Stratégie de négociation en temps opportun avec double oscillateur de dynamique

Auteur:ChaoZhang est là., Date: 2024-12-17 14h36 et 46 minLes étiquettes:Indice de résistanceSMALe taux d'intérêtLe MACD

Résumé

Cette stratégie est un système de trading intelligent basé sur deux indicateurs de dynamique: le RSI et le RSI stochastique. Il identifie les conditions de surachat et de survente du marché en combinant les signaux de deux oscillateurs de dynamique, capturant les opportunités de trading potentielles. Le système prend en charge l'adaptation des périodes et peut ajuster de manière flexible les cycles de trading en fonction des différents environnements du marché.

Principe de stratégie

La logique de base de la stratégie repose sur les éléments clés suivants: 1. Utilise l'indicateur RSI à 14 périodes pour calculer la dynamique des prix 2. Utilise le RSI stochastique à 14 périodes pour la confirmation secondaire 3. déclencheurs de signaux d'achat lorsque le RSI est inférieur à 35 et le RSI stochastique est inférieur à 20 Les déclencheurs vendent le signal lorsque le RSI est supérieur à 70 et le RSI stochastique est supérieur à 80 5. Applique le lissage SMA à 3 périodes au RSI stochastique pour la stabilité du signal 6. Prend en charge la commutation entre les délais quotidiens et hebdomadaires

Les avantages de la stratégie

- Le mécanisme de confirmation double du signal réduit considérablement les interférences de faux signaux

- Les paramètres de l'indicateur peuvent être ajustés de manière flexible en fonction de la volatilité du marché

- Le lissage SMA réduit efficacement le bruit du signal

- Soutenir les opérations à plusieurs périodes pour répondre aux besoins des différents investisseurs

- L'interface visuelle affiche intuitivement les signaux d'achat/vente pour l'analyse

- Structure de code claire, facile à entretenir et à développer

Risques stratégiques

- Peut générer des signaux de négociation excessifs sur les marchés latéraux

- Décalage potentiel du signal lors d'inversions rapides de tendance

- Des paramètres incorrects peuvent entraîner des occasions de négociation manquées

- Des signaux erronés peuvent se produire lors d'une forte volatilité du marché

- Exige des paramètres de stop-loss appropriés pour le contrôle des risques

Directions d'optimisation de la stratégie

- Introduction d'indicateurs de jugement de tendance tels que le MACD ou l'EMA pour améliorer la fiabilité du signal

- Ajouter des facteurs de volume pour améliorer la qualité du signal

- Mettre en œuvre des mécanismes de stop-loss dynamiques pour optimiser la gestion des risques

- Développer un système d'optimisation adaptatif des paramètres pour la stabilité de la stratégie

- Considérer l' incorporation d' indicateurs de volatilité du marché pour optimiser le calendrier des transactions

Résumé

La stratégie construit un système de trading fiable en combinant les avantages du RSI et du RSI stochastique. Le mécanisme de confirmation du double signal réduit efficacement les faux signaux, tandis que les paramètres flexibles offrent une forte adaptabilité.

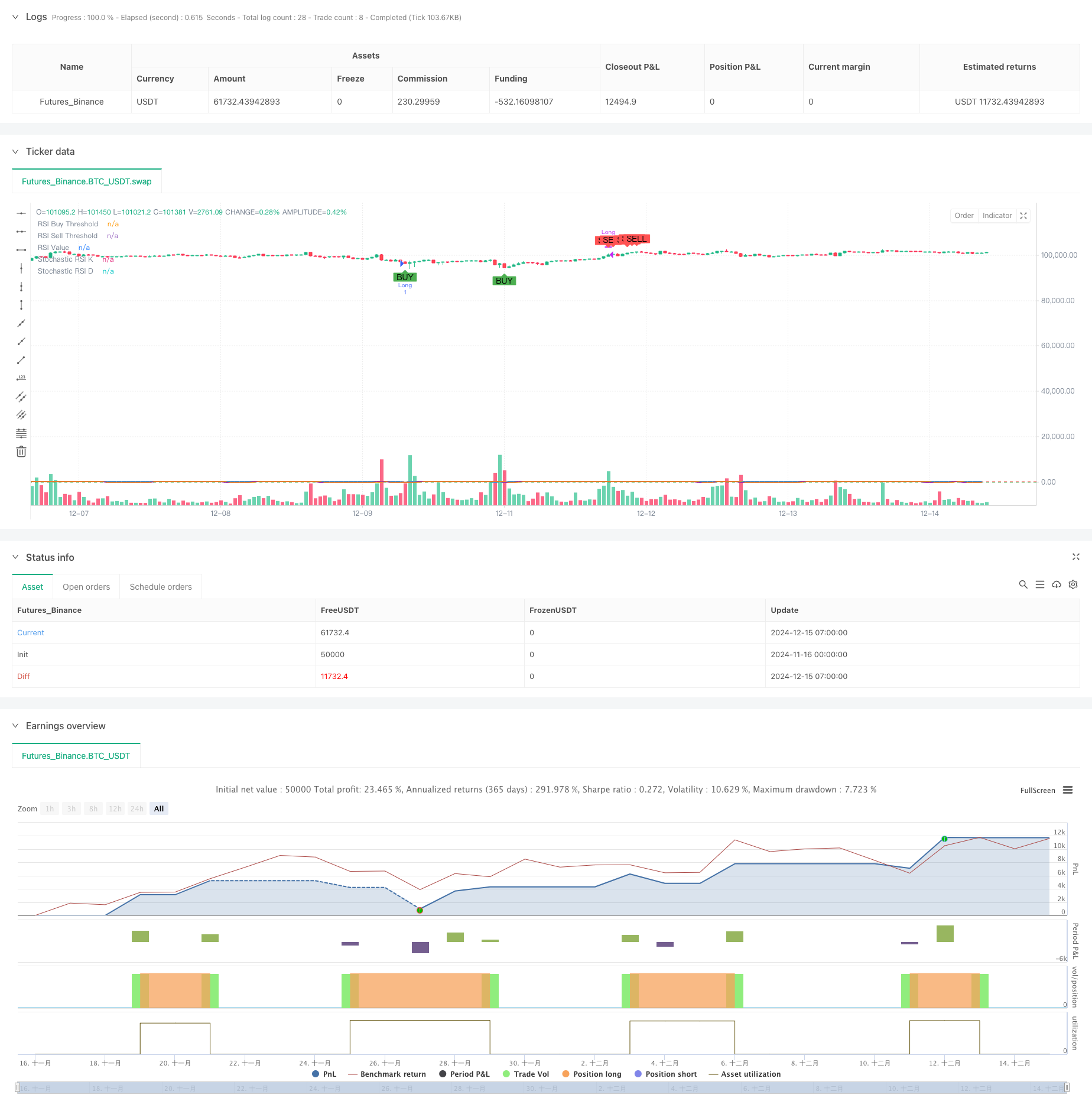

/*backtest

start: 2024-11-16 00:00:00

end: 2024-12-15 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BTC Buy & Sell Strategy (RSI & Stoch RSI)", overlay=true)

// Input Parameters

rsi_length = input.int(14, title="RSI Length")

stoch_length = input.int(14, title="Stochastic Length")

stoch_smooth_k = input.int(3, title="Stochastic %K Smoothing")

stoch_smooth_d = input.int(3, title="Stochastic %D Smoothing")

// Threshold Inputs

rsi_buy_threshold = input.float(35, title="RSI Buy Threshold")

stoch_buy_threshold = input.float(20, title="Stochastic RSI Buy Threshold")

rsi_sell_threshold = input.float(70, title="RSI Sell Threshold")

stoch_sell_threshold = input.float(80, title="Stochastic RSI Sell Threshold")

use_weekly_data = input.bool(false, title="Use Weekly Data", tooltip="Enable to use weekly timeframe for calculations.")

// Timeframe Configuration

timeframe = use_weekly_data ? "W" : timeframe.period

// Calculate RSI and Stochastic RSI

rsi_value = request.security(syminfo.tickerid, timeframe, ta.rsi(close, rsi_length))

stoch_rsi_k_raw = request.security(syminfo.tickerid, timeframe, ta.stoch(close, high, low, stoch_length))

stoch_rsi_k = ta.sma(stoch_rsi_k_raw, stoch_smooth_k)

stoch_rsi_d = ta.sma(stoch_rsi_k, stoch_smooth_d)

// Define Buy and Sell Conditions

buy_signal = (rsi_value < rsi_buy_threshold) and (stoch_rsi_k < stoch_buy_threshold)

sell_signal = (rsi_value > rsi_sell_threshold) and (stoch_rsi_k > stoch_sell_threshold)

// Strategy Execution

if buy_signal

strategy.entry("Long", strategy.long, comment="Buy Signal")

if sell_signal

strategy.close("Long", comment="Sell Signal")

// Plot Buy and Sell Signals

plotshape(buy_signal, style=shape.labelup, location=location.belowbar, color=color.green, title="Buy Signal", size=size.small, text="BUY")

plotshape(sell_signal, style=shape.labeldown, location=location.abovebar, color=color.red, title="Sell Signal", size=size.small, text="SELL")

// Plot RSI and Stochastic RSI for Visualization

hline(rsi_buy_threshold, "RSI Buy Threshold", color=color.green)

hline(rsi_sell_threshold, "RSI Sell Threshold", color=color.red)

plot(rsi_value, color=color.blue, linewidth=2, title="RSI Value")

plot(stoch_rsi_k, color=color.purple, linewidth=2, title="Stochastic RSI K")

plot(stoch_rsi_d, color=color.orange, linewidth=1, title="Stochastic RSI D")

- Stratégie de négociation quantitative à indicateurs multiples - Stratégie 7 en 1 à super indicateur

- Tendance multi-indicateurs suivie par la stratégie quantitative de négociation suracheté/survendu du RSI

- Tendance à la moyenne mobile à double canal suivant la stratégie

- La stratégie de négociation des ordres de limite dynamiques multi-indicateurs SMA-RSI-MACD

- Tendance à la hausse des taux de gain à l' EMA à plusieurs périodes (avancée)

- Stratégie quantitative de changement à court terme basée sur le canal G et l'EMA

- Stratégie de négociation quantitative croisée dynamique de moyenne mobile double

- Stratégie de négociation complète multi-indicateur: combinaison parfaite de dynamique, de surachat/survente et de volatilité

- Système d'analyse de l'extension haute/basse de 52 semaines

- Système de négociation d'analyse technique à stratégies multiples

- Tendance à la moyenne mobile double suivant une stratégie avec gestion des risques

- Triple Supertrend et Bandes de Bollinger Tendance multi-indicateur suivant la stratégie

- Stratégie quantitative sur la dynamique de rupture sur plusieurs lignes de tendance

- Système de gestion des capitaux basé sur la dynamique de l'indice RSI et la force de la tendance de l'ADX

- Stratégie de carte thermique de pivot de liquidité à plusieurs délais

- Tendance sur plusieurs périodes suivant une stratégie basée sur l'ATR de prise de bénéfices et d'arrêt des pertes

- Stratégie de suivi de tendance avancée avec arrêt de suivi adaptatif

- Indicateur multi-technique de tendance suivant une stratégie avec filtre de dynamique RSI

- Stratégie de croisement dynamique des moyennes mobiles exponentielles gérées par le risque

- Stratégie de croisement de la moyenne mobile exponentielle double et de l'indice de résistance relative

- Stratégie de capture de tendance quantitative avancée avec filtre de plage dynamique

- Politique d'exécution du signal TradingView (version intégrée du service HTTP)

- Stratégie avancée d'analyse croisée de cinq jours basée sur l'intégration du RSI et du MACD

- Système de négociation adaptatif basé sur les deux indicateurs RSI

- Stratégie dynamique double supertendance volume-prix

- Stratégie de suivi de la volatilité du cygne noir et de la dynamique croisée de la moyenne mobile

- Stratégie de négociation intelligente de la fourchette de volatilité combinant les bandes de Bollinger et le SuperTrend

- Tendance synergique multi-indicateur suivant une stratégie avec un système dynamique de stop-loss

- Bollinger Bands Momentum Breakout Tendance d' adaptation à la suite de la stratégie

- Stratégie améliorée d'inversion moyenne avec mise en œuvre du MACD-ATR