Trend Dinamis Mengikut Strategi

Penulis:ChaoZhang, Tarikh: 2024-06-03 16:57:51Tag:ATR

Ringkasan

Strategi ini menggunakan penunjuk Supertrend untuk menangkap trend pasaran. Indikator Supertrend menggabungkan harga dan turun naik, dengan garis hijau yang menunjukkan trend menaik dan garis merah yang menunjukkan trend menurun. Strategi ini menghasilkan isyarat beli dan jual dengan mengesan perubahan warna garis indikator, sambil menggunakan garis indikator sebagai tahap stop-loss dinamik. Strategi ini juga menggabungkan logik stop-loss dan mengambil keuntungan tetap untuk mengoptimumkan prestasi.

Prinsip Strategi

- Mengira rentang atas (atas) dan bawah (dn) penunjuk Supertrend dan menentukan arah trend semasa (trend) berdasarkan hubungan antara harga penutupan dan rentang atas dan bawah.

- Menghasilkan isyarat beli (buySignal) apabila trend berubah dari ke bawah (-1) ke atas (1), dan menghasilkan isyarat jual (sellSignal) apabila trend berubah dari ke atas (1) ke bawah (-1).

- Apabila isyarat beli dihasilkan, buka kedudukan panjang dan tetapkan band bawah (dn) sebagai tahap stop-loss; apabila isyarat jual dihasilkan, buka kedudukan pendek dan tetapkan band atas (up) sebagai tahap stop-loss.

- Memperkenalkan logik stop-loss, di mana tahap stop-loss dipindahkan ke atas / ke bawah apabila harga naik / jatuh oleh beberapa mata (trailingValue), menyediakan perlindungan stop-loss.

- Memperkenalkan logik mengambil keuntungan tetap, menutup kedudukan untuk keuntungan apabila trend berubah.

Kelebihan Strategi

- Kebolehsesuaian: Indikator Supertrend menggabungkan harga dan turun naik, yang membolehkannya menyesuaikan diri dengan keadaan pasaran dan instrumen perdagangan yang berbeza.

- Stop-loss dinamik: Menggunakan garis penunjuk sebagai tahap stop-loss dinamik dapat mengawal risiko dengan berkesan dan mengurangkan kerugian.

- Stop-loss: Memperkenalkan logik stop-loss boleh melindungi keuntungan apabila trend berterusan, meningkatkan keuntungan strategi.

- Isyarat yang jelas: Isyarat beli dan jual yang dihasilkan oleh strategi adalah jelas dan mudah dikendalikan dan dilaksanakan.

- Parameter fleksibel: Parameter strategi (seperti tempoh ATR, pengganda ATR, dll.) boleh diselaraskan berdasarkan ciri pasaran dan gaya perdagangan, meningkatkan kesesuaian.

Risiko Strategi

- Risiko parameter: Tetapan parameter yang berbeza boleh membawa kepada perbezaan yang ketara dalam prestasi strategi, yang memerlukan pengujian balik dan pengoptimuman parameter yang menyeluruh.

- Risiko pasaran yang bergolak: Dalam pasaran yang bergolak, perubahan trend yang kerap boleh menyebabkan strategi menghasilkan isyarat perdagangan yang berlebihan, meningkatkan kos transaksi dan risiko tergelincir.

- Risiko perubahan trend tiba-tiba: Apabila trend pasaran tiba-tiba berubah, strategi mungkin tidak dapat menyesuaikan kedudukan dengan tepat pada masanya, yang membawa kepada peningkatan kerugian.

- Risiko pengoptimuman yang berlebihan: Mengoptimumkan strategi yang berlebihan boleh menyebabkan pemasangan lengkung, yang mengakibatkan prestasi yang buruk di pasaran masa depan.

Arahan Pengoptimuman Strategi

- Menggabungkan analisis pelbagai jangka masa untuk mengesahkan kestabilan trend dan mengurangkan perdagangan yang kerap di pasaran yang bergelora.

- Menggabungkan penunjuk teknikal atau faktor asas lain untuk meningkatkan ketepatan penentuan trend.

- Mengoptimumkan logik stop-loss dan mengambil keuntungan, seperti memperkenalkan nisbah mengambil keuntungan dinamik atau nisbah risiko-balasan, untuk meningkatkan nisbah keuntungan-kerugian strategi.

- Melakukan ujian ketahanan pada parameter untuk memilih kombinasi parameter yang mengekalkan prestasi yang baik dalam keadaan pasaran yang berbeza.

- Memperkenalkan ukuran kedudukan dan peraturan pengurusan wang untuk mengawal risiko perdagangan individu dan risiko keseluruhan.

Ringkasan

Strategi Pengikut Trend Dinamik menggunakan penunjuk Supertrend untuk menangkap trend pasaran, mengawal risiko melalui stop-loss dinamik dan trailing stop-loss, sambil mengunci keuntungan dengan mengambil keuntungan tetap. Strategi ini dapat disesuaikan, mempunyai isyarat yang jelas, dan mudah dikendalikan. Walau bagaimanapun, dalam penerapan praktikal, perhatian harus diberikan kepada pengoptimuman parameter, risiko pasaran bergolak, dan risiko perubahan trend tiba-tiba. Dengan memperkenalkan analisis pelbagai jangka masa, mengoptimumkan logik stop-loss dan mengambil keuntungan, menjalankan ujian ketahanan parameter, dan melaksanakan langkah-langkah lain, prestasi dan kestabilan strategi dapat ditingkatkan lagi.

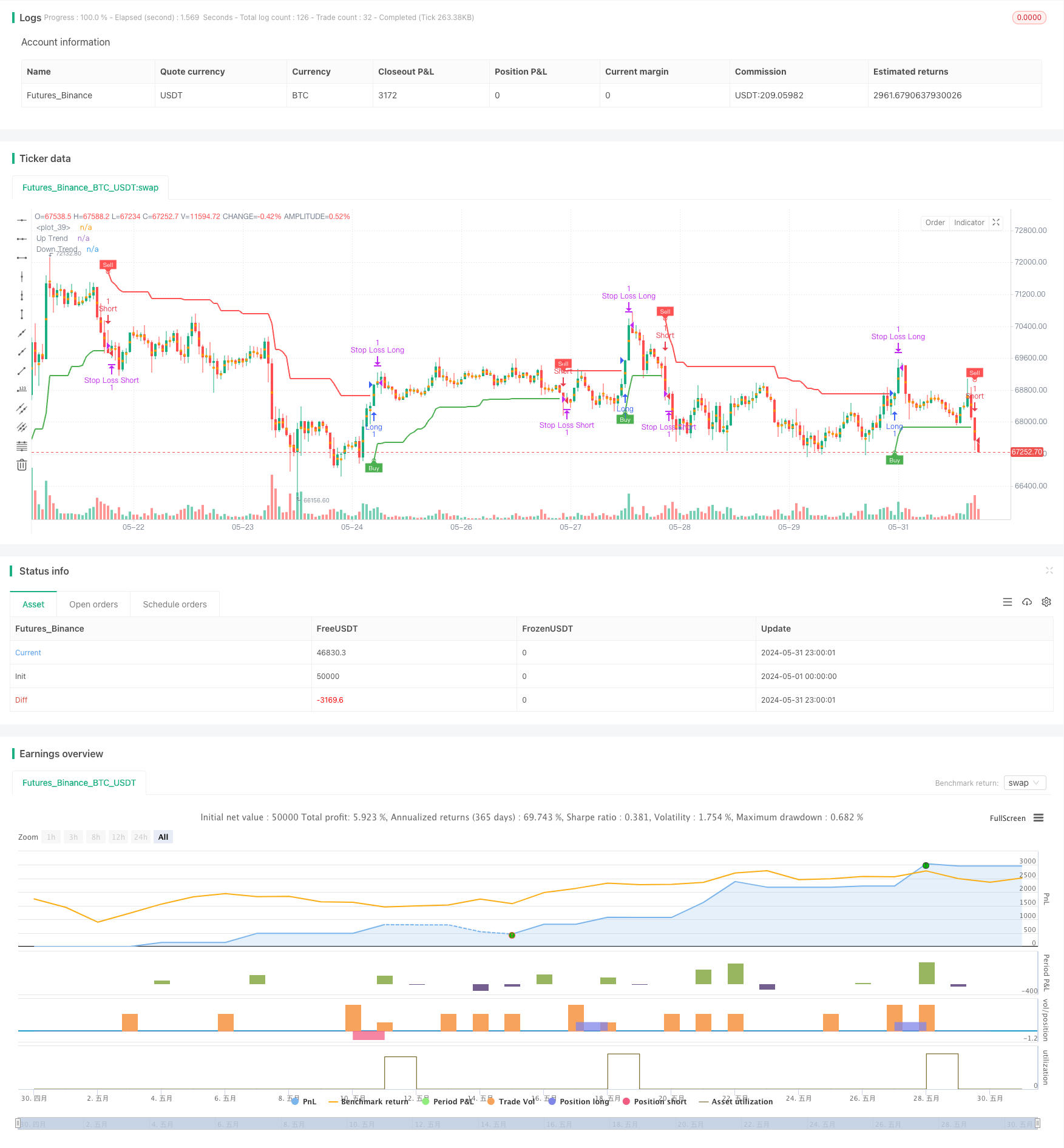

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Supertrend Strategy', overlay=true, format=format.price, precision=2)

Periods = input.int(title='ATR Period', defval=10)

src = input.source(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

changeATR = input.bool(title='Change ATR Calculation Method ?', defval=true)

showsignals = input.bool(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input.bool(title='Highlighter On/Off ?', defval=true)

// ATR calculation

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Supertrend calculations

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

// Trend direction

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plotting

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Highlighting

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

// Alerts

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

// Pip and trailing stop calculation

pips = 50

pipValue = syminfo.mintick * pips

trailingPips = 10

trailingValue = syminfo.mintick * trailingPips

// Strategy

if (buySignal)

strategy.entry("Long", strategy.long, stop=dn, comment="SuperTrend Buy")

if (sellSignal)

strategy.entry("Short", strategy.short, stop=up, comment="SuperTrend Sell")

// Take profit on trend change

if (changeCond and trend == -1)

strategy.close("Long", comment="SuperTrend Direction Change")

if (changeCond and trend == 1)

strategy.close("Short", comment="SuperTrend Direction Change")

// Initial Stop Loss

longStopLevel = up - pipValue

shortStopLevel = dn + pipValue

// Trailing Stop Loss

var float longTrailStop = na

var float shortTrailStop = na

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

if (longTrailStop == na or close > strategy.position_avg_price + trailingValue)

longTrailStop := high - trailingValue

strategy.exit("Stop Loss Long", from_entry="Long", stop=longTrailStop)

if (strategy.position_size < 0) // Short position

if (shortTrailStop == na or close < strategy.position_avg_price - trailingValue)

shortTrailStop := low + trailingValue

strategy.exit("Stop Loss Short", from_entry="Short", stop=shortTrailStop)

// Initial Exit

strategy.exit("Initial Stop Loss Long", from_entry="Long", stop=longStopLevel)

strategy.exit("Initial Stop Loss Short", from_entry="Short", stop=shortStopLevel)

- Trend Pelbagai Jangka Masa Mengikut Strategi dengan Pengurusan Volatiliti ATR

- Multi-SMA Support Level False Breakout Strategy dengan Sistem Stop-Loss ATR

- Z-Score dan Supertrend Berasaskan Strategi Dagangan Dinamis: Sistem Pemindahan Pendek Panjang

- Sistem Dagangan Stop-Loss Beradaptasi yang dioptimumkan AI dengan integrasi pelbagai penunjuk teknikal

- VWAP-ATR Sistem Dagangan Aksi Harga Dinamik

- Strategi pembalikan purata dengan Bollinger Bands, RSI dan Sistem Stop-Loss Dinamik berasaskan ATR

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)

- Strategi Dagangan Trend Lanjutan Berdasarkan Bollinger Bands dan Corak Candlestick

- Volatiliti ATR dan Trend Penyesuaian Berasaskan Purata Bergerak Berikutan Strategi Keluar

- Dual Timeframe Supertrend dengan Sistem Pengoptimuman RSI

- Sistem Dagangan Mengikut Trend Multi-Timeframe dengan Integrasi ATR dan MACD

- Strategi Dagangan Intraday Multi-Filter MACD dan RSI

- Strategi Perdagangan Arbitraj Berasaskan Hubungan Harga Antara Dua Pasaran

- Strategi Dagangan berasaskan RSI dengan mengambil keuntungan berasaskan peratusan dan menghentikan kerugian

- Strategi gabungan MACD dan Martingale untuk perdagangan panjang yang dioptimumkan

- Elliott Wave Stochastic EMA Strategi

- Bollinger Bands dan Strategi Crossover Purata Bergerak

- Strategi crossover purata bergerak berganda SMA

- 10SMA dan MACD Dual Trend Berikutan Strategi Dagangan

- Strategi Dagangan semula jadi gabungan MACD dan RSI

- Strategi Penembusan Jangka Masa Dinamik Tinggi-Rendah

- Smooth Moving Average Stop Loss & Take Profit Strategy dengan Penapis Trend dan Exception Exit

- Strategi Convergensi MACD dengan R: R, had harian, dan Stop Loss yang lebih ketat

- Starlight Moving Average Crossover Strategi

- Peratusan Sempadan Strategi Dagangan Kuantitatif

- Strategi crossover purata bergerak berdasarkan purata bergerak berganda

- Strategi Gabungan MACD dan Supertrend

- Strategi Beli / Jual Berdasarkan Bentuk Volume & Candlestick

- Trend SMA Mengikuti Strategi dengan Penghentian Kerugian Terakhir dan Masuk Kembali yang Disiplin

- EMA dan Bollinger Bands Breakout Strategy

- CDC Action Zone Strategi Bot Dagangan dengan ATR untuk mengambil keuntungan dan hentikan kerugian