Média móvel cruzada + estratégia de impulso da linha lenta do MACD

Autora:ChaoZhang, Data: 2024-04-12 17:16:06Tags:SMAEMAMACD

Resumo

Esta estratégia combina cruzamento da média móvel e do indicador MACD como os principais sinais de negociação. Ele usa o cruzamento de uma média móvel rápida com múltiplas médias móveis lentas como sinal de entrada e o valor positivo/negativo do histograma da linha lenta do MACD como confirmação da tendência. A estratégia define vários níveis de take-profit e stop-loss na entrada e ajusta continuamente o nível de stop-loss à medida que o tempo de detenção aumenta para bloquear os lucros.

Princípio da estratégia

- Quando o MA rápido cruza acima do MA lento 1, o preço de fechamento está acima do MA lento 2 e o histograma MACD é superior a 0, vá longo;

- Quando a MA rápida cruzar abaixo da MA lenta 1, o preço de fechamento estiver abaixo da MA lenta 2 e o histograma MACD for inferior a 0, vá para curto;

- Estabelecer vários níveis de take-profit e stop-loss na entrada. Os níveis de take-profit são baseados na preferência de risco, enquanto os níveis de stop-loss são ajustados continuamente à medida que o tempo de detenção aumenta para bloquear gradualmente os lucros;

- Os períodos de médias móveis, os parâmetros MACD, os níveis de take-profit e stop-loss, etc., podem ser ajustados de forma flexível para se adaptarem às diferentes condições de mercado.

Esta estratégia usa o cruzamento MA para capturar tendências e MACD para confirmar a direção, aumentando a confiabilidade do julgamento da tendência.

Vantagens da estratégia

- O cruzamento MA é um método clássico de acompanhamento de tendências que pode capturar a formação de tendências em tempo útil;

- A utilização de múltiplos MAs permite avaliar de forma mais abrangente a força e a persistência das tendências;

- O indicador MACD pode identificar efetivamente as tendências e avaliar a dinâmica, servindo como um forte complemento ao cruzamento MA;

- O projeto de multi-take-profit e de stop-loss dinâmico pode controlar os riscos e permitir que os lucros funcionem, aumentando a robustez do sistema;

- Os parâmetros são ajustáveis e adaptáveis e podem ser ajustados de forma flexível de acordo com diferentes instrumentos e prazos.

Riscos estratégicos

- O cruzamento da MA apresenta o risco de atraso do sinal, que pode perder tendências iniciais ou perseguir altas;

- A definição inadequada dos parâmetros pode conduzir a um excesso de negociação ou a períodos de detenção demasiado longos, aumentando os custos e os riscos;

- Os níveis de stop-loss excessivamente agressivos podem conduzir a stop-outs prematuros, enquanto os níveis de take-profit excessivamente conservadores podem afetar os retornos;

- Mudanças bruscas de tendência ou anomalias de mercado podem fazer com que a estratégia falhe.

Estes riscos podem ser controlados através da otimização de parâmetros, ajustamento de posições, definição de condições adicionais, etc. No entanto, nenhuma estratégia pode evitar completamente os riscos e os investidores devem tratá-la com cautela.

Orientações para a otimização da estratégia

- Considerar a introdução de mais indicadores, tais como RSI, Bandas de Bollinger, etc., para confirmar ainda mais as tendências e os sinais;

- Realizar uma otimização mais refinada da definição dos níveis de take-profit e stop-loss, como a consideração dos níveis ATR ou baseados em percentagem;

- Ajustar dinamicamente os parâmetros com base na volatilidade do mercado para melhorar a adaptabilidade;

- Introduzir um módulo de dimensionamento das posições para ajustar as dimensões das posições com base nas condições de risco;

- Reunir a estratégia para estabelecer uma carteira de estratégia para diversificar os riscos.

Através da otimização e melhoria contínuas, a estratégia pode tornar-se mais robusta e confiável, melhor adaptada ao ambiente de mercado em mudança.

Resumo

Esta estratégia combina os indicadores MA crossover e MACD para construir um sistema de negociação relativamente completo. O design de vários MA e múltiplas operações aumenta as capacidades de captura de tendências e controle de risco do sistema. A lógica da estratégia é clara e fácil de entender e implementar, adequada para otimização e melhoria.

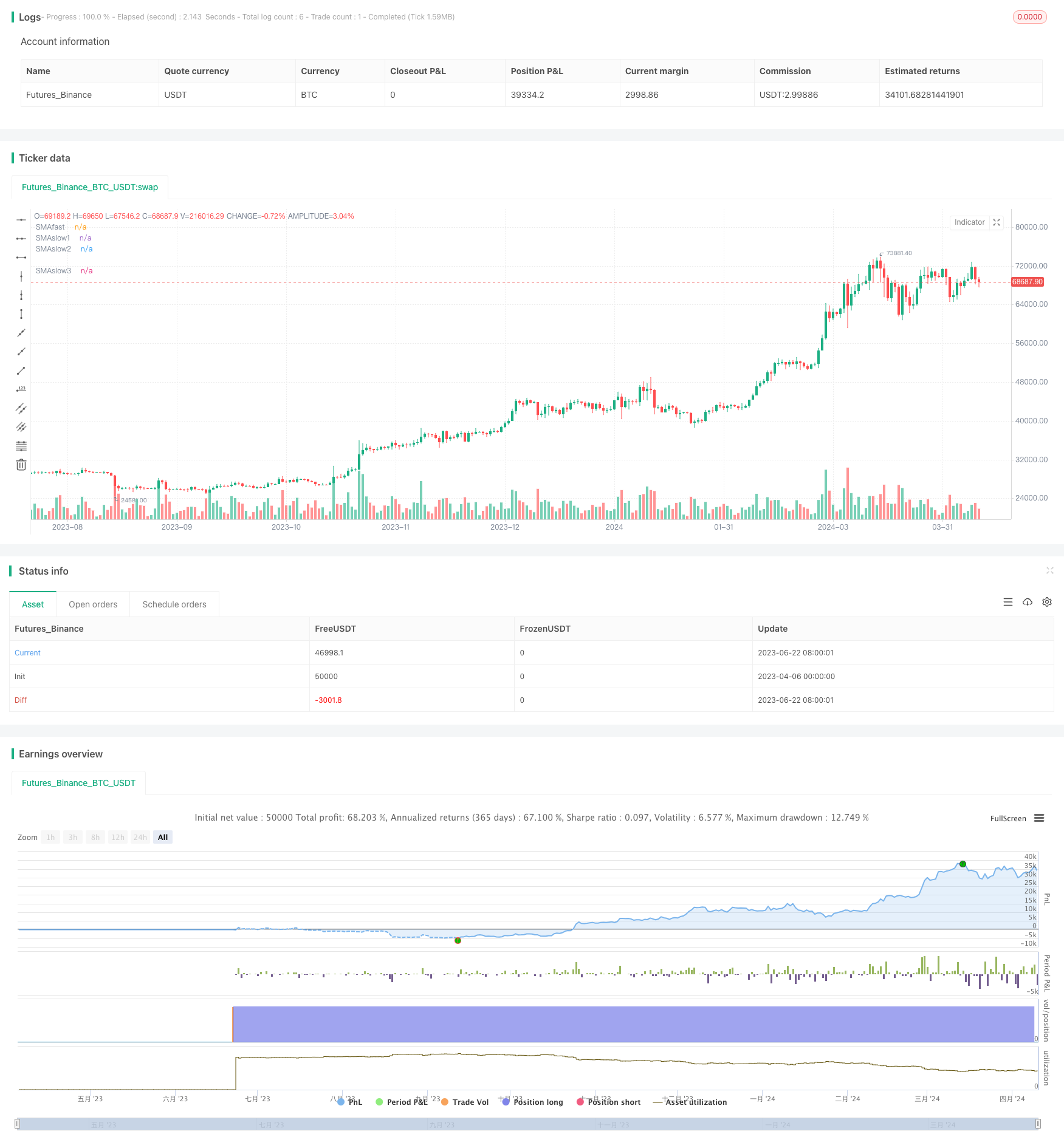

/*backtest

start: 2023-04-06 00:00:00

end: 2024-04-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © maxmirus

//@version=5

strategy("My strategy_Cross_SMA(EMA)+Macd,slow3",overlay=true)

// ver 4

// Date Inputs

startDate = input(timestamp('2019-01-01T00:00:00+0300'), '' , inline='time1',

tooltip=' Время первого бара расчета стратегии. Первый ордер может быть выставлен на следующем баре после стартового.')

finishDate = input(timestamp('2044-01-01T00:00:00+0300'), '' , inline='time2',

tooltip=' Время после которого больше не будут размещаться ордера входа в позицию.')

// Calculate start/end date and time condition

time_cond = true

//SMA(EMA) Inputs

fast=input.int(12, title="Fastlength",group="MA")

slow1=input.int(54,title="Slowlength1",group="MA")

slow2=input.int(100, title="Slowlength2",group="MA")

slow3=input.int(365, title="Slowlength3",group="MA")

fastma=input.string(title="Fastlength", defval="EMA",options=["SMA","EMA"],group="MA")

slowma1=input.string(title="Slowlength1", defval="EMA",options=["SMA","EMA"],group="MA")

slowma2=input.string(title="Slowlength2", defval="EMA",options=["SMA","EMA"],group="MA")

slowma3=input.string(title="Slowlength3", defval="EMA",options=["SMA","EMA"],group="MA")

fastlength = fastma == "EMA" ? ta.ema(close, fast) : ta.sma(close, fast)

slowlength1 = slowma1 == "EMA" ? ta.ema(close, slow1) : ta.sma(close, slow1)

slowlength2 = slowma2 == "EMA" ? ta.ema(close, slow2) : ta.sma(close, slow2)

slowlength3 = slowma3 == "EMA" ? ta.ema(close, slow3) : ta.sma(close, slow3)

//Macd Inputs

macdfastline = input.int(12, title="FastMacd",group="MACD")

macdslowline = input.int(26,title="SlowMacd",group="MACD")

macdhistline = input.int(9,title="HistMacd",group="MACD")

src=input(defval=close,title="Source",group="MACD")

sma_source = input.string(title="Oscillator MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

sma_signal = input.string(title="Signal Line MA Type", defval="EMA", options=["SMA", "EMA"],group="MACD")

fast_ma = sma_source == "SMA" ? ta.sma(src, macdfastline) : ta.ema(src, macdfastline)

slow_ma = sma_source == "SMA" ? ta.sma(src, macdslowline) : ta.ema(src, macdslowline)

macd = fast_ma - slow_ma

signal = sma_signal == "SMA" ? ta.sma(macd, macdhistline) : ta.ema(macd, macdhistline)

hist = macd - signal

//fastMACD = ta.ema(close, macdline) - ta.ema(close, signalline)

//signalMACD = ta.ema(MACD, histline)

//histMACD = MACD - aMACD

//EMA Plot

plot(fastlength,title="SMAfast",color=color.blue)

plot(slowlength1,title="SMAslow1",color=color.orange)

plot(slowlength2,title="SMAslow2",color=color.red)

plot(slowlength3,title="SMAslow3",color=color.black)

//Macd plot

//col_macd = input(#2962FF, "MACD Line ", group="Color Settings", inline="MACD")

//col_signal = input(#FF6D00, "Signal Line ", group="Color Settings", inline="Signal")

//col_grow_above = input(#26A69A, "Above Grow", group="Histogram", inline="Above")

//col_fall_above = input(#B2DFDB, "Fall", group="Histogram", inline="Above")

//col_grow_below = input(#FFCDD2, "Below Grow", group="Histogram", inline="Below")

//col_fall_below = input(#FF5252, "Fall", group="Histogram", inline="Below")

//plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below)))

//plot(macd, title="MACD", color=col_macd)

//plot(signal, title="Signal", color=col_signal)

//Take profit

tp1=input.float(5.1,title="Take Profit1_%",step=0.1)/100

tp2=input.float(10.1,title="Take Profit2_%",step=0.1)/100

//Stop loss

sl1=input.float(5.1,title="Stop loss1_%",step=0.1)/100

sl2=input.float(0.1,title="Stop loss2_%",step=0.1)/100

sl3=input.float(-5.5,title="Stop loss3_%", step=0.1)/100

//Qty closing position

Qty1 = input.float(0.5, title="QtyClosingPosition1",step=0.01)

Qty2 = input.float(0.25, title="QtyClosingPosition2",step=0.01)

//Take profit Long and Short

LongTake1=strategy.position_avg_price*(1+tp1)

LongTake2=strategy.position_avg_price*(1+tp2)

ShortTake1=strategy.position_avg_price*(1-tp1)

ShortTake2=strategy.position_avg_price*(1-tp2)

//Plot Levels Take

plot(strategy.position_size > 0 ? LongTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongTake2 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake1 : na,color=color.green,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortTake2 : na,color=color.green,style=plot.style_linebr)

//Stop loss long and short

LongStop1=strategy.position_avg_price*(1-sl1)

LongStop2=strategy.position_avg_price*(1-sl2)

LongStop3=strategy.position_avg_price*(1-sl3)

ShortStop1=strategy.position_avg_price*(1+sl1)

ShortStop2=strategy.position_avg_price*(1+sl2)

ShortStop3=strategy.position_avg_price*(1+sl3)

//Stop=strategy.position_avg_price

//Plot Levels Stop

plot(strategy.position_size > 0 ? LongStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size > 0 ? LongStop3 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop1 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop2 : na,color=color.red,style=plot.style_linebr)

plot(strategy.position_size < 0 ? ShortStop3 : na,color=color.red,style=plot.style_linebr)

//Entry condition

LongCondition1 = ta.crossover(fastlength, slowlength1)

LongCondition2 = close>slowlength2

LongCondition3 = time_cond

LongCondition4=close>slowlength3

//LongCondition5=slowlength100>slowlength3

LongCondition6 = hist > 0

buy=(LongCondition1 and LongCondition2 and LongCondition3 and LongCondition4 and LongCondition6 ) and strategy.position_size<=0

//longCondition3 = nz(strategy.position_size) == 0//если отсутствует открытая позиция

ShortCondition1 = ta.crossunder(fastlength, slowlength1)

ShortCondition2 = close<slowlength2

ShortCondition3 = time_cond

ShortCondition4=close<slowlength3

//ShortCondition5=slowlength100<slowlength3

ShortCondition6=hist < 0

sell=(ShortCondition1 and ShortCondition2 and ShortCondition3 and ShortCondition4 and ShortCondition6 ) and strategy.position_size>=0

//Strategy entry

strategy.cancel_all(not strategy.position_size)

if(buy)

strategy.cancel_all()

strategy.entry("Buy",strategy.long)

if(sell)

strategy.cancel_all()

strategy.entry("Sell",strategy.short)

//Strategy Long exit

var int exitCounter=0

exitCounter := not strategy.position_size or strategy.position_size > 0 and strategy.position_size[1] < 0 or strategy.position_size < 0 and strategy.position_size[1] > 0 ? 0:

strategy.position_size > 0 and strategy.position_size[1]>strategy.position_size? exitCounter[1] + 1:

strategy.position_size < 0 and strategy.position_size[1]<strategy.position_size? exitCounter[1] - 1:

exitCounter[1]

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long1",strategy.short, qty=math.abs(strategy.position_size*Qty1), limit=LongTake1, oca_name='Long1', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Take Long2",strategy.short, qty=math.abs(strategy.position_size*Qty2), limit=LongTake2, oca_name='Long2', oca_type=strategy.oca.cancel)

if strategy.position_size > 0 and strategy.position_size[1]<=0

strategy.order("Stop Long1",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop1,oca_name='Long1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==1

strategy.order("Stop Long2",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop2,oca_name='Long2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==2

strategy.order("Stop Long3",strategy.short, qty=math.abs(strategy.position_size),stop=LongStop3)

// Strategy Short exit

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short1", strategy.long, qty=math.abs(strategy.position_size*Qty1), limit=ShortTake1, oca_name='Short1', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Take Short2", strategy.long, qty=math.abs(strategy.position_size*Qty2), limit=ShortTake2, oca_name='Short2', oca_type=strategy.oca.cancel)

if strategy.position_size < 0 and strategy.position_size[1]>=0

strategy.order("Stop Short1",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop1,oca_name='Short1',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-1

strategy.order("Stop Short2",strategy.long, qty=math.abs(strategy.position_size),stop=ShortStop2,oca_name='Short2',oca_type=strategy.oca.cancel)

if ta.change(exitCounter) and exitCounter==-2

strategy.order("Stop Short3",strategy.long,qty=math.abs(strategy.position_size),stop=ShortStop3)

- Indicador de inversão de K I

- Sistema de negociação de confirmação de tendência MACD duplo

- Indicador MACD personalizado CM - Quadro de tempo múltiplo - V2

- A estratégia de negociação de duplo crossover MACD de atraso zero - negociação de alta frequência baseada na captura de tendências de curto prazo

- ZeroLag MACD Estratégia curta longa

- Estratégia de negociação quantitativa de cruzamento de datas de média móvel MACD dupla ajustável

- Estratégia de combinação MACD e Martingale para negociação longa otimizada

- Sistema de negociação MACD Multi-Interval Dynamic Stop-Loss e Take-Profit

- Estratégia de ruptura do MACD BB

- Estratégia de previsão cruzada de oscilação dinâmica do MACD

- Estratégia de negociação da rede de rebote de grande amplitude Wavetrend

- Estratégia de cruzamento do MACD

- Otimizada estratégia de seguimento da tendência do MACD com gestão de risco baseada no ATR

- ZeroLag MACD Estratégia curta longa

- BBSR Estratégia Extrema

- A estratégia de negociação de reversão de alta frequência baseada no indicador RSI de impulso

- Estratégia do índice de força relativa do RSI

- Estratégia de ruptura das bandas de Bollinger

- Donchian Channel e Larry Williams Estratégia do Grande Índice de Comércio

- SPARK Dimensão dinâmica das posições e estratégia de negociação de indicadores duplos

- Estratégia dinâmica de DCA baseada no volume

- Estratégia do detector de vale do MACD

- N Bars estratégia de fuga

- Estratégia de negociação de alta frequência de criptomoedas estável de baixo risco baseada no RSI e no MACD

- Bollinger Bands Estocástico RSI Estratégia de sinal extremo

- RSI Estratégia de negociação bilateral

- KRK ADA 1H Estratégia estocástica lenta com mais entradas e IA

- A estratégia de negociação baseada no volume MA adaptativa piramidal dinâmica de stop loss e take profit

- Estratégia de cruzamento do MACD TEMA

- Estratégia dupla do RSI e das bandas de Bollinger