Bollinger Bands Momentum Trend Mengikuti Strategi Kuantitatif

Penulis:ChaoZhangTanggal: 2024-11-12 15:53:44Tag:BBRSIEMASMASDSL

Gambaran umum

Strategi ini adalah sistem perdagangan yang komprehensif berdasarkan Bollinger Bands, indikator RSI, dan moving average. Sistem ini mengidentifikasi peluang perdagangan potensial melalui rentang volatilitas harga Bollinger Bands, tingkat overbought/oversold RSI, dan penyaringan tren EMA. Sistem ini mendukung perdagangan panjang dan pendek dan menyediakan beberapa mekanisme keluar untuk melindungi modal.

Prinsip Strategi

Strategi ini didasarkan pada komponen inti berikut:

- Menggunakan Bollinger Bands dengan 1.8 standar deviasi untuk menentukan rentang volatilitas harga

- Menggunakan RSI 7-periode untuk kondisi overbought/oversold

- EMA 500 periode opsional sebagai filter tren

- Ketentuan masuk:

- Long: RSI di bawah 25 dan price breaks di bawah Bollinger Band bawah

- Pendek: RSI di atas 75 dan harga pecah di atas Bollinger Band atas

- Metode keluar mendukung ambang RSI atau reverse breakout Bollinger Band

- Perlindungan stop loss berdasarkan persentase opsional

Keuntungan Strategi

- Beberapa indikator teknis bekerja sama untuk meningkatkan keandalan sinyal

- Pengaturan parameter yang fleksibel memungkinkan penyesuaian untuk kondisi pasar yang berbeda

- Mendukung perdagangan bilateral untuk memanfaatkan peluang pasar sepenuhnya

- Menyediakan beberapa mekanisme keluar untuk menyesuaikan gaya perdagangan yang berbeda

- Penyaringan tren secara efektif mengurangi sinyal palsu

- Mekanisme stop loss memberikan kontrol risiko yang baik

Risiko Strategi

- Dapat menghasilkan sinyal palsu yang sering di berbagai pasar

- Beberapa indikator dapat menyebabkan sinyal tertunda

- Batas RSI tetap mungkin tidak cukup fleksibel untuk lingkungan pasar yang berbeda

- Parameter Bollinger Bands perlu disesuaikan berdasarkan volatilitas pasar

- Pengaturan stop loss dapat dengan mudah diaktifkan selama fluktuasi yang keras

Arah Optimasi Strategi

- Memperkenalkan adaptif Bollinger Bands pengganda berdasarkan volatilitas pasar

- Tambahkan indikator volume untuk konfirmasi

- Pertimbangkan untuk menambahkan filter waktu untuk menghindari perdagangan selama periode tertentu

- Mengembangkan sistem ambang RSI yang dinamis

- Mengintegrasikan lebih banyak indikator konfirmasi tren

- Optimalkan mekanisme stop loss, pertimbangkan untuk menggunakan stop loss dinamis

Ringkasan

Ini adalah strategi perdagangan kuantitatif yang dirancang dengan baik yang menangkap peluang pasar melalui beberapa indikator teknis. Strategi ini sangat dapat dikonfigurasi dan dapat beradaptasi dengan kebutuhan perdagangan yang berbeda. Meskipun ada beberapa risiko yang melekat, stabilitas dan keandalan dapat ditingkatkan lebih lanjut melalui optimasi parameter dan indikator tambahan.

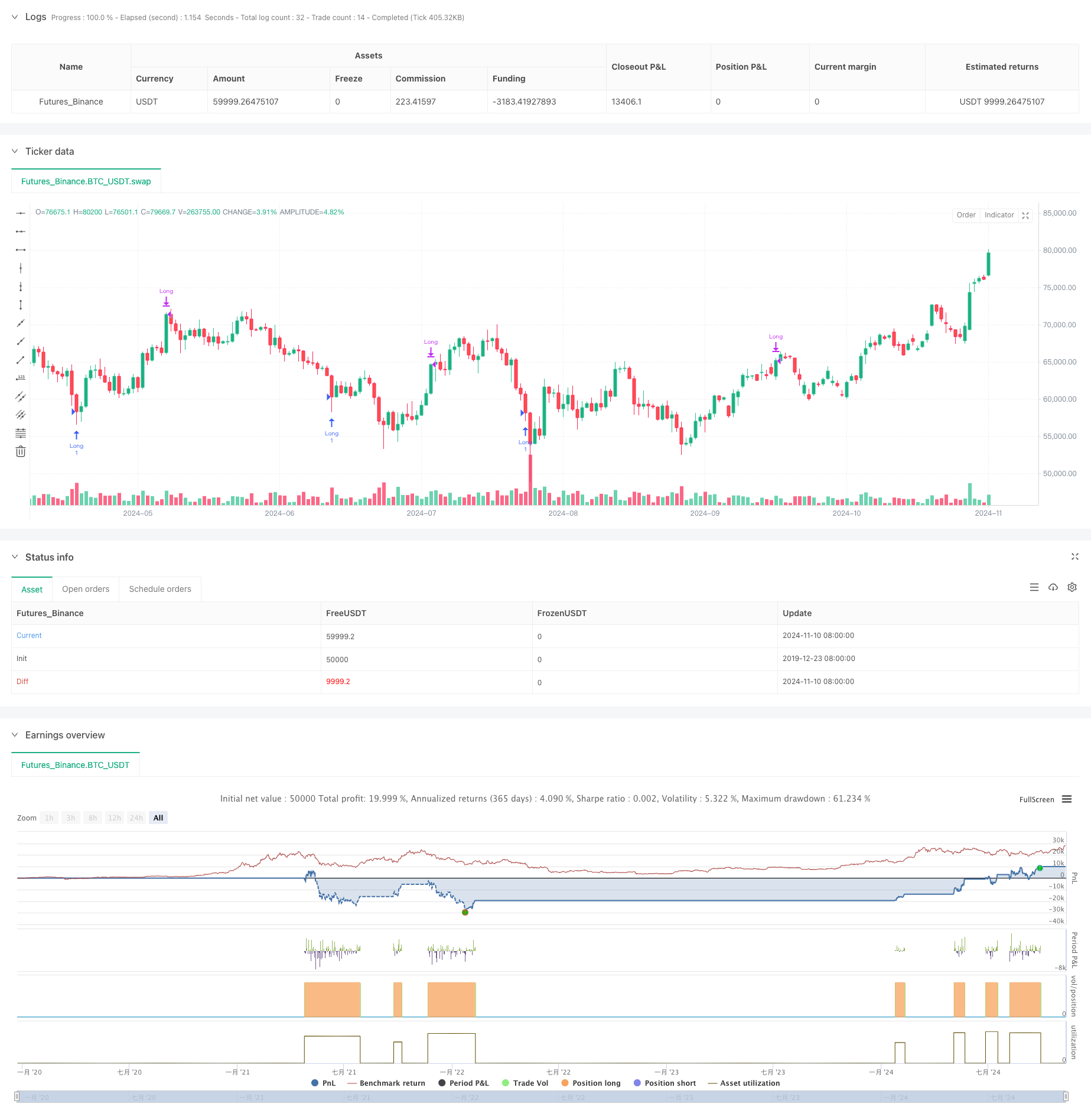

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Scalp Pro", overlay=true)

// Inputs for the strategy

length = input(20, title="Bollinger Band Length")

src = input(close, title="Source")

mult = input(1.8, title="Bollinger Band Multiplier")

rsiLength = input(7, title="RSI Length")

rsiOverbought = input(75, title="RSI Overbought Level")

rsiOversold = input(25, title="RSI Oversold Level")

// Custom RSI exit points

rsiExitLong = input(75, title="RSI Exit for Long (Overbought)")

rsiExitShort = input(25, title="RSI Exit for Short (Oversold)")

// Moving Average Inputs

emaLength = input(500, title="EMA Length")

enableEMAFilter = input.bool(true, title="Enable EMA Filter")

// Exit method: Choose between 'RSI' and 'Bollinger Bands'

exitMethod = input.string("RSI", title="Exit Method", options=["RSI", "Bollinger Bands"])

// Enable/Disable Long and Short trades

enableLong = input.bool(true, title="Enable Long Trades")

enableShort = input.bool(false, title="Enable Short Trades")

// Enable/Disable Stop Loss

enableStopLoss = input.bool(false, title="Enable Stop Loss")

stopLossPercent = input.float(1.0, title="Stop Loss Percentage (%)", minval=0.1) / 100

// Bollinger Bands calculation

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upperBB = basis + dev

lowerBB = basis - dev

// RSI calculation

rsi = ta.rsi(src, rsiLength)

// 200 EMA to filter trades (calculated but only used if enabled)

ema200 = ta.ema(src, emaLength)

// Long condition: RSI below oversold, price closes below the lower Bollinger Band, and optionally price is above the 200 EMA

longCondition = enableLong and (rsi < rsiOversold) and (close < lowerBB) and (not enableEMAFilter or close > ema200)

if (longCondition)

strategy.entry("Long", strategy.long)

// Short condition: RSI above overbought, price closes above the upper Bollinger Band, and optionally price is below the 200 EMA

shortCondition = enableShort and (rsi > rsiOverbought) and (close > upperBB) and (not enableEMAFilter or close < ema200)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Stop Loss setup

if (enableStopLoss)

strategy.exit("Long Exit", "Long", stop = strategy.position_avg_price * (1 - stopLossPercent))

strategy.exit("Short Exit", "Short", stop = strategy.position_avg_price * (1 + stopLossPercent))

// Exit conditions based on the user's choice of exit method

if (exitMethod == "RSI")

// Exit based on RSI

exitLongCondition = rsi >= rsiExitLong

if (exitLongCondition)

strategy.close("Long")

exitShortCondition = rsi <= rsiExitShort

if (exitShortCondition)

strategy.close("Short")

else if (exitMethod == "Bollinger Bands")

// Exit based on Bollinger Bands

exitLongConditionBB = close >= upperBB

if (exitLongConditionBB)

strategy.close("Long")

exitShortConditionBB = close <= lowerBB

if (exitShortConditionBB)

strategy.close("Short")

- Strategi pembalikan rata-rata yang ditingkatkan dengan pelaksanaan MACD-ATR

- Bollinger Bands dan RSI Combined Trading Strategy

- Adaptive Bollinger Bands Strategi Manajemen Posisi Dinamis

- Bollinger Bands dan RSI Combined Dynamic Trading Strategy

- Bollinger Bands dan RSI Crossover Trading Strategy

- Strategi pembalikan rata-rata yang ditingkatkan dengan Bollinger Bands dan Integrasi RSI

- Strategi Perdagangan Dinamis Multi-Indikator

- Strategi Perdagangan Komprehensif Multi-Indikator: Kombinasi sempurna dari Momentum, Overbought/Oversold, dan Volatility

- Sistem Perdagangan Breakout Dinamis Multidimensional Berdasarkan Bollinger Bands dan RSI

- Multi-Technical Indicator Dynamic Adaptive Trading Strategy (MTDAT)

- Strategi Perdagangan Kuantitatif Tren Dinamis MACD Lanjutan

- Sistem Trading Trend Breakout dengan Moving Average (Strategi TBMA)

- Strategi Multi-Trend Following berbasis ATR dengan Sistem Optimasi Take-Profit dan Stop-Loss

- Sistem Perdagangan Smart Adaptif berbasis Momentum RSI dengan Manajemen Risiko Multi-level

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization (Strategi Perdagangan Dinamis RSI yang Adaptif dengan Optimasi Ambang)

- RSI dan AO Synergistic Trend Setelah Strategi Perdagangan Kuantitatif

- Adaptive Trend Momentum RSI Strategy dengan Sistem Filter Moving Average

- Dual Moving Average Cross RSI Momentum Strategy dengan Sistem Optimasi Risiko-Reward

- Sistem Strategi Dinamis Crossover Multi-Indikator: Model Perdagangan Kuantitatif Berdasarkan EMA, RVI dan Sinyal Perdagangan

- RSI Dynamic Range Reversal Quantitative Strategy dengan Volatility Optimization Model

- Analisis Teknis Multi-Periode dan Strategi Perdagangan Sentimen Pasar

- Strategi periode kepemilikan dinamis berdasarkan pola pembalikan 123 poin

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Analisis Integrasi Berdasarkan EMA, RSI dan ADX

- Strategi Perdagangan Divergensi SAR Parabolik

- Kombinasi Momentum SMA Crossover Strategy dengan Sentiment Pasar dan Resistance Level Optimization System

- Momentum RSI Multi-Periode dan Tren EMA Triple Mengikuti Strategi Komposit

- Trend Momentum Rata-rata Bergerak Berbagai Mengikuti Strategi

- E9 Shark-32 Pattern Strategi Penembusan Harga Kuantitatif

- Eksposur Pasar Terbuka Penyesuaian Posisi Dinamis Strategi Perdagangan Kuantitatif

- Tren Tingkat Menang Tinggi Artinya Strategi Perdagangan Reversi