Stochastic Crossover Indicator Momentum Trading Strategy

Author: ChaoZhang, Date: 2024-04-28 11:57:14Tags: STOCHSMA

Overview

This strategy uses the crossover signals of the Stochastic Oscillator to identify potential buying and selling opportunities. When the %K line of the Stochastic Oscillator crosses above the %D line and the %K value is below 20, the strategy generates a buy signal. Conversely, when the %K line crosses below the %D line and the %K value is above 80, the strategy generates a sell signal. The strategy is applied to a 5-minute time frame.

Strategy Principle

The Stochastic Oscillator consists of the %K line and the %D line. The %K line measures the position of the closing price relative to the high and low prices over a specified period. The %D line is a moving average of the %K line, used to smooth the %K line and generate more reliable signals. When the %K line crosses the %D line, it indicates a change in price momentum, which can be interpreted as a potential buy or sell signal. This strategy uses the crossovers of the Stochastic Oscillator to identify potential trend reversals or momentum changes. When the %K line crosses above the %D line and the %K value is below 20 (indicating oversold conditions), the strategy generates a buy signal. Conversely, when the %K line crosses below the %D line and the %K value is above 80 (indicating overbought conditions), the strategy generates a sell signal. This approach attempts to capture shifts in the trend before a price reversal occurs.

Strategy Advantages

- Simplicity: The strategy is based on a widely used technical indicator and is easy to understand and implement.

- Trend identification: By using the crossovers of the Stochastic Oscillator, the strategy can identify potential trend reversals and momentum changes.

- Overbought/oversold signals: By combining the crossovers of the Stochastic Oscillator with overbought/oversold levels, the strategy attempts to identify extreme conditions before a price reversal occurs.

Strategy Risks

- False signals: The Stochastic Oscillator may generate false signals, leading to unprofitable trades.

- Lag: As a lagging indicator, the Stochastic Oscillator may generate signals after the price has already reversed.

- Lack of trend confirmation: The strategy may generate frequent trading signals in choppy markets, resulting in overtrading and potential losses.

Strategy Optimization

- Trend confirmation: Additional technical indicators or price action analysis can be incorporated to confirm the trend before generating trading signals. This can help filter out false signals in choppy markets.

- Dynamic parameters: The parameters of the Stochastic Oscillator can be dynamically adjusted based on market volatility or other market conditions to optimize the strategy’s performance.

- Risk management: Proper stop-loss and position sizing controls can be implemented to limit potential losses and protect profits.

Summary

The Stochastic Crossover Indicator Momentum Trading Strategy uses the crossovers of the Stochastic Oscillator to identify potential buying and selling opportunities while considering the overbought/oversold state of the asset. Although the strategy is simple and can identify trend reversals, it may also generate false signals and lack trend confirmation. By incorporating trend confirmation indicators, dynamic parameter optimization, and risk management, the strategy’s performance can be further enhanced. However, it is essential to thoroughly test and evaluate the strategy under different market conditions before implementation.

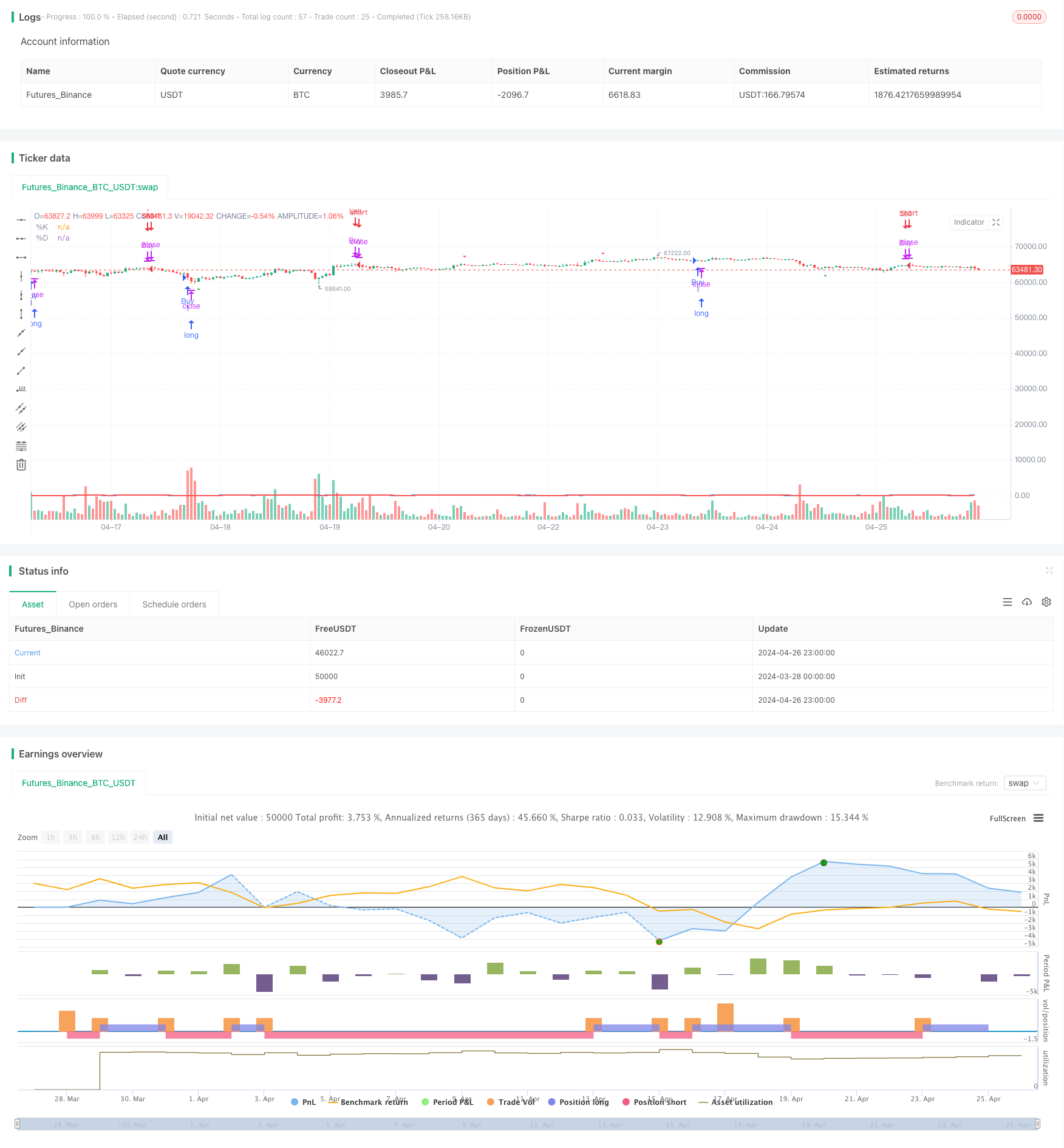

/*backtest

start: 2024-03-28 00:00:00

end: 2024-04-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Stochastic Crossover Buy/Sell", shorttitle="Stochastic Crossover", overlay=true)

// Stochastic Oscillator Parameters

length = input(14, title="Stochastic Length")

smoothK = input(3, title="Stochastic %K Smoothing")

smoothD = input(3, title="Stochastic %D Smoothing")

// Calculate %K and %D

stoch = stoch(close, high, low, length)

k = sma(stoch, smoothK)

d = sma(k, smoothD)

// Plot Stochastic Lines

plot(k, color=color.blue, linewidth=2, title="%K")

plot(d, color=color.red, linewidth=2, title="%D")

// Stochastic Crossover Buy/Sell Signals

buySignal = crossover(k, d) and k < 20 // Buy when %K crosses above %D and %K is below 20

sellSignal = crossunder(k, d) and k > 80 // Sell when %K crosses below %D and %K is above 80

// Plot Buy/Sell Arrows

plotshape(series=buySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=sellSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Entry and Exit Points

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.close("Buy", when=sellSignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

strategy.close("Sell", when=buySignal)

- Multi-Indicator Cross-Trend Following Trading Strategy: Quantitative Analysis Based on Stochastic RSI and Moving Average System

- Buy&Sell Strategy depends on AO+Stoch+RSI+ATR

- Multi-Stochastic Oscillation and Momentum Analysis System

- Multi-EMA Trend Momentum Trading Strategy with Risk Management System

- BBSR Extreme Strategy

- EMA/SMA Multi-Indicator Comprehensive Trend Following Strategy

- Multi-Parameter Stochastic Intelligent Trend Trading Strategy

- RSI and Stochastic Fusion Cross Strategy

- Enhanced Momentum Oscillator and Stochastic Divergence Quantitative Trading Strategy

- Crypto Big Move Stochastic RSI Strategy

- Multi-Indicator Trend Following Strategy

- Squeeze Backtest Transformer v2.0

- Fibonacci Trend Reversal Strategy

- HTF Zigzag Path Strategy

- WaveTrend Cross LazyBear Strategy

- CCI, DMI, and MACD Hybrid Long-Short Strategy

- AlphaTradingBot Trading Strategy

- Vegas SuperTrend Enhanced Strategy

- Quantitative Trading Strategy Based on Modified Hull Moving Average and Ichimoku Kinko Hyo

- RSI Trend Reversal Strategy

- RSI and Dual EMA Crossover Signal Quantitative Strategy

- Elliott Wave Theory 4-9 Impulse Wave Automatic Detection Trading Strategy

- Stochastic Oscillator and Moving Average Crossover Strategy with Stop Loss and Stochastic Filter

- Intraday Scalable Volatility Trading Strategy

- KRK aDa Stochastic Slow Mean Reversion Strategy with AI Enhancements

- Real-time Trendline Trading Based on Pivot Points and Slope

- EMA23/EMA50 Double Moving Average Crossover Quantitative Trading Strategy

- Trend-Capturing Strategy with Horizontal Line Breakout

- Moving Average Crossover with Multiple Take Profits Strategy

- MACD Golden Cross and Death Cross Strategy