ボリンジャー・バンドの動向傾向は定量戦略に従っている

作者: リン・ハーンチャオチャン,日付: 2024年11月12日 15:53:44タグ:BBRSIエイマSMASDSL

概要

この戦略は,ボリンジャーバンド,RSI指標,移動平均値に基づいた包括的な取引システムである.ボリンジャーバンドの価格変動幅,RSI過剰購入/過剰販売レベル,EMAトレンドフィルタリングを通じて潜在的な取引機会を特定する.システムは長期と短期の両方をサポートし,資本を保護するための複数の退出メカニズムを提供します.

戦略の原則

戦略は以下の基本要素に基づいています.

- 価格変動範囲を決定するために,標準偏差1.8のボリンジャー帯を使用する.

- 超買/超売条件で7期間のRSIを使用する.

- トレンドフィルターとしてオプションの500期EMA

- 入国条件:

- ロング:RSIは25以下で,価格はボリンジャー・バンドの下位を下回る

- ショート:RSIは75以上で,価格はボリンジャーバンド上位を突破する

- アクジットメソッドは,RSIの

値またはボリンジャー・バンドの逆転ブレイクをサポートする. - ストップ・ロスト・プロテクション

戦略 の 利点

- 複数の技術指標が信号の信頼性を向上させるために協働する

- 柔軟なパラメータ設定により,異なる市場条件に調整できます

- 市場機会を完全に利用するために二国間貿易を支援する

- 異なる取引スタイルに合わせて複数の出口メカニズムを提供します.

- トレンドフィルタリングは誤った信号を効果的に減少させる

- ストップ・ロスのメカニズムは,良いリスク制御を提供します.

戦略リスク

- 異なる市場で頻繁に誤った信号を生む可能性があります

- 複数の指標が信号の遅延を引き起こす可能性があります

- 固定RSIの

値は,異なる市場環境に十分な柔軟性がない可能性があります. - ボリンジャー・バンドのパラメータは,市場の変動に基づいて調整する必要があります.

- ストップ・ロスの設定は,激しい変動中に簡単に起動できます.

戦略の最適化方向

- 市場変動に基づく適応ボリンジャー帯倍数引入

- 確認のために音量指標を追加する

- 特定の期間の取引を避けるために時間フィルターを追加することを検討します

- 動的RSIの

値システムを開発する - より多くの傾向確認指標を統合する

- ストップ・ロスのメカニズムを最適化し,ダイナミック・ストップ・ロスの使用を検討する

概要

これは,複数の技術指標を通じて市場機会を把握する,よく設計された定量的な取引戦略である.この戦略は高度に構成可能で,異なる取引ニーズに適応することができる.固有リスクがあるものの,パラメータ最適化および追加の補助指標によって安定性と信頼性がさらに向上することができる. 体系的な取引方法を探している投資家にとって,これは検討する価値のある戦略フレームワークである.

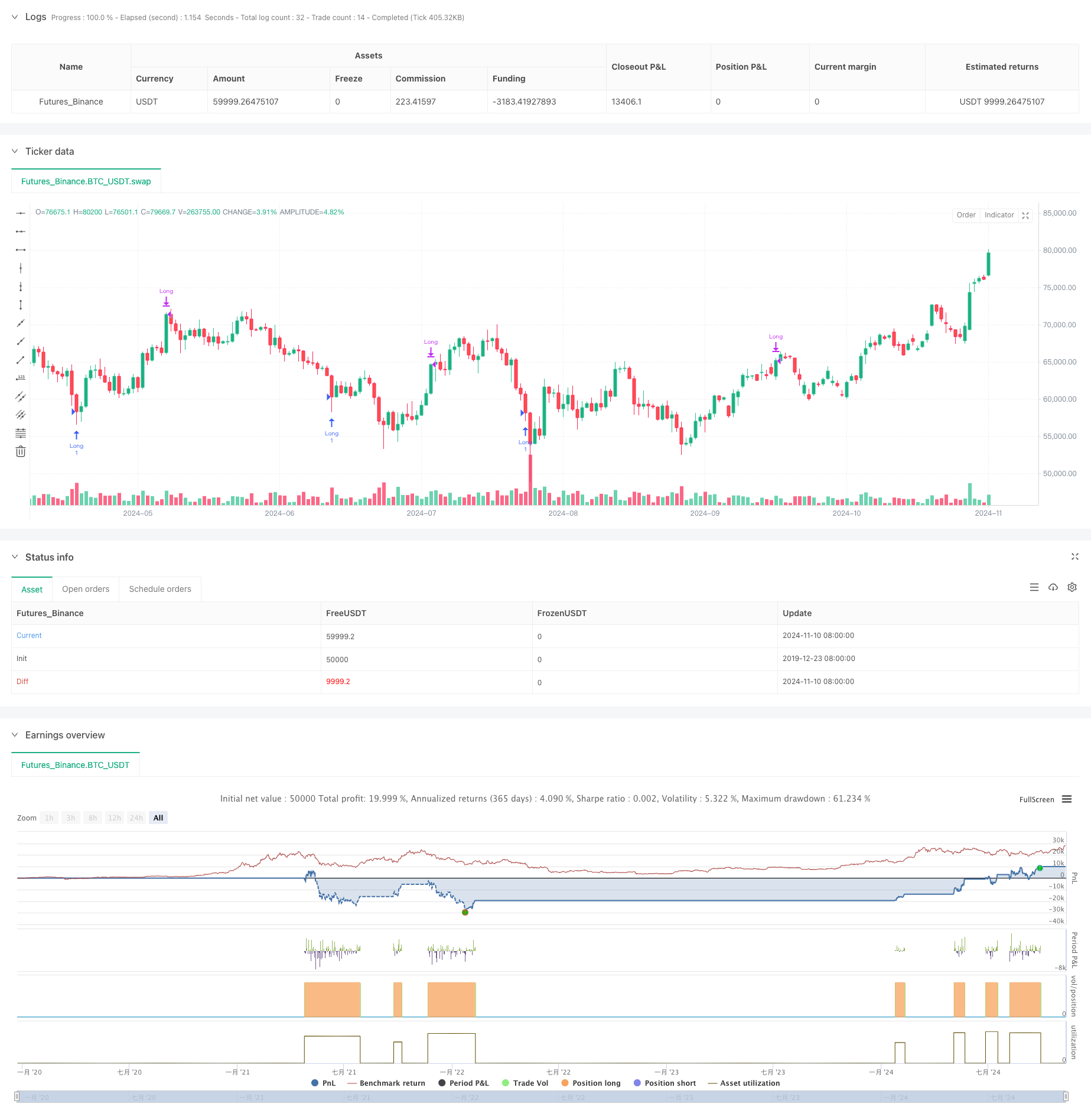

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bollinger Bands Scalp Pro", overlay=true)

// Inputs for the strategy

length = input(20, title="Bollinger Band Length")

src = input(close, title="Source")

mult = input(1.8, title="Bollinger Band Multiplier")

rsiLength = input(7, title="RSI Length")

rsiOverbought = input(75, title="RSI Overbought Level")

rsiOversold = input(25, title="RSI Oversold Level")

// Custom RSI exit points

rsiExitLong = input(75, title="RSI Exit for Long (Overbought)")

rsiExitShort = input(25, title="RSI Exit for Short (Oversold)")

// Moving Average Inputs

emaLength = input(500, title="EMA Length")

enableEMAFilter = input.bool(true, title="Enable EMA Filter")

// Exit method: Choose between 'RSI' and 'Bollinger Bands'

exitMethod = input.string("RSI", title="Exit Method", options=["RSI", "Bollinger Bands"])

// Enable/Disable Long and Short trades

enableLong = input.bool(true, title="Enable Long Trades")

enableShort = input.bool(false, title="Enable Short Trades")

// Enable/Disable Stop Loss

enableStopLoss = input.bool(false, title="Enable Stop Loss")

stopLossPercent = input.float(1.0, title="Stop Loss Percentage (%)", minval=0.1) / 100

// Bollinger Bands calculation

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upperBB = basis + dev

lowerBB = basis - dev

// RSI calculation

rsi = ta.rsi(src, rsiLength)

// 200 EMA to filter trades (calculated but only used if enabled)

ema200 = ta.ema(src, emaLength)

// Long condition: RSI below oversold, price closes below the lower Bollinger Band, and optionally price is above the 200 EMA

longCondition = enableLong and (rsi < rsiOversold) and (close < lowerBB) and (not enableEMAFilter or close > ema200)

if (longCondition)

strategy.entry("Long", strategy.long)

// Short condition: RSI above overbought, price closes above the upper Bollinger Band, and optionally price is below the 200 EMA

shortCondition = enableShort and (rsi > rsiOverbought) and (close > upperBB) and (not enableEMAFilter or close < ema200)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Stop Loss setup

if (enableStopLoss)

strategy.exit("Long Exit", "Long", stop = strategy.position_avg_price * (1 - stopLossPercent))

strategy.exit("Short Exit", "Short", stop = strategy.position_avg_price * (1 + stopLossPercent))

// Exit conditions based on the user's choice of exit method

if (exitMethod == "RSI")

// Exit based on RSI

exitLongCondition = rsi >= rsiExitLong

if (exitLongCondition)

strategy.close("Long")

exitShortCondition = rsi <= rsiExitShort

if (exitShortCondition)

strategy.close("Short")

else if (exitMethod == "Bollinger Bands")

// Exit based on Bollinger Bands

exitLongConditionBB = close >= upperBB

if (exitLongConditionBB)

strategy.close("Long")

exitShortConditionBB = close <= lowerBB

if (exitShortConditionBB)

strategy.close("Short")

関連性

- MACD-ATRの実装による強化された平均逆転戦略

- Bollinger Bands と RSI の組み合わせた取引戦略

- アダプティブ・ボリンガー・バンド ダイナミック・ポジション・マネジメント・戦略

- Bollinger Bands と RSI の組み合わせたダイナミック・トレーディング・戦略

- Bollinger Bands と RSI のクロスオーバー 取引 戦略

- Bollinger Bands と RSI 統合による強化された平均逆転戦略

- 多指標ダイナミック取引戦略

- 多指標の包括的な取引戦略:モメンタム,過剰購入/過剰販売,および不安定性の完璧な組み合わせ

- Bollinger Bands と RSI に基づく多次元ダイナミック・ブレイクアウト・トレーディング・システム

- マルチテクニカル指標動的適応取引戦略 (MTDAT)

もっと

- 先進的なMACD動的トレンド量的な取引戦略

- トレンド・ブレイク・トレーディング・システム (TBMA戦略)

- ATRベースの多トレンドフォロー戦略,利益とストップ損失最適化システム

- RSI モメントベースのスマートアダプティブ・トレーディング・システム

- アダプティブ RSI オシレーター

値最適化によるダイナミック・トレーディング・戦略 - RSIとAOの相乗効果傾向 定量的な取引戦略

- アダプティブ・トレンド・モメンタム・RSI戦略 移動平均フィルターシステム

- リスク・リターン最適化システムを持つ二重移動平均のクロスRSIモメント戦略

- 多指標クロスオーバー・ダイナミック・戦略システム: EMA,RVI,取引信号に基づく定量的な取引モデル

- RSI 動的範囲逆転 変動最適化モデルによる定量戦略

- 多期技術分析と市場情勢取引戦略

- ダイナミックホールディング期間の戦略 123 ポイント逆転パターンに基づく

- マルチテクニカルインジケータークロスオーバーモメント量的な取引戦略 - EMA,RSI,ADXに基づく統合分析

- パラボリック SAR ダイバージェンツ取引戦略

- 市場情勢とレジスタンスレベル最適化システムとの組み合わせたモメンタムSMAクロスオーバー戦略

- 複合戦略をフォローする多期RSIモメンタムと三重EMAトレンド

- 戦略をフォローする多動平均勢力の傾向

- E9 サメ32 パターン 定量的な価格ブレイク戦略

- オープンマーケット ダイナミックポジション調整 定量取引戦略

- 高勝率トレンドは逆転トレード戦略を意味する