Estrategia de convergencia del MACD con R:R, límites diarios y stop loss más ajustados

El autor:¿ Qué pasa?, Fecha: 2024-06-03 16:47:56Las etiquetas:El MACD

Resumen general

Esta estrategia utiliza la convergencia y divergencia del indicador MACD para generar señales comerciales. Cuando la línea MACD cruza la línea de señal, y el valor de la línea MACD es mayor que 1.5 o menor que -1.5, genera señales largas y cortas, respectivamente. La estrategia establece niveles fijos de toma de ganancias y stop-loss e introduce el concepto de relación riesgo-recompensa (R: R). Además, emplea límites de pérdida y ganancias máximas diarias y un stop-loss de seguimiento más ajustado para controlar mejor los riesgos.

Principio de la estrategia

- Calcular la línea MACD y la línea de señal del indicador MACD.

- Determinar las situaciones de cruce entre la línea MACD y la línea de señal, considerando al mismo tiempo si el valor de la línea MACD supera ciertos umbrales (1.5 y -1.5).

- Cuando aparezca una señal larga, abrir una posición larga con un precio de toma de ganancias del precio más alto actual + 600 unidades mínimas de tick y un precio de stop-loss del precio más bajo actual - 100 unidades mínimas de tick.

- Cuando aparezca una señal corta, abra una posición corta con un precio de toma de beneficio del precio más bajo actual - 600 unidades mínimas de tick y un precio de stop-loss del precio más alto actual + 100 unidades mínimas de tick.

- Introducir una lógica de stop-loss de seguimiento: cuando el precio suba (posición larga) o baje (posición corta) más de 300 unidades mínimas de tick en relación con el precio de entrada, mover el precio de stop-loss al precio de entrada + (precio de cierre - precio de entrada - 300) para posiciones largas o al precio de entrada - (precio de entrada - precio de cierre - 300) para posiciones cortas.

- Establecer límites máximos diarios de pérdida y ganancia: cuando la pérdida diaria alcance 600 unidades mínimas de tick o la ganancia alcance 1800 unidades mínimas de tick, cierre todas las posiciones.

Análisis de ventajas

- La combinación del indicador MACD con las condiciones de umbral de precios filtra efectivamente algunas señales de ruido.

- La relación riesgo-recompensación fija (R: R) hace que el riesgo y la recompensa de cada operación sean controlables.

- La lógica de stop-loss de seguimiento protege las ganancias después de que se forme una tendencia y reduce las reducciones.

- Los límites máximos diarios de pérdidas y ganancias ayudan a controlar la exposición diaria al riesgo y a evitar pérdidas o ganancias excesivas seguidas de retiros.

Análisis de riesgos

- El indicador MACD tiene un efecto de retraso, que puede dar lugar a señales retardadas o falsas.

- Los niveles fijos de toma de ganancias y de stop-loss pueden no adaptarse a las diferentes condiciones del mercado y podrían activarse con frecuencia en mercados inestables.

- La lógica de stop-loss de seguimiento puede no detener las pérdidas a tiempo durante las inversiones de tendencia, lo que conduce a la devolución de beneficios.

- Los límites máximos diarios de pérdida y ganancias pueden hacer que la estrategia cierre posiciones prematuramente cuando la tendencia diaria es clara, perdiendo beneficios potenciales.

Dirección de optimización

- Considere el uso de indicadores MACD de marcos de tiempo múltiples para confirmar las señales y mejorar la precisión de la señal.

- Ajustar dinámicamente los niveles de take profit y stop loss en función de la volatilidad del mercado para adaptarse a las diferentes condiciones del mercado.

- Optimizar la lógica de stop-loss posterior, como establecer la distancia de stop-loss posterior basada en el indicador ATR para una mejor adaptación a las fluctuaciones de precios.

- Optimizar los parámetros de los límites máximos diarios de pérdidas y ganancias para encontrar valores límite adecuados que controlen los riesgos y capten los movimientos de tendencia tanto como sea posible.

Resumen de las actividades

Esta estrategia utiliza la convergencia y la divergencia del indicador MACD para generar señales comerciales, al tiempo que introduce medidas de control de riesgos como la relación riesgo-recompensa, el stop-loss trasero y los límites diarios. Aunque la estrategia puede capturar los movimientos de tendencia y controlar los riesgos hasta cierto punto, todavía hay espacio para la optimización y mejora.

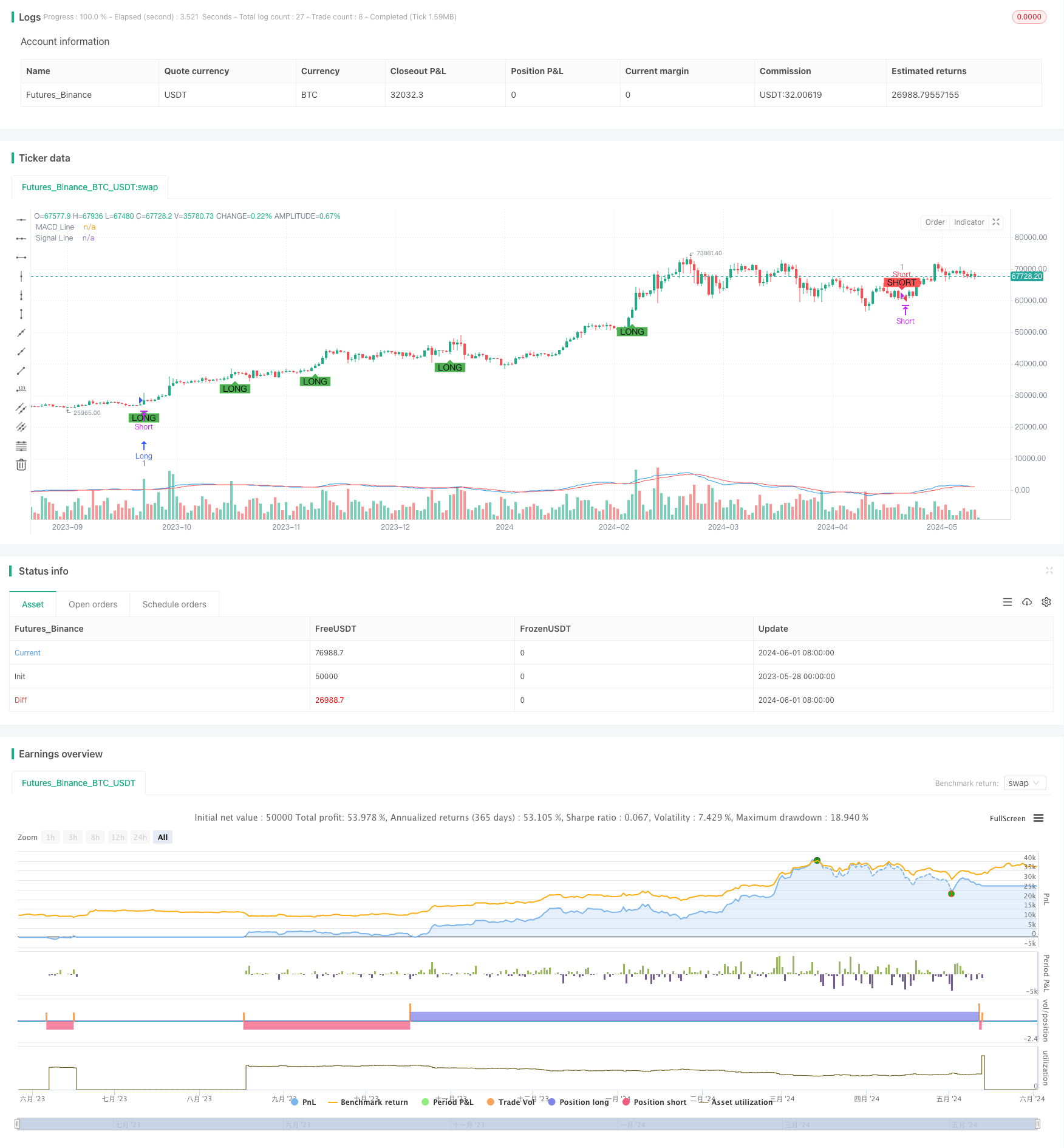

/*backtest

start: 2023-05-28 00:00:00

end: 2024-06-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © DD173838

//@version=5

strategy("MACD Convergence Strategy with R:R, Daily Limits, and Tighter Stop Loss", overlay=true, default_qty_type=strategy.fixed, default_qty_value=1)

// MACD settings

fastLength = input.int(12, title="Fast Length", minval=1)

slowLength = input.int(26, title="Slow Length", minval=1)

signalSmoothing = input.int(9, title="Signal Smoothing", minval=1)

source = input(close, title="Source")

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(source, fastLength, slowLength, signalSmoothing)

// Plot MACD and signal line

plot(macdLine, title="MACD Line", color=color.blue)

plot(signalLine, title="Signal Line", color=color.red)

// Define convergence conditions

macdConvergenceUp = ta.crossover(macdLine, signalLine) and macdLine > 1.5

macdConvergenceDown = ta.crossunder(macdLine, signalLine) and macdLine < -1.5

// Define take profit and stop loss

takeProfit = 600

stopLoss = 100

// Plot buy and sell signals on the chart

plotshape(series=macdConvergenceDown, title="Short Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SHORT")

plotshape(series=macdConvergenceUp, title="Long Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="LONG")

// Execute short and long orders with defined take profit and stop loss

if (macdConvergenceDown)

strategy.entry("Short", strategy.short, qty=1, stop=high + (stopLoss / syminfo.mintick), limit=low - (takeProfit / syminfo.mintick))

if (macdConvergenceUp)

strategy.entry("Long", strategy.long, qty=1, stop=low - (stopLoss / syminfo.mintick), limit=high + (takeProfit / syminfo.mintick))

// Trailing stop logic

var float entryPrice = na

var float trailingStopPrice = na

if (strategy.position_size != 0)

entryPrice := strategy.opentrades.entry_price(0)

if (strategy.position_size > 0) // For long positions

if (close - entryPrice > 300)

trailingStopPrice := entryPrice + (close - entryPrice - 300)

if (strategy.position_size < 0) // For short positions

if (entryPrice - close > 300)

trailingStopPrice := entryPrice - (entryPrice - close - 300)

if (strategy.position_size > 0 and not na(trailingStopPrice) and close < trailingStopPrice)

strategy.close("Long", comment="Trailing Stop")

if (strategy.position_size < 0 and not na(trailingStopPrice) and close > trailingStopPrice)

strategy.close("Short", comment="Trailing Stop")

// Daily drawdown and profit limits

var float startOfDayEquity = na

if (na(startOfDayEquity) or ta.change(time('D')) != 0)

startOfDayEquity := strategy.equity

maxDailyLoss = 600

maxDailyProfit = 1800

currentDailyPL = strategy.equity - startOfDayEquity

if (currentDailyPL <= -maxDailyLoss)

strategy.close_all(comment="Max Daily Loss Reached")

if (currentDailyPL >= maxDailyProfit)

strategy.close_all(comment="Max Daily Profit Reached")

- Tendencia cruzada MACD-RSI Seguir la estrategia con el sistema de optimización de bandas de Bollinger

- Estrategia de negociación de tendencia de stop-loss dinámico de múltiples indicadores

- Estrategia de optimización del impulso de tendencia dinámica con indicador de canal G

- Tendencia de múltiples indicadores a raíz de la estrategia cruzada de negociación de opciones de la EMA

- Estrategia cuantitativa de transición a corto y largo plazo basada en el canal G y la EMA

- Tendencia de los indicadores multi-técnicos siguiendo la estrategia con filtro de impulso del RSI

- Estrategia de negociación de tiempo inteligente con oscilador de doble momento

- Estrategia avanzada de análisis cruzado de cinco días basada en la integración del RSI y el MACD

- Estrategia mejorada de reversión media con la implementación del MACD-ATR

- Dos promedios móviles y MACD tendencia combinada siguiendo el sistema de negociación inteligente Dinámica tomar beneficios

- Estrategia cruzada de impulso de tendencia MACD-RSI con modelo de gestión de riesgos

- Estrategia de negociación basada en el índice de rendimiento de la inversión con porcentaje basado en la toma de ganancias y el stop loss

- Estrategia de combinación MACD y Martingale para una operación larga optimizada

- Estrategia de la EMA estocástica de Elliott Wave

- Las bandas de Bollinger y la estrategia de cruce de promedios móviles

- Estrategia de cruce de la media móvil doble de SMA

- 10SMA y MACD Tendencia dual a raíz de la estrategia de negociación

- Estrategia de negociación natural combinada del MACD y del RSI

- Estrategia de ruptura dinámica de tiempo alto-bajo

- Tendencia dinámica siguiendo la estrategia

- Estrategia de Stop Loss & Take Profit de promedio móvil sin problemas con filtro de tendencia y salida excepcional

- Estrategia de cruce de promedio móvil de luz estelar

- Estrategia de negociación cuantitativa de umbral porcentual

- Estrategia de cruce de medias móviles basada en medias móviles dobles

- Estrategia de combinación del MACD y la Supertrend

- Estrategia de compra/venta basada en el volumen y los patrones de candlestick

- Tendencia de la SMA siguiendo la estrategia con un stop-loss y una reentrada disciplinada

- Estrategia de ruptura de la EMA y de las bandas de Bollinger

- Zona de acción de CDC estrategia de trading bot con ATR para tomar ganancias y detener pérdidas

- Promedio móvil adaptativo basado en la rejilla dinámica de velas continuas con estrategia dinámica de stop loss

- Estrategia cruzada de la MA