Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

Author: ChaoZhang, Date: 2024-11-12 16:07:32Tags: RSIATRBATLRSD

Overview

This strategy is an adaptive trading system based on the Relative Strength Index (RSI), which optimizes trade signal generation through dynamic adjustment of overbought and oversold thresholds. The core innovation lies in the introduction of Bufi’s Adaptive Threshold (BAT) method, which dynamically adjusts RSI trigger thresholds based on market trends and price volatility, thereby improving the effectiveness of traditional RSI strategies.

Strategy Principles

The core concept is upgrading traditional fixed-threshold RSI systems to dynamic threshold systems. Implementation details: 1. Using short-period RSI to calculate market overbought/oversold conditions 2. Calculating price trend slope through linear regression 3. Measuring price volatility using standard deviation 4. Integrating trend and volatility information to dynamically adjust RSI thresholds 5. Raising thresholds in uptrends and lowering them in downtrends 6. Reducing threshold sensitivity when prices deviate significantly from means

The strategy includes two risk control mechanisms: - Fixed-period position closing - Maximum loss stop-loss

Strategy Advantages

- Strong Dynamic Adaptability:

- Automatically adjusts trading thresholds based on market conditions

- Avoids drawbacks of fixed parameters in different market environments

- Comprehensive Risk Control:

- Maximum holding time limits

- Capital stop-loss protection

- Percentage-based position management

- Improved Signal Quality:

- Reduces false signals in oscillating markets

- Enhances trend capture capability

- Balances sensitivity and stability

Strategy Risks

- Parameter Sensitivity:

- BAT coefficient selection affects strategy performance

- RSI period settings require thorough testing

- Adaptive length parameters need optimization

- Market Environment Dependence:

- May miss opportunities in high volatility markets

- Significant slippage possible during extreme volatility

- Parameters need adjustment for different markets

- Technical Limitations:

- Relies on historical data for threshold calculation

- Potential lag in signal generation

- Trading costs need consideration

Strategy Optimization Directions

- Parameter Optimization:

- Introduce adaptive parameter selection mechanisms

- Dynamically adjust parameters for different market cycles

- Add automatic parameter optimization functionality

- Signal Optimization:

- Incorporate additional technical indicators for validation

- Add market cycle identification functionality

- Optimize entry timing determination

- Risk Control Optimization:

- Implement dynamic stop-loss mechanisms

- Optimize position management strategies

- Add drawdown control mechanisms

Summary

This innovative adaptive trading strategy addresses the limitations of traditional RSI strategies through dynamic threshold optimization. The strategy comprehensively considers market trends and volatility, featuring strong adaptability and risk control capabilities. While challenges exist in parameter optimization, continuous improvement and optimization make this strategy promising for actual trading. Traders are advised to conduct thorough backtesting and parameter optimization before live implementation, with appropriate adjustments based on specific market characteristics.

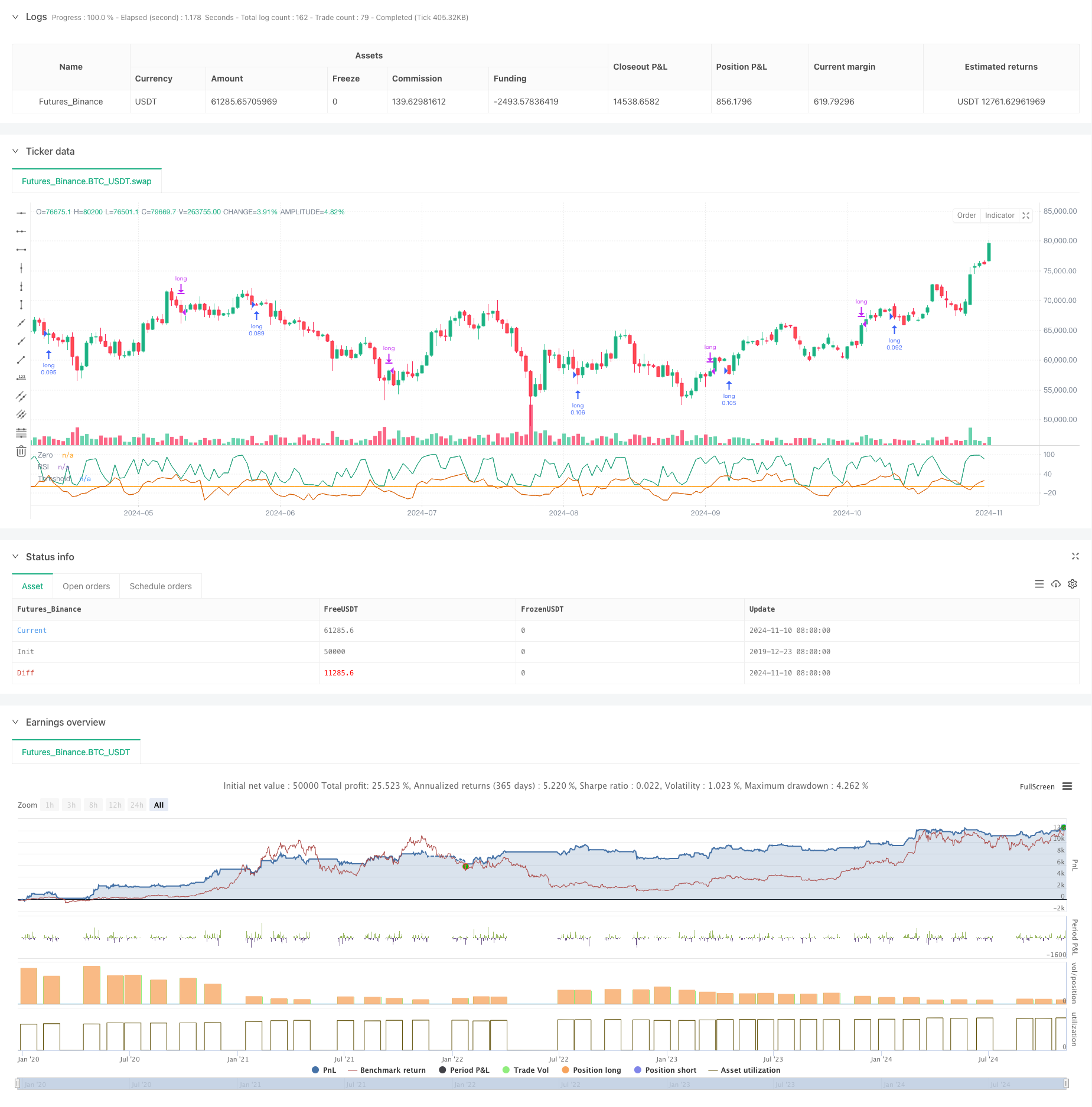

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PineCodersTASC

// TASC Issue: October 2024

// Article: Overbought/Oversold

// Oscillators: Useless Or Just Misused

// Article By: Francesco P. Bufi

// Language: TradingView's Pine Script™ v5

// Provided By: PineCoders, for tradingview.com

//@version=5

title ='TASC 2024.10 Adaptive Oscillator Threshold'

stitle = 'AdapThrs'

strategy(title, stitle, false, default_qty_type = strategy.percent_of_equity,

default_qty_value = 10, slippage = 5)

// --- Inputs ---

string sys = input.string("BAT", "System", options=["Traditional", "BAT"])

int rsiLen = input.int(2, "RSI Length", 1)

int buyLevel = input.int(14, "Buy Level", 0)

int adapLen = input.int(8, "Adaptive Length", 2)

float adapK = input.float(6, "Adaptive Coefficient")

int exitBars = input.int(28, "Fixed-Bar Exit", 1, group = "Strategy Settings")

float DSL = input.float(1600, "Dollar Stop-Loss", 0, group = "Strategy Settings")

// --- Functions ---

// Bufi's Adaptive Threshold

BAT(float price, int length) =>

float sd = ta.stdev(price, length)

float lr = ta.linreg(price, length, 0)

float slope = (lr - price[length]) / (length + 1)

math.min(0.5, math.max(-0.5, slope / sd))

// --- Calculations ---

float osc = ta.rsi(close, rsiLen)

// Strategy entry rules

// - Traditional system

if sys == "Traditional" and osc < buyLevel

strategy.entry("long", strategy.long)

// - BAT system

float thrs = buyLevel * adapK * BAT(close, adapLen)

if sys == "BAT" and osc < thrs

strategy.entry("long", strategy.long)

// Strategy exit rules

// - Fixed-bar exit

int nBar = bar_index - strategy.opentrades.entry_bar_index(0)

if exitBars > 0 and nBar >= exitBars

strategy.close("long", "exit")

// - Dollar stop-loss

if DSL > 0 and strategy.opentrades.profit(0) <= - DSL

strategy.close("long", "Stop-loss", immediately = true)

// Visuals

rsiColor = #1b9e77

thrsColor = #d95f02

rsiLine = plot(osc, "RSI", rsiColor, 1)

thrsLine = plot(sys == "BAT" ? thrs : buyLevel, "Threshold", thrsColor, 1)

zeroLine = plot(0.0, "Zero", display = display.none)

fill(zeroLine, thrsLine, sys == "BAT" ? thrs : buyLevel, 0.0, color.new(thrsColor, 60), na)

- Multi-Indicator Intelligent Pyramiding Strategy

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Dual Timeframe Supertrend RSI Intelligent Trading Strategy

- RSI Trend Reversal Trading Strategy with ATR Stop Loss and Trading Zone Control

- Dual Timeframe Supertrend with RSI Optimization System

- RSI Trend Reversal Strategy

- Dynamic Trend Quantitative Strategy Based on Bollinger Bands and RSI Cross

- Multi-Momentum Linear Regression Crossover Strategy

- RSI-ATR Momentum Volatility Combined Trading Strategy

- Multi-Level Dynamic Trend Following System

- Dual Moving Average Crossover with Dynamic Risk Management Strategy

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Advanced MACD Dynamic Trend Quantitative Trading Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- RSI and AO Synergistic Trend Following Quantitative Trading Strategy

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Dual Moving Average Cross RSI Momentum Strategy with Risk-Reward Optimization System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy

- Dynamic Holding Period Strategy Based on 123 Point Reversal Pattern

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Parabolic SAR Divergence Trading Strategy