Gambaran keseluruhan

Strategi ini adalah sistem perdagangan komprehensif yang menggabungkan beberapa petunjuk utama dalam analisis teknikal, termasuk sistem dua rata-rata ((SMA), rata-rata pergerakan yang seragam ((MACD), indeks kekuatan relatif ((RSI) dan analisis titik rintangan. Idea utama strategi ini adalah untuk mengesahkan isyarat perdagangan melalui petunjuk teknikal berbilang dimensi, sambil menggabungkan petunjuk sentimen pasaran untuk mengoptimumkan pengurusan pegangan, akhirnya mencapai tujuan untuk meningkatkan kemenangan dan risikonya.

Prinsip Strategi

Strategi ini menggunakan dua purata bergerak sederhana jangka pendek (10 hari) dan jangka panjang (30 hari) sebagai sistem isyarat utama. Sistem akan mengeluarkan isyarat apabila rata-rata jangka pendek melintasi rata-rata jangka panjang ke atas, dan indikator MACD menunjukkan tren multi arah (garis MACD di atas garis isyarat).

Kelebihan Strategik

- Mekanisme pengesahan berbilang: meningkatkan kebolehpercayaan isyarat dagangan dengan pengesahan berbilang untuk persilangan rata-rata, MACD trend dan rintangan

- Pengurusan Kedudukan Cerdas: Memperkenalkan Indeks RSI untuk Pemantauan Emosi, yang dapat menguruskan risiko pegangan dengan lebih baik

- Adaptif: parameter strategi boleh disesuaikan dengan keadaan pasaran yang berbeza

- Pengendalian risiko yang baik: pelbagai mekanisme penghentian kerugian, termasuk penghentian teknikal dan emosi

- Tingkat sistematisasi yang tinggi: keputusan perdagangan sepenuhnya sistematis, mengurangkan gangguan penilaian subjektif

Risiko Strategik

- Sistem garis rata mungkin menghasilkan isyarat palsu dalam pasaran yang bergolak

- Terlalu bergantung pada petunjuk teknikal mungkin mengabaikan faktor asas

- Pengoptimuman parameter boleh menyebabkan pemasangan berlebihan

- Pengesanan titik rintangan mungkin terlewat dalam keadaan pantas

- RSI mungkin gagal dalam keadaan pasaran tertentu

Arah pengoptimuman strategi

- Pengenalan penunjuk kuantiti pertukaran: dapat meningkatkan penilaian terhadap kekuatan trend pasaran

- Parameter penyesuaian dinamik: secara automatik menyesuaikan kitaran garis purata dan RSI dengan turun naik pasaran

- Menambah penapis trend: memperkenalkan garis rata-rata jangka panjang sebagai penapis trend

- Mengoptimumkan pengiraan bit rintangan: pertimbangkan penggunaan algoritma pengenalan bit rintangan dinamik

- Menambah indikator kadar turun naik: untuk menyesuaikan saiz kedudukan dan kedudukan berhenti

ringkaskan

Strategi ini membina sistem perdagangan yang lengkap dengan menggabungkan beberapa petunjuk teknikal klasik. Kelebihan strategi adalah mekanisme pengesahan isyarat pelbagai dan sistem kawalan risiko yang baik, tetapi masih perlu memperhatikan kesan persekitaran pasaran terhadap prestasi strategi. Dengan arah pengoptimuman yang disyorkan, kestabilan dan kesesuaian strategi dijangka akan ditingkatkan lagi. Dalam aplikasi langsung, para pelabur disarankan untuk menyesuaikan parameter dengan sewajarnya mengikut keutamaan risiko dan keadaan pasaran mereka sendiri, dan sentiasa menjaga perhatian kepada asas pasaran.

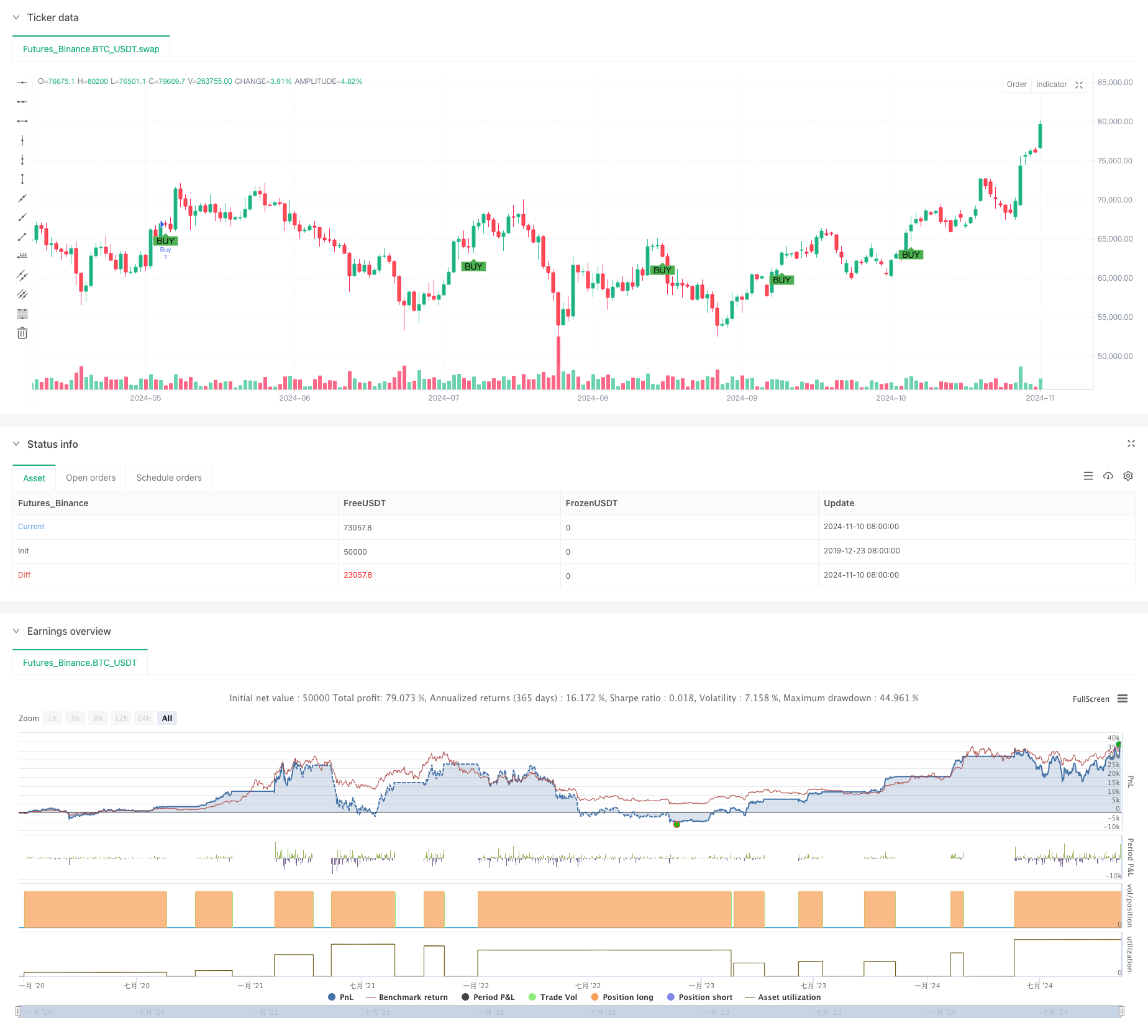

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment (Enhanced RR)", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Define buy condition based on SMA and MACD

buyCondition = ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance

sellCondition = close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance)

if (sellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Add alert for buy condition

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

// Add alert for sell condition to notify when price hits major resistance

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

// Add alert for early close condition (for losing trades)

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

// Add alert for holding winning condition (optional)

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")