ملٹی ایم اے ٹرینڈ شدت ٹریڈنگ کی حکمت عملی - ایم اے انحراف پر مبنی ایک لچکدار سمارٹ ٹریڈنگ سسٹم

مصنف:چاؤ ژانگ، تاریخ: 2024-12-11 17:46:33ٹیگز:ایم اےاے ٹی آرHTFRRٹی پیSL

جائزہ

یہ حکمت عملی ایک ذہین تجارتی نظام ہے جو متعدد چلتی اوسط اور رجحان کی شدت پر مبنی ہے۔ یہ پوزیشن مینجمنٹ اور رسک کنٹرول کے لئے اے ٹی آر اتار چڑھاؤ اشارے کے ساتھ مل کر مختلف ادوار کی قیمت اور چلتی اوسط کے درمیان انحراف کا تجزیہ کرکے مارکیٹ کے رجحان کی طاقت کی پیمائش کرتا ہے۔ یہ حکمت عملی اعلی حسب ضرورت پیش کرتی ہے اور مختلف مارکیٹ کے ماحول اور تجارتی ضروریات کے مطابق پیرامیٹرز کو لچکدار انداز میں ایڈجسٹ کرسکتی ہے۔

حکمت عملی کا اصول

حکمت عملی کا بنیادی منطق مندرجہ ذیل پہلوؤں پر مبنی ہے: رجحان کی سمت اور کراسنگ سگنل کی نشاندہی کرنے کے لئے مختلف ادوار کے دو چلتے ہوئے اوسط (تیز اور سست) کا استعمال کرتا ہے قیمت اور حرکت پذیر اوسط کے درمیان انحراف (پوائنٹس میں) کا حساب لگاتے ہوئے رجحان کی طاقت کو شمار کرتا ہے شمعدان کے پیٹرن (گلوپنگ، ہتھوڑا، فٹنگ اسٹار، ڈوجی) کو تصدیق کے اشارے کے طور پر شامل کرتا ہے 4. متحرک طور پر سٹاپ نقصان اور منافع کے اہداف کا حساب کرنے کے لئے اے ٹی آر اشارے کا استعمال کرتا ہے 5. آرڈر مینجمنٹ کے لئے جزوی منافع اور ٹریلنگ اسٹاپ استعمال کرتا ہے

حکمت عملی کے فوائد

- نظام کو مختلف مارکیٹ کے ماحول کے لئے پیرامیٹر ایڈجسٹمنٹ کے ذریعے مضبوط موافقت ہے

- کمزور رجحانات میں کثرت سے تجارت سے بچنے کے لئے انحراف کی پیمائش کے ذریعے رجحان کی طاقت کو مقداری بناتا ہے

- بہتر سگنل کی وشوسنییتا کے لئے متعدد تکنیکی اشارے اور پیٹرن کو یکجا کرتا ہے

- مناسب رسک کنٹرول کے لئے اے ٹی آر پر مبنی متحرک اسٹاپ نقصان کا استعمال کرتا ہے

- کمپاؤنڈ اور فکسڈ پوزیشن سائزنگ دونوں طریقوں کی حمایت کرتا ہے

- منافع کو مؤثر طریقے سے بچانے کے لئے جزوی منافع لینے اور ٹریلنگ اسٹاپس کی خصوصیات

حکمت عملی کے خطرات

- مختلف مارکیٹوں میں غلط سگنل پیدا کر سکتے ہیں، oscillator فلٹر شامل کرنے پر غور

- متعدد اشارے کے امتزاج سے کچھ تجارتی مواقع ضائع ہوسکتے ہیں

- پیرامیٹرز کی زیادہ سے زیادہ اصلاح سے زیادہ فٹ ہونے کا خطرہ ہوسکتا ہے

- کم لیکویڈ مارکیٹس میں بڑی تجارتوں کو سلائڈج کا خطرہ لاحق ہوسکتا ہے

- زیادہ سے زیادہ واحد نقصانات سے بچنے کے لئے مناسب سٹاپ نقصان کی ترتیبات کی ضرورت ہوتی ہے

حکمت عملی کی اصلاح

- اضافی رجحان کی تصدیق کے طور پر حجم کے اشارے شامل کر سکتے ہیں

- تجارتی تعدد کو متحرک طور پر ایڈجسٹ کرنے کے لئے اتار چڑھاؤ کے اشارے متعارف کرانے پر غور کریں

- مختلف ٹائم فریموں میں رجحان کی مستقل مزاجی کی بنیاد پر سگنل فلٹر کریں

- مزید سٹاپ نقصان کے اختیارات شامل کریں، جیسے وقت پر مبنی اسٹاپ

- حکمت عملی کی موافقت کو بہتر بنانے کے لئے موافقت پذیر پیرامیٹر اصلاحاتی میکانزم تیار کریں

خلاصہ

یہ حکمت عملی ایک جامع تجارتی نظام تیار کرتی ہے جس میں حرکت پذیر اوسط ، رجحان کی طاقت کی مقدار ، موم بتی کے نمونوں اور متحرک رسک مینجمنٹ کو جوڑ دیا جاتا ہے۔ یہ متعدد تصدیق کے طریقہ کار کے ذریعہ تجارتی وشوسنییتا کو بڑھانے کے ساتھ ساتھ اسٹریٹجک سادگی کو برقرار رکھتا ہے۔ حکمت عملی کی اعلی حسب ضرورت اس کو مختلف تجارتی طرزوں اور مارکیٹ کے ماحول کے مطابق ڈھالنے کی اجازت دیتی ہے ، لیکن عمل درآمد کے دوران پیرامیٹر کی اصلاح اور رسک کنٹرول پر توجہ دی جانی چاہئے۔

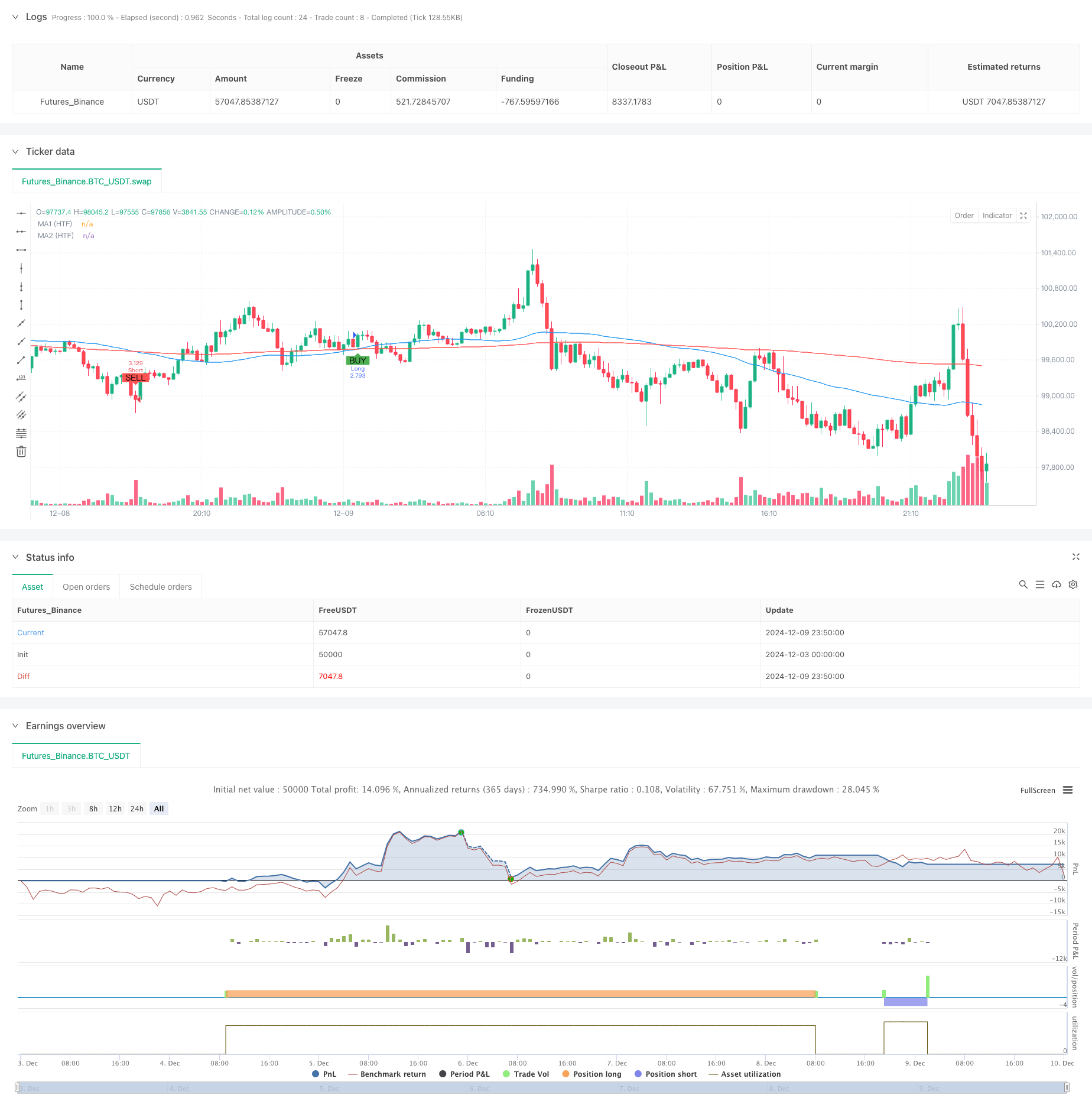

/*backtest

start: 2024-12-03 00:00:00

end: 2024-12-10 00:00:00

period: 10m

basePeriod: 10m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Customizable Strategy with Signal Intensity Based on Pips Above/Below MAs", overlay=true)

// Customizable Inputs

// Account and Risk Management

account_size = input.int(100000, title="Account Size (USD)", minval=1)

compounded_results = input.bool(true, title="Compounded Results")

risk_per_trade = input.float(1.0, title="Risk per Trade (%)", minval=0.1, maxval=100) / 100

// Moving Averages Settings

ma1_length = input.int(50, title="Moving Average 1 Length", minval=1)

ma2_length = input.int(200, title="Moving Average 2 Length", minval=1)

// Higher Time Frame for Moving Averages

ma_htf = input.timeframe("D", title="Higher Time Frame for MA Delay")

// Signal Intensity Range based on pips

signal_intensity_min = input.int(0, title="Signal Intensity Start (Pips)", minval=0, maxval=1000)

signal_intensity_max = input.int(1000, title="Signal Intensity End (Pips)", minval=0, maxval=1000)

// ATR-Based Stop Loss and Take Profit

atr_length = input.int(14, title="ATR Length", minval=1)

atr_multiplier_stop = input.float(1.5, title="Stop Loss Size (ATR Multiplier)", minval=0.1)

atr_multiplier_take_profit = input.float(2.5, title="Take Profit Size (ATR Multiplier)", minval=0.1)

// Trailing Stop and Partial Profit

trailing_stop_rr = input.float(2.0, title="Trailing Stop (R:R)", minval=0)

partial_profit_percentage = input.float(50, title="Take Partial Profit (%)", minval=0, maxval=100)

// Trend Filter Settings

trend_filter_enabled = input.bool(true, title="Trend Filter Enabled")

trend_filter_sensitivity = input.float(50, title="Trend Filter Sensitivity", minval=0, maxval=100)

// Candle Pattern Type for Entry

entry_candle_type = input.string("Any", title="Entry Candle Type", options=["Any", "Engulfing", "Hammer", "Shooting Star", "Doji"])

// Moving Average Entry Conditions

ma_entry_condition = input.string("Both", title="MA Entry", options=["Fast Above Slow", "Fast Below Slow", "Both"])

// Trade Direction (Long, Short, or Both)

trade_direction = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"])

// ATR Calculation

atr_value = ta.atr(atr_length)

// Moving Average Calculations (using Higher Time Frame)

ma1_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma1_length)

ma2_htf = ta.sma(request.security(syminfo.tickerid, ma_htf, close), ma2_length)

// Candle Pattern Conditions

is_engulfing = close[1] < open[1] and close > open and high > high[1] and low < low[1]

is_hammer = (high - low) > 3 * (close - open) and (close > open) and (low == ta.lowest(low, 5))

is_shooting_star = (high - low) > 3 * (open - close) and (open > close) and (high == ta.highest(high, 5))

is_doji = (close - open) <= ((high - low) * 0.1)

// Apply the selected candle pattern

candle_condition = false

if entry_candle_type == "Any"

candle_condition := true

if entry_candle_type == "Engulfing"

candle_condition := is_engulfing

if entry_candle_type == "Hammer"

candle_condition := is_hammer

if entry_candle_type == "Shooting Star"

candle_condition := is_shooting_star

if entry_candle_type == "Doji"

candle_condition := is_doji

// Moving Average Entry Conditions

ma_cross_above = ta.crossover(ma1_htf, ma2_htf)

ma_cross_below = ta.crossunder(ma1_htf, ma2_htf)

// Calculate pips distance to MAs and normalize it for signal intensity

pip_size = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

// Calculate distances in pips between price and MAs

distance_to_ma1_pips = math.abs(close - ma1_htf) / pip_size

distance_to_ma2_pips = math.abs(close - ma2_htf) / pip_size

// Calculate signal intensity based on the pips distance

// Normalize the signal intensity between the user-specified min and max

signal_intensity = math.min(math.max((distance_to_ma1_pips + distance_to_ma2_pips), signal_intensity_min), signal_intensity_max)

// Trend Filter Condition (Optional)

trend_condition = false

if trend_filter_enabled

trend_condition := ta.sma(close, ma2_length) > ta.sma(close, ma2_length + int(trend_filter_sensitivity))

// Entry Conditions Based on MA, Candle Patterns, and Trade Direction

long_condition = (trade_direction == "Long" or trade_direction == "Both") and (ma_entry_condition == "Fast Above Slow" or ma_entry_condition == "Both") and ma_cross_above and candle_condition and (not trend_filter_enabled or trend_condition) and signal_intensity > signal_intensity_min

short_condition = (trade_direction == "Short" or trade_direction == "Both") and (ma_entry_condition == "Fast Below Slow" or ma_entry_condition == "Both") and ma_cross_below and candle_condition and (not trend_filter_enabled or not trend_condition) and signal_intensity > signal_intensity_min

// Position Sizing Based on Risk Per Trade and ATR for Stop Loss

risk_amount = account_size * risk_per_trade

stop_loss_atr = atr_multiplier_stop * atr_value

// Calculate the position size based on the risk amount and ATR stop loss

position_size = risk_amount / stop_loss_atr

// If compounded results are not enabled, adjust position size for non-compounded returns

if not compounded_results

position_size := position_size / account_size * 100000 // Adjust for non-compounded results

// Convert take profit and stop loss from ATR to USD

pip_value = syminfo.mintick * 10 // Assuming Forex; for other asset classes, modify as needed

take_profit_atr = atr_multiplier_take_profit * atr_value

take_profit_usd = (take_profit_atr * pip_value) * position_size

stop_loss_usd = (stop_loss_atr * pip_value) * position_size

// Trailing Stop

trail_stop_level = trailing_stop_rr * stop_loss_atr

// Initialize long_box_id and short_box_id as boxes (not ints)

var box long_box_id = na

var box short_box_id = na

// Track Monthly Profit

var float monthly_profit = 0.0

if (month(timenow) != month(timenow[1])) // New month

monthly_profit := 0

// Long Trade Management

if long_condition

strategy.entry("Long", strategy.long, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Long", limit=strategy.position_avg_price + stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Long", from_entry="Long", limit=strategy.position_avg_price + take_profit_atr, stop=strategy.position_avg_price - stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

if not na(long_box_id)

box.delete(long_box_id)

// Plot Take Profit and Stop Loss for Long Positions

// long_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + take_profit_atr, right=bar_index, bottom=strategy.position_avg_price - stop_loss_atr, bgcolor=color.new(color.green, 90), border_width=1, border_color=color.new(color.green, 0))

// Short Trade Management

if short_condition

strategy.entry("Short", strategy.short, qty=position_size)

// Partial Profit at 50% position close when 1:1 risk/reward

strategy.exit("Partial Profit", from_entry="Short", limit=strategy.position_avg_price - stop_loss_atr, qty_percent=partial_profit_percentage / 100)

// Full take profit and stop loss with trailing stop

strategy.exit("Take Profit Short", from_entry="Short", limit=strategy.position_avg_price - take_profit_atr, stop=strategy.position_avg_price + stop_loss_atr, trail_offset=trail_stop_level)

// Delete the old box if it exists

// if not na(short_box_id)

// box.delete(short_box_id)

// Plot Take Profit and Stop Loss for Short Positions

// short_box_id := box.new(left=bar_index - 1, top=strategy.position_avg_price + stop_loss_atr, right=bar_index, bottom=strategy.position_avg_price - take_profit_atr, bgcolor=color.new(color.red, 90), border_width=1, border_color=color.new(color.red, 0))

// Plot MAs and Signals

plot(ma1_htf, color=color.blue, title="MA1 (HTF)")

plot(ma2_htf, color=color.red, title="MA2 (HTF)")

plotshape(series=long_condition, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=short_condition, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

- متحرک سپورٹ اور مزاحمت ٹریڈنگ سسٹم کے ساتھ انکولی چینل بریک آؤٹ حکمت عملی

- فبونیکی ریٹریکشن لیولز پر مبنی مقداری تجارتی حکمت عملی کے بعد ملٹی کنڈیشن ٹرینڈ

- متحرک اوسط کراس اوور کی بنیاد پر خطرہ-انعامی تناسب کو بہتر بنانے کی حکمت عملی

- متحرک رسک مینجمنٹ کے ساتھ دوہری حرکت پذیر اوسط کراس اوور حکمت عملی

- ای ٹی آر پر مبنی متحرک سٹاپ نقصان کی اصلاح کے ساتھ ڈبل ای ایم اے پل بیک ٹریڈنگ سسٹم

- متحرک رسک مینجڈ ایکسپونینشل موونگ ایوریج کراس اوور حکمت عملی

- اے ٹی آر پر مبنی رسک مینجمنٹ سسٹم کے ساتھ حکمت عملی کے بعد دوہری چلتی اوسط رجحان

- دوہری محور پوائنٹ الٹ ٹریڈنگ کی بہتر حکمت عملی

- متحرک حرکت پذیر اوسط اور بولنگر بینڈ کراس حکمت عملی کے ساتھ فکسڈ سٹاپ نقصان کی اصلاح کا ماڈل

- دوہری آر ایس آئی اشارے پر مبنی موافقت پذیر رینج ٹریڈنگ سسٹم

- متحرک RSI سمارٹ ٹائمنگ سوئنگ ٹریڈنگ کی حکمت عملی

- شمعدان جذب پیٹرن تجزیہ پر مبنی دو طرفہ تجارتی حکمت عملی

- Bollinger Breakout with Mean Reversion 4H Quantitative Trading Strategy (بولنگر بریک آؤٹ کے ساتھ اوسط ریورس 4H مقداری تجارتی حکمت عملی)

- متحرک گرڈ پوزیشن سائزنگ حکمت عملی کے بعد رجحان

- دوہری بی بی آئی (بُک اور بیئر انڈیکس) کراس اوور حکمت عملی

- متحرک طویل / مختصر سوئنگ ٹریڈنگ کی حکمت عملی کے ساتھ چلتی اوسط کراس اوور سگنل سسٹم

- تجارتی حکمت عملی کے بعد ملٹی تکنیکی اشارے کا رجحان

- اعلی درجے کی Volatility Mean Reversion ٹریڈنگ حکمت عملی: VIX اور چلتی اوسط پر مبنی کثیر جہتی مقداری ٹریڈنگ سسٹم

- سونے کے رجحان چینل کی تبدیلی کی حکمت عملی

- اعلی درجے کی ای ایم اے مومنٹم ٹرینڈ ٹریڈنگ حکمت عملی

- حجم وزن دوہری رجحان کا پتہ لگانے کا نظام

- کثیر عنصر کاؤنٹر ٹرینڈ ٹریڈنگ کی حکمت عملی

- بہتر مومنٹم آسکیلیٹر اور اسٹوکاسٹک ڈائیورجنسی کوانٹیٹیٹو ٹریڈنگ حکمت عملی

- ٹرینڈ بریکآؤٹ ٹریڈنگ حکمت عملی کے ساتھ ملٹی ٹائم فریم فبونیکی ریٹریسیشن

- کثیر اشارے کا رجحان منافع کی اصلاح کے ساتھ حکمت عملی کے بعد

- فائدہ اٹھانے کی اصلاح کے ساتھ فریکٹل بریک آؤٹ مومنٹم ٹریڈنگ کی حکمت عملی

- چانڈے مومنٹم اوسیلیٹر پر مبنی موافقت پذیر اوسط ریورس ٹریڈنگ حکمت عملی

- تجارتی حکمت عملی کے بعد MACD-Supertrend دوہری تصدیق کا رجحان

- کثیر مدتی سپر ٹرینڈ متحرک تجارتی حکمت عملی

- فبونیکی ریٹریسیشن اور محور پوائنٹس ٹریڈنگ کی حکمت عملی کے ساتھ ملٹی ٹائم فریم ای ایم اے