RSI Dynamic Drawdown Stop-Loss Strategy

Author: ChaoZhang, Date: 2024-06-07 15:47:51Tags: RSIMA

Overview

This strategy is based on the Wyckoff Methodology, combining the Relative Strength Index (RSI) and Volume Moving Average (Volume MA) to identify the accumulation and distribution phases of the market, generating buy and sell signals. Additionally, the strategy employs a dynamic drawdown stop-loss mechanism to control risk by setting a maximum drawdown threshold.

Strategy Principle

- Calculate the RSI indicator and Volume Moving Average.

- When the RSI crosses above the oversold area and the volume is greater than the Volume MA, it identifies the market’s accumulation phase and generates a buy signal.

- When the RSI crosses below the overbought area and the volume is greater than the Volume MA, it identifies the market’s distribution phase and generates a sell signal.

- The strategy simultaneously tracks the account’s maximum equity and current drawdown. If the current drawdown exceeds the set maximum drawdown threshold, the strategy closes all positions.

- Buy positions are closed during the distribution phase or when the drawdown exceeds the maximum drawdown, while sell positions are closed during the accumulation phase or when the drawdown exceeds the maximum drawdown.

Strategy Advantages

- By combining RSI and volume indicators, the strategy can more accurately capture the accumulation and distribution phases of the market.

- The dynamic drawdown stop-loss mechanism effectively controls the strategy’s maximum drawdown, reducing overall strategy risk.

- Suitable for 5-minute high-frequency data, allowing quick response to market changes and timely position adjustments.

Strategy Risks

- RSI and volume indicators may generate misleading signals under certain market conditions, leading to incorrect trading decisions by the strategy.

- The setting of the maximum drawdown threshold needs to be adjusted according to market characteristics and personal risk preferences; improper settings may lead to premature position closing or excessive risk-taking.

- The strategy may generate frequent trading signals in choppy markets, increasing trading costs.

Strategy Optimization Directions

- Consider introducing other technical indicators such as MACD, Bollinger Bands, etc., to improve the accuracy of the strategy’s signals.

- Optimize the parameters of the RSI and volume indicators, such as adjusting the length of the RSI, overbought/oversold thresholds, etc., to adapt to different market conditions.

- In addition to drawdown stop-loss, incorporate trailing stop-loss or profit protection mechanisms to further control risk and lock in profits.

Summary

The RSI Dynamic Drawdown Stop-Loss Strategy identifies the accumulation and distribution phases of the market by combining RSI and volume indicators while employing a dynamic drawdown stop-loss mechanism to control risk. The strategy considers both market trend and risk management, making it practical to some extent. However, the strategy’s performance depends on the choice of indicator parameters and market characteristics, requiring continuous optimization and adjustment to improve its stability and profitability.

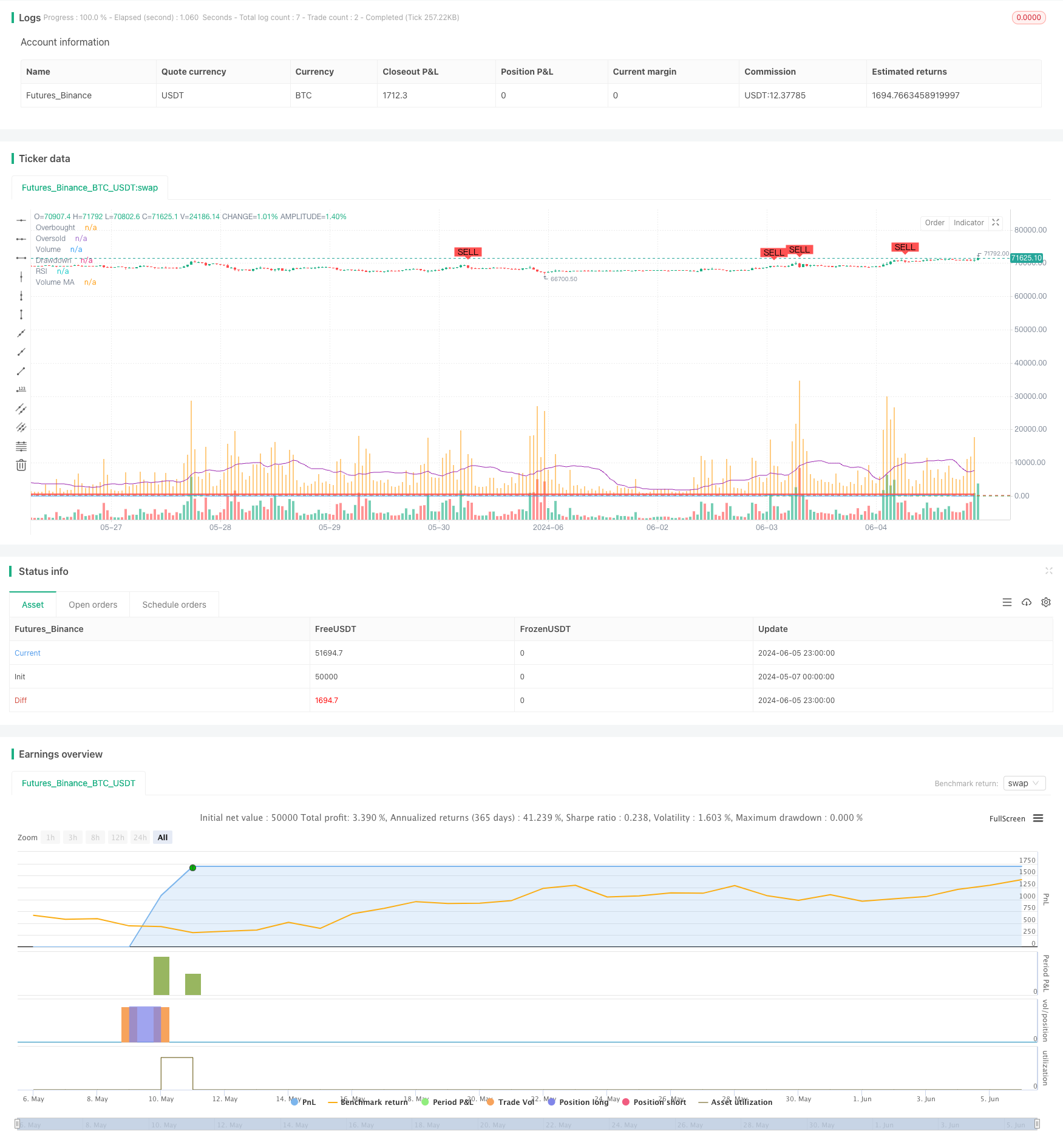

/*backtest

start: 2024-05-07 00:00:00

end: 2024-06-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Wyckoff Methodology Strategy with Max Drawdown", overlay=true)

// Define input parameters

length = input(14, title="RSI Length")

overbought = input(70, title="RSI Overbought Level")

oversold = input(30, title="RSI Oversold Level")

volume_length = input(20, title="Volume MA Length")

initial_capital = input(10000, title="Initial Capital")

max_drawdown = input(500, title="Max Drawdown")

// Calculate RSI

rsi = ta.rsi(close, length)

// Calculate Volume Moving Average

vol_ma = ta.sma(volume, volume_length)

// Identify Accumulation Phase

accumulation = ta.crossover(rsi, oversold) and volume > vol_ma

// Identify Distribution Phase

distribution = ta.crossunder(rsi, overbought) and volume > vol_ma

// Plot RSI

hline(overbought, "Overbought", color=color.red)

hline(oversold, "Oversold", color=color.green)

plot(rsi, title="RSI", color=color.blue)

// Plot Volume and Volume Moving Average

plot(volume, title="Volume", color=color.orange, style=plot.style_histogram)

plot(vol_ma, title="Volume MA", color=color.purple)

// Variables to track drawdown

var float max_equity = initial_capital

var float drawdown = 0.0

// Update max equity and drawdown

current_equity = strategy.equity

if (current_equity > max_equity)

max_equity := current_equity

drawdown := max_equity - current_equity

// Generate Buy and Sell Signals

if (accumulation and drawdown < max_drawdown)

strategy.entry("Buy", strategy.long)

if (distribution and drawdown < max_drawdown)

strategy.entry("Sell", strategy.short)

// Plot Buy and Sell signals on chart

plotshape(series=accumulation, location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal", text="BUY")

plotshape(series=distribution, location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal", text="SELL")

// Close positions if drawdown exceeds max drawdown

if (drawdown >= max_drawdown)

strategy.close_all("Max Drawdown Exceeded")

// Set strategy exit conditions

strategy.close("Buy", when=distribution or drawdown >= max_drawdown)

strategy.close("Sell", when=accumulation or drawdown >= max_drawdown)

// Display drawdown on chart

plot(drawdown, title="Drawdown", color=color.red, linewidth=2, style=plot.style_stepline)

- Momentum Trend Ichimoku Cloud Trading Strategy

- Multi-Confirmation Reversal Buy Strategy

- Dual-Period RSI Trend Momentum Strategy with Pyramiding Position Management System

- Best TradingView Strategy

- Advanced Dynamic Fibonacci Retracement Trend Quantitative Trading Strategy

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Dynamic RSI Oversold Rebound Trading Strategy with Stop-Loss Optimization Model

- Short-Term Trading Strategy Based on Bollinger Bands, Moving Average, and RSI

- Moving Average and Relative Strength Index Strategy

- Multi-Moving Average Momentum Trend Following Strategy

- BB Breakout Strategy

- VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

- Chande-Kroll Stop Dynamic ATR Trend Following Strategy

- This strategy generates trading signals based on the Chaikin Money Flow (CMF)

- Trend Filtered Pin Bar Reversal Strategy

- Quantitative Trading Strategy Based on Reversal Patterns at Support and Resistance Levels

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- TSI Crossover Strategy

- EMA Dual Moving Average Crossover Strategy

- Williams %R Dynamic TP/SL Adjustment Strategy

- VWAP Trading Strategy with Volume Anomaly Detection

- Supertrend and EMA Combination Strategy

- TGT Falling Buy Strategy Based on Price Decline

- Dual Trend Strategy with EMA Crossover and RSI Filter

- EMA and Parabolic SAR Combination Strategy

- MACD and RSI Multi-Filter Intraday Trading Strategy

- Price Relationship-based Arbitrage Trading Strategy Between Two Markets

- RSI-based Trading Strategy with Percentage-based Take Profit and Stop Loss

- MACD and Martingale Combination Strategy for Optimized Long Trading

- Elliott Wave Stochastic EMA Strategy