Overview

This strategy is a trend-following system based on Exponential Moving Average (EMA) crossovers, incorporating dynamic position sizing and risk management. It uses fast and slow EMA crossover signals to identify market trends while dynamically adjusting trade sizes through percentage risk calculations and employing trailing stops to protect profits.

Strategy Principles

The core logic relies on two EMAs with different periods (default 9 and 21). A long entry signal is generated when the fast EMA crosses above the slow EMA, while positions are closed when the fast EMA crosses below the slow EMA. Each trade size is dynamically calculated based on a fixed percentage risk (default 1%) of total account equity, with take-profit levels set according to risk-reward ratios and percentage-based trailing stops.

Strategy Advantages

- Dynamic position sizing ensures consistent risk per trade, avoiding the excessive risk of fixed position sizes.

- Trailing stop mechanism effectively locks in profits and exits positions when trends reverse.

- Risk-reward ratio settings ensure clear profit-loss ratios for each trade.

- EMA crossover signals effectively capture medium to long-term trends, reducing false signals.

- Fully automated system eliminates emotional interference.

Strategy Risks

- May generate frequent false crossover signals in ranging markets, leading to consecutive losses.

- Trailing stops might trigger too early in highly volatile markets, missing larger trends.

- Fixed percentage risk settings may lack flexibility when market volatility changes.

- Stop losses might be jumped over in quick reversal markets, resulting in larger than expected losses.

Optimization Directions

- Incorporate volatility indicators (like ATR) to dynamically adjust stop-loss and take-profit levels.

- Add trend strength filters, such as RSI or ADX, to reduce false signals in ranging markets.

- Develop dynamic EMA period adjustment mechanisms based on market volatility.

- Include volume confirmation indicators to improve signal reliability.

- Implement dynamic risk adjustment mechanisms based on recent losses.

Summary

This is a complete trading system that combines classical technical analysis methods with modern risk management concepts. The strategy controls risk through dynamic position sizing and trailing stops while capturing trending opportunities using EMA crossovers. While there are some inherent limitations, the suggested optimization directions can further enhance the strategy’s robustness and adaptability. The strategy is particularly suitable for long-term trend trading with controlled risk.

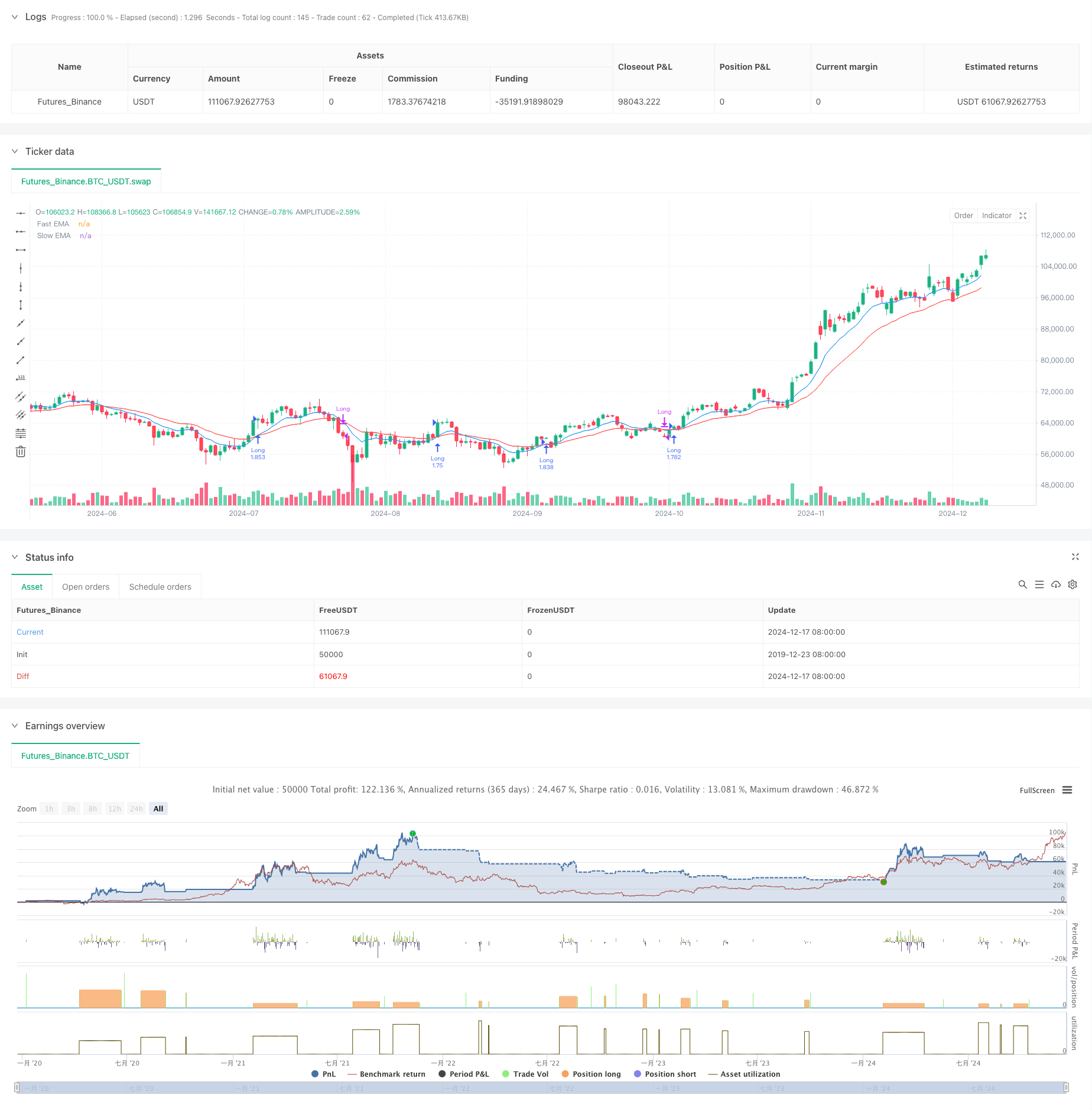

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bitcoin Exponential Profit Strategy", overlay=true)

// User settings

fastLength = input.int(9, title="Fast EMA Length", minval=1)

slowLength = input.int(21, title="Slow EMA Length", minval=1)

riskPercent = input.float(1, title="Risk % Per Trade", step=0.1) / 100

rewardMultiplier = input.float(2, title="Reward Multiplier (R:R)", step=0.1)

trailOffsetPercent = input.float(0.5, title="Trailing Stop Offset %", step=0.1) / 100

// Calculate EMAs

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

// Plot EMAs

plot(fastEMA, color=color.blue, title="Fast EMA")

plot(slowEMA, color=color.red, title="Slow EMA")

// Account balance and dynamic position sizing

capital = strategy.equity

riskAmount = capital * riskPercent

// Define Stop Loss and Take Profit Levels

stopLossLevel = close * (1 - riskPercent)

takeProfitLevel = close * (1 + rewardMultiplier * riskPercent)

// Trailing stop offset

trailOffset = close * trailOffsetPercent

// Entry Condition: Bullish Crossover

if ta.crossover(fastEMA, slowEMA)

positionSize = riskAmount / math.max(close - stopLossLevel, 0.01) // Prevent division by zero

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("TakeProfit", from_entry="Long", stop=stopLossLevel, limit=takeProfitLevel, trail_offset=trailOffset)

// Exit Condition: Bearish Crossunder

if ta.crossunder(fastEMA, slowEMA)

strategy.close("Long")

// Labels for Signals

if ta.crossover(fastEMA, slowEMA)

label.new(bar_index, low, "BUY", color=color.green, textcolor=color.white, style=label.style_label_up)

if ta.crossunder(fastEMA, slowEMA)

label.new(bar_index, high, "SELL", color=color.red, textcolor=color.white, style=label.style_label_down)