Tendência dinâmica na sequência da estratégia

Autora:ChaoZhang, Data: 2024-06-03 16:57:51Tags:ATR

Resumo

Esta estratégia utiliza o indicador Supertrend para capturar tendências de mercado. O indicador Supertrend combina preço e volatilidade, com uma linha verde indicando uma tendência de alta e uma linha vermelha indicando uma tendência de queda. A estratégia gera sinais de compra e venda detectando mudanças na cor da linha do indicador, enquanto usa a linha do indicador como um nível dinâmico de stop-loss. A estratégia também incorpora trailing stop-loss e lógica fixa de take-profit para otimizar o desempenho.

Princípio da estratégia

- Calcular as faixas superior (superior) e inferior (dn) do indicador Supertrend e determinar a direção da tendência atual (tendência) com base na relação entre o preço de fechamento e as faixas superior e inferior.

- Gerar um sinal de compra (buySignal) quando a tendência muda de descendente (-1) para ascendente (1), e gerar um sinal de venda (sellSignal) quando a tendência muda de ascendente (1) para descendente (-1).

- Quando for gerado um sinal de compra, abrir uma posição longa e definir a faixa inferior (dn) como o nível de stop-loss; quando for gerado um sinal de venda, abrir uma posição curta e definir a faixa superior (up) como o nível de stop-loss.

- Introduzir a lógica de stop-loss de trailing, em que o nível de stop-loss é movido para cima/para baixo quando o preço sobe/desce por um determinado número de pontos (trailingValue), proporcionando uma proteção de stop-loss.

- Introduzir uma lógica fixa de lucro, fechando a posição para lucro quando a tendência muda.

Vantagens da estratégia

- Adaptabilidade: O indicador Supertrend combina preço e volatilidade, permitindo-lhe adaptar-se a diferentes condições de mercado e instrumentos de negociação.

- A utilização da linha do indicador como nível dinâmico de stop loss pode controlar eficazmente o risco e reduzir as perdas.

- Trailing stop-loss: A introdução de uma lógica de stop-loss pode proteger os lucros quando a tendência continua, aumentando a rentabilidade da estratégia.

- Sinais claros: os sinais de compra e venda gerados pela estratégia são claros e fáceis de operar e executar.

- Parâmetros flexíveis: Os parâmetros da estratégia (como período ATR, multiplicador ATR, etc.) podem ser ajustados com base nas características do mercado e no estilo de negociação, melhorando a adaptabilidade.

Riscos estratégicos

- Risco de parâmetros: diferentes definições de parâmetros podem levar a diferenças significativas no desempenho da estratégia, exigindo um exame retrospectivo completo e otimização de parâmetros.

- Risco de mercado instável: em mercados instáveis, mudanças frequentes de tendência podem fazer com que a estratégia gere sinais de negociação excessivos, aumentando os custos de transação e o risco de deslizamento.

- Risco de mudança súbita de tendência: quando as tendências do mercado mudam subitamente, a estratégia pode não ser capaz de ajustar as posições em tempo útil, o que leva a maiores perdas.

- Risco de otimização excessiva: a otimização excessiva da estratégia pode levar à adaptação da curva, resultando em um desempenho fraco nos mercados futuros.

Orientações para a otimização da estratégia

- Incorporar análises de vários prazos para confirmar a estabilidade das tendências e reduzir a frequência das negociações em mercados instáveis.

- Combinar outros indicadores técnicos ou fatores fundamentais para melhorar a precisão da determinação da tendência.

- Otimizar a lógica de stop-loss e take-profit, como a introdução de uma relação dinâmica take-profit ou risco-recompensa, para melhorar a relação lucro-perda da estratégia.

- Realizar testes de robustez de parâmetros para selecionar combinações de parâmetros que mantenham um bom desempenho em diferentes condições de mercado.

- Introduzir regras de dimensionamento das posições e de gestão de fundos para controlar o risco comercial individual e o risco global.

Resumo

A estratégia de seguimento de tendência dinâmica utiliza o indicador de supertendência para capturar tendências de mercado, controlando o risco através de stop-loss dinâmico e stop-loss de rastreamento, enquanto bloqueia lucros com take-profit fixo. A estratégia é adaptável, tem sinais claros e é fácil de operar. No entanto, na aplicação prática, deve-se prestar atenção à otimização de parâmetros, risco de mercado agitado e risco de mudança súbita de tendência.

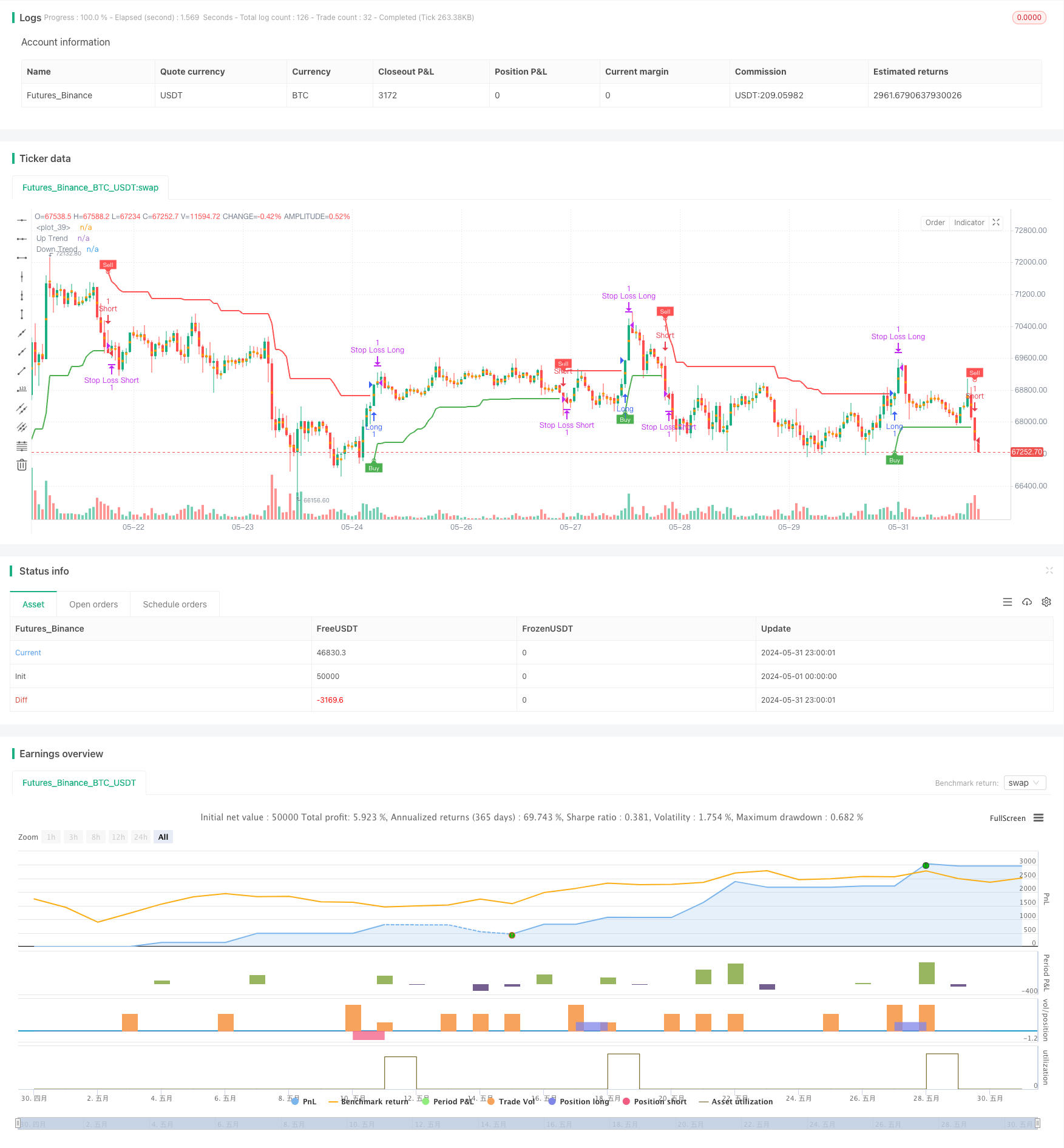

/*backtest

start: 2024-05-01 00:00:00

end: 2024-05-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Supertrend Strategy', overlay=true, format=format.price, precision=2)

Periods = input.int(title='ATR Period', defval=10)

src = input.source(hl2, title='Source')

Multiplier = input.float(title='ATR Multiplier', step=0.1, defval=3.0)

changeATR = input.bool(title='Change ATR Calculation Method ?', defval=true)

showsignals = input.bool(title='Show Buy/Sell Signals ?', defval=true)

highlighting = input.bool(title='Highlighter On/Off ?', defval=true)

// ATR calculation

atr2 = ta.sma(ta.tr, Periods)

atr = changeATR ? ta.atr(Periods) : atr2

// Supertrend calculations

up = src - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

dn = src + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

// Trend direction

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

// Plotting

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

buySignal = trend == 1 and trend[1] == -1

plotshape(buySignal ? up : na, title='UpTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

plotshape(buySignal and showsignals ? up : na, title='Buy', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(color.green, 0), textcolor=color.new(color.white, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

sellSignal = trend == -1 and trend[1] == 1

plotshape(sellSignal ? dn : na, title='DownTrend Begins', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

plotshape(sellSignal and showsignals ? dn : na, title='Sell', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(color.red, 0), textcolor=color.new(color.white, 0))

// Highlighting

mPlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0)

longFillColor = highlighting ? trend == 1 ? color.green : color.white : color.white

shortFillColor = highlighting ? trend == -1 ? color.red : color.white : color.white

fill(mPlot, upPlot, title='UpTrend Highligter', color=longFillColor, transp=90)

fill(mPlot, dnPlot, title='DownTrend Highligter', color=shortFillColor, transp=90)

// Alerts

alertcondition(buySignal, title='SuperTrend Buy', message='SuperTrend Buy!')

alertcondition(sellSignal, title='SuperTrend Sell', message='SuperTrend Sell!')

changeCond = trend != trend[1]

alertcondition(changeCond, title='SuperTrend Direction Change', message='SuperTrend has changed direction!')

// Pip and trailing stop calculation

pips = 50

pipValue = syminfo.mintick * pips

trailingPips = 10

trailingValue = syminfo.mintick * trailingPips

// Strategy

if (buySignal)

strategy.entry("Long", strategy.long, stop=dn, comment="SuperTrend Buy")

if (sellSignal)

strategy.entry("Short", strategy.short, stop=up, comment="SuperTrend Sell")

// Take profit on trend change

if (changeCond and trend == -1)

strategy.close("Long", comment="SuperTrend Direction Change")

if (changeCond and trend == 1)

strategy.close("Short", comment="SuperTrend Direction Change")

// Initial Stop Loss

longStopLevel = up - pipValue

shortStopLevel = dn + pipValue

// Trailing Stop Loss

var float longTrailStop = na

var float shortTrailStop = na

if (strategy.opentrades > 0)

if (strategy.position_size > 0) // Long position

if (longTrailStop == na or close > strategy.position_avg_price + trailingValue)

longTrailStop := high - trailingValue

strategy.exit("Stop Loss Long", from_entry="Long", stop=longTrailStop)

if (strategy.position_size < 0) // Short position

if (shortTrailStop == na or close < strategy.position_avg_price - trailingValue)

shortTrailStop := low + trailingValue

strategy.exit("Stop Loss Short", from_entry="Short", stop=shortTrailStop)

// Initial Exit

strategy.exit("Initial Stop Loss Long", from_entry="Long", stop=longStopLevel)

strategy.exit("Initial Stop Loss Short", from_entry="Short", stop=shortStopLevel)

- Estratégia de negociação de balanço de tendência multi-EMA com gestão de risco baseada em ATR

- Rompimento da estrutura com confirmação de volume Estratégia de negociação inteligente multicondicional

- Estratégia de negociação de tendência de stop-loss dinâmico de múltiplos indicadores

- Tendência multicondicional na sequência de uma estratégia de negociação quantitativa baseada em níveis de retracement de Fibonacci

- Estratégia de negociação de média móvel inteligente de tendência de avanço com vários filtros

- Estratégia RSI-EMA-ATR de negociação de volatilidade com vários indicadores

- Triple Supertrend e Bandas de Bollinger Tendência de múltiplos indicadores Seguindo estratégia

- Estratégia Quantitativa de Momento de Desvio de Tendências Multidireccional

- Sistema de Gestão de Capital Baseado na Força da Tendência do RSI e do ADX

- Tendência de múltiplos prazos após a estratégia com Take Profit e Stop Loss baseados em ATR

- Estratégia avançada de seguimento da tendência com parada de rastreamento adaptativa

- A estratégia de negociação intradiária com múltiplos filtros MACD e RSI

- Estratégia de negociação de arbitragem baseada na relação de preços entre dois mercados

- Estratégia de negociação baseada em RSI com percentagem baseada em Take Profit e Stop Loss

- Estratégia de combinação MACD e Martingale para negociação longa otimizada

- Estratégia de EMA estocástica de onda de Elliott

- Bandas de Bollinger e estratégia de cruzamento da média móvel

- Estratégia de cruzamento de média móvel dupla da SMA

- 10A tendência dupla do SMA e do MACD na sequência da estratégia de negociação

- MACD e RSI Combinada Estratégia de Negociação Natural

- Estratégia de ruptura dinâmica de prazo alto-baixo

- Estratégia de Stop Loss & Take Profit com filtro de tendência e saída de exceção

- Estratégia de convergência do MACD com R:R, limites diários e stop loss mais apertados

- Estratégia de cruzamento de média móvel de luz estelar

- Percentagem de limiar Estratégia quantitativa de negociação

- Estratégia de cruzamento de médias móveis baseada em médias móveis duplas

- Estratégia de combinação do MACD e da Supertrend

- Estratégia de compra/venda baseada em padrões de volume e candelabro

- Tendência da SMA seguindo a estratégia com stop-loss e reentrada disciplinada

- Estratégia de ruptura da EMA e das bandas de Bollinger

- CDC Zona de Ação Trading Bot Estratégia com ATR para tirar lucro e parar perda