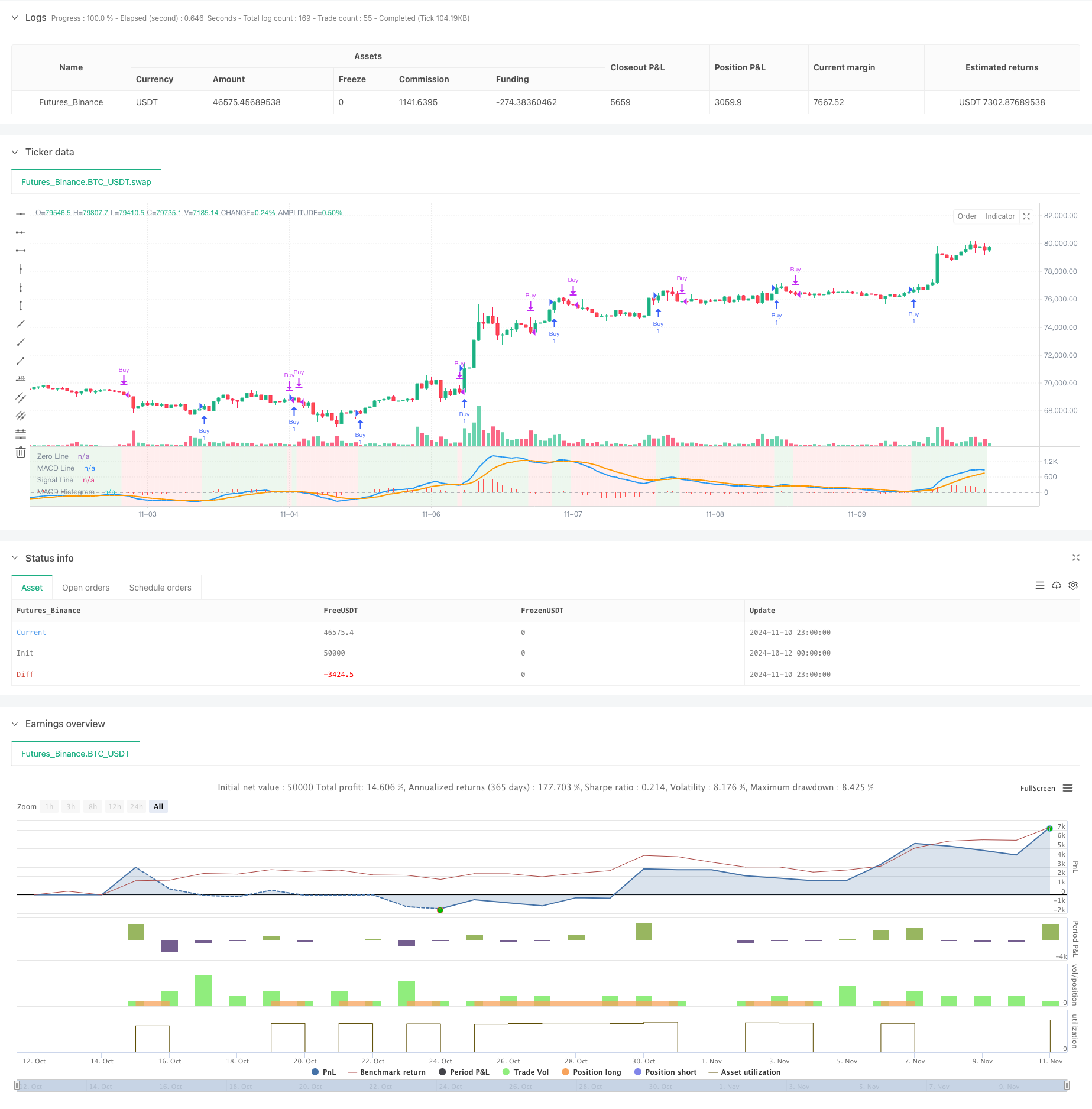

/*backtest

start: 2024-10-12 00:00:00

end: 2024-11-11 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Hanzo - Top 10 MACD Strategy", overlay=false) // MACD in a separate pane

// Define dropdown options for MACD settings

macdOption = input.string(title="Select MACD Setting",

defval="Standard (12, 26, 9)",

options=["Standard (12, 26, 9)",

"Short-Term (5, 35, 5)",

"Long-Term (19, 39, 9)",

"Scalping (3, 10, 16)",

"Cryptocurrency (20, 50, 9)",

"Forex (8, 17, 9)",

"Conservative (24, 52, 18)",

"Trend-Following (7, 28, 7)",

"Swing Trading (5, 15, 5)",

"Contrarian (15, 35, 5)"])

// MACD setting based on user selection

var int fastLength = 12

var int slowLength = 26

var int signalLength = 9

switch macdOption

"Standard (12, 26, 9)" =>

fastLength := 12

slowLength := 26

signalLength := 9

"Short-Term (5, 35, 5)" =>

fastLength := 5

slowLength := 35

signalLength := 5

"Long-Term (19, 39, 9)" =>

fastLength := 19

slowLength := 39

signalLength := 9

"Scalping (3, 10, 16)" =>

fastLength := 3

slowLength := 10

signalLength := 16

"Cryptocurrency (20, 50, 9)" =>

fastLength := 20

slowLength := 50

signalLength := 9

"Forex (8, 17, 9)" =>

fastLength := 8

slowLength := 17

signalLength := 9

"Conservative (24, 52, 18)" =>

fastLength := 24

slowLength := 52

signalLength := 18

"Trend-Following (7, 28, 7)" =>

fastLength := 7

slowLength := 28

signalLength := 7

"Swing Trading (5, 15, 5)" =>

fastLength := 5

slowLength := 15

signalLength := 5

"Contrarian (15, 35, 5)" =>

fastLength := 15

slowLength := 35

signalLength := 5

// MACD Calculation

[macdLine, signalLine, _] = ta.macd(close, fastLength, slowLength, signalLength)

macdHist = macdLine - signalLine

// Buy and Sell conditions based on MACD crossovers

enterLong = ta.crossover(macdLine, signalLine)

exitLong = ta.crossunder(macdLine, signalLine)

// Execute buy and sell orders with price labels in the comments

if (enterLong)

strategy.entry("Buy", strategy.long, comment="Buy at " + str.tostring(close, "#.##"))

if (exitLong)

strategy.close("Buy", comment="Sell at " + str.tostring(close, "#.##"))

// Plot the signal price using plotchar for buy/sell prices

//plotchar(enterLong ? close : na, location=location.belowbar, color=color.green, size=size.small, title="Buy Price", offset=0)

//plotchar(exitLong ? close : na, location=location.abovebar, color=color.red, size=size.small, title="Sell Price", offset=0)

// Background highlighting based on bullish or bearish MACD

isBullish = macdLine > signalLine

isBearish = macdLine < signalLine

// Change background to green for bullish periods and red for bearish periods

bgcolor(isBullish ? color.new(color.green, 90) : na, title="Bullish Background")

bgcolor(isBearish ? color.new(color.red, 90) : na, title="Bearish Background")

// Plot the MACD and Signal line in a separate pane

plot(macdLine, title="MACD Line", color=color.blue, linewidth=2)

plot(signalLine, title="Signal Line", color=color.orange, linewidth=2)

hline(0, "Zero Line", color=color.gray)

plot(macdHist, title="MACD Histogram", style=plot.style_histogram, color=color.red)

関連性

- MACD-EMA 多期動的クロスオーバー量的な取引システム

- 多戦略技術分析取引システム

- ダイナミック・ダブル・ムービング・平均・クロスオーバー・量子的取引戦略

- 双 EMA トレンド モメンタム 取引戦略

- GチャネルとEMAをベースにした定量的な長期短期間の切り替え戦略

- 多期EMA横断高利率トレンド 戦略をフォローする (高度)

- 上方ウィック・ブイッシュ・キャンドル・ブレークアウト戦略なし

- MACD と RSI の組み合わせた自然取引戦略

- 多次元ゴールド金曜日の異常戦略分析システム

- エリオット波理論 4-9 インパルス波自動検出 取引戦略

もっと

- ダイナミック・テイク・プロフィット・ストップ・ロスト EMAクロスオーバー量的な取引戦略

- 多EMAクロスオーバートレンド ダイナミックストップ・ロストとテイク・プロフィートの最適化による戦略

- ダイナミックなリスクマネジメントを伴う二重移動平均のクロスオーバー戦略

- 2つのプラットフォームによるヘッジバランス戦略

- ダイナミック・リスク管理戦略による二重移動平均の交差

- マルチMA トレンド強さをモメンタム・プロフィート・テイキング戦略で把握する

- 多戦略適応トレンドフォローとブレイクトレードシステム

- マルチレベル移動平均値とキャンドルスティックパターン認識取引システム

- 多期EMAトレンド・モメンタム・トレード戦略

- 賢明な時間に基づく長短回転バランスのとれた取引戦略

- トレンド・ブレイク・トレーディング・システム (TBMA戦略)

- ATRベースの多トレンドフォロー戦略,利益とストップ損失最適化システム

- RSI モメントベースのスマートアダプティブ・トレーディング・システム

- アダプティブ RSI オシレーター

値最適化によるダイナミック・トレーディング・戦略 - RSIとAOの相乗効果傾向 定量的な取引戦略

- アダプティブ・トレンド・モメンタム・RSI戦略 移動平均フィルターシステム

- リスク・リターン最適化システムを持つ二重移動平均のクロスRSIモメント戦略

- 多指標クロスオーバー・ダイナミック・戦略システム: EMA,RVI,取引信号に基づく定量的な取引モデル

- RSI 動的範囲逆転 変動最適化モデルによる定量戦略

- ボリンジャー・バンドの動向傾向は定量戦略に従っている