Stratégie de croisement MACD

Auteur:ChaoZhang est là., Date: 2024-04-18 17:56:23 Je suis désoléLes étiquettes:Le taux d'intérêt- Je vous en prie.

Résumé

Cette stratégie utilise le croisement de deux moyennes mobiles exponentielles (EMA) avec des périodes différentes pour générer des signaux de trading. Lorsque l'EMA rapide traverse au-dessus de l'EMA lente, elle génère un signal d'achat, et lorsque l'EMA rapide traverse au-dessous de l'EMA lente, elle génère un signal de vente.

Principe de stratégie

- Calculer l'EMA rapide (période de défaut est de 12) et l'EMA lente (période de défaut est de 26).

- Définir la zone haussière (EMA rapide au-dessus de l'EMA lente et le prix au-dessus de l'EMA rapide) et la zone baissière (EMA rapide au-dessous de l'EMA lente et le prix au-dessous de l'EMA rapide).

- Achetez lorsque vous passez de la zone baissière à la zone haussière, et vendez lorsque vous passez de la zone haussière à la zone baissière.

- Marquez les zones haussières et baissières sur le graphique avec des couleurs verte et rouge, et utilisez des flèches pour marquer les signaux d'achat et de vente.

Les avantages de la stratégie

- Simple et facile à comprendre, adapté aux débutants.

- Largement applicable, peut être utilisée pour divers instruments financiers et délais.

- Une forte capacité de suivi des tendances, capable de saisir les tendances à moyen et long terme.

- Paramètres réglables, plus de souplesse.

Risques stratégiques

- Prédisposé à générer de faux signaux sur des marchés instables, conduisant à des pertes.

- Lente à réagir à l'inversion de tendance, ce qui entraîne un certain glissement.

- Une mauvaise sélection des paramètres affectera les performances de la stratégie.

Directions d'optimisation de la stratégie

- Ajoutez des filtres de tendance, par exemple ne négocier que lorsque l'ADX dépasse une certaine valeur, pour réduire les pertes sur les marchés instables.

- Optimiser les délais d'entrée et de sortie, par exemple en utilisant l'ATR pour déterminer les stop-loss et les take-profit, réduisant ainsi les pertes d'une seule transaction.

- Optimiser les paramètres pour trouver la meilleure combinaison, améliorer la stabilité et la rentabilité.

- Combiner avec d'autres indicateurs de jugement auxiliaire, tels que MACD, RSI, etc., pour améliorer la précision du signal.

Résumé

La stratégie de croisement MACD est une stratégie simple basée sur le suivi des tendances. Ses avantages sont la simplicité, la praticité et une large applicabilité, tandis que ses inconvénients sont la difficulté à saisir les inversions de tendance et la sélection de paramètres.

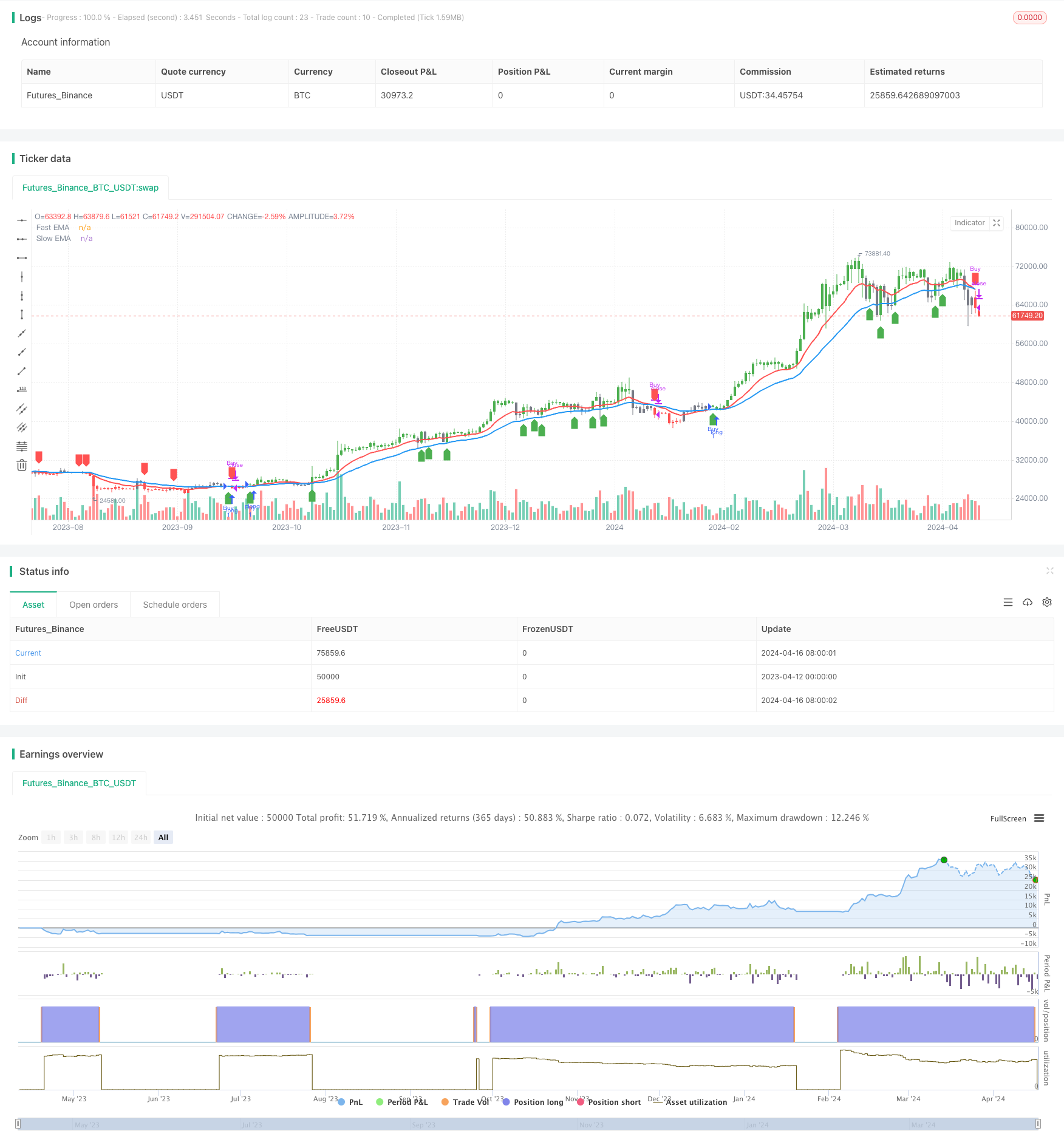

/*backtest

start: 2023-04-12 00:00:00

end: 2024-04-17 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Advance EMA Crossover Strategy', overlay=true, precision=6)

//****************************************************************************//

// CDC Action Zone is based on a simple EMA crossover

// between [default] EMA12 and EMA26

// The zones are defined by the relative position of

// price in relation to the two EMA lines

// Different zones can be use to activate / deactivate

// other trading strategies

// The strategy can also be used on its own with

// acceptable results, buy on the first green candle

// and sell on the first red candle

//****************************************************************************//

// Define User Input Variables

xsrc = input(title='Source Data', defval=close)

xprd1 = input(title='Fast EMA period', defval=12)

xprd2 = input(title='Slow EMA period', defval=26)

xsmooth = input(title='Smoothing period (1 = no smoothing)', defval=1)

fillSW = input(title='Paint Bar Colors', defval=true)

fastSW = input(title='Show fast moving average line', defval=true)

slowSW = input(title='Show slow moving average line', defval=true)

plotSigsw = input(title='Plot Buy/Sell Signals?', defval=true)

//****************************************************************************//

//Calculate Indicators

xPrice = ta.ema(xsrc, xsmooth)

FastMA = ta.ema(xPrice, xprd1)

SlowMA = ta.ema(xPrice, xprd2)

//****************************************************************************//

// Define Color Zones and Conditions

BullZone = FastMA > SlowMA and xPrice > FastMA // Bullish Zone

BearZone = FastMA < SlowMA and xPrice < FastMA // Bearish Zone

//****************************************************************************//

// Strategy Entry and Exit Conditions

if (BullZone and not BullZone[1])

strategy.entry("Buy", strategy.long) // Buy on the transition into BullZone

if (BearZone and not BearZone[1])

strategy.close("Buy") // Sell on the transition into BearZone

//****************************************************************************//

// Display color on chart

plotcolor = BullZone ? color.green : BearZone ? color.red : color.gray

barcolor(color=fillSW ? plotcolor : na)

//****************************************************************************//

// Plot Fast and Slow Moving Averages

plot(fastSW ? FastMA : na, color=color.red, title="Fast EMA", linewidth=2)

plot(slowSW ? SlowMA : na, color=color.blue, title="Slow EMA", linewidth=2)

//****************************************************************************//

// Plot Buy and Sell Signals

plotshape(series=plotSigsw and BullZone and not BullZone[1], location=location.belowbar, color=color.green, style=shape.labelup, title="Buy Signal")

plotshape(series=plotSigsw and BearZone and not BearZone[1], location=location.abovebar, color=color.red, style=shape.labeldown, title="Sell Signal")

//****************************************************************************//

Relationnée

- Stratégie de position transfrontalière à la veille avec filtre EMA

- Stratégie de croisement des deux moyennes mobiles de l'EMA

- Stratégie de négociation de la dynamique de l'EMA

- Stratégie de négociation croisée tripla EMA avec stop-loss et take-profit dynamiques

- Tendance de l'élan croisé multi-EMA à la suite de la stratégie

- Système de négociation automatisé multi-EMA avec verrouillage des bénéfices

- Tendance à la triple EMA à la suite d' une stratégie de négociation quantitative

- Stratégie de tendance de l'EMA sur plusieurs périodes avec système de rupture quotidienne haute-basse

- Tendance croisée multi-EMA à la suite d'une stratégie de négociation quantitative

- Système de négociation de suivi de la dynamique EMA hybride à double chaîne

Plus de

- Stratégie de capture de tendance avec rupture horizontale

- Stratégie de croisement des moyennes mobiles avec plusieurs prises de bénéfices

- MACD Stratégie de la croix d'or et de la croix de la mort

- La stratégie MACD-V et Fibonacci pour la prise de profit dynamique sur plusieurs délais

- Stratégie de capture des tendances

- Stratégie de négociation quantitative basée sur les moyennes mobiles et les bandes de Bollinger

- Stratégie de rupture des bandes de Bollinger

- Stratégie de dynamique à double échéancier

- Stratégie de rupture du MACD BB

- Stratégie de négociation de la grille de rebond sur-vendue à grande amplitude

- Stratégie optimisée de suivi des tendances MACD avec gestion des risques basée sur ATR

- Stratégie courte longue du MACD ZeroLag

- BBSR Stratégie extrême

- Stratégie de négociation à inversion à haute fréquence basée sur l'indicateur de dynamique RSI

- Stratégie de l'indice de résistance relative de l'indice RSI

- Stratégie de rupture des bandes de Bollinger

- Donchian Channel et Larry Williams Stratégie du grand indice du commerce

- SPARK Taille dynamique des positions et stratégie de négociation à double indicateur

- La moyenne mobile croisée + la stratégie de dynamique de la ligne lente du MACD

- Stratégie dynamique de DCA basée sur le volume