Tren Multi-Timeframe Mengikuti Sistem Trading dengan Integrasi ATR dan MACD

Penulis:ChaoZhang, Tanggal: 2024-11-25 14:42:33Tag:EMARSIATRMACDMTFSLTP

Gambaran umum

Strategi ini adalah sistem perdagangan trend berikut yang komprehensif yang menggabungkan analisis multi-frame waktu, moving average, indikator momentum, dan indikator volatilitas. Sistem ini mengidentifikasi arah tren melalui persilangan rata-rata bergerak eksponensial jangka pendek dan jangka panjang (EMA), menggunakan Relative Strength Index (RSI) untuk kondisi overbought/oversold, menggabungkan MACD untuk konfirmasi momentum, dan menggunakan EMA jangka waktu yang lebih tinggi sebagai filter tren. Sistem ini menggunakan mekanisme stop-loss dan take-profit dinamis berbasis ATR yang beradaptasi dengan volatilitas pasar.

Prinsip Strategi

Strategi ini menggunakan mekanisme verifikasi multi-layer untuk keputusan perdagangan:

- Identifikasi Tren: Menggunakan 9 dan 21 periode EMA crossover untuk menangkap perubahan tren

- Konfirmasi Momentum: Memverifikasi momentum tren melalui penyeberangan dan arah MACD (12,26,9)

- Filter Overbought/Oversold: Menggunakan indikator RSI(14) pada tingkat 70/30 untuk penyaringan

- Konfirmasi jangka waktu yang lebih tinggi: EMA harian opsional sebagai filter tren

- Manajemen Risiko: Menggunakan 1,5x ATR untuk trailing stop-loss dan 2x ATR untuk target keuntungan

Sistem ini hanya memasuki perdagangan ketika beberapa kondisi terpenuhi: EMA crossover, RSI tidak pada tingkat ekstrem, arah MACD yang benar, dan konfirmasi tren jangka waktu yang lebih tinggi.

Keuntungan Strategi

- Mekanisme verifikasi ganda secara signifikan mengurangi sinyal palsu

- Penyaringan tren jangka waktu yang lebih tinggi meningkatkan tingkat kemenangan

- Stop dinamis berbasis volatilitas memberikan kemampuan beradaptasi yang kuat

- Sistem manajemen risiko yang komprehensif

- Parameter dapat disesuaikan secara fleksibel untuk pasar yang berbeda

- Mendukung perdagangan bilateral, beradaptasi dengan berbagai lingkungan pasar

- Kombinasi indikator mempertimbangkan tren dan momentum

Risiko Strategi

- Beberapa kondisi dapat menyebabkan kesempatan perdagangan yang hilang

- Kemungkinan perdagangan yang sering di berbagai pasar

- Optimasi parameter dapat menyebabkan overfitting

- Konfirmasi jangka waktu yang lebih tinggi dapat menunda entri Solusi:

- Sesuaikan parameter secara dinamis berdasarkan karakteristik pasar

- Meningkatkan fleksibilitas dalam pemilihan arah perdagangan

- Memperkenalkan mekanisme penyaringan volatilitas

- Mengoptimalkan mekanisme adaptasi parameter

Arahan Optimasi

- Menerapkan penyaringan volatilitas untuk menyesuaikan ukuran posisi pada periode volatilitas tinggi

- Mengembangkan mekanisme adaptasi parameter berdasarkan kondisi pasar

- Tambahkan indikator volume untuk mengkonfirmasi validitas sinyal

- Mengoptimalkan logika penilaian tren jangka waktu yang lebih tinggi

- Meningkatkan strategi stop-loss, mempertimbangkan untuk menambahkan keluar berbasis waktu

- Mengembangkan modul evaluasi kinerja strategi

Ringkasan

Strategi ini adalah sistem perdagangan trend berikut yang dapat mencapai pengembalian yang stabil di pasar tren melalui kombinasi beberapa indikator teknis dan protokol manajemen risiko yang ketat. Sistem ini sangat dapat diperluas dan dapat beradaptasi dengan lingkungan pasar yang berbeda melalui optimasi.

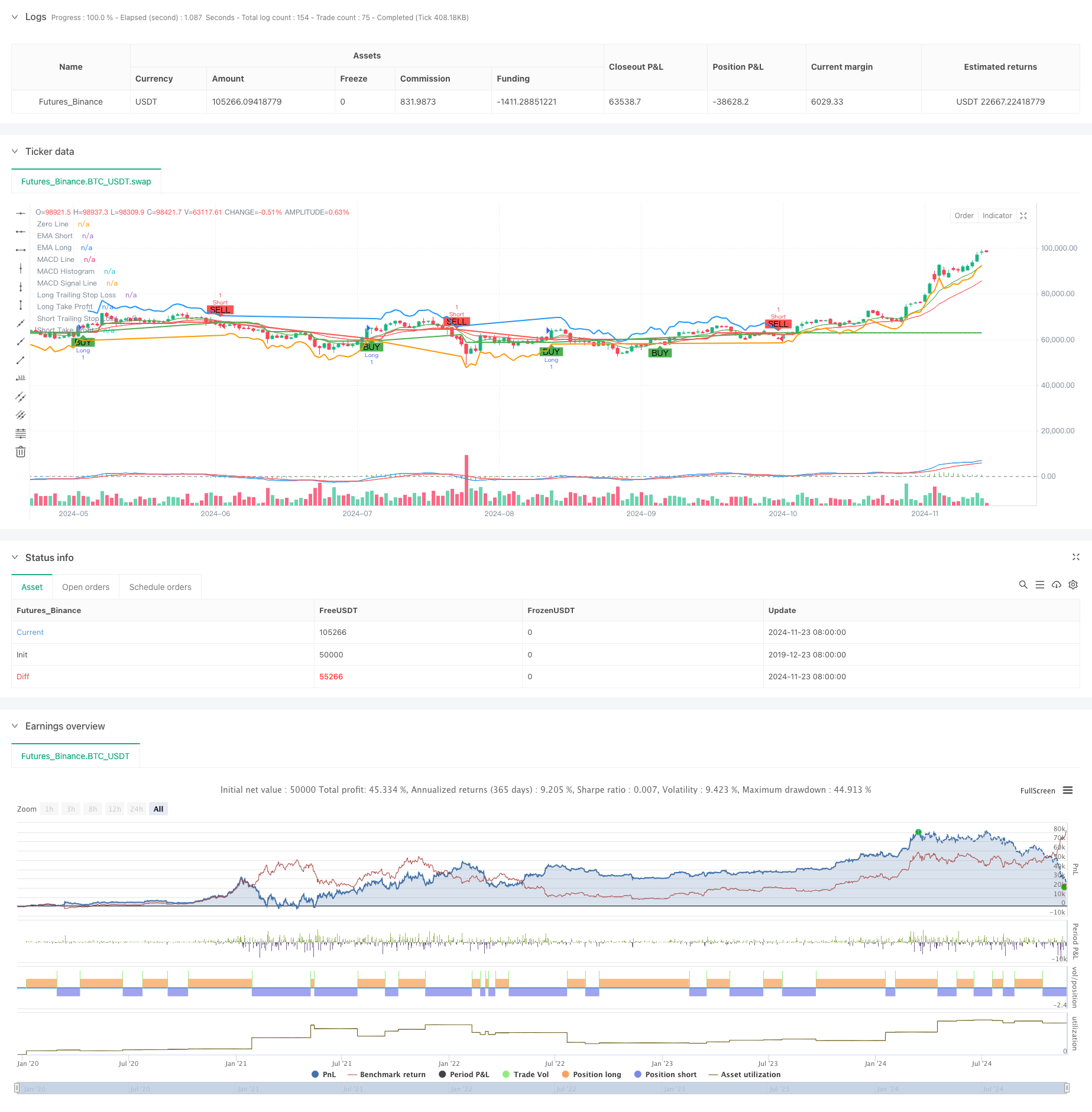

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-24 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Trend Following with ATR, MTF Confirmation, and MACD", overlay=true)

// Parameters

emaShortPeriod = input.int(9, title="Short EMA Period", minval=1)

emaLongPeriod = input.int(21, title="Long EMA Period", minval=1)

rsiPeriod = input.int(14, title="RSI Period", minval=1)

rsiOverbought = input.int(70, title="RSI Overbought", minval=50)

rsiOversold = input.int(30, title="RSI Oversold", minval=1)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplier = input.float(1.5, title="ATR Multiplier", minval=0.1)

takeProfitATRMultiplier = input.float(2.0, title="Take Profit ATR Multiplier", minval=0.1)

// Multi-timeframe settings

htfEMAEnabled = input.bool(true, title="Use Higher Timeframe EMA Confirmation?", inline="htf")

htfEMATimeframe = input.timeframe("D", title="Higher Timeframe", inline="htf")

// MACD Parameters

macdShortPeriod = input.int(12, title="MACD Short Period", minval=1)

macdLongPeriod = input.int(26, title="MACD Long Period", minval=1)

macdSignalPeriod = input.int(9, title="MACD Signal Period", minval=1)

// Select trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Both", "Long", "Short"])

// Calculating indicators

emaShort = ta.ema(close, emaShortPeriod)

emaLong = ta.ema(close, emaLongPeriod)

rsiValue = ta.rsi(close, rsiPeriod)

atrValue = ta.atr(atrPeriod)

// Calculate MACD

[macdLine, macdSignalLine, _] = ta.macd(close, macdShortPeriod, macdLongPeriod, macdSignalPeriod)

// Higher timeframe EMA confirmation

htfEMALong = request.security(syminfo.tickerid, htfEMATimeframe, ta.ema(close, emaLongPeriod))

// Trading conditions

longCondition = ta.crossover(emaShort, emaLong) and rsiValue < rsiOverbought and (not htfEMAEnabled or close > htfEMALong) and macdLine > macdSignalLine

shortCondition = ta.crossunder(emaShort, emaLong) and rsiValue > rsiOversold and (not htfEMAEnabled or close < htfEMALong) and macdLine < macdSignalLine

// Plotting EMAs

plot(emaShort, title="EMA Short", color=color.green)

plot(emaLong, title="EMA Long", color=color.red)

// Plotting MACD

hline(0, "Zero Line", color=color.gray)

plot(macdLine - macdSignalLine, title="MACD Histogram", color=color.green, style=plot.style_histogram)

plot(macdLine, title="MACD Line", color=color.blue)

plot(macdSignalLine, title="MACD Signal Line", color=color.red)

// Trailing Stop-Loss and Take-Profit levels

var float trailStopLoss = na

var float trailTakeProfit = na

if (strategy.position_size > 0) // Long Position

trailStopLoss := na(trailStopLoss) ? close - atrValue * atrMultiplier : math.max(trailStopLoss, close - atrValue * atrMultiplier)

trailTakeProfit := close + atrValue * takeProfitATRMultiplier

strategy.exit("Exit Long", "Long", stop=trailStopLoss, limit=trailTakeProfit, when=shortCondition)

if (strategy.position_size < 0) // Short Position

trailStopLoss := na(trailStopLoss) ? close + atrValue * atrMultiplier : math.min(trailStopLoss, close + atrValue * atrMultiplier)

trailTakeProfit := close - atrValue * takeProfitATRMultiplier

strategy.exit("Exit Short", "Short", stop=trailStopLoss, limit=trailTakeProfit, when=longCondition)

// Strategy Entry

if (longCondition and (tradeDirection == "Both" or tradeDirection == "Long"))

strategy.entry("Long", strategy.long)

if (shortCondition and (tradeDirection == "Both" or tradeDirection == "Short"))

strategy.entry("Short", strategy.short)

// Plotting Buy/Sell signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")

// Plotting Trailing Stop-Loss and Take-Profit levels

plot(strategy.position_size > 0 ? trailStopLoss : na, title="Long Trailing Stop Loss", color=color.red, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? trailStopLoss : na, title="Short Trailing Stop Loss", color=color.green, linewidth=2, style=plot.style_line)

plot(strategy.position_size > 0 ? trailTakeProfit : na, title="Long Take Profit", color=color.blue, linewidth=2, style=plot.style_line)

plot(strategy.position_size < 0 ? trailTakeProfit : na, title="Short Take Profit", color=color.orange, linewidth=2, style=plot.style_line)

- Strategi DCA dinamis berbasis volume

- Strategi Intelijen Pembalikan Tren Multi-Indikator yang Ditingkatkan

- Strategi Momentum Crossover MACD dengan Optimasi Take Profit dan Stop Loss Dinamis

- Multi-Indikator Crossover Momentum Trading Strategy dengan Optimized Take Profit dan Stop Loss System

- Tren Dinamis Mengikuti dengan Strategi Take-Profit dan Stop-Loss yang Tepat

- Strategi pembalikan RSI berjangka waktu yang berlebihan

- Tren Dinamis Mengikuti Strategi Menggabungkan Supertrend dan EMA

- Trend Multi-Timeframe Mengikuti Strategi dengan Manajemen Volatilitas ATR

- Strategi perdagangan jangka pendek multi-indikator dengan leverage tinggi

- Strategi Perdagangan Dinamis Multi-Indikator

- VWAP-ATR Sistem Perdagangan Aksi Harga Dinamis

- Strategi Kuantitatif Tren Dinamis Berdasarkan Bollinger Bands dan RSI Cross

- Strategi Reversi Rata-rata dengan Bollinger Band, RSI dan Sistem Stop-Loss Dinamis Berbasis ATR

- Sistem Strategi Perdagangan Dinamis Berdasarkan Indikator SAR Parabolik

- Adaptive Volatility and Momentum Quantitative Trading System (AVMQTS) (Sistem Perdagangan Kuantitatif Volatilitas dan Momentum Adaptif)

- Strategi Trading Trend Lanjutan Berdasarkan Bollinger Bands dan Pola Candlestick

- Volatilitas ATR dan Trend Adaptif Berdasarkan Moving Average Setelah Strategi Keluar

- Strategi Trading Tren Momentum EMA Dual dengan Sistem Sinyal Lilin Full Body

- Dual Timeframe Supertrend dengan Sistem Optimasi RSI

- Trend Crossover Rata-rata Bergerak Ganda Mengikuti Strategi dengan Sistem Stop-Loss dan Take-Profit Dinamis

- Dual Timeframe Supertrend RSI Strategi Perdagangan Cerdas

- Dual MACD Price Action Breakout Trailing Strategi

- Multi-EMA Trend Momentum Recognition dan Sistem Perdagangan Stop-Loss

- Dual EMA Volume Trend Confirmation Strategy untuk Perdagangan Kuantitatif

- Strategi Crossover EMA-RSI ganda dengan Take-Profit/Stop-Loss dinamis

- Perbaikan Tren Adaptif Dinamis Multi-Periode Mengikuti Sistem Perdagangan

- Strategi perdagangan dua arah dengan volatilitas besar: Sistem entri ambang berbasis titik

- Strategi Kuantitatif Reversi Rata-rata Bollinger yang Ditingkatkan

- Dynamic Darvas Box Breakout dengan Moving Average Trend Confirmation Trading System

- Strategi Perdagangan Kuantitatif EMA Crossover Dinamis Take-Profit Stop-Loss