多期技術分析と市場情勢取引戦略

作者: リン・ハーンチャオチャン,日付: 2024年11月12日 15:52:16タグ:SMAマックドRSI

概要

この戦略は,複数の技術指標と市場情緒を組み合わせた包括的な取引システムである.コア戦略は,トレンド確認のためにMACD指標と組み合わせた短期および長期のシンプル・ムービング・平均値 (SMA) のクロスオーバー信号を利用する.さらに,この戦略は,市場情勢指標 (RSI) とチャートパターン認識システム,ダブルトップ/ボトムとヘッド&ショルダーパターンを含む.この戦略は,効率性と成功率を改善するために特定の取引セッション中に実行するように特別に設計されている.

戦略の原則

この戦略は,次の主要な要素に基づいています.

- 多期移動平均値システム: 10期および30期SMAを使用してトレンドを特定する

- MACD指標: 傾向の確認のために標準パラメータ (12,26,9) を使用する

- 市場情勢の監視: 過買い/過売状況のRSI指標を使用

- グラフパターンの認識: 双重上/下,頭と肩のパターンの自動識別を含む

- 時間フィルタリング: 特定の取引セッションに焦点を当てた

- 抵抗レベル識別:主要抵抗レベルを決定するために20期回顧を使用して

購入条件は: ターゲット取引セッション内にあり,短期SMAが長期SMAを超越し,MACDが上昇信号を示している. 販売条件は:価格が主要レジスタンスレベルに達し MACDが下落シグナルを示している.

戦略 の 利点

- 多次元信号確認:技術指標とチャートパターンを組み合わせることで信号の信頼性が向上します

- 総合的なリスク管理:RSIに基づく早期離脱メカニズムを含む

- 市場情勢統合:過剰な取引を避けるために市場情勢判断のためにRSI指標を使用する

- 自動パターン認識:主観的な判断による偏見を減らす

- 時間のフィルタリング:効率の向上のために,市場活動が活発な時期に焦点を当てます

戦略リスク

- パラメータ敏感性:複数の技術指標のパラメータが戦略の業績に影響を与える可能性がある

- 遅延リスク: 移動平均値とMACDには固有の遅延がある.

- パターン認識の精度:自動認識システムは誤った信号を生成する可能性があります.

- 市場環境による依存: 異なる市場で頻繁に誤った信号を生む可能性があります.

- 時間制限: 特定のセッションでの取引のみは,他の期間の機会を逃す可能性があります.

オプティマイゼーションの方向性

- パラメータ調整: 市場変動に基づく適応性のあるパラメータ調整メカニズムを導入する

- シグナル重量化システム:意思決定の正確性を向上させるために,様々な指標信号の重量化システムを確立する

- ストップ・ロスの最適化:リスク管理を強化するために動的ストップ・ロスのメカニズムを追加

- パターン認識の強化: グラフパターン認識の精度を向上させるために機械学習アルゴリズムを組み込む

- バックテスト期間延長: 戦略の安定性を検証するために,異なる市場サイクルにわたってテストを行う.

概要

この戦略は,複数の技術指標と市場情勢の組み合わせによって比較的完全な取引システムを確立する包括的な取引戦略である.この戦略の強みは多次元信号確認と包括的なリスク管理メカニズムにあるが,パラメータ敏感性とパターン認識の正確性において課題に直面している.特にパラメータ適応および機械学習アプリケーションにおいて,継続的な最適化と改善を通じて,この戦略はパフォーマンス向上の可能性を持っている.

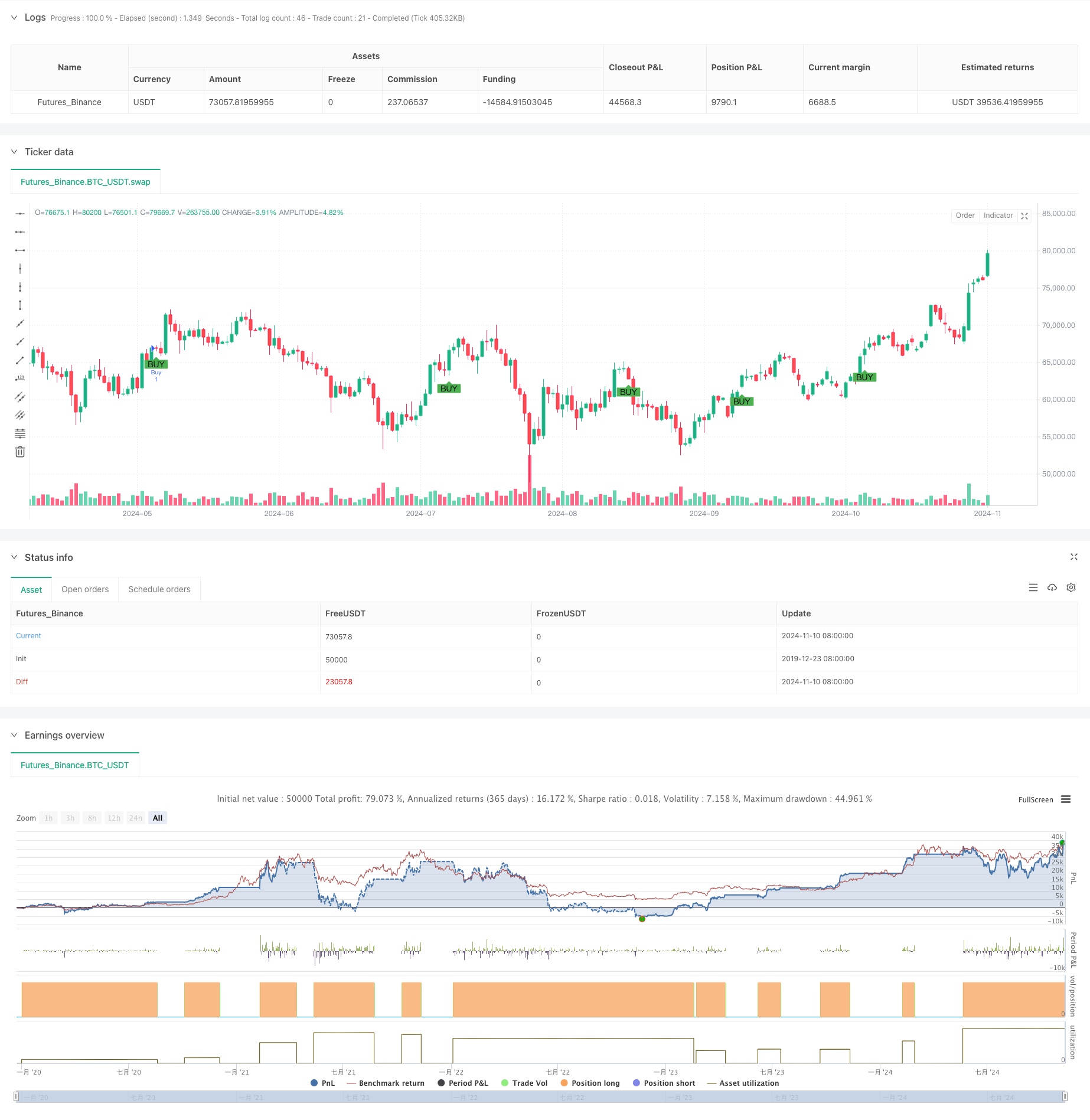

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("XAUUSD SMA with MACD & Market Sentiment + Chart Patterns", overlay=true)

// Input parameters for moving averages

shortSMA_length = input.int(10, title="Short SMA Length", minval=1)

longSMA_length = input.int(30, title="Long SMA Length", minval=1)

// MACD settings

[macdLine, signalLine, _] = ta.macd(close, 12, 26, 9)

// Lookback period for identifying major resistance (swing highs)

resistance_lookback = input.int(20, title="Resistance Lookback Period", tooltip="Lookback period for identifying major resistance")

// Calculate significant resistance (local swing highs over the lookback period)

major_resistance = ta.highest(close, resistance_lookback)

// Calculate SMAs

shortSMA = ta.sma(close, shortSMA_length)

longSMA = ta.sma(close, longSMA_length)

// RSI for market sentiment

rsiLength = input.int(14, title="RSI Length", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought Level", minval=50, maxval=100)

rsiOversold = input.int(30, title="RSI Oversold Level", minval=0, maxval=50)

rsi = ta.rsi(close, rsiLength)

// Time filtering: only trade during New York session (12:00 PM - 9:00 PM UTC)

isNewYorkSession = true

// Define buy condition based on SMA, MACD, and New York session

buyCondition = isNewYorkSession and ta.crossover(shortSMA, longSMA) and macdLine > signalLine

// Define sell condition: only sell if price is at or above the identified major resistance during New York session

sellCondition = isNewYorkSession and close >= major_resistance and macdLine < signalLine

// Define sentiment-based exit conditions

closeEarlyCondition = strategy.position_size < 0 and rsi > rsiOverbought // Close losing trade early if RSI is overbought

holdWinningCondition = strategy.position_size > 0 and rsi < rsiOversold // Hold winning trade if RSI is oversold

// ------ Chart Patterns ------ //

// Double Top/Bottom Pattern Detection

doubleTop = ta.highest(close, 50) == close[25] and ta.highest(close, 50) == close[0] // Approximate double top: two peaks

doubleBottom = ta.lowest(close, 50) == close[25] and ta.lowest(close, 50) == close[0] // Approximate double bottom: two troughs

// Head and Shoulders Pattern Detection

shoulder1 = ta.highest(close, 20)[40]

head = ta.highest(close, 20)[20]

shoulder2 = ta.highest(close, 20)[0]

isHeadAndShoulders = shoulder1 < head and shoulder2 < head and shoulder1 == shoulder2

// Pattern-based signals

patternBuyCondition = isNewYorkSession and doubleBottom and rsi < rsiOversold // Buy at double bottom in oversold conditions

patternSellCondition = isNewYorkSession and (doubleTop or isHeadAndShoulders) and rsi > rsiOverbought // Sell at double top or head & shoulders in overbought conditions

// Execute strategy: Enter long position when buy conditions are met

if (buyCondition or patternBuyCondition)

strategy.entry("Buy", strategy.long)

// Close the position when the sell condition is met (price at resistance or pattern sell)

if (sellCondition or patternSellCondition and not holdWinningCondition)

strategy.close("Buy")

// Close losing trades early if sentiment is against us

if (closeEarlyCondition)

strategy.close("Buy")

// Visual cues for buy and sell signals

plotshape(series=buyCondition or patternBuyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition or patternSellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// ------ Alerts for Patterns ------ //

// Add alert for pattern-based buy condition

alertcondition(patternBuyCondition, title="Pattern Buy Signal Activated", message="Double Bottom or Pattern Buy signal activated: Conditions met.")

// Add alert for pattern-based sell condition

alertcondition(patternSellCondition, title="Pattern Sell Signal Activated", message="Double Top or Head & Shoulders detected. Sell signal triggered.")

// Existing alerts for SMA/MACD-based conditions

alertcondition(buyCondition, title="Buy Signal Activated", message="Buy signal activated: Short SMA has crossed above Long SMA and MACD is bullish.")

alertcondition(sellCondition, title="Sell at Major Resistance", message="Sell triggered at major resistance level.")

alertcondition(closeEarlyCondition, title="Close Losing Trade Early", message="Sentiment is against your position, close trade.")

alertcondition(holdWinningCondition, title="Hold Winning Trade", message="RSI indicates oversold conditions, holding winning trade.")

関連性

- 動向分析戦略を持つ多指標トレンド取引システム

- MACDとRSI 多フィルター・イントラデイ・トレーディング・戦略

- 市場情勢とレジスタンスレベル最適化システムとの組み合わせたモメンタムSMAクロスオーバー戦略

- MACD-RSIクロスオーバートレンド ボリンジャーバンド最適化システムによる戦略をフォローする

- RSI,MACD,ボリンジャー帯とボリュームベースのハイブリッド取引戦略

- 戦略をフォローするダブル移動平均チャネルトレンド

- SMA-RSI-MACD マルチインジケータ ダイナミック・リミット・オーダー・トレーディング・戦略

- 双勢オシレータースマートタイム取引戦略

- 多指標量的な取引戦略 - スーパー指標7対1戦略

- 多因子動的適応傾向 戦略をフォローする

もっと

- トレンド・ブレイク・トレーディング・システム (TBMA戦略)

- ATRベースの多トレンドフォロー戦略,利益とストップ損失最適化システム

- RSI モメントベースのスマートアダプティブ・トレーディング・システム

- アダプティブ RSI オシレーター

値最適化によるダイナミック・トレーディング・戦略 - RSIとAOの相乗効果傾向 定量的な取引戦略

- アダプティブ・トレンド・モメンタム・RSI戦略 移動平均フィルターシステム

- リスク・リターン最適化システムを持つ二重移動平均のクロスRSIモメント戦略

- 多指標クロスオーバー・ダイナミック・戦略システム: EMA,RVI,取引信号に基づく定量的な取引モデル

- RSI 動的範囲逆転 変動最適化モデルによる定量戦略

- ボリンジャー・バンドの動向傾向は定量戦略に従っている

- ダイナミックホールディング期間の戦略 123 ポイント逆転パターンに基づく

- マルチテクニカルインジケータークロスオーバーモメント量的な取引戦略 - EMA,RSI,ADXに基づく統合分析

- パラボリック SAR ダイバージェンツ取引戦略

- 市場情勢とレジスタンスレベル最適化システムとの組み合わせたモメンタムSMAクロスオーバー戦略

- 複合戦略をフォローする多期RSIモメンタムと三重EMAトレンド

- 戦略をフォローする多動平均勢力の傾向

- E9 サメ32 パターン 定量的な価格ブレイク戦略

- オープンマーケット ダイナミックポジション調整 定量取引戦略

- 高勝率トレンドは逆転トレード戦略を意味する

- 2つの移動平均RSIトレンドモメンタム戦略