Analisis Teknis Multi-Periode dan Strategi Perdagangan Sentimen Pasar

Penulis:ChaoZhang, Tanggal: 2024-11-12 15:52:16Tag:SMAMACDRSI

Gambaran umum

Strategi ini adalah sistem perdagangan yang komprehensif yang menggabungkan beberapa indikator teknis dan sentimen pasar. Strategi inti memanfaatkan sinyal silang dari Rata-rata Gerak Sederhana (SMA) jangka pendek dan jangka panjang, dikombinasikan dengan indikator MACD untuk konfirmasi tren. Selain itu, strategi ini mengintegrasikan indikator sentimen pasar (RSI) dan sistem pengenalan pola grafik, termasuk pola ganda atas / bawah dan kepala dan bahu. Strategi ini dirancang khusus untuk dilaksanakan selama sesi perdagangan tertentu untuk meningkatkan efisiensi dan tingkat keberhasilan.

Prinsip Strategi

Strategi ini beroperasi berdasarkan komponen inti berikut:

- Sistem rata-rata bergerak multi-periode: Menggunakan SMA 10-periode dan 30-periode untuk identifikasi tren

- Indikator MACD: Menggunakan parameter standar (12,26,9) untuk konfirmasi tren

- Pemantauan sentimen pasar: Menggunakan indikator RSI untuk kondisi overbought/oversold

- Pengakuan pola grafik: Termasuk identifikasi otomatis pola ganda atas/bawah dan kepala dan bahu

- Filter waktu: Fokus pada sesi perdagangan tertentu

- Identifikasi tingkat resistensi: Menggunakan 20 periode lookback untuk menentukan tingkat resistensi utama

Kondisi pembelian membutuhkan: berada dalam sesi perdagangan target, SMA jangka pendek melintasi SMA jangka panjang, dan MACD menunjukkan sinyal bullish. Kondisi jual membutuhkan: Harga mencapai tingkat resistensi utama dan MACD menunjukkan sinyal bearish.

Keuntungan Strategi

- Konfirmasi sinyal multi-dimensi: Menggabungkan indikator teknis dan pola grafik meningkatkan keandalan sinyal

- Manajemen risiko yang komprehensif: Termasuk mekanisme keluar awal berdasarkan RSI

- Integrasi sentimen pasar: Menggunakan indikator RSI untuk penilaian sentimen pasar untuk menghindari perdagangan yang berlebihan

- Pengakuan pola otomatis: Mengurangi bias dari penilaian subjektif

- Penyaringan waktu: Fokus pada periode aktivitas pasar yang tinggi untuk meningkatkan efisiensi

Risiko Strategi

- Sensitivitas parameter: Beberapa parameter indikator teknis dapat mempengaruhi kinerja strategi

- Risiko lag: Rata-rata bergerak dan MACD memiliki lag yang melekat

- Keakuratan pengenalan pola: Sistem pengenalan otomatis dapat menghasilkan sinyal palsu

- Ketergantungan lingkungan pasar: Dapat menghasilkan sinyal palsu yang sering di berbagai pasar

- Pembatasan waktu: Perdagangan hanya selama sesi tertentu dapat melewatkan peluang di periode lain

Arahan Optimasi

- Penyesuaian parameter: Memperkenalkan mekanisme penyesuaian parameter adaptif berdasarkan volatilitas pasar

- Sistem bobot sinyal: Menetapkan sistem bobot untuk berbagai sinyal indikator untuk meningkatkan akurasi keputusan

- Optimasi stop-loss: Tambahkan mekanisme stop-loss dinamis untuk meningkatkan kontrol risiko

- Peningkatan pengenalan pola: Masukkan algoritma pembelajaran mesin untuk meningkatkan akurasi pengenalan pola grafik

- Perpanjangan periode backtest: Melakukan pengujian di berbagai siklus pasar untuk memverifikasi stabilitas strategi

Ringkasan

Ini adalah strategi perdagangan komprehensif yang membangun sistem perdagangan yang relatif lengkap melalui kombinasi beberapa indikator teknis dan sentimen pasar. Kekuatan strategi terletak pada konfirmasi sinyal multi-dimensi dan mekanisme manajemen risiko yang komprehensif, meskipun menghadapi tantangan dalam sensitivitas parameter dan akurasi pengenalan pola.

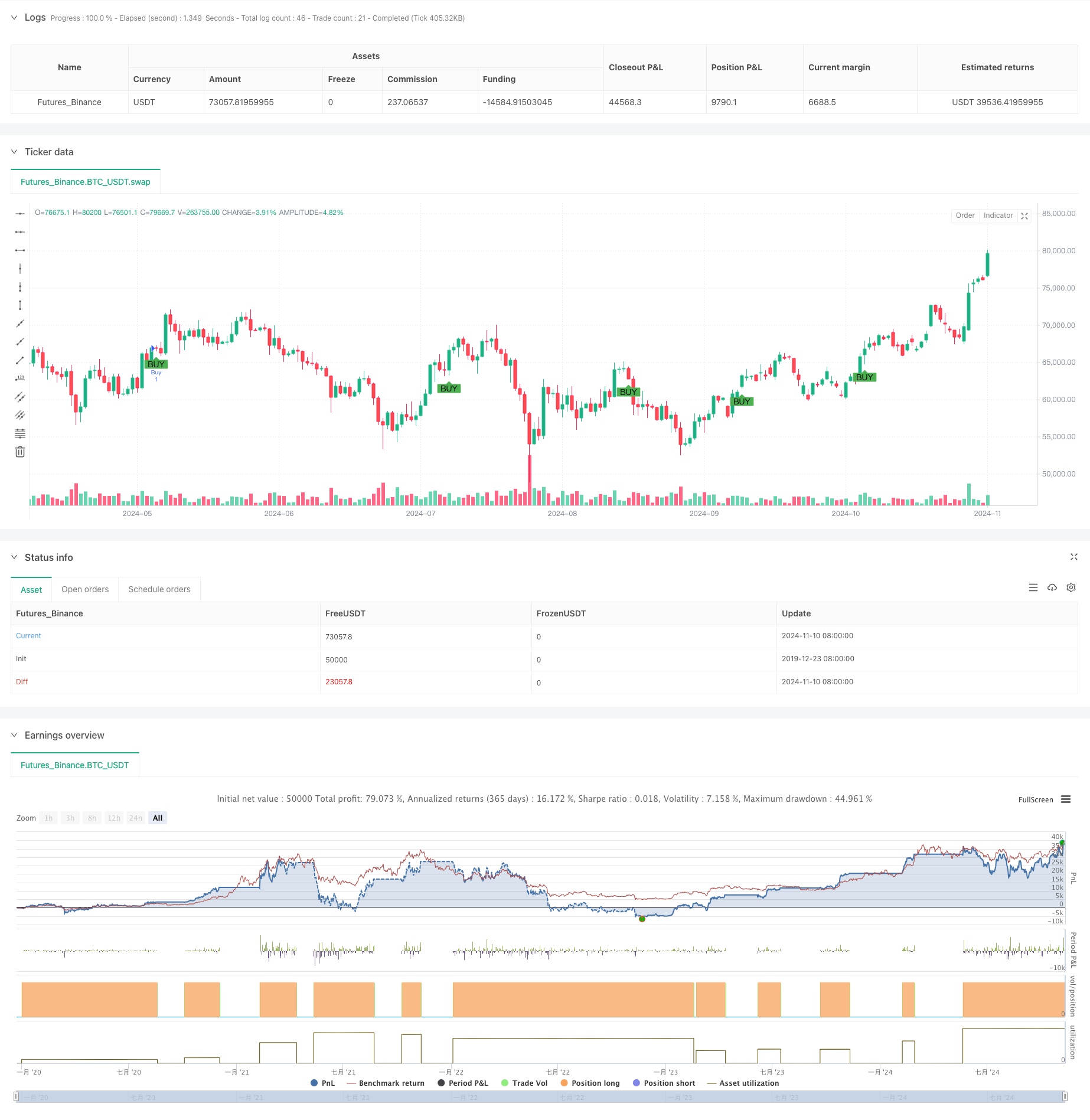

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment + Chart Patterns", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Time filtering: only trade during New York session (12:00 PM - 9:00 PM UTC)

isNewYorkSession = true

// Define buy condition based on SMA, MACD, and New York session

buyCondition = isNewYorkSession and ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance during New York session

sellCondition = isNewYorkSession and close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// ------ Chart Patterns ------ //

// Double Top/Bottom Pattern Detection

doubleTop = ta.highest(close, 50) == close[25] and ta.highest(close, 50) == close[0] // Approximate double top: two peaks

doubleBottom = ta.lowest(close, 50) == close[25] and ta.lowest(close, 50) == close[0] // Approximate double bottom: two troughs

// Head and Shoulders Pattern Detection

shoulder1 = ta.highest(close, 20)[40]

head = ta.highest(close, 20)[20]

shoulder2 = ta.highest(close, 20)[0]

isHeadAndShoulders = shoulder1 < head and shoulder2 < head and shoulder1 == shoulder2

// Pattern-based signals

patternBuyCondition = isNewYorkSession and doubleBottom and rsi < rsiOversold // Buy at double bottom in oversold conditions

patternSellCondition = isNewYorkSession and (doubleTop or isHeadAndShoulders) and rsi > rsiOverbought // Sell at double top or head & shoulders in overbought conditions

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition or patternBuyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance or pattern sell)

if (sellCondition or patternSellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition or patternBuyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition or patternSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// ------ Alerts for Patterns ------ //

// Add alert for pattern-based buy condition

alertcondition(patternBuyCondition, title="Pattern Buy Signal Activated", message="Double Bottom or Pattern Buy signal activated: Conditions met.")

// Add alert for pattern-based sell condition

alertcondition(patternSellCondition, title="Pattern Sell Signal Activated", message="Double Top or Head & Shoulders detected. Sell signal triggered.")

// Existing alerts for SMA/MACD-based conditions

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")

- Sistem Perdagangan Tren Multi-Indikator dengan Strategi Analisis Momentum

- Strategi Perdagangan Intraday Multi-Filter MACD dan RSI

- Kombinasi Momentum SMA Crossover Strategy dengan Sentiment Pasar dan Resistance Level Optimization System

- MACD-RSI Crossover Trend Mengikuti Strategi dengan Sistem Optimasi Bollinger Bands

- RSI, MACD, Bollinger Bands dan Strategi Perdagangan Hibrida Berbasis Volume

- Tren Saluran Rata-rata Bergerak Ganda Mengikuti Strategi

- SMA-RSI-MACD Multi-Indicator Dynamic Limit Order Trading Strategy

- Strategi perdagangan waktu cerdas dengan osilator momentum ganda

- Strategi Perdagangan Kuantitatif Multi-Indikator - Super Indikator 7-in-1 Strategi

- Multi-Faktor Dinamis Adaptive Trend Mengikuti Strategi

- Sistem Trading Trend Breakout dengan Moving Average (Strategi TBMA)

- Strategi Multi-Trend Following berbasis ATR dengan Sistem Optimasi Take-Profit dan Stop-Loss

- Sistem Perdagangan Smart Adaptif berbasis Momentum RSI dengan Manajemen Risiko Multi-level

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization (Strategi Perdagangan Dinamis RSI yang Adaptif dengan Optimasi Ambang)

- RSI dan AO Synergistic Trend Setelah Strategi Perdagangan Kuantitatif

- Adaptive Trend Momentum RSI Strategy dengan Sistem Filter Moving Average

- Dual Moving Average Cross RSI Momentum Strategy dengan Sistem Optimasi Risiko-Reward

- Sistem Strategi Dinamis Crossover Multi-Indikator: Model Perdagangan Kuantitatif Berdasarkan EMA, RVI dan Sinyal Perdagangan

- RSI Dynamic Range Reversal Quantitative Strategy dengan Volatility Optimization Model

- Bollinger Bands Momentum Trend Mengikuti Strategi Kuantitatif

- Strategi periode kepemilikan dinamis berdasarkan pola pembalikan 123 poin

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Analisis Integrasi Berdasarkan EMA, RSI dan ADX

- Strategi Perdagangan Divergensi SAR Parabolik

- Kombinasi Momentum SMA Crossover Strategy dengan Sentiment Pasar dan Resistance Level Optimization System

- Momentum RSI Multi-Periode dan Tren EMA Triple Mengikuti Strategi Komposit

- Trend Momentum Rata-rata Bergerak Berbagai Mengikuti Strategi

- E9 Shark-32 Pattern Strategi Penembusan Harga Kuantitatif

- Eksposur Pasar Terbuka Penyesuaian Posisi Dinamis Strategi Perdagangan Kuantitatif

- Tren Tingkat Menang Tinggi Artinya Strategi Perdagangan Reversi

- Strategi Momentum Tren RSI Rata-rata Bergerak Ganda