Multi-Indicator Volatility Trading RSI-EMA-ATR Strategy

Author: ChaoZhang, Date: 2024-12-20 14:47:41Tags: RSIEMAATRSMA

Overview

This strategy is a short-term trading system that combines multiple technical indicators, primarily based on RSI (Relative Strength Index), EMA (Exponential Moving Average), and ATR (Average True Range) for generating trading signals. By utilizing multiple indicators together, the strategy considers both price trends and market volatility, with an optional volume filter, creating a relatively complete trading decision system.

Strategy Principle

The strategy employs a triple-filtering mechanism to ensure signal reliability: 1. Trend Determination: Using the crossover relationship between Fast EMA (5-period) and Slow EMA (21-period) to judge current market trend 2. Overbought/Oversold: Using RSI indicator (14-period) for reversal trading within the 45-55 range 3. Volatility Confirmation: Using ATR indicator to determine if current market volatility is suitable for trading, requiring ATR value to be greater than 0.8 times its moving average 4. Optional volume filter requiring volume to be above its 20-period moving average

Specific trigger conditions for long and short signals are: - Long Condition: Fast EMA above Slow EMA + RSI below 45 + Volatility condition met - Short Condition: Fast EMA below Slow EMA + RSI above 55 + Volatility condition met

Strategy Advantages

- Multiple confirmation mechanisms improve trading reliability and effectively reduce false signals

- Combines trend-following and reversal trading characteristics, capable of capturing major trends while profiting from range-bound markets

- Controls volatility through ATR indicator, avoiding frequent trading during low volatility periods

- Strategy has good adaptability and can be adjusted through parameters to suit different market environments

- Optional volume filtering mechanism further improves trading accuracy

Strategy Risks

- May experience slippage in volatile markets, affecting actual execution

- Parameter optimization faces overfitting risk, requiring thorough testing across different time periods

- Fast and Slow EMAs may produce excessive crossovers in sideways markets, leading to false signals

- Fixed RSI thresholds may need adjustment in different market environments

- Trading costs (0.1% commission) may significantly impact strategy returns

Strategy Optimization Directions

- Consider adding multiple timeframe confirmation, such as adding trend filters on larger timeframes

- Recommend adding stop-loss and take-profit mechanisms, potentially based on ATR multiples

- Consider implementing a position management system with dynamic position sizing based on volatility

- Consider introducing market sentiment indicators to adjust trading parameters in extreme market conditions

- Recommend adding trading time filters to avoid trading during low liquidity periods

Summary

This is a well-designed multi-indicator trading system that improves trading reliability through multiple confirmation mechanisms. The strategy’s core advantage lies in combining trend and volatility analysis while considering multiple market dimensions. While there is room for optimization, it is overall a trading strategy worth further refinement and implementation.

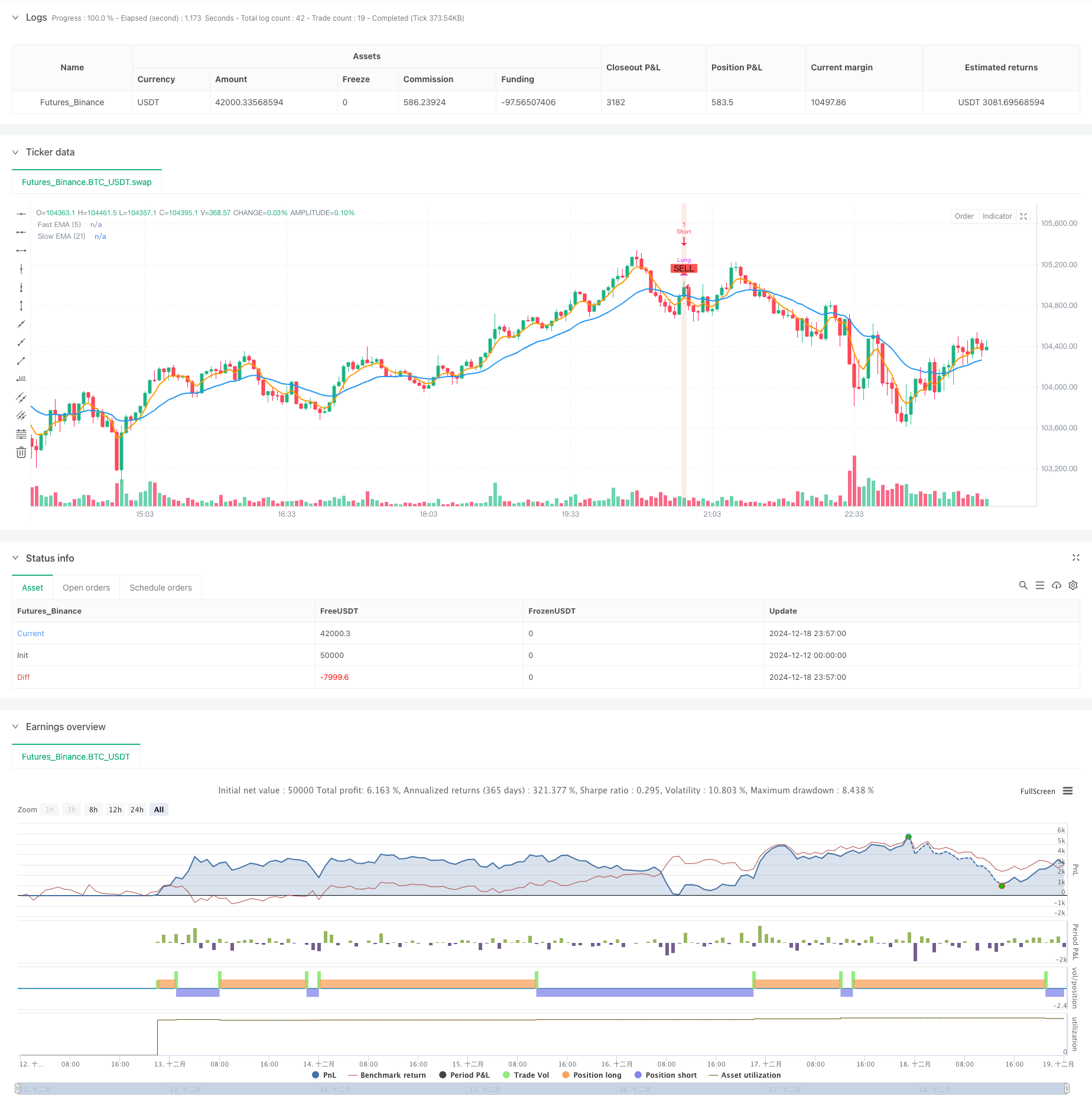

/*backtest

start: 2024-12-12 00:00:00

end: 2024-12-19 00:00:00

period: 3m

basePeriod: 3m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Scalp Master BTCUSDT Strategy", overlay=true, max_labels_count=500, initial_capital=10000, commission_type=strategy.commission.percent, commission_value=0.1)

//=== Kullanıcı Parametreleri ===

rsi_length = input.int(14, "RSI Length")

rsi_lower_band = input.float(45, "RSI Lower Band")

rsi_upper_band = input.float(55, "RSI Upper Band")

ema_fast_length = input.int(5, "Fast EMA")

ema_slow_length = input.int(21, "Slow EMA")

atr_period = input.int(14, "ATR Period")

atr_mult = input.float(0.8, "ATR Multiplier")

volume_filter = input.bool(false, "Enable Volume Filter")

volume_period = input.int(20, "Volume SMA Period")

volume_mult = input.float(1.0, "Volume Threshold Multiplier")

//=== Hesaplamalar ===

// RSI Hesabı

rsi_val = ta.rsi(close, rsi_length)

// ATR Tabanlı Volatilite Kontrolü

atr_val = ta.atr(atr_period)

volatility_ok = atr_val > (ta.sma(atr_val, atr_period) * atr_mult)

// EMA Trend

ema_fast_val = ta.ema(close, ema_fast_length)

ema_slow_val = ta.ema(close, ema_slow_length)

trend_up = ema_fast_val > ema_slow_val

trend_down = ema_fast_val < ema_slow_val

// Hacim Filtresi

volume_sma = ta.sma(volume, volume_period)

high_volume = volume > (volume_sma * volume_mult)

// Sinyal Koşulları (Aynı Alarm Koşulları)

long_signal = trend_up and rsi_val < rsi_lower_band and volatility_ok and (volume_filter ? high_volume : true)

short_signal = trend_down and rsi_val > rsi_upper_band and volatility_ok and (volume_filter ? high_volume : true)

//=== Strateji Mantığı ===

// Basit bir yaklaşım:

// - Long sinyali gelince önce Short pozisyonu kapat, sonra Long pozisyona gir.

// - Short sinyali gelince önce Long pozisyonu kapat, sonra Short pozisyona gir.

if (long_signal)

strategy.close("Short") // Eğer varsa Short pozisyonu kapat

strategy.entry("Long", strategy.long)

if (short_signal)

strategy.close("Long") // Eğer varsa Long pozisyonu kapat

strategy.entry("Short", strategy.short)

// EMA Çizimleri

plot(ema_fast_val, title="Fast EMA (5)", color=color.new(color.orange, 0), linewidth=2)

plot(ema_slow_val, title="Slow EMA (21)", color=color.new(color.blue, 0), linewidth=2)

// Sinyal İşaretleri

plotshape(long_signal, title="BUY Signal", location=location.belowbar,

color=color.new(color.green, 0), style=shape.labelup, text="BUY")

plotshape(short_signal, title="SELL Signal", location=location.abovebar,

color=color.new(color.red, 0), style=shape.labeldown, text="SELL")

// Arka plan renklendirmesi

bgcolor(long_signal ? color.new(color.green, 85) : short_signal ? color.new(color.red, 85) : na)

// Alarm Koşulları (İndikatör ile aynı koşullar)

alertcondition(long_signal, title="Buy Alert", message="BTCUSDT Scalp Master: Buy Signal Triggered")

alertcondition(short_signal, title="Sell Alert", message="BTCUSDT Scalp Master: Sell Alert Triggered")

- Multi-Indicator Dynamic Adaptive Position Sizing with ATR Volatility Strategy

- Multi-Indicator Trend Momentum Crossover Quantitative Strategy

- Multi-Timeframe Moving Average and RSI Trend Trading Strategy

- Short-term Short Selling Strategy for High-liquidity Currency Pairs

- High-Frequency Dynamic Multi-Indicator Moving Average Crossover Strategy

- Multi-Technical Indicator Trend Following Strategy with RSI Momentum Filter

- Multi-EMA Trend Following Strategy with Dynamic ATR Targets

- Golden Momentum Capture Strategy: Multi-Timeframe Exponential Moving Average Crossover System

- Multi-Period Exponential Moving Average Crossover Strategy with Options Trading Suggestion System

- Multi-EMA Trend Momentum Trading Strategy with Risk Management System

- Break of Structure with Volume Confirmation Multi-Condition Intelligent Trading Strategy

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Multi-Moving Average Trend Following Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Dynamic EMA Breakthrough and Reversal Strategy

- Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

- Multi-level ATH Dynamic Tracking Triple-Entry Strategy

- Adaptive VWAP Bands with Garman-Klass Volatility Dynamic Tracking Strategy

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

- Dual Moving Average Trend Following Strategy with Risk Management

- Triple Supertrend and Bollinger Bands Multi-Indicator Trend Following Strategy

- Multi-Trendline Breakout Momentum Quantitative Strategy

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Timeframe Liquidity Pivot Heatmap Strategy

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- Advanced Trend Following Strategy with Adaptive Trailing Stop

- Multi-Technical Indicator Trend Following Strategy with RSI Momentum Filter

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy