Strategi Dagangan Dinamis RSI Osilator Beradaptasi dengan Pengoptimuman Sempadan

Penulis:ChaoZhang, Tarikh: 2024-11-12 16:07:32Tag:RSIATRBATLRSD

Ringkasan

Strategi ini adalah sistem dagangan adaptif berdasarkan Indeks Kekuatan Relatif (RSI), yang mengoptimumkan penjanaan isyarat perdagangan melalui penyesuaian dinamik ambang overbought dan oversold. Inovasi teras terletak pada pengenalan kaedah Adaptive Threshold (BAT) Bufi

Prinsip Strategi

Konsep teras adalah menaik taraf sistem RSI ambang tetap tradisional kepada sistem ambang dinamik.

- Menggunakan RSI jangka pendek untuk mengira keadaan pasaran yang terlalu banyak dibeli/terlalu banyak dijual

- Mengira cerun trend harga melalui regresi linear

- Pengukuran turun naik harga menggunakan penyimpangan standard

- Mengintegrasikan maklumat trend dan turun naik untuk menyesuaikan ambang RSI secara dinamik

- Meningkatkan ambang dalam aliran menaik dan menurunkan mereka dalam aliran menurun

- Mengurangkan sensitiviti ambang apabila harga menyimpang secara ketara dari purata

Strategi ini merangkumi dua mekanisme kawalan risiko:

- Penutupan kedudukan tempoh tetap

- Pendapatan yang diperolehi

Kelebihan Strategi

- Keupayaan penyesuaian dinamik yang kuat:

- Mengatur secara automatik ambang dagangan berdasarkan keadaan pasaran

- Mengelakkan kelemahan parameter tetap dalam persekitaran pasaran yang berbeza

- Kawalan Risiko Komprehensif:

- Had masa penyimpanan maksimum

- Perlindungan Stop Loss Modal

- Pengurusan kedudukan berasaskan peratusan

- Kualiti isyarat yang lebih baik:

- Mengurangkan isyarat palsu dalam pasaran berayun

- Meningkatkan keupayaan menangkap trend

- Mengimbangi kepekaan dan kestabilan

Risiko Strategi

- Sensitiviti parameter:

- Pilihan pekali BAT mempengaruhi prestasi strategi

- Tetapan tempoh RSI memerlukan ujian menyeluruh

- Parameter panjang adaptif memerlukan pengoptimuman

- Kebergantungan persekitaran pasaran:

- Mungkin terlepas peluang di pasaran volatiliti tinggi

- Kemungkinan pergeseran yang signifikan semasa turun naik yang melampau

- Parameter perlu disesuaikan untuk pasaran yang berbeza

- Sekatan teknikal:

- Mengandalkan data sejarah untuk pengiraan ambang

- Potensi kelewatan dalam penjanaan isyarat

- Kos dagangan perlu dipertimbangkan

Arahan Pengoptimuman Strategi

- Pengoptimuman Parameter:

- Memperkenalkan mekanisme pemilihan parameter adaptif

- Sesuaikan parameter secara dinamik untuk kitaran pasaran yang berbeza

- Tambah fungsi pengoptimuman parameter automatik

- Pengoptimuman Isyarat:

- Masukkan penunjuk teknikal tambahan untuk pengesahan

- Tambah fungsi pengenalan kitaran pasaran

- Mengoptimumkan penentuan masa kemasukan

- Pengoptimuman Kawalan Risiko:

- Melaksanakan mekanisme stop-loss dinamik

- Mengoptimumkan strategi pengurusan kedudukan

- Tambah mekanisme kawalan pengeluaran

Ringkasan

Strategi perdagangan adaptif yang inovatif ini menangani batasan strategi RSI tradisional melalui pengoptimuman ambang dinamik. Strategi ini secara komprehensif mempertimbangkan trend pasaran dan turun naik, memaparkan keupayaan penyesuaian dan kawalan risiko yang kuat. Walaupun terdapat cabaran dalam pengoptimuman parameter, peningkatan dan pengoptimuman berterusan menjadikan strategi ini menjanjikan untuk perdagangan sebenar. Pedagang dinasihatkan untuk menjalankan pengujian balik dan pengoptimuman parameter yang menyeluruh sebelum pelaksanaan langsung, dengan penyesuaian yang sesuai berdasarkan ciri pasaran tertentu.

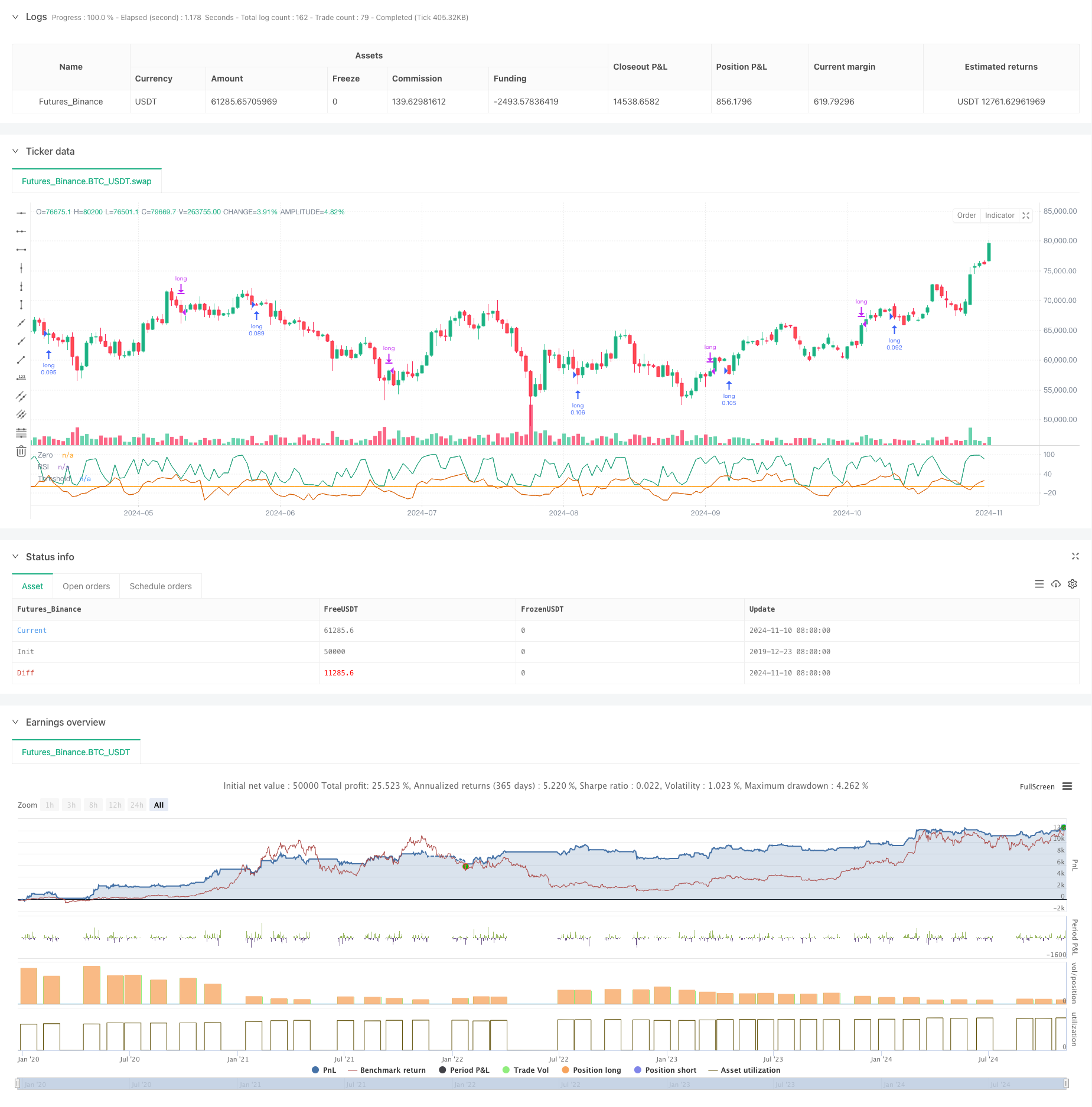

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PineCodersTASC

// TASC Issue: October 2024

// Article: Overbought/Oversold

// Oscillators: Useless Or Just Misused

// Article By: Francesco P. Bufi

// Language: TradingView's Pine Script™ v5

// Provided By: PineCoders, for tradingview.com

//@version=5

title ='TASC 2024.10 Adaptive Oscillator Threshold'

stitle = 'AdapThrs'

strategy(title, stitle, false, default_qty_type = strategy.percent_of_equity,

default_qty_value = 10, slippage = 5)

// --- Inputs ---

string sys = input.string("BAT", "System", options=["Traditional", "BAT"])

int rsiLen = input.int(2, "RSI Length", 1)

int buyLevel = input.int(14, "Buy Level", 0)

int adapLen = input.int(8, "Adaptive Length", 2)

float adapK = input.float(6, "Adaptive Coefficient")

int exitBars = input.int(28, "Fixed-Bar Exit", 1, group = "Strategy Settings")

float DSL = input.float(1600, "Dollar Stop-Loss", 0, group = "Strategy Settings")

// --- Functions ---

// Bufi's Adaptive Threshold

BAT(float price, int length) =>

float sd = ta.stdev(price, length)

float lr = ta.linreg(price, length, 0)

float slope = (lr - price[length]) / (length + 1)

math.min(0.5, math.max(-0.5, slope / sd))

// --- Calculations ---

float osc = ta.rsi(close, rsiLen)

// Strategy entry rules

// - Traditional system

if sys == "Traditional" and osc < buyLevel

strategy.entry("long", strategy.long)

// - BAT system

float thrs = buyLevel * adapK * BAT(close, adapLen)

if sys == "BAT" and osc < thrs

strategy.entry("long", strategy.long)

// Strategy exit rules

// - Fixed-bar exit

int nBar = bar_index - strategy.opentrades.entry_bar_index(0)

if exitBars > 0 and nBar >= exitBars

strategy.close("long", "exit")

// - Dollar stop-loss

if DSL > 0 and strategy.opentrades.profit(0) <= - DSL

strategy.close("long", "Stop-loss", immediately = true)

// Visuals

rsiColor = #1b9e77

thrsColor = #d95f02

rsiLine = plot(osc, "RSI", rsiColor, 1)

thrsLine = plot(sys == "BAT" ? thrs : buyLevel, "Threshold", thrsColor, 1)

zeroLine = plot(0.0, "Zero", display = display.none)

fill(zeroLine, thrsLine, sys == "BAT" ? thrs : buyLevel, 0.0, color.new(thrsColor, 60), na)

- Strategi Piramida Pintar Berbilang Penunjuk

- Strategi Dagangan Dinamis Beradaptasi Indikator Multi-Teknik (MTDAT)

- Strategi Perdagangan Pintar RSI Supertrend Jangka Masa Berganda

- Strategi Pembalikan Trend RSI

- Dual Timeframe Supertrend dengan Sistem Pengoptimuman RSI

- Strategi Crossover Regresi Linear Multi-Momentum

- Strategi Kuantitatif Trend Dinamik Berdasarkan Bollinger Bands dan RSI Cross

- RSI-ATR Momentum Volatiliti Strategi Dagangan Gabungan

- Strategi Integrasi RSI-Bollinger Bands: Sistem Dagangan Multi-Indikator yang Dinamis dan Sesuai Sendiri

- Strategi Kembalikan Selasa (Filter hujung minggu)

- Pertukaran purata bergerak berganda dengan strategi pengurusan risiko dinamik

- Mengambil kekuatan trend Multi-MA dengan strategi mengambil keuntungan momentum

- Sistem Dagangan Berpeluang Berpeluang

- Rata-rata Bergerak Berbilang Tahap dengan Sistem Dagangan Pengiktirafan Pola Candlestick

- Strategi Dagangan EMA Trend Momentum Multi-Timeframe

- Strategi Dagangan Berimbang Berasaskan Masa Berputar Pendek dan Lama

- Strategi Dagangan Kuantitatif Trend Dinamik MACD Lanjutan

- Sistem Dagangan Trend Breakout dengan Purata Bergerak (Strategi TBMA)

- ATR-Based Multi-Trend Following Strategy dengan Sistem Pengoptimuman Take-Profit dan Stop-Loss

- RSI Sistem Dagangan Beradaptasi Pintar Berasaskan Momentum dengan Pengurusan Risiko Berbilang Tahap

- RSI dan AO Trend Synergistic Berikutan Strategi Dagangan Kuantitatif

- Adaptive Trend Momentum RSI Strategy dengan Sistem Penapis Purata Bergerak

- Dual Moving Average Cross RSI Momentum Strategy dengan Sistem Pengoptimuman Risiko-Penghargaan

- Sistem Strategi Dinamik Crossover Multi-Indikator: Model Dagangan Kuantitatif Berdasarkan EMA, RVI dan Isyarat Dagangan

- Strategi Kuantitatif Pembalikan Julat Dinamik RSI dengan Model Optimasi Volatiliti

- Trend Momentum Bollinger Bands Berikutan Strategi Kuantitatif

- Analisis Teknikal Pelbagai Tempoh dan Strategi Perdagangan Sentimen Pasaran

- Strategi tempoh pegangan dinamik berdasarkan corak pembalikan 123 mata

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Analisis Integrasi Berdasarkan EMA, RSI dan ADX

- Strategi Perdagangan Perbezaan SAR Parabolik