ATR Volatility and Moving Average Based Adaptive Trend Following Exit Strategy

Author: ChaoZhang, Date: 2024-11-27 14:07:11Tags: ATRSMAMABAND

Overview

This is a trend following strategy based on ATR (Average True Range) bands and moving averages. The strategy utilizes the ATR indicator to dynamically adjust profit-taking and stop-loss positions, while using moving averages to determine market trend direction, achieving trend capture and risk control. The core of the strategy lies in using ATR bands as a dynamic exit mechanism, allowing the strategy to adaptively adjust position exit points based on market volatility changes.

Strategy Principles

The strategy consists of three core components:

- ATR Band Calculation: Uses 14-period ATR indicator, constructing upper and lower volatility bands by adding and subtracting 2 times the ATR value from the current closing price.

- Moving Average System: Employs a 50-period Simple Moving Average (SMA) as the basis for trend judgment.

- Trade Signal Generation:

- Entry Signal: Initiates a long position when price crosses above the moving average.

- Exit Signal: Closes positions when price touches either the upper or lower ATR band.

The strategy combines trend following with volatility management, enabling both market trend capture and dynamic risk exposure adjustment based on market volatility changes.

Strategy Advantages

- Strong Adaptability: ATR indicator automatically adjusts profit-taking and stop-loss positions based on market volatility changes, providing good market adaptability.

- Reasonable Risk Control: Effectively controls risk exposure for each trade through ATR multiplier settings.

- Robust Trend Capture: Effectively identifies market trend direction by incorporating moving averages.

- Flexible Parameter Settings: Can adapt to different market environments by adjusting ATR period, multiplier, and moving average period.

- Clear Execution Logic: Precise entry and exit conditions avoid interference from subjective judgment.

Strategy Risks

- Choppy Market Risk: May generate frequent false signals in sideways markets, leading to excessive trading costs.

- Slippage Risk: Actual execution prices may significantly deviate from theoretical prices during intense market volatility.

- Trend Reversal Risk: May not stop losses timely when market trends suddenly reverse.

- Parameter Optimization Risk: Optimal parameters may vary significantly across different market environments.

Strategy Optimization Directions

-

Incorporate Trend Strength Filtering:

- Add trend strength indicators like ADX or DMI to filter trading signals in weak trend environments.

- Adjust ATR multiplier in strong trend environments to capture larger profit potential.

-

Enhance Position Management:

- Dynamically adjust position size based on ATR values.

- Implement staged position building and reduction mechanisms.

-

Add Market Environment Recognition:

- Introduce volatility cycle analysis.

- Add market pattern recognition module.

-

Optimize Exit Mechanism:

- Implement dynamic profit protection.

- Add time-based stop-loss mechanism.

Summary

This strategy constructs an adaptive and risk-controlled trend following system by combining ATR bands and moving averages. The core advantage lies in its ability to dynamically adjust risk control positions based on market volatility changes while capturing market trend direction through moving averages. Although inherent risks exist, the proposed optimization directions can further enhance strategy stability and profitability. This is a practically valuable strategy framework suitable for in-depth research and application in live trading.

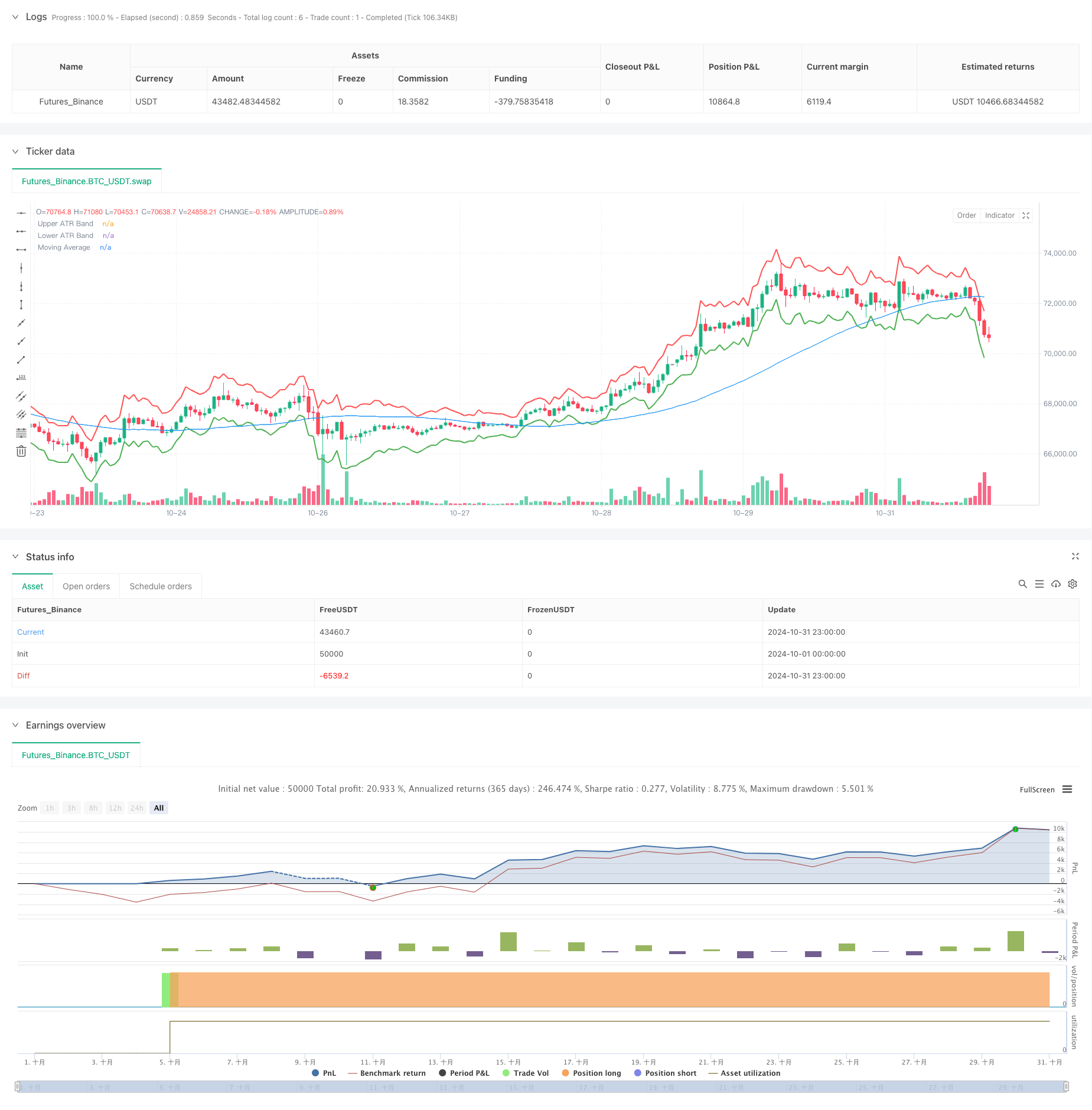

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("ATR Band Exit Strategy", overlay=true)

// Define input parameters

atrLength = input(14, title="ATR Length")

atrMultiplier = input(2.0, title="ATR Multiplier")

maLength = input(50, title="Moving Average Length")

// Calculate ATR and moving average

atrValue = ta.atr(atrLength)

maValue = ta.sma(close, maLength)

// Calculate upper and lower ATR bands

upperBand = close + atrMultiplier * atrValue

lowerBand = close - atrMultiplier * atrValue

// Plot ATR bands

plot(upperBand, title="Upper ATR Band", color=color.red, linewidth=2)

plot(lowerBand, title="Lower ATR Band", color=color.green, linewidth=2)

// Entry condition (for demonstration: long if price above moving average)

longCondition = ta.crossover(close, maValue)

if (longCondition)

strategy.entry("Long", strategy.long)

// Exit conditions (exit if price crosses the upper or lower ATR bands)

if (close >= upperBand)

strategy.close("Long", comment="Exit on Upper ATR Band")

if (close <= lowerBand)

strategy.close("Long", comment="Exit on Lower ATR Band")

// Optional: Plot the moving average for reference

plot(maValue, title="Moving Average", color=color.blue)

- MA, SMA, MA Slope, Trailing Stop Loss, Re-Entry

- Dynamic ATR Stop Loss and Take Profit Moving Average Crossover Strategy

- Dynamic Volatility Index (VIDYA) with ATR Trend-Following Reversal Strategy

- High/Low Breakout Strategy with Alpha Trend and Moving Average Filter

- Dual Moving Average Crossover Strategy with Dynamic Risk Management

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Multi-Indicator Fusion Mean Reversion Trend Following Strategy

- Dynamic Moving Average and Bollinger Bands Cross Strategy with Fixed Stop-Loss Optimization Model

- ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

- Adaptive Moving Average Crossover with Trailing Stop-Loss Strategy

- Adaptive Trend Following Strategy Based on Momentum Oscillator

- PVT-EMA Trend Crossover Volume-Price Strategy

- MACD-EMA Multi-Period Dynamic Crossover Quantitative Trading System

- MACD Dynamic Oscillation Cross-Prediction Strategy

- VWAP-ATR Dynamic Price Action Trading System

- Dynamic Trend Quantitative Strategy Based on Bollinger Bands and RSI Cross

- Mean Reversion Strategy with Bollinger Bands, RSI and ATR-Based Dynamic Stop-Loss System

- Dynamic Trading Strategy System Based on Parabolic SAR Indicator

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS)

- Advanced Trend Trading Strategy Based on Bollinger Bands and Candlestick Patterns

- Dual EMA Momentum Trend Trading Strategy with Full Body Candle Signal System

- Dual Timeframe Supertrend with RSI Optimization System

- Dual Moving Average Crossover Trend Following Strategy with Dynamic Stop-Loss and Take-Profit System

- Multi-Timeframe Trend Following Trading System with ATR and MACD Integration

- Dual Timeframe Supertrend RSI Intelligent Trading Strategy

- Dual MACD Price Action Breakout Trailing Strategy

- Multi-EMA Trend Momentum Recognition and Stop-Loss Trading System

- Dual EMA Volume Trend Confirmation Strategy for Quantitative Trading

- Dual EMA-RSI Crossover Strategy with Dynamic Take-Profit/Stop-Loss

- Enhanced Multi-Period Dynamic Adaptive Trend Following Trading System