Strategi Dagangan Kuasa Bull Bear dengan Sistem Ambil Keuntungan Dinamik Berasaskan Percentile Volume

Penulis:ChaoZhang, Tarikh: 2025-01-06 16:16:04Tag:BBPEMAATRTP

Ringkasan

Strategi ini menggabungkan penunjuk Bull Bear Power (BBP) dengan sistem mengambil keuntungan dinamik berbilang peringkat berdasarkan persentil jumlah. Ia mewujudkan sistem perdagangan yang adaptif dan terkawal risiko melalui analisis berbilang dimensi data harga, jumlah, dan momentum. Logik teras termasuk menggunakan nilai BBP yang dinormalisasi Z-Score sebagai pencetus isyarat perdagangan, sambil menggabungkan analisis persentil jumlah untuk penyesuaian mengambil keuntungan dinamik.

Prinsip Strategi

Pengiraan teras merangkumi beberapa komponen utama:

- Indikator BBP: Mengukur keseimbangan kuasa pasaran dengan menjumlahkan perbezaan antara harga tinggi dan EMA (kekuatan lembu) dan harga rendah dan EMA (kekuatan beruang).

- Normalisasi Z-Score: Menstandarisasi nilai BBP untuk menilai tahap penyimpangan kekuatan pasaran.

- Analisis Volume: Mengira jumlah semasa berbanding purata bergerak untuk mengukur aktiviti pasaran.

- Analisis Percentile: Mengira percentile sejarah harga dan jumlah untuk pengedaran kebarangkalian keadaan pasaran.

- Pendapatan Dinamis: Membetulkan tahap keuntungan berdasarkan penilaian komposit ATR, persentil jumlah, dan persentil harga.

Kelebihan Strategi

- Analisis Berbilang Dimensi: Menyediakan perspektif pasaran yang komprehensif melalui momentum harga, jumlah, dan kedudukan pasaran.

- Kebolehsesuaian yang tinggi: Sesuaikan dengan persekitaran pasaran yang berbeza melalui mekanisme mengambil keuntungan yang dinamik.

- Pembahagian risiko: Melaksanakan strategi mengambil keuntungan pelbagai peringkat untuk merealisasikan keuntungan pada tahap harga yang berbeza.

- Keunggulan Statistik: Mencapai kelebihan yang signifikan melalui Z-Score dan analisis persentil.

- Kebolehluasan: Rangka kerja membolehkan penambahan dimensi analisis baru dengan mudah.

Risiko Strategi

- Sensitiviti Parameter: Beberapa parameter memerlukan pengoptimuman untuk persekitaran pasaran yang berbeza.

- Kebergantungan kepada persekitaran pasaran: Mungkin kurang berprestasi semasa tempoh tidak menentu atau peralihan trend.

- Pelanggaran pelaksanaan: Perintah mengambil keuntungan pelbagai peringkat mungkin menghadapi pelepasan pelaksanaan.

- Kerumitan Pengiraan: Pengiraan masa nyata beberapa penunjuk boleh menyebabkan beban sistem.

- Risiko isyarat palsu: Boleh menghasilkan isyarat perdagangan yang salah di pasaran yang berbeza.

Arahan pengoptimuman

- Penyesuaian Parameter: Memperkenalkan kaedah pembelajaran mesin untuk pengoptimuman parameter automatik.

- Ramalan Pasaran: Tambah modul klasifikasi persekitaran pasaran untuk mengenal pasti keadaan buruk pada peringkat awal.

- Pengoptimuman Stop-Loss: Melaksanakan mekanisme stop-loss dinamik untuk meningkatkan kawalan risiko.

- Penapisan Isyarat: Tambah penapisan kekuatan trend untuk mengurangkan isyarat palsu.

- Pengurusan Posisi: Mengoptimumkan algoritma peruntukan kedudukan untuk meningkatkan kecekapan modal.

Ringkasan

Strategi ini menggabungkan penunjuk BBP tradisional dengan kaedah analisis kuantitatif moden untuk mewujudkan sistem perdagangan dengan asas teori yang kukuh dan kepraktisan yang kuat. Ia mencapai keseimbangan yang baik antara pulangan dan risiko melalui mekanisme mengambil keuntungan dan penyesuaian dinamik pelbagai peringkat. Walaupun pengoptimuman parameter menimbulkan beberapa cabaran, pengembangan kerangka strategi memberikan ruang yang cukup untuk penambahbaikan masa depan. Dalam aplikasi praktikal, peniaga harus membuat penyesuaian khusus berdasarkan ciri pasaran dan keutamaan risiko individu.

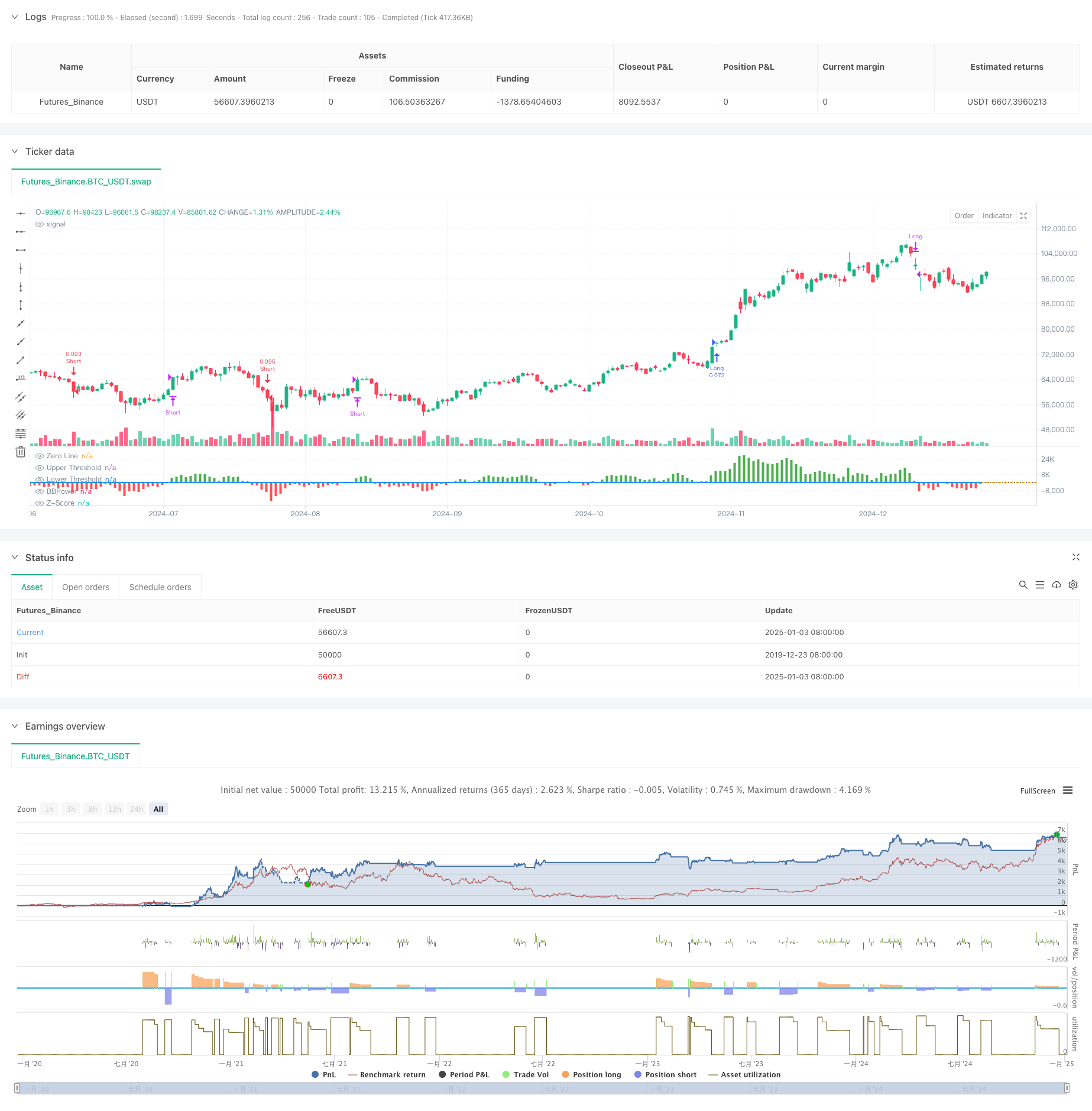

/*backtest

start: 2019-12-23 08:00:00

end: 2025-01-04 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © PresentTrading

// The BBP Strategy with Volume-Percentile TP by PresentTrading emerges as a sophisticated approach that integrates multiple analytical layers to enhance trading precision and profitability.

// Unlike traditional strategies that rely solely on price movements or volume indicators, this strategy synergizes Bollinger Bands Power (BBP) with volume percentile analysis to determine optimal entry and exit points. Additionally, it employs a dynamic take-profit mechanism based on ATR (Average True Range) multipliers adjusted by volume and percentile factors, ensuring adaptability to varying market conditions.

// This multi-faceted approach not only enhances signal accuracy but also optimizes risk management, setting it apart from conventional trading methodologies.

//@version=5

strategy("BBP Strategy with Volume-Percentile TP - Strategy [presentTrading] ", overlay=false, precision=3, commission_value= 0.1, commission_type=strategy.commission.percent, slippage= 1, currency=currency.USD, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, initial_capital=10000)

// ————————

// Bull Bear Power Strategy Settings

// ————————

lengthInput = input.int(21, "EMA Length")

zLength = input.int(252, "Z-Score Length")

zThreshold = input.float(1.618, "Z-Score Threshold")

// ————————

// Take Profit Settings

// ————————

tp_group = "Take Profit Settings"

// Enable/disable take profit function

useTP = input.bool(true, "Use Take Profit", group=tp_group)

// === ATR Base Settings ===

// ATR calculation period for determining base price movement range

baseAtrLength = input.int(20, "ATR Period", minval=1, group=tp_group, tooltip="ATR period for calculating base price movement range. Shorter periods are more sensitive to recent volatility")

// === Take Profit Multiplier Settings ===

// First take profit ATR multiplier, usually the most conservative target

atrMult1 = input.float(1.618, "TP1 ATR Multiplier", minval=0.1, step=0.1, group=tp_group, tooltip="First take profit level ATR multiplier, recommended 1.5-2.0")

// Second take profit ATR multiplier, medium profit target

atrMult2 = input.float(2.382, "TP2 ATR Multiplier", minval=0.1, step=0.1, group=tp_group, tooltip="Second take profit level ATR multiplier, recommended 2.5-3.0")

// Third take profit ATR multiplier, most aggressive target

atrMult3 = input.float(3.618, "TP3 ATR Multiplier", minval=0.1, step=0.1, group=tp_group, tooltip="Third take profit level ATR multiplier, recommended 4.0-5.0")

// === Position Size Allocation ===

// First take profit position size, usually larger for securing basic profits

tp1_size = input.float(13, "TP1 Position %", minval=1, maxval=100, group=tp_group, tooltip="Position size percentage for first take profit, recommended 30-40%")

// Second take profit position size, medium allocation

tp2_size = input.float(13, "TP2 Position %", minval=1, maxval=100, group=tp_group, tooltip="Position size percentage for second take profit, recommended 30-40%")

// Third take profit position size, usually smaller for catching larger moves

tp3_size = input.float(13, "TP3 Position %", minval=1, maxval=100, group=tp_group, tooltip="Position size percentage for third take profit, recommended 20-30%")

// ————————

// Volume Analysis Settings

// ————————

vol_group = "Volume Analysis Settings"

// Volume MA period for determining relative volume levels

vol_period = input.int(100, "Volume MA Period", minval=1, group=vol_group, tooltip="Period for calculating volume moving average, recommended 20-30")

// === Volume Level Thresholds ===

// High volume threshold relative to MA

vol_high = input.float(2.0, "High Volume Multiplier", minval=1.0, step=0.1, group=vol_group, tooltip="High volume threshold multiplier, typically 2x MA or above")

// Medium volume threshold

vol_med = input.float(1.5, "Medium Volume Multiplier", minval=1.0, step=0.1, group=vol_group, tooltip="Medium volume threshold multiplier, typically around 1.5x MA")

// Low volume threshold

vol_low = input.float(1.0, "Low Volume Multiplier", minval=0.5, step=0.1, group=vol_group, tooltip="Low volume threshold multiplier, typically around 1x MA")

// === Volume Adjustment Factors ===

// High volume adjustment factor, usually extends take profit targets

vol_high_mult = input.float(1.5, "High Volume Factor", minval=0.1, step=0.1, group=vol_group, tooltip="Take profit adjustment factor for high volume")

// Medium volume adjustment factor

vol_med_mult = input.float(1.3, "Medium Volume Factor", minval=0.1, step=0.1, group=vol_group, tooltip="Take profit adjustment factor for medium volume")

// Low volume adjustment factor

vol_low_mult = input.float(1.0, "Low Volume Factor", minval=0.1, step=0.1, group=vol_group, tooltip="Take profit adjustment factor for low volume")

// ————————

// Percentile Analysis Settings

// ————————

perc_group = "Percentile Analysis Settings"

// Percentile calculation period for evaluating price position

perc_period = input.int(100, "Percentile Period", minval=20, group=perc_group, tooltip="Historical period for percentile calculations, recommended 100-200")

// === Percentile Thresholds ===

// High percentile threshold, typically indicates relative high levels

perc_high = input.float(90, "High Percentile", minval=50, maxval=100, group=perc_group, tooltip="High level percentile threshold, typically above 90")

// Medium percentile threshold

perc_med = input.float(80, "Medium Percentile", minval=50, maxval=100, group=perc_group, tooltip="Medium level percentile threshold, typically around 80")

// Low percentile threshold

perc_low = input.float(70, "Low Percentile", minval=0, maxval=100, group=perc_group, tooltip="Low level percentile threshold, typically around 70")

// === Percentile Adjustment Factors ===

// High percentile adjustment factor

perc_high_mult = input.float(1.5, "High Percentile Factor", minval=0.1, step=0.1, group=perc_group, tooltip="Take profit adjustment factor for high percentile levels")

// Medium percentile adjustment factor

perc_med_mult = input.float(1.3, "Medium Percentile Factor", minval=0.1, step=0.1, group=perc_group, tooltip="Take profit adjustment factor for medium percentile levels")

// Low percentile adjustment factor

perc_low_mult = input.float(1.0, "Low Percentile Factor", minval=0.1, step=0.1, group=perc_group, tooltip="Take profit adjustment factor for low percentile levels")

// ————————

// Core Bull Bear Power Calculations

// ————————

emaClose = ta.ema(close, lengthInput)

bullPower = high - emaClose

bearPower = low - emaClose

bbp = bullPower + bearPower

bbp_mean = ta.sma(bbp, zLength)

bbp_std = ta.stdev(bbp, zLength)

zscore = (bbp - bbp_mean) / bbp_std

// ————————

// Volume & Percentile Analysis

// ————————

// 成交量分析

vol_sma = ta.sma(volume, vol_period)

vol_mult = volume / vol_sma

// 百分位數計算

calcPercentile(src) =>

var values = array.new_float(0)

array.unshift(values, src)

if array.size(values) > perc_period

array.pop(values)

array.size(values) > 0 ? array.percentrank(values, array.size(values)-1) * 100 : 50

price_perc = calcPercentile(close)

vol_perc = calcPercentile(volume)

// 止盈動態調整系數計算

getTpFactor() =>

vol_score = vol_mult > vol_high ? vol_high_mult : vol_mult > vol_med ? vol_med_mult : vol_mult > vol_low ? vol_low_mult : 0.8

price_score = price_perc > perc_high ? perc_high_mult :price_perc > perc_med ? perc_med_mult :price_perc > perc_low ? perc_low_mult : 0.8

math.avg(vol_score, price_score)

// ————————

// Entry/Exit Logic

// ————————

longCondition = ta.crossover(zscore, zThreshold)

shortCondition = ta.crossunder(zscore, -zThreshold)

exitLongCondition = ta.crossunder(zscore, 0)

exitShortCondition = ta.crossover(zscore, 0)

if (barstate.isconfirmed)

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

if exitLongCondition

strategy.close("Long")

if exitShortCondition

strategy.close("Short")

// ————————

// Take Profit Execution

// ————————

if useTP and strategy.position_size != 0

base_move = ta.atr(baseAtrLength)

tp_factor = getTpFactor()

is_long = strategy.position_size > 0

entry_price = strategy.position_avg_price

if is_long

tp1_price = entry_price + (base_move * atrMult1 * tp_factor)

tp2_price = entry_price + (base_move * atrMult2 * tp_factor)

tp3_price = entry_price + (base_move * atrMult3 * tp_factor)

strategy.exit("TP1", "Long", qty_percent=tp1_size, limit=tp1_price)

strategy.exit("TP2", "Long", qty_percent=tp2_size, limit=tp2_price)

strategy.exit("TP3", "Long", qty_percent=tp3_size, limit=tp3_price)

else

tp1_price = entry_price - (base_move * atrMult1 * tp_factor)

tp2_price = entry_price - (base_move * atrMult2 * tp_factor)

tp3_price = entry_price - (base_move * atrMult3 * tp_factor)

strategy.exit("TP1", "Short", qty_percent=tp1_size, limit=tp1_price)

strategy.exit("TP2", "Short", qty_percent=tp2_size, limit=tp2_price)

strategy.exit("TP3", "Short", qty_percent=tp3_size, limit=tp3_price)

// ————————

// Plotting

// ————————

plot(bbp, color=bbp >= 0 ? color.new(color.green, 0) : color.new(color.red, 0),

title="BBPower", style=plot.style_columns)

hline(0, "Zero Line", color=color.gray, linestyle=hline.style_dotted)

plot(zscore, title="Z-Score", color=color.blue, linewidth=2)

hline(zThreshold, "Upper Threshold", color=color.orange, linestyle=hline.style_dashed)

hline(-zThreshold, "Lower Threshold", color=color.orange, linestyle=hline.style_dashed)

- Trend Dinamik Mengikut dengan Strategi Ambil Keuntungan dan Hentikan Kerugian yang Tepat

- Trend Dinamik Mengikut Strategi Menggabungkan Supertrend dan EMA

- Strategi Crossover Purata Bergerak Eksponensial yang Diuruskan Risiko Dinamik

- Strategi Dagangan Trend Purata Bergerak Eksponensial Tiga

- EMA Advanced Crossover Trend Following Strategy dengan Sistem Pengurusan Hentian Dinamik berasaskan ATR

- Sistem Strategi Dinamik Crossover Multi-Indikator: Model Dagangan Kuantitatif Berdasarkan EMA, RVI dan Isyarat Dagangan

- MACD Crossover Momentum Strategy dengan Dynamic Take Profit dan Stop Loss Optimization

- Sistem Pengurusan Modal Berasaskan Momentum RSI dan ADX Trend Strength

- Adaptive Moving Average Crossover dengan strategi Stop-Loss yang mengikut

- Strategi Dagangan Swing Panjang/Pendek Dinamik dengan Sistem Isyarat Crossover Purata Bergerak

- Strategi Perdagangan corak candlestick pelbagai jangka masa

- Algoritma Perdagangan Trend Dinamik Supertrend Multi-Timeframe

- Strategi Dagangan Rintisan MACD Lanjutan dengan Pengurusan Risiko Beradaptasi

- Strategi Penangkapan Trend Kuantitatif Berdasarkan Analisis Panjang Wick Candlestick

- Strategi Perdagangan Penembusan VWAP Penyimpangan Standar Ganda Statistik

- Strategi Grid Panjang Berdasarkan Pengeluaran dan Matlamat Keuntungan

- Tren silang purata bergerak dinamik mengikut strategi dengan sistem pengurusan risiko ATR

- Multi-Indicator Optimized KDJ Trend Crossover Strategy Berdasarkan Sistem Dagangan Pola Stochastic Dinamis

- Trend Purata Bergerak Berbilang Jangka Masa Heikin-Ashi Mengikut Sistem Dagangan

- Tren Dinamis yang Disesuaikan Volatiliti Mengikuti Strategi Berdasarkan Penunjuk DI dengan Pengurusan Hentian ATR

- Z-Score Normal Isyarat Linear Strategi Dagangan Kuantitatif

- Strategi Perdagangan Trend Inteligent Stochastic Berbilang Parameter

- Multi-EMA Cross dengan Strategi Dagangan Volume-Price Momentum

- Sistem Perdagangan Trend Penembusan Tahap Harga Berbilang Tempoh Berdasarkan Tahap Harga Utama

- Strategi Dagangan Retracement Fibonacci Lanjutan Mengikuti Trend dan Pembalikan

- EMA Advanced Crossover Trend Following Strategy dengan Sistem Pengurusan Hentian Dinamik berasaskan ATR

- Strategi Dagangan Bollinger Bands dengan isyarat pulangan rasional

- Trend purata bergerak berbilang tempoh mengikut strategi silang VWAP

- Pilihan sinergi RSI-Rata-rata Bergerak Berganda Strategi Dagangan Kuantitatif

- Advanced WaveTrend dan EMA Ribbon Fusion Trading Strategy