Tren Dinamis Mengikuti Strategi

Penulis:ChaoZhang, Tanggal: 2024-06-03 16:57:51Tag:ATR

Gambaran umum

Strategi ini menggunakan indikator Supertrend untuk menangkap tren pasar. Indikator Supertrend menggabungkan harga dan volatilitas, dengan garis hijau yang menunjukkan tren naik dan garis merah yang menunjukkan tren turun. Strategi ini menghasilkan sinyal beli dan jual dengan mendeteksi perubahan warna garis indikator, sambil menggunakan garis indikator sebagai tingkat stop-loss dinamis. Strategi ini juga menggabungkan trailing stop-loss dan logika take-profit tetap untuk mengoptimalkan kinerja.

Prinsip Strategi

- Menghitung band atas (atas) dan bawah (dn) dari indikator Supertrend dan menentukan arah tren saat ini (tren) berdasarkan hubungan antara harga penutupan dan band atas dan bawah.

- Menghasilkan sinyal beli (buySignal) ketika tren berubah dari turun (-1) ke atas (1), dan menghasilkan sinyal jual (sellSignal) ketika tren berubah dari naik (1) ke bawah (-1).

- Ketika sinyal beli dihasilkan, buka posisi panjang dan atur band bawah (dn) sebagai level stop loss; ketika sinyal jual dihasilkan, buka posisi pendek dan atur band atas (up) sebagai level stop loss.

- Memperkenalkan logika stop-loss trailing, di mana level stop-loss dipindahkan ke atas/bawah ketika harga naik/turun oleh sejumlah poin (trailingValue), memberikan perlindungan stop-loss.

- Memperkenalkan logika mengambil keuntungan tetap, menutup posisi untuk keuntungan ketika tren berubah.

Keuntungan Strategi

- Kemampuan beradaptasi: Indikator Supertrend menggabungkan harga dan volatilitas, memungkinkan untuk beradaptasi dengan kondisi pasar dan instrumen perdagangan yang berbeda.

- Stop-loss dinamis: Menggunakan garis indikator sebagai tingkat stop-loss dinamis dapat secara efektif mengendalikan risiko dan mengurangi kerugian.

- Trailing stop-loss: Memperkenalkan logika stop-loss trailing dapat melindungi keuntungan ketika tren berlanjut, meningkatkan profitabilitas strategi.

- Sinyal yang jelas: Sinyal beli dan jual yang dihasilkan oleh strategi jelas dan mudah dioperasikan dan dilaksanakan.

- Parameter fleksibel: Parameter strategi (seperti periode ATR, multiplier ATR, dll.) dapat disesuaikan berdasarkan karakteristik pasar dan gaya perdagangan, meningkatkan kemampuan beradaptasi.

Risiko Strategi

- Risiko parameter: Pengaturan parameter yang berbeda dapat menyebabkan perbedaan signifikan dalam kinerja strategi, yang membutuhkan pengujian backtesting dan optimasi parameter yang menyeluruh.

- Risiko pasar bergolak: Di pasar bergolak, perubahan tren yang sering dapat menyebabkan strategi menghasilkan sinyal perdagangan yang berlebihan, meningkatkan biaya transaksi dan risiko tergelincir.

- Risiko perubahan tren tiba-tiba: Ketika tren pasar tiba-tiba berubah, strategi mungkin tidak dapat menyesuaikan posisi secara tepat waktu, yang mengarah pada peningkatan kerugian.

- Risiko over-optimization: Over-optimizing strategi dapat menyebabkan kurva fitting, mengakibatkan kinerja yang buruk di pasar masa depan.

Arah Optimasi Strategi

- Menggabungkan analisis multi-frame waktu untuk mengkonfirmasi stabilitas tren dan mengurangi perdagangan yang sering di pasar yang bergolak.

- Menggabungkan indikator teknis atau faktor fundamental lainnya untuk meningkatkan akurasi penentuan tren.

- Mengoptimalkan logika stop-loss dan take-profit, seperti memperkenalkan rasio take-profit dinamis atau risiko-imbalan, untuk meningkatkan rasio profit-loss strategi.

- Melakukan pengujian ketahanan pada parameter untuk memilih kombinasi parameter yang mempertahankan kinerja yang baik dalam kondisi pasar yang berbeda.

- Memperkenalkan ukuran posisi dan aturan pengelolaan uang untuk mengendalikan risiko perdagangan individu dan risiko keseluruhan.

Ringkasan

Strategi Trend Following Dinamis menggunakan indikator Supertrend untuk menangkap tren pasar, mengendalikan risiko melalui stop loss dinamis dan trailing stop loss, sambil mengunci keuntungan dengan take profit tetap. Strategi ini dapat disesuaikan, memiliki sinyal yang jelas, dan mudah dioperasikan. Namun, dalam penerapan praktis, perhatian harus diberikan pada optimasi parameter, risiko pasar bergolak, dan risiko perubahan tren mendadak. Dengan memperkenalkan analisis multi-frame waktu, mengoptimalkan logika stop loss dan take profit, melakukan pengujian robusitas parameter, dan menerapkan langkah-langkah lainnya, kinerja dan stabilitas strategi dapat ditingkatkan lebih lanjut.

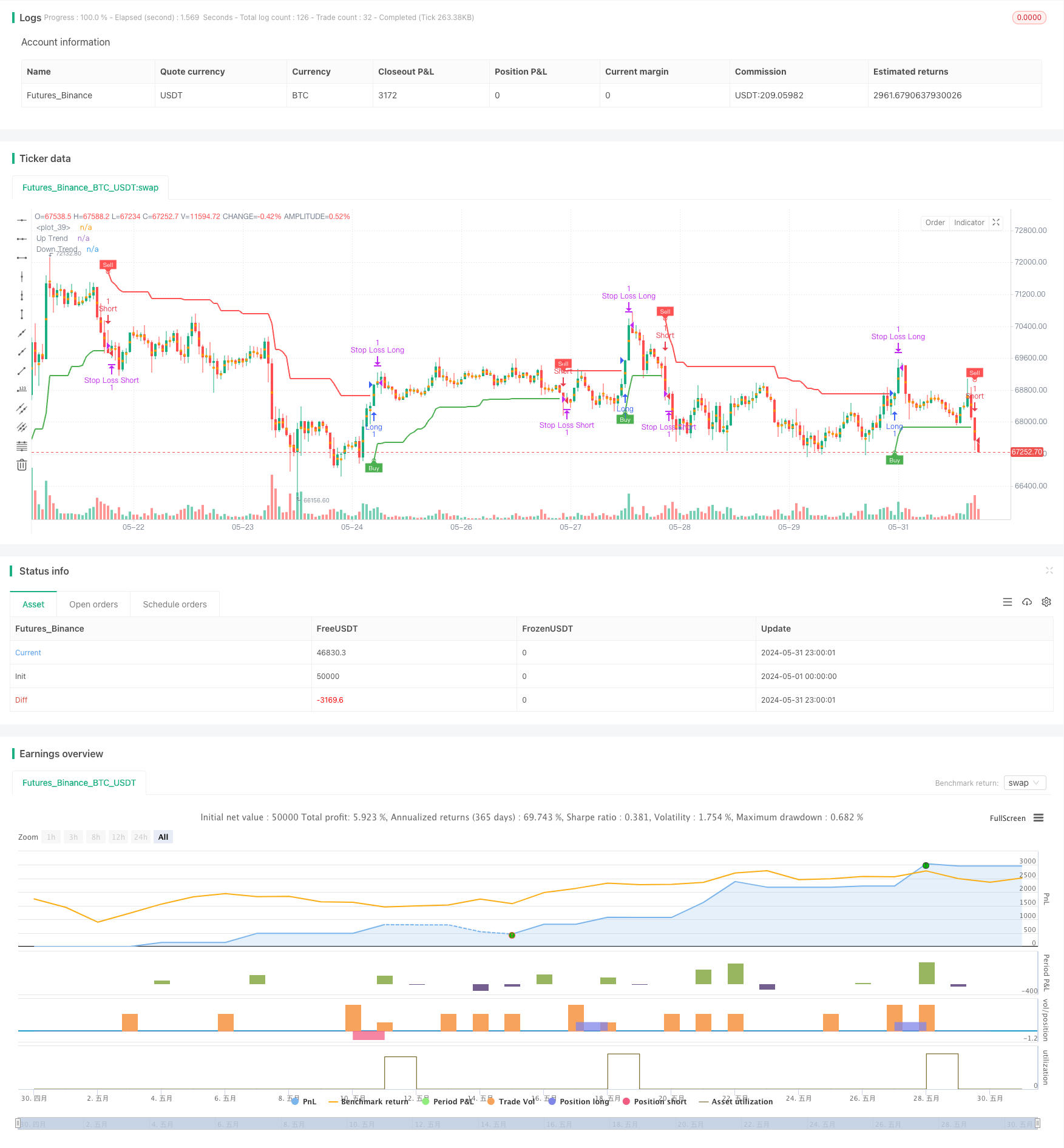

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Supertrend Strategy', overlay=true, format=format.price, precision=2)

Periods = input.int(title='ATR Period', defval=10)

src = input.source(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

changeATR = input.bool(title='Change ATR Calculation Method ?', defval=true)

showsignals = input.bool(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input.bool(title='Highlighter On/Off ?', defval=true)

// ATR calculation

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Supertrend calculations

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

// Trend direction

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plotting

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Highlighting

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

// Alerts

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

// Pip and trailing stop calculation

pips = 50

pipValue = syminfo.mintick * pips

trailingPips = 10

trailingValue = syminfo.mintick * trailingPips

// Strategy

if (buySignal)

strategy.entry("Long", strategy.long, stop=dn, comment="SuperTrend Buy")

if (sellSignal)

strategy.entry("Short", strategy.short, stop=up, comment="SuperTrend Sell")

// Take profit on trend change

if (changeCond and trend == -1)

strategy.close("Long", comment="SuperTrend Direction Change")

if (changeCond and trend == 1)

strategy.close("Short", comment="SuperTrend Direction Change")

// Initial Stop Loss

longStopLevel = up - pipValue

shortStopLevel = dn + pipValue

// Trailing Stop Loss

var float longTrailStop = na

var float shortTrailStop = na

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

if (longTrailStop == na or close > strategy.position_avg_price + trailingValue)

longTrailStop := high - trailingValue

strategy.exit("Stop Loss Long", from_entry="Long", stop=longTrailStop)

if (strategy.position_size < 0) // Short position

if (shortTrailStop == na or close < strategy.position_avg_price - trailingValue)

shortTrailStop := low + trailingValue

strategy.exit("Stop Loss Short", from_entry="Short", stop=shortTrailStop)

// Initial Exit

strategy.exit("Initial Stop Loss Long", from_entry="Long", stop=longStopLevel)

strategy.exit("Initial Stop Loss Short", from_entry="Short", stop=shortStopLevel)

- Multi-EMA Trend-Following Swing Trading Strategy dengan manajemen risiko berbasis ATR

- Pemecahan Struktur dengan Konfirmasi Volume Multi-kondisi Strategi Perdagangan Cerdas

- Strategi Trading Tren Stop-Loss Dinamis Multi-Indicator

- Tren multi-kondisi mengikuti strategi perdagangan kuantitatif berdasarkan tingkat retracement Fibonacci

- Strategi Trading Rata-rata Bergerak Cerdas Penembusan Tren Multi-Filter

- Strategi Trading Volatilitas Multi-Indikator RSI-EMA-ATR

- Triple Supertrend dan Bollinger Bands Multi-Indicator Trend Mengikuti Strategi

- Multi-Trendline Breakout Momentum Strategi Kuantitatif

- Sistem Manajemen Modal Berbasis Kekuatan Tren RSI dan ADX

- Trend Multi-Timeframe Mengikuti Strategi dengan Take Profit dan Stop Loss berbasis ATR

- Strategi Trend Following Advanced dengan Adaptive Trailing Stop

- Strategi Perdagangan Intraday Multi-Filter MACD dan RSI

- Strategi Perdagangan Arbitrage Berbasis Hubungan Harga Antara Dua Pasar

- Strategi Trading berbasis RSI dengan Take Profit dan Stop Loss berbasis Persentase

- Strategi Kombinasi MACD dan Martingale untuk Optimalisasi Perdagangan Panjang

- Elliott Wave Stochastic EMA Strategi

- Bollinger Bands dan Moving Average Crossover Strategy

- Strategi Crossover SMA Dual Moving Average

- 10SMA dan MACD Dual Trend Mengikuti Strategi Trading

- Strategi perdagangan alami gabungan MACD dan RSI

- Strategi Breakout Tinggi-Rendah dalam Kerangka Waktu Dinamis

- Smooth Moving Average Stop Loss & Take Profit Strategy dengan Trend Filter dan Exception Exit

- Strategi Konvergensi MACD dengan R: R, Batas Harian, dan Stop Loss yang lebih ketat

- Starlight Moving Average Crossover Strategi

- Persentase ambang Strategi perdagangan kuantitatif

- Strategi crossover rata-rata bergerak berdasarkan rata-rata bergerak ganda

- Strategi Kombinasi MACD dan Supertrend

- Strategi Beli/Jual Berdasarkan Volume & Pola Lilin

- Trend SMA Mengikuti Strategi dengan Stop-Loss Belakang dan Re-Entry Disiplin

- EMA dan Bollinger Bands Breakout Strategy

- CDC Action Zone Trading Bot Strategy dengan ATR untuk mengambil keuntungan dan menghentikan kerugian