Quantitative Long-Short Switching Strategy Based on G-Channel and EMA

Author: ChaoZhang, Date: 2024-12-20 14:31:56Tags: EMAMASMARSIMACD

Overview

This strategy is a quantitative trading system that combines G-Channel and Exponential Moving Average (EMA). The core concept is to capture market trend directions through G-Channel while using EMA for signal confirmation and risk control, aiming to generate profits from market fluctuations. The strategy operates in a fully automated mode without manual intervention.

Strategy Principle

The strategy operates based on two core indicators: G-Channel and EMA. G-Channel identifies price trends by dynamically calculating upper and lower bands, generating trading signals when prices break through the channel. Specifically, the strategy uses a 100-period G-Channel calculation, continuously updating the channel boundaries through mathematical formulas. Additionally, a 50-period EMA is introduced as secondary confirmation, executing trades only when the price’s relative position to EMA meets expectations. Buy conditions are triggered when G-Channel signals long and closing price is below EMA, while sell conditions occur when G-Channel signals short and closing price is above EMA.

Strategy Advantages

- Combines trend-following and mean-reversion characteristics, maintaining stable performance in various market conditions

- Uses EMA as auxiliary confirmation to effectively reduce false breakout risks

- Employs fully automated trading to avoid emotional interference

- Features simple and clear calculation logic, easy to understand and maintain

- Offers strong parameter adjustability to adapt to different market characteristics

Strategy Risks

- May result in frequent trading in oscillating markets, increasing transaction costs

- Improper G-Channel parameter settings may lead to signal lag

- Inappropriate EMA period selection might miss important trend turning points

- Possibility of significant drawdowns during extreme market volatility Risk mitigation measures:

- Implement stop-loss mechanisms

- Optimize parameter configuration

- Add market environment filtering

- Set reasonable position management strategies

Strategy Optimization Directions

- Introduce volatility indicators to adjust strategy parameters or pause trading in high-volatility environments

- Incorporate volume analysis to improve signal reliability

- Add trend strength filters to avoid frequent trading in weak trend markets

- Optimize EMA parameter adaptive mechanisms to enhance system adaptability

- Develop multi-timeframe signal confirmation mechanisms to improve trading stability

Summary

This strategy constructs a robust quantitative trading system by combining G-Channel and EMA technical indicators. The strategy logic is clear, implementation is simple, and it offers good scalability. Through proper parameter optimization and risk control measures, the strategy shows potential for generating stable returns in live trading. It is recommended to optimize the strategy based on market characteristics and strictly implement risk management protocols when applying it to live trading.

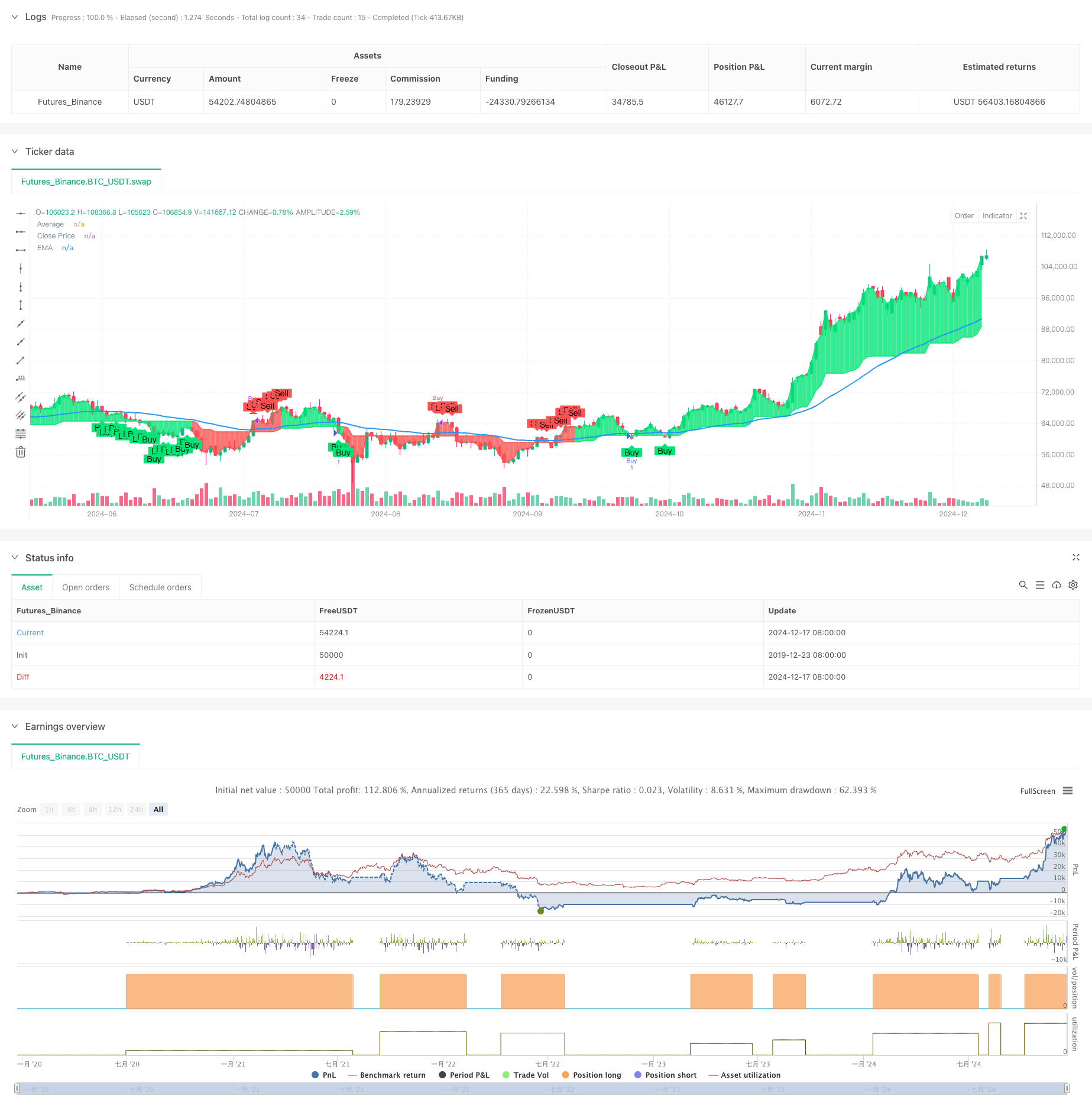

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © stanleygao01

//@version=5

strategy('G-Channel with EMA Strategy', overlay=true)

// G-Channel parameters

length = input(100, title='G-Channel Length')

src = input(close, title='Source')

a = 0.0

b = 0.0

a := math.max(src, nz(a[1])) - nz(a[1] - b[1]) / length

b := math.min(src, nz(b[1])) + nz(a[1] - b[1]) / length

avg = math.avg(a, b)

crossup = b[1] < close[1] and b > close

crossdn = a[1] < close[1] and a > close

bullish = ta.barssince(crossdn) <= ta.barssince(crossup)

// EMA parameters

emaLength = input(50, title='EMA Length')

ema = ta.ema(close, emaLength)

// Buy and Sell Conditions

buyCondition = bullish and close < ema

sellCondition = not bullish and close > ema

// Plot G-Channel

c = bullish ? color.lime : color.red

p1 = plot(avg, title='Average', color=c, linewidth=1, transp=90)

p2 = plot(close, title='Close Price', color=c, linewidth=1, transp=100)

fill(p1, p2, color=c, transp=90)

// Plot EMA

plot(ema, title='EMA', color=color.new(color.blue, 0), linewidth=2)

// Strategy Entries and Exits

if buyCondition

strategy.entry('Buy', strategy.long)

if sellCondition

strategy.close('Buy')

// Plot Buy/Sell Labels

plotshape(buyCondition, title='Buy Signal', location=location.belowbar, color=color.new(color.lime, 0), style=shape.labelup, text='Buy')

plotshape(sellCondition, title='Sell Signal', location=location.abovebar, color=color.new(color.red, 0), style=shape.labeldown, text='Sell')

- Multi-Strategy Technical Analysis Trading System

- Multi-EMA Dynamic Trend Capture Quantitative Trading Strategy

- Dynamic Dual Moving Average Crossover Quantitative Trading Strategy

- Multi-Timeframe EMA Cross High-Win Rate Trend Following Strategy (Advanced)

- Multi-Level Dynamic MACD Trend Following Strategy with 52-Week High/Low Extension Analysis System

- Multi-Technical Indicator Synergistic Trading System

- No Upper Wick Bullish Candle Breakout Strategy

- Advanced Multi-Indicator Multi-Dimensional Trend Cross Quantitative Strategy

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Dynamic Multi-Period Exponential Moving Average Cross Strategy with Pullback Optimization System

- Multi-Indicator Dynamic Stop-Loss Momentum Trend Trading Strategy

- Multi-Condition Trend Following Quantitative Trading Strategy Based on Fibonacci Retracement Levels

- Multi-Moving Average Trend Following Trading Strategy

- Multi-Filter Trend Breakthrough Smart Moving Average Trading Strategy

- Dynamic EMA Breakthrough and Reversal Strategy

- Dynamic Trend Momentum Optimization Strategy with G-Channel Indicator

- Multi-level ATH Dynamic Tracking Triple-Entry Strategy

- Adaptive VWAP Bands with Garman-Klass Volatility Dynamic Tracking Strategy

- Multi-Indicator Trend Following Options Trading EMA Cross Strategy

- Multi-Indicator Volatility Trading RSI-EMA-ATR Strategy

- Dual Moving Average Trend Following Strategy with Risk Management

- Triple Supertrend and Bollinger Bands Multi-Indicator Trend Following Strategy

- Multi-Trendline Breakout Momentum Quantitative Strategy

- RSI Momentum and ADX Trend Strength Based Capital Management System

- Multi-Timeframe Liquidity Pivot Heatmap Strategy

- Multi-Timeframe Trend Following Strategy with ATR-Based Take Profit and Stop Loss

- Advanced Trend Following Strategy with Adaptive Trailing Stop

- Multi-Technical Indicator Trend Following Strategy with RSI Momentum Filter

- Dynamic Risk-Managed Exponential Moving Average Crossover Strategy

- Dual Exponential Moving Average and Relative Strength Index Crossover Strategy