RSI and AO Synergistic Trend Following Quantitative Trading Strategy

Author: ChaoZhang, Date: 2024-11-12 16:05:28Tags: RSIAOTPSL

Overview

This strategy is a quantitative trading system based on the synergistic effect of the Relative Strength Index (RSI) and Awesome Oscillator (AO). It identifies potential long opportunities by capturing signals when RSI crosses above 50 while AO is in negative territory. The strategy employs percentage-based take profit and stop loss mechanisms for risk management, using 10% of account equity for each trade.

Strategy Principles

The core logic relies on the cooperation of two technical indicators: 1. RSI Indicator: Uses 14-period RSI to monitor price momentum, with crossover above 50 indicating established upward momentum. 2. AO Indicator: Calculates price momentum by comparing 5-period and 34-period moving averages, with negative values indicating oversold market conditions. 3. Entry Conditions: Long positions are opened when RSI crosses above 50 and AO is negative, capturing potential reversals in oversold areas. 4. Exit Conditions: Implements 2% take profit and 1% stop loss settings to maintain reasonable risk-reward ratios.

Strategy Advantages

- High Signal Reliability: Dual confirmation through RSI and AO enhances trading signal reliability.

- Comprehensive Risk Control: Fixed percentage-based take profit and stop loss effectively control per-trade risk.

- Scientific Money Management: Uses fixed proportion of account equity, avoiding excessive leverage.

- Clear Logic: Strategy rules are intuitive and easy to understand and execute.

- Good Visualization: Various signals are clearly marked on charts for easy identification and confirmation.

Strategy Risks

- False Breakout Risk: RSI crossing 50 may produce false signals, requiring additional technical confirmation.

- Tight Stop Loss: 1% stop loss might be too tight for market volatility.

- Unidirectional Trading Limitation: Strategy only takes long positions, missing opportunities in bear markets.

- Slippage Impact: May face significant slippage risk during high volatility periods.

- Parameter Sensitivity: Strategy performance highly depends on RSI and AO parameter settings.

Optimization Directions

- Signal Filtering: Suggest adding volume confirmation mechanism to improve signal reliability.

- Dynamic Stop Loss: Consider replacing fixed stops with trailing stops for better profit protection.

- Parameter Optimization: Recommend historical backtesting for RSI and AO parameters.

- Market Selection: Add market trend analysis to only trade during upward trends.

- Position Sizing: Consider dynamic position sizing based on signal strength.

Summary

This trend-following strategy combines RSI and AO indicators to capture long opportunities during oversold reversals. While well-designed with proper risk management, there’s room for optimization. Traders should conduct thorough backtesting before live implementation and adjust parameters according to market conditions. The strategy is suitable for traders with higher risk tolerance and good understanding of technical analysis.

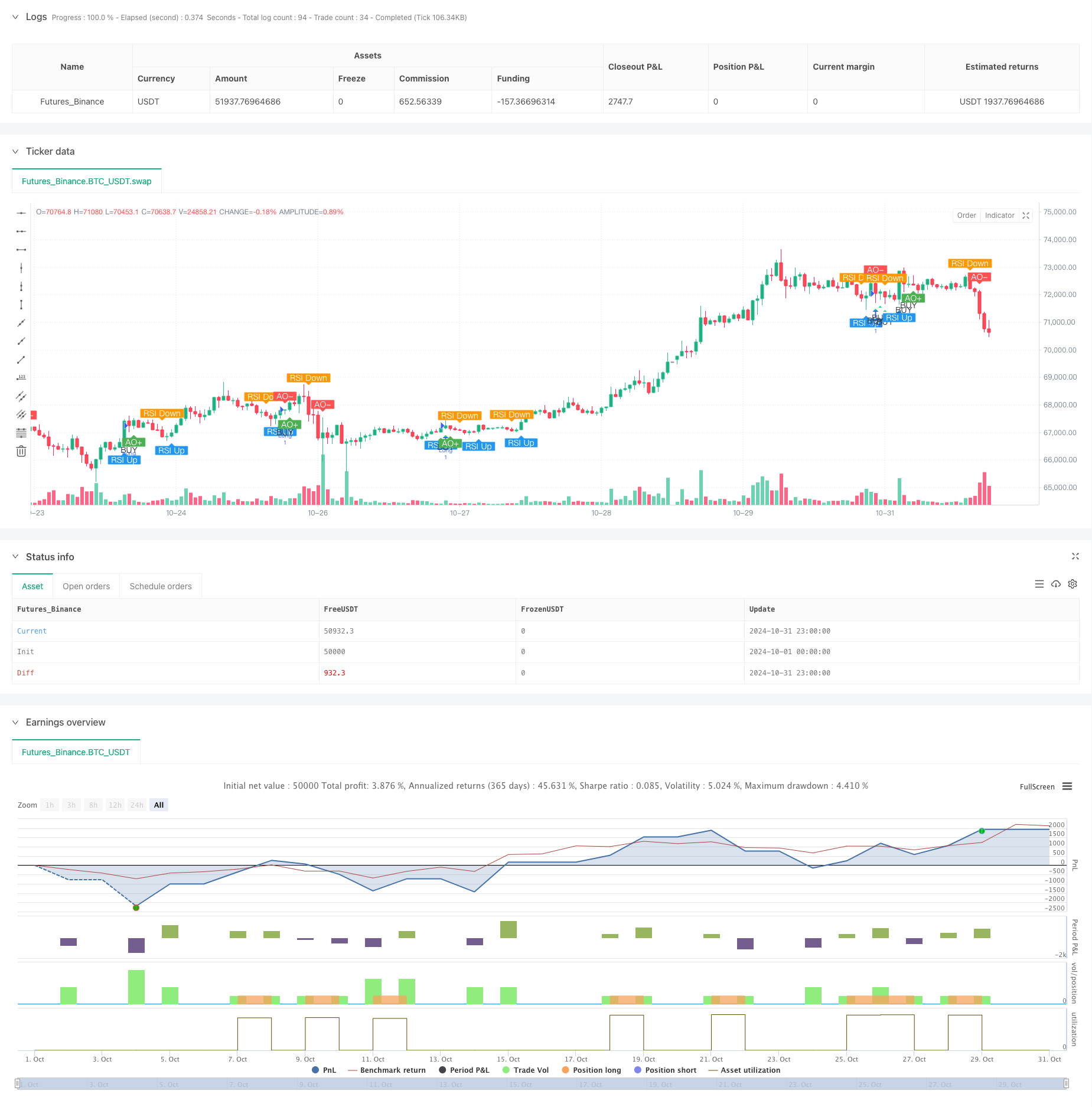

/*backtest

start: 2024-10-01 00:00:00

end: 2024-10-31 23:59:59

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title="🐂 BUY Only - RSI Crossing 50 + AO Negative", shorttitle="🐂 AO<0 RSI+50 Strategy", overlay=true)

// -----------------------------

// --- User Inputs ---

// -----------------------------

// RSI Settings

rsiPeriod = input.int(title="RSI Period", defval=14, minval=1)

// AO Settings

aoShortPeriod = input.int(title="AO Short Period", defval=5, minval=1)

aoLongPeriod = input.int(title="AO Long Period", defval=34, minval=1)

// Strategy Settings

takeProfitPerc = input.float(title="Take Profit (%)", defval=2.0, minval=0.0, step=0.1)

stopLossPerc = input.float(title="Stop Loss (%)", defval=1.0, minval=0.0, step=0.1)

// -----------------------------

// --- Awesome Oscillator (AO) Calculation ---

// -----------------------------

// Calculate the Awesome Oscillator

ao = ta.sma(hl2, aoShortPeriod) - ta.sma(hl2, aoLongPeriod)

// Detect AO Crossing Zero

aoCrossOverZero = ta.crossover(ao, 0)

aoCrossUnderZero = ta.crossunder(ao, 0)

// -----------------------------

// --- Relative Strength Index (RSI) Calculation ---

// -----------------------------

// Calculate RSI

rsiValue = ta.rsi(close, rsiPeriod)

// Detect RSI Crossing 50

rsiCrossOver50 = ta.crossover(rsiValue, 50)

rsiCrossUnder50 = ta.crossunder(rsiValue, 50)

// -----------------------------

// --- Plotting Arrows and Labels ---

// -----------------------------

// Plot AO Cross Over Arrow (AO+)

plotshape(series=aoCrossOverZero,

location=location.belowbar,

color=color.green,

style=shape.labelup,

title="AO Crosses Above Zero",

text="AO+",

textcolor=color.white,

size=size.small)

// Plot AO Cross Under Arrow (AO-)

plotshape(series=aoCrossUnderZero,

location=location.abovebar,

color=color.red,

style=shape.labeldown,

title="AO Crosses Below Zero",

text="AO-",

textcolor=color.white,

size=size.small)

// Plot RSI Cross Over Arrow (RSI Up)

plotshape(series=rsiCrossOver50,

location=location.belowbar,

color=color.blue,

style=shape.labelup,

title="RSI Crosses Above 50",

text="RSI Up",

textcolor=color.white,

size=size.small)

// Plot RSI Cross Under Arrow (RSI Down)

plotshape(series=rsiCrossUnder50,

location=location.abovebar,

color=color.orange,

style=shape.labeldown,

title="RSI Crosses Below 50",

text="RSI Down",

textcolor=color.white,

size=size.small)

// -----------------------------

// --- Buy Signal Condition ---

// -----------------------------

// Define Buy Signal: AO is negative and previous bar's RSI > 50

buySignal = (ao < 0) and (rsiValue[1] > 50)

// Plot Buy Signal

plotshape(series=buySignal,

location=location.belowbar,

color=color.lime,

style=shape.triangleup,

title="Buy Signal",

text="BUY",

textcolor=color.black,

size=size.small)

// -----------------------------

// --- Strategy Execution ---

// -----------------------------

// Entry Condition

if buySignal

strategy.entry("Long", strategy.long)

// Exit Conditions

// Calculate Stop Loss and Take Profit Prices

if strategy.position_size > 0

// Entry price

entryPrice = strategy.position_avg_price

// Stop Loss and Take Profit Levels

stopLevel = entryPrice * (1 - stopLossPerc / 100)

takeProfitLevel = entryPrice * (1 + takeProfitPerc / 100)

// Submit Stop Loss and Take Profit Orders

strategy.exit("Exit Long", from_entry="Long", stop=stopLevel, limit=takeProfitLevel)

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Dynamic RSI-Price Divergence Detection and Adaptive Trading Strategy System

- RSI-based Trading Strategy with Percentage-based Take Profit and Stop Loss

- RSI Low Point Reversal Strategy

- Multi-Zone RSI Trading Strategy

- Dual Timeframe Stochastic Momentum Trading Strategy

- Multi-RSI-EMA Momentum Hedging Strategy with Position Scaling

- Multi-Timeframe RSI Oversold Reversal Strategy

- Dual EMA Crossover with RSI Momentum Enhanced Trading Strategy

- Weighted Moving Average and Relative Strength Index Crossover Strategy with Risk Management Optimization System

- Multi-MA Trend Strength Capture with Momentum Profit-Taking Strategy

- Multi-Strategy Adaptive Trend Following and Breakout Trading System

- Multi-Level Moving Average with Candlestick Pattern Recognition Trading System

- Multi-Timeframe EMA Trend Momentum Trading Strategy

- Intelligent Time-Based Long-Short Rotation Balanced Trading Strategy

- Advanced MACD Dynamic Trend Quantitative Trading Strategy

- Trend Breakout Trading System with Moving Average (TBMA Strategy)

- ATR-Based Multi-Trend Following Strategy with Take-Profit and Stop-Loss Optimization System

- RSI Momentum-based Smart Adaptive Trading System with Multi-level Risk Management

- Adaptive RSI Oscillator Dynamic Trading Strategy with Threshold Optimization

- Adaptive Trend Momentum RSI Strategy with Moving Average Filter System

- Dual Moving Average Cross RSI Momentum Strategy with Risk-Reward Optimization System

- Multi-Indicator Crossover Dynamic Strategy System: A Quantitative Trading Model Based on EMA, RVI and Trading Signals

- RSI Dynamic Range Reversal Quantitative Strategy with Volatility Optimization Model

- Bollinger Bands Momentum Trend Following Quantitative Strategy

- Multi-Period Technical Analysis and Market Sentiment Trading Strategy

- Dynamic Holding Period Strategy Based on 123 Point Reversal Pattern

- Multi-Technical Indicator Crossover Momentum Quantitative Trading Strategy - Integration Analysis Based on EMA, RSI and ADX

- Parabolic SAR Divergence Trading Strategy

- Combined Momentum SMA Crossover Strategy with Market Sentiment and Resistance Level Optimization System