Adaptive Trend Following Strategy Based on Fibonacci Retracement

Author: ChaoZhang, Date: 2024-07-31 14:14:04Tags: FIBONACCIFIBMATA

Overview

This strategy is a trend-following trading system based on the Fibonacci retracement principle. It utilizes Fibonacci levels to determine market trends and potential reversal points, executing trades based on these levels. The core of the strategy lies in identifying price crossovers with key Fibonacci levels as entry and exit signals. Additionally, the strategy incorporates a dynamic stop-loss and take-profit mechanism to manage risk and lock in profits.

Strategy Principles

-

Fibonacci Level Calculation: The strategy first calculates Fibonacci retracement levels based on the highest and lowest prices of the past 20 candles. It focuses on two key levels: 61.8% and 38.2%.

-

Trade Signal Generation:

- A long signal is triggered when the price crosses above the 61.8% level.

- A short signal is triggered when the price crosses below the 38.2% level.

-

Position Management: The strategy enters long or short positions directly when signals occur.

-

Stop-Loss and Take-Profit Settings:

- For long trades: Take-profit = Entry price + target_points Stop-loss = Entry price - stop_loss_points

- For short trades: Take-profit = Entry price - target_points Stop-loss = Entry price + stop_loss_points

-

Visualization: The strategy plots the 61.8% and 38.2% Fibonacci levels on the chart for easy observation by traders.

Strategy Advantages

-

High Adaptability: By dynamically calculating Fibonacci levels, the strategy can adapt to different market environments and volatilities.

-

Combines Trend Following and Reversal: The strategy captures both trend continuation (breakout of 61.8% level) and potential reversals (breakdown of 38.2% level), enhancing trading comprehensiveness.

-

Comprehensive Risk Management: Built-in dynamic stop-loss and take-profit mechanism effectively controls risk exposure for each trade.

-

Flexible Parameters: Allows users to customize the number of historical candles, target points, and stop-loss points to suit different trading styles and market characteristics.

-

Visual Support: Graphical display of Fibonacci levels helps traders intuitively understand market structure and potential support/resistance levels.

Strategy Risks

-

False Breakout Risk: In range-bound markets, price may frequently cross Fibonacci levels, leading to multiple false signals.

-

Slippage Impact: In highly volatile markets, actual execution prices may significantly deviate from signal prices.

-

Limitations of Fixed Stop-Loss and Take-Profit: Using fixed point values for stop-loss and take-profit may not be suitable for all market environments, especially when volatility changes significantly.

-

Overtrading Risk: Under certain market conditions, the strategy may generate too many trading signals, increasing transaction costs.

-

Single Timeframe Limitation: Relying solely on signals from a single timeframe may overlook larger market trends.

Strategy Optimization Directions

-

Introduce Trend Filters: Incorporate longer-term moving averages or ADX indicators to ensure trading in the direction of the main trend.

-

Dynamic Stop-Loss and Take-Profit: Adjust stop-loss and take-profit levels dynamically based on ATR (Average True Range) to adapt to different market volatilities.

-

Multi-Timeframe Analysis: Integrate Fibonacci levels from higher timeframes to improve trading decision reliability.

-

Add Volume Confirmation: Consider volume factors when generating signals to filter out low-quality breakouts.

-

Optimize Parameter Selection: Utilize backtesting data and machine learning algorithms to find optimal parameter combinations for different market environments.

-

Incorporate Other Technical Indicators: Combine RSI or MACD indicators to add confirmation mechanisms for trading signals.

-

Improve Entry Timing: Consider setting limit orders near Fibonacci levels instead of simple market orders to obtain better execution prices.

Conclusion

The Adaptive Trend Following Strategy Based on Fibonacci Retracement is a trading system that combines classical technical analysis principles with modern quantitative trading techniques. It seeks to balance trend continuation and potential reversals by dynamically identifying key price levels, providing traders with a flexible and systematic trading approach.

The core advantages of the strategy lie in its adaptability and risk management capabilities, allowing it to maintain relatively stable performance across different market environments. However, traders using this strategy need to be aware of potential risks such as false breakouts and overtrading, and consider introducing additional filtering mechanisms and multi-dimensional analysis to further enhance the strategy’s robustness.

Through continuous optimization and improvement, such as introducing dynamic stop-loss and take-profit mechanisms and multi-timeframe analysis, this strategy has the potential to become a more comprehensive and efficient trading system. Ultimately, traders need to personalize the strategy based on their own risk preferences and market insights to achieve optimal trading results.

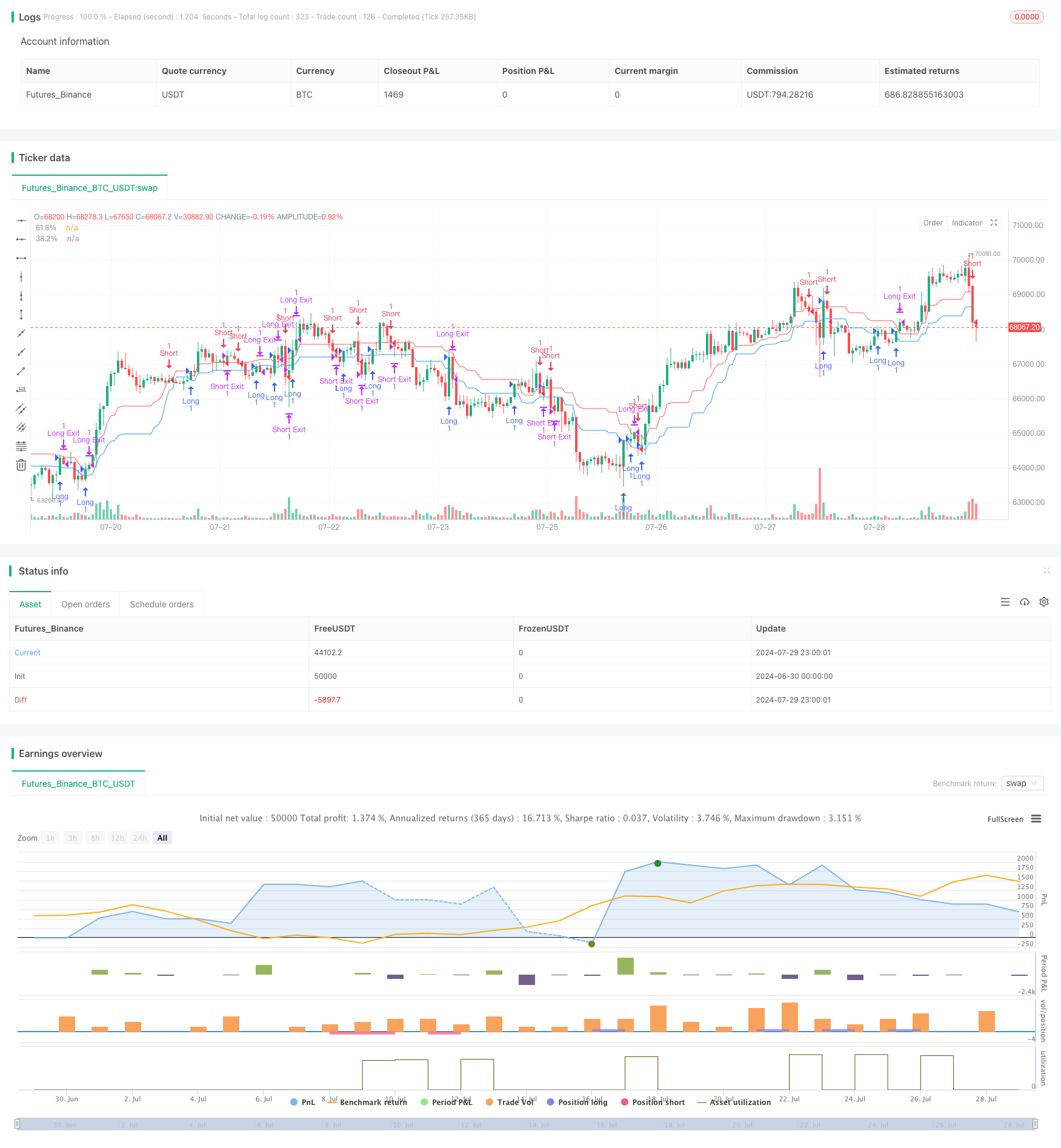

/*backtest

start: 2024-06-30 00:00:00

end: 2024-07-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fibonacci Retracement Strategy", overlay=true)

// Input parameters

fib_levels = input.bool(true, title="Show Fibonacci Levels")

n = input.int(20, title="Number of Historical Candles")

target_points = input.int(100, title="Target Points")

stop_loss_points = input.int(50, title="Stop Loss Points")

// Calculate Fibonacci levels

high_price = ta.highest(close, 20)

low_price = ta.lowest(close, 20)

range_ = high_price - low_price

fib618 = high_price - range_ * 0.618

fib382 = high_price - range_ * 0.382

// Strategy logic

long_condition = ta.crossover(close, fib618)

short_condition = ta.crossunder(close, fib382)

// Plot Fibonacci levels

plot(fib_levels ? fib618 : na , "61.8%", color=color.blue, trackprice=true)

plot(fib_levels ? fib382 : na , "38.2%", color=color.red, trackprice=true)

// Strategy entry and exit

if long_condition

strategy.entry("Long", strategy.long)

if short_condition

strategy.entry("Short", strategy.short)

// Calculate target and stop loss levels

long_target = strategy.position_avg_price + target_points

long_stop_loss = strategy.position_avg_price - stop_loss_points

short_target = strategy.position_avg_price - target_points

short_stop_loss = strategy.position_avg_price + stop_loss_points

// Strategy exit

strategy.exit("Long Exit", "Long", limit=long_target, stop=long_stop_loss)

strategy.exit("Short Exit", "Short", limit=short_target, stop=short_stop_loss)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Advanced Fibonacci Retracement and Volume-Weighted Price Action Trading Strategy

- Adaptive Multi-Level Trading Strategy Based on Fibonacci Retracement

- Crypto Big Move Stochastic RSI Strategy

- Continuous Candle Based Dynamic Grid Adaptive Moving Average with Dynamic Stop Loss Strategy

- SMA Dual Moving Average Trading Strategy

- Trend Catcher Strategy

- Moving Average Crossover Strategy

- MA Cross Strategy

- Cross-Market Overnight Position Strategy with EMA Filter

- Dual Moving Average Momentum Trading Strategy: Time-Optimized Trend Following System

- Enhanced EMA/WMA Crossover Strategy with Comprehensive Exit Conditions

- Supertrend and EMA Crossover Quantitative Trading Strategy

- EMA, SMA, Moving Average Crossover, Momentum Indicator

- Comprehensive Trading System Combining SMA Crossover Strategy with Fair Value Gap Pullback

- Dynamic Support-Resistance Breakout Moving Average Crossover Strategy

- Dynamic Trend Following with Precision Take-Profit and Stop-Loss Strategy

- Ichimoku Kinko Hyo Trend Following and Support Resistance Strategy

- Bollinger Bands Mean Reversion Trading Strategy with Dynamic Support

- MORNING CANDLE BREAKOUT AND REVERSION STRATEGY

- Advanced Markov Model Technical Indicator Fusion Trading Strategy

- Multi-Layer Volatility Band Trading Strategy

- Multi-Period Moving Average Crossover Strategy with Dynamic Volatility Filter

- Multi-Indicator Comprehensive Momentum Trading Strategy

- Triple EMA with Dynamic Support/Resistance Trading Strategy

- Dual RSI Strategy: Advanced Trend Capture System Combining Divergence and Crossover

- Lorenzian Classification Multi-Timeframe Target Strategy

- Dual Moving Average Trend Capture Strategy with Dynamic Stop-Loss and Filter

- Multi-Indicator Trend Following with Volume Confirmation Strategy

- Adaptive Quantitative Trading Strategy with Dual Moving Average Crossover and Take Profit/Stop Loss