Williams %R Dynamic TP/SL Adjustment Strategy

Author: ChaoZhang, Date: 2024-06-07 15:52:55Tags: EMATPSL

Overview

This strategy is based on the Williams %R indicator and optimizes trading performance by dynamically adjusting take profit and stop loss levels. Buy signals are generated when the Williams %R crosses above the oversold area (-80), and sell signals are generated when it crosses below the overbought area (-20). An Exponential Moving Average (EMA) is used to smooth the Williams %R values and reduce noise. The strategy offers flexible parameter settings, including indicator periods, take profit/stop loss (TP/SL) levels, trading hours, and trade direction choices, to adapt to different market conditions and trader preferences.

Strategy Principles

- Calculate the Williams %R indicator value for a given period.

- Calculate the Exponential Moving Average (EMA) of the Williams %R.

- When the Williams %R crosses above the -80 level from below, it triggers a buy signal; when it crosses below the -20 level from above, it triggers a sell signal.

- After a buy entry, set take profit and stop loss levels. The trade is closed when the TP/SL price levels are reached or when the Williams %R triggers a reverse signal.

- After a sell entry, set take profit and stop loss levels. The trade is closed when the TP/SL price levels are reached or when the Williams %R triggers a reverse signal.

- Optionally, trade within a specified time range (e.g., 9:00-11:00) and choose whether to trade near the top of the hour (X minutes before to Y minutes after).

- Optionally, choose the trade direction as long only, short only, or both.

Advantages Analysis

- Dynamic TP/SL: Dynamically adjust take profit and stop loss levels based on user settings, which can better protect profits and control risks.

- Flexible parameters: Users can set various parameters according to their preferences, such as indicator periods, TP/SL levels, trading hours, etc., to adapt to different market conditions.

- Smoothed indicator: Introducing EMA to smooth Williams %R values can effectively reduce indicator noise and improve signal reliability.

- Restricted trading time: Optionally trade within a specific time range to avoid highly volatile market periods and reduce risk.

- Customizable trade direction: Choose to go long only, short only, or trade in both directions based on market trends and personal judgment.

Risk Analysis

- Improper parameter settings: If the TP/SL settings are too loose or too strict, it may lead to profit loss or frequent stop-outs.

- Trend identification errors: The Williams %R indicator performs poorly in choppy markets and may generate false signals.

- Limited effect of time restrictions: Limiting trading time may cause the strategy to miss some good trading opportunities.

- Over-optimization: Over-optimizing parameters may lead to poor strategy performance in future actual trading.

Optimization Directions

- Combine with other indicators: Such as trend indicators, volatility indicators, etc., to improve the accuracy of signal confirmation.

- Dynamic parameter optimization: Adjust parameters in real-time according to market conditions, such as using different parameter settings in trending and ranging markets.

- Improve TP/SL methods: Such as using trailing stop loss, partial profit-taking, etc., to better protect profits and control risks.

- Incorporate money management: Dynamically adjust the position size of each trade based on account balance and risk preferences.

Summary

The Williams %R Dynamic TP/SL Adjustment Strategy captures overbought and oversold price conditions in a simple and effective way while providing flexible parameter settings to adapt to different market environments and trading styles. The strategy dynamically adjusts take profit and stop loss levels, which can better control risks and protect profits. However, when applying the strategy in practice, attention should still be paid to factors such as parameter settings, signal confirmation, and trading time selection to further improve the robustness and profitability of the strategy.

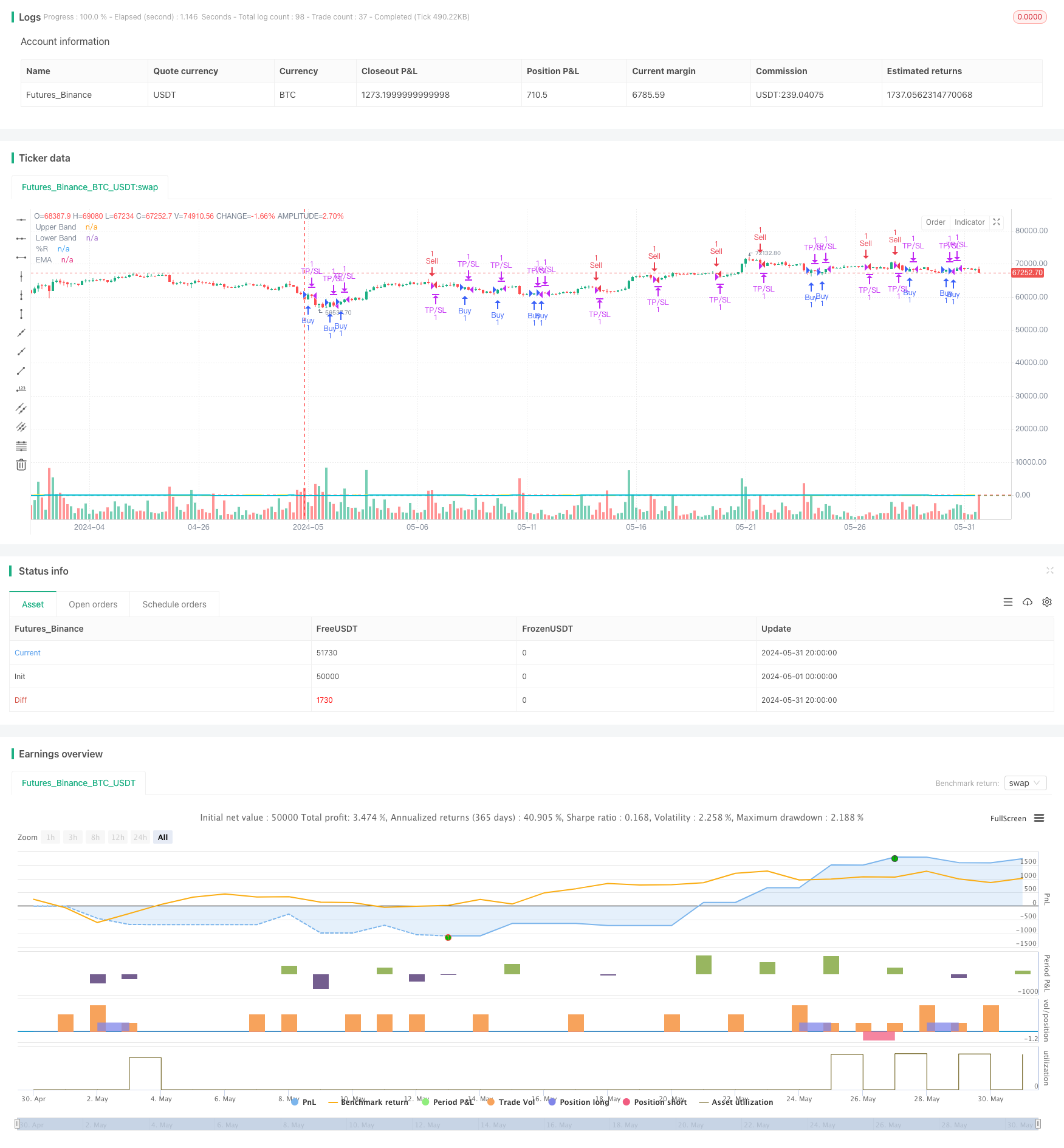

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Williams %R Strategy defined buy/sell criteria with TP / SL", overlay=true)

// User inputs for TP and SL levels

tp_level = input.int(defval=60, title="Take Profit (ticks)", minval=10, maxval=500, step=10)

sl_level = input.int(defval=60, title="Stop Loss (ticks)", minval=10, maxval=200, step=10)

// Williams %R calculation

length = input.int(defval=21, title="Length", minval=5, maxval=50, step=1)

willy = 100 * (close - ta.highest(length)) / (ta.highest(length) - ta.lowest(length))

// Exponential Moving Average (EMA) of Williams %R

ema_length = input.int(defval=13, title="EMA Length", minval=5, maxval=50, step=1)

ema_willy = ta.ema(willy, ema_length)

// User inputs for Williams %R thresholds

buy_threshold = -80

sell_threshold = -20

// User input to enable/disable specific trading hours

use_specific_hours = input.bool(defval=false, title="Use Specific Trading Hours")

start_hour = input(defval=timestamp("0000-01-01 09:00:00"), title="Start Hour")

end_hour = input(defval=timestamp("0000-01-01 11:00:00"), title="End Hour")

// User input to choose trade direction

trade_direction = input.string(defval="Both", title="Trade Direction", options=["Buy Only", "Sell Only", "Both"])

// User input to enable/disable "Minutes Before" and "Minutes After" options

enable_minutes_before_after = input.bool(defval=true, title="Enable Minutes Before/After Options")

minutes_before = enable_minutes_before_after ? input.int(defval=10, title="Minutes Before the Top of the Hour", minval=0, maxval=59, step=1) : 0

minutes_after = enable_minutes_before_after ? input.int(defval=10, title="Minutes After the Top of the Hour", minval=0, maxval=59, step=1) : 0

// Condition to check if the current minute is within the user-defined time window around the top of the hour

is_top_of_hour_range = (minute(time) >= (60 - minutes_before) and minute(time) <= 59) or (minute(time) >= 0 and minute(time) <= minutes_after)

// Condition to check if the current time is within the user-defined specific trading hours

in_specific_hours = true

if use_specific_hours

in_specific_hours := (hour(time) * 60 + minute(time)) >= (hour(start_hour) * 60 + minute(start_hour)) and (hour(time) * 60 + minute(time)) <= (hour(end_hour) * 60 + minute(end_hour))

// Buy and Sell conditions with time-based restriction

buy_condition = ta.crossover(willy, buy_threshold) and is_top_of_hour_range and in_specific_hours

sell_condition = ta.crossunder(willy, sell_threshold) and is_top_of_hour_range and in_specific_hours

// Strategy entry and exit with TP and SL

if (trade_direction == "Buy Only" or trade_direction == "Both") and buy_condition

strategy.entry("Buy", strategy.long)

if (trade_direction == "Sell Only" or trade_direction == "Both") and sell_condition

strategy.entry("Sell", strategy.short)

// If a buy entry was taken, allow the trade to be closed after reaching TP and SL or if conditions for a sell entry are true

if (strategy.opentrades > 0)

strategy.exit("TP/SL", profit=tp_level, loss=sl_level)

// Plot Williams %R and thresholds for visualization

hline(-20, "Upper Band", color=color.red)

hline(-80, "Lower Band", color=color.green)

plot(willy, title="%R", color=color.yellow, linewidth=2)

plot(ema_willy, title="EMA", color=color.aqua, linewidth=2)

- EMA Crossover Trading Strategy with Dynamic Take Profit and Stop Loss

- Adaptive Trend-Following Trading Strategy: 200 EMA Breakout with Dynamic Risk Management System

- EMA Crossover with Dual Take Profit and Stop Loss Strategy

- Automated Quantitative Trading System with Dual EMA Crossover and Risk Management

- Advanced EMA Crossover Strategy: Adaptive Trading System with Dynamic Stop-Loss and Take-Profit Targets

- Multi-Timeframe Exponential Moving Average Crossover Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Long Entry on EMA Cross with Risk Management Strategy

- Dynamic Trend Following Strategy Combining Supertrend and EMA

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- EMA Crossover Momentum Scalping Strategy

- BB Breakout Strategy

- VWAP and RSI Dynamic Bollinger Bands Take Profit and Stop Loss Strategy

- Chande-Kroll Stop Dynamic ATR Trend Following Strategy

- This strategy generates trading signals based on the Chaikin Money Flow (CMF)

- Trend Filtered Pin Bar Reversal Strategy

- Quantitative Trading Strategy Based on Reversal Patterns at Support and Resistance Levels

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- TSI Crossover Strategy

- EMA Dual Moving Average Crossover Strategy

- RSI Dynamic Drawdown Stop-Loss Strategy

- VWAP Trading Strategy with Volume Anomaly Detection

- Supertrend and EMA Combination Strategy

- TGT Falling Buy Strategy Based on Price Decline

- Dual Trend Strategy with EMA Crossover and RSI Filter

- EMA and Parabolic SAR Combination Strategy

- MACD and RSI Multi-Filter Intraday Trading Strategy

- Price Relationship-based Arbitrage Trading Strategy Between Two Markets

- RSI-based Trading Strategy with Percentage-based Take Profit and Stop Loss

- MACD and Martingale Combination Strategy for Optimized Long Trading