Dynamic Trend Following Strategy

Author: ChaoZhang, Date: 2024-06-03 16:57:51Tags: ATR

Overview

This strategy utilizes the Supertrend indicator to capture market trends. The Supertrend indicator combines price and volatility, with a green line indicating an uptrend and a red line indicating a downtrend. The strategy generates buy and sell signals by detecting changes in the color of the indicator line, while using the indicator line as a dynamic stop-loss level. The strategy also incorporates trailing stop-loss and fixed take-profit logic to optimize performance.

Strategy Principle

- Calculate the upper (up) and lower (dn) bands of the Supertrend indicator and determine the current trend direction (trend) based on the relationship between the closing price and the upper and lower bands.

- Generate a buy signal (buySignal) when the trend changes from downward (-1) to upward (1), and generate a sell signal (sellSignal) when the trend changes from upward (1) to downward (-1).

- When a buy signal is generated, open a long position and set the lower band (dn) as the stop-loss level; when a sell signal is generated, open a short position and set the upper band (up) as the stop-loss level.

- Introduce trailing stop-loss logic, where the stop-loss level is moved up/down when the price rises/falls by a certain number of points (trailingValue), providing stop-loss protection.

- Introduce fixed take-profit logic, closing the position for profit when the trend changes.

Strategy Advantages

- Adaptability: The Supertrend indicator combines price and volatility, enabling it to adapt to different market conditions and trading instruments.

- Dynamic stop-loss: Using the indicator line as a dynamic stop-loss level can effectively control risk and reduce losses.

- Trailing stop-loss: Introducing trailing stop-loss logic can protect profits when the trend continues, enhancing the strategy’s profitability.

- Clear signals: The buy and sell signals generated by the strategy are clear and easy to operate and execute.

- Flexible parameters: The strategy’s parameters (such as ATR period, ATR multiplier, etc.) can be adjusted based on market characteristics and trading style, improving adaptability.

Strategy Risks

- Parameter risk: Different parameter settings may lead to significant differences in strategy performance, requiring thorough backtesting and parameter optimization.

- Choppy market risk: In choppy markets, frequent trend changes may cause the strategy to generate excessive trading signals, increasing transaction costs and slippage risk.

- Sudden trend change risk: When market trends suddenly change, the strategy may not be able to adjust positions in a timely manner, leading to increased losses.

- Over-optimization risk: Over-optimizing the strategy may lead to curve fitting, resulting in poor performance in future markets.

Strategy Optimization Directions

- Incorporate multi-timeframe analysis to confirm the stability of trends and reduce frequent trading in choppy markets.

- Combine other technical indicators or fundamental factors to improve the accuracy of trend determination.

- Optimize stop-loss and take-profit logic, such as introducing dynamic take-profit or risk-reward ratio, to improve the strategy’s profit-loss ratio.

- Perform robustness testing on parameters to select parameter combinations that maintain good performance under different market conditions.

- Introduce position sizing and money management rules to control individual trade risk and overall risk.

Summary

The Dynamic Trend Following Strategy utilizes the Supertrend indicator to capture market trends, controlling risk through dynamic stop-loss and trailing stop-loss, while locking in profits with fixed take-profit. The strategy is adaptable, has clear signals, and is easy to operate. However, in practical application, attention should be paid to parameter optimization, choppy market risk, and sudden trend change risk. By introducing multi-timeframe analysis, optimizing stop-loss and take-profit logic, conducting parameter robustness testing, and implementing other measures, the strategy’s performance and stability can be further enhanced.

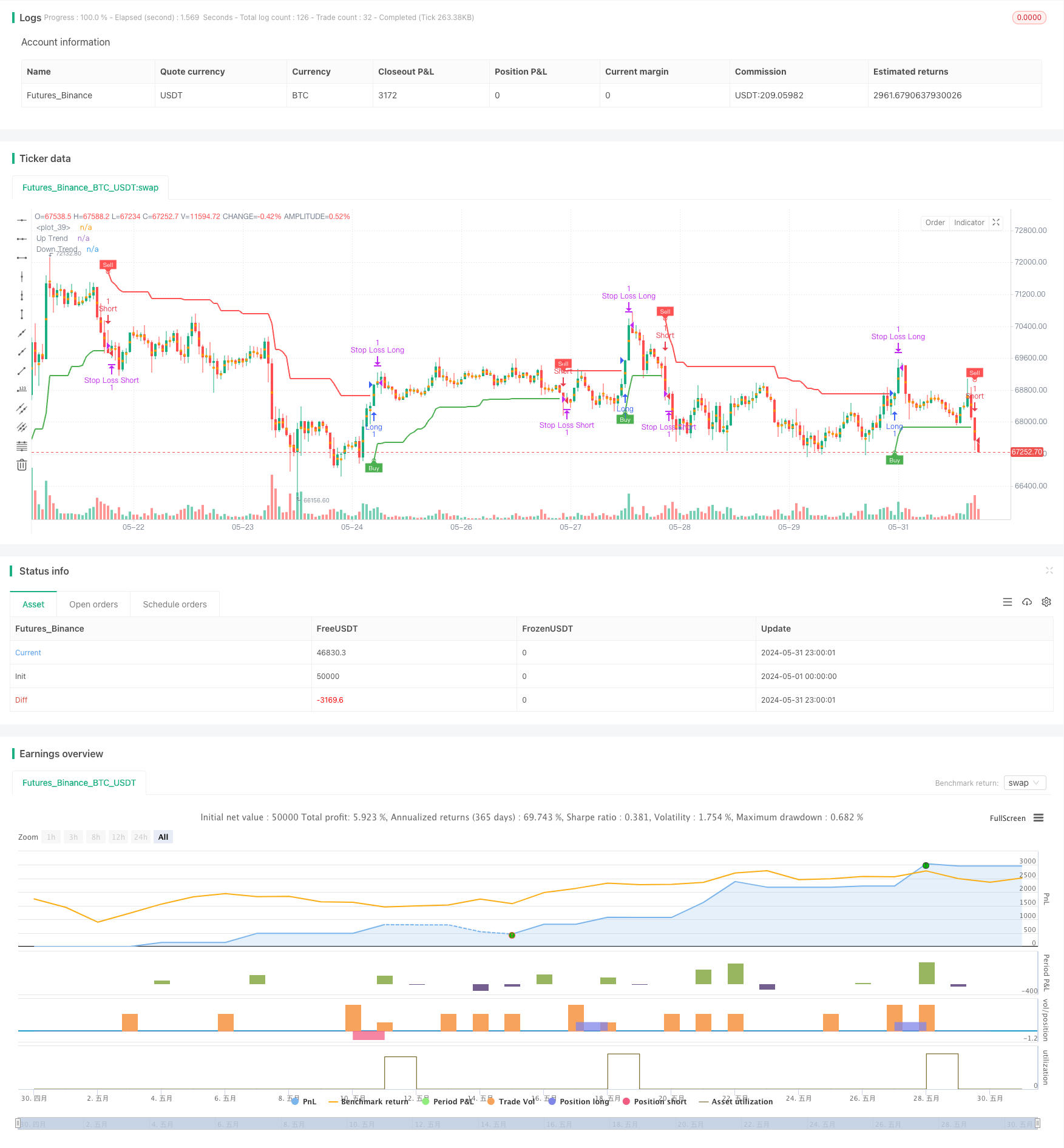

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Supertrend Strategy', overlay=true, format=format.price, precision=2)

Periods = input.int(title='ATR Period', defval=10)

src = input.source(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

changeATR = input.bool(title='Change ATR Calculation Method ?', defval=true)

showsignals = input.bool(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input.bool(title='Highlighter On/Off ?', defval=true)

// ATR calculation

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Supertrend calculations

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

// Trend direction

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plotting

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Highlighting

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

// Alerts

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

// Pip and trailing stop calculation

pips = 50

pipValue = syminfo.mintick * pips

trailingPips = 10

trailingValue = syminfo.mintick * trailingPips

// Strategy

if (buySignal)

strategy.entry("Long", strategy.long, stop=dn, comment="SuperTrend Buy")

if (sellSignal)

strategy.entry("Short", strategy.short, stop=up, comment="SuperTrend Sell")

// Take profit on trend change

if (changeCond and trend == -1)

strategy.close("Long", comment="SuperTrend Direction Change")

if (changeCond and trend == 1)

strategy.close("Short", comment="SuperTrend Direction Change")

// Initial Stop Loss

longStopLevel = up - pipValue

shortStopLevel = dn + pipValue

// Trailing Stop Loss

var float longTrailStop = na

var float shortTrailStop = na

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

if (longTrailStop == na or close > strategy.position_avg_price + trailingValue)

longTrailStop := high - trailingValue

strategy.exit("Stop Loss Long", from_entry="Long", stop=longTrailStop)

if (strategy.position_size < 0) // Short position

if (shortTrailStop == na or close < strategy.position_avg_price - trailingValue)

shortTrailStop := low + trailingValue

strategy.exit("Stop Loss Short", from_entry="Short", stop=shortTrailStop)

// Initial Exit

strategy.exit("Initial Stop Loss Long", from_entry="Long", stop=longStopLevel)

strategy.exit("Initial Stop Loss Short", from_entry="Short", stop=shortStopLevel)

- Multi-EMA Trend-Following Swing Trading Strategy with ATR-Based Risk Management

- Break of Structure with Volume Confirmation Multi-Condition Intelligent Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Multi-Indicator Volatility Trading RSI-EMA-ATR Strategy

- Triple Supertrend and Bollinger Bands Multi-Indicator Trend Following Strategy

- Multi-Trendline Breakout Momentum Quantitative Strategy

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- Advanced Trend Following Strategy with Adaptive Trailing Stop

- MACD and RSI Multi-Filter Intraday Trading Strategy

- Price Relationship-based Arbitrage Trading Strategy Between Two Markets

- RSI-based Trading Strategy with Percentage-based Take Profit and Stop Loss

- MACD and Martingale Combination Strategy for Optimized Long Trading

- Elliott Wave Stochastic EMA Strategy

- Bollinger Bands and Moving Average Crossover Strategy

- SMA Dual Moving Average Crossover Strategy

- 10SMA and MACD Dual Trend Following Trading Strategy

- MACD and RSI Combined Natural Trading Strategy

- Dynamic Timeframe High-Low Breakout Strategy

- Smooth Moving Average Stop Loss & Take Profit Strategy with Trend Filter and Exception Exit

- MACD Convergence Strategy with R:R, Daily Limits, and Tighter Stop Loss

- Starlight Moving Average Crossover Strategy

- Percentage Threshold Quantitative Trading Strategy

- Moving Average Crossover Strategy Based on Dual Moving Averages

- MACD and Supertrend Combination Strategy

- Buy/Sell Strategy Based on Volume & Candlestick Patterns

- SMA Trend Following Strategy with Trailing Stop-Loss and Disciplined Re-Entry

- EMA and Bollinger Bands Breakout Strategy

- CDC Action Zone Trading Bot Strategy with ATR for Take Profit and Stop Loss